The document discusses India's new eInvoice requirements which will become mandatory on April 1, 2020. Key points include:

- Businesses over ₹500 crore turnover must issue eInvoices starting January 2020, while those over ₹100 crore can start voluntarily in February.

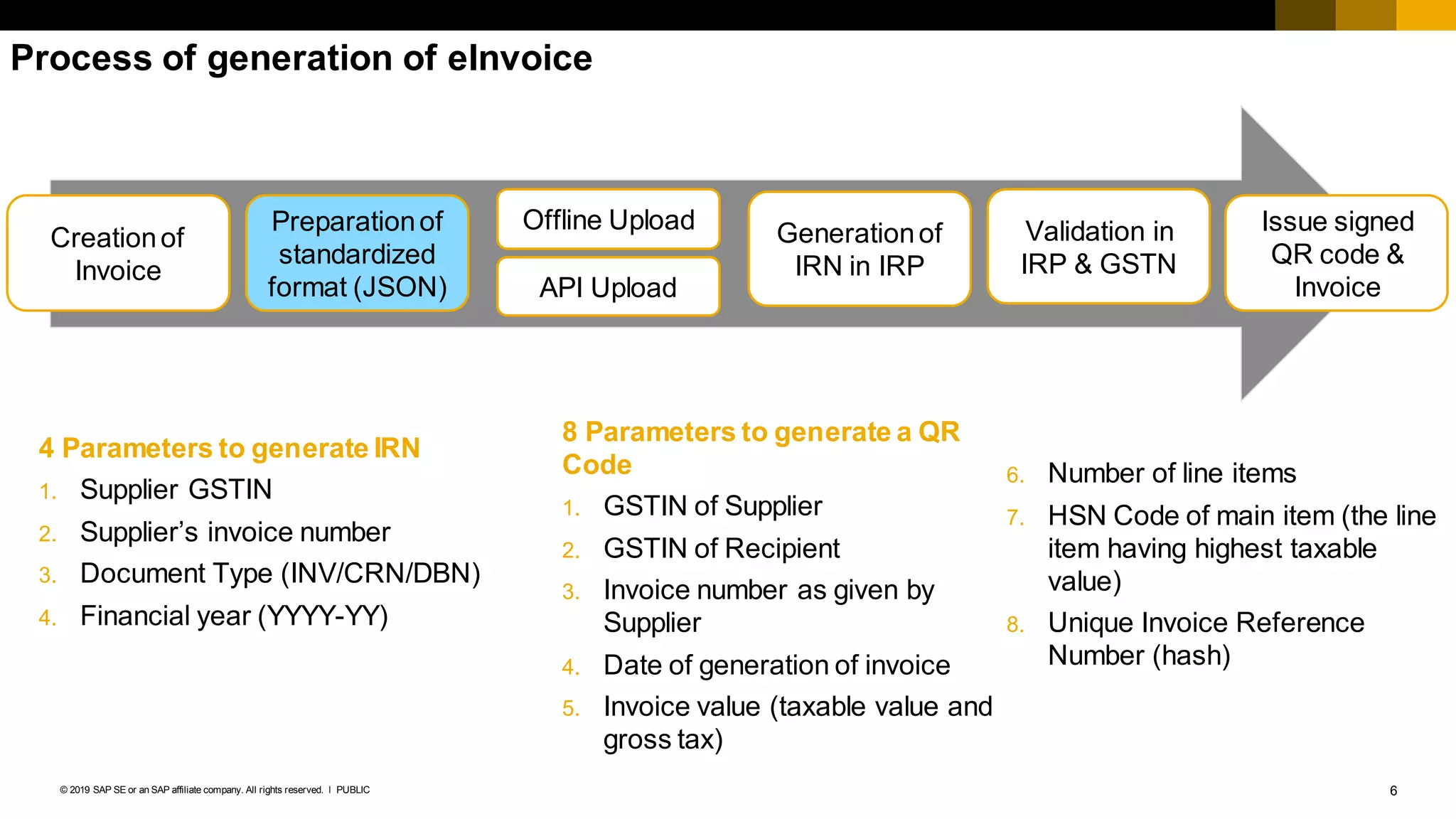

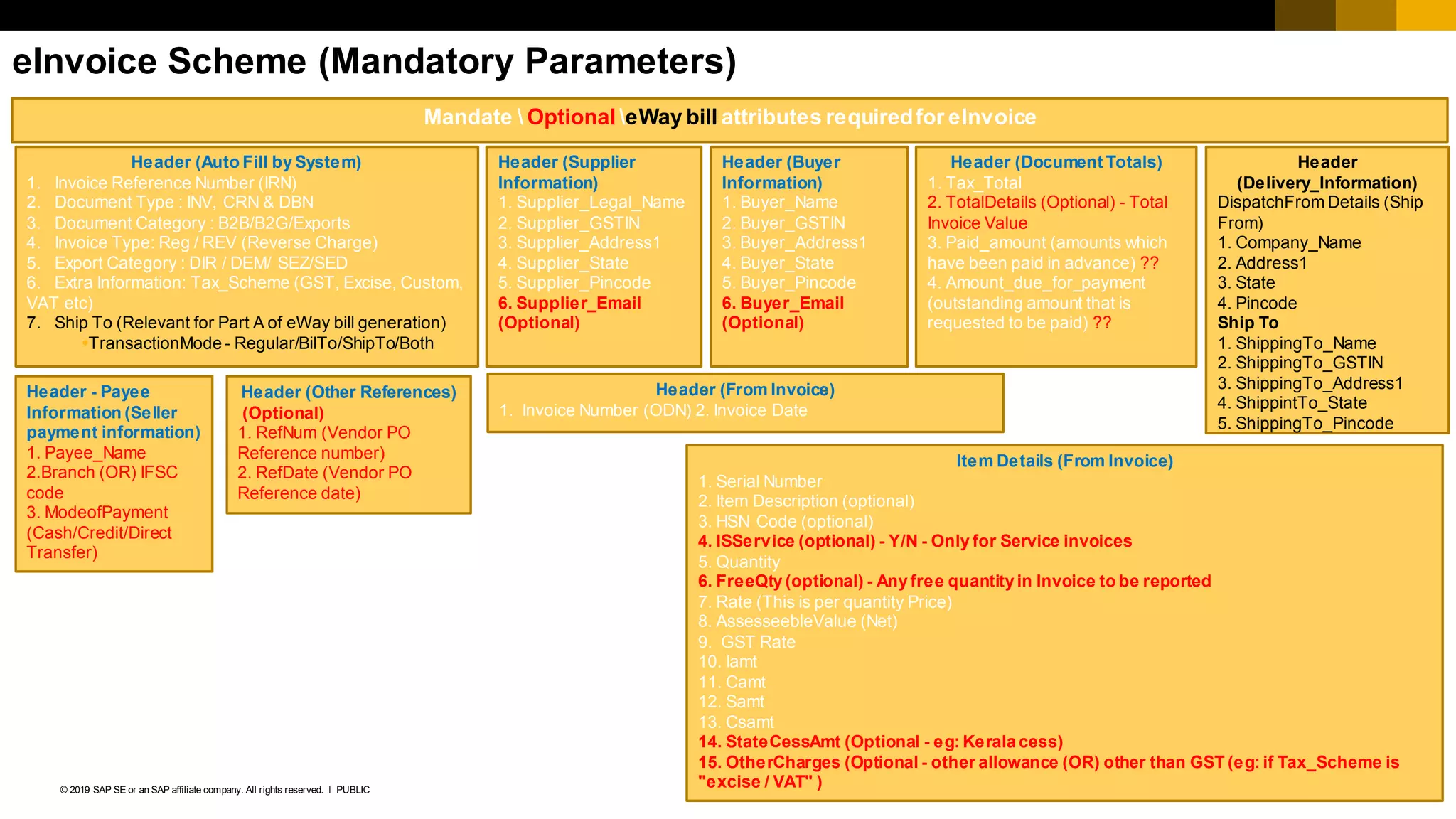

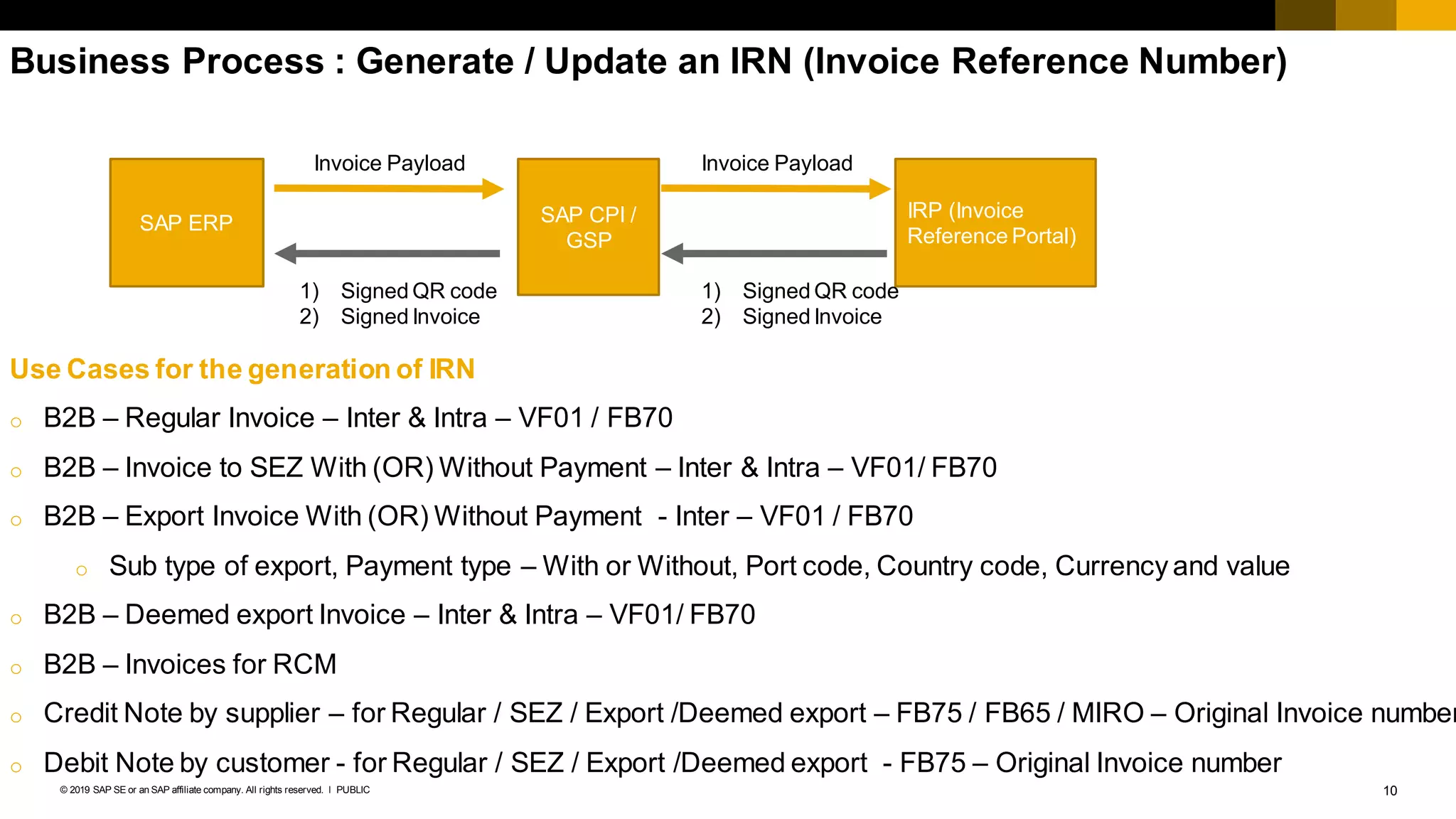

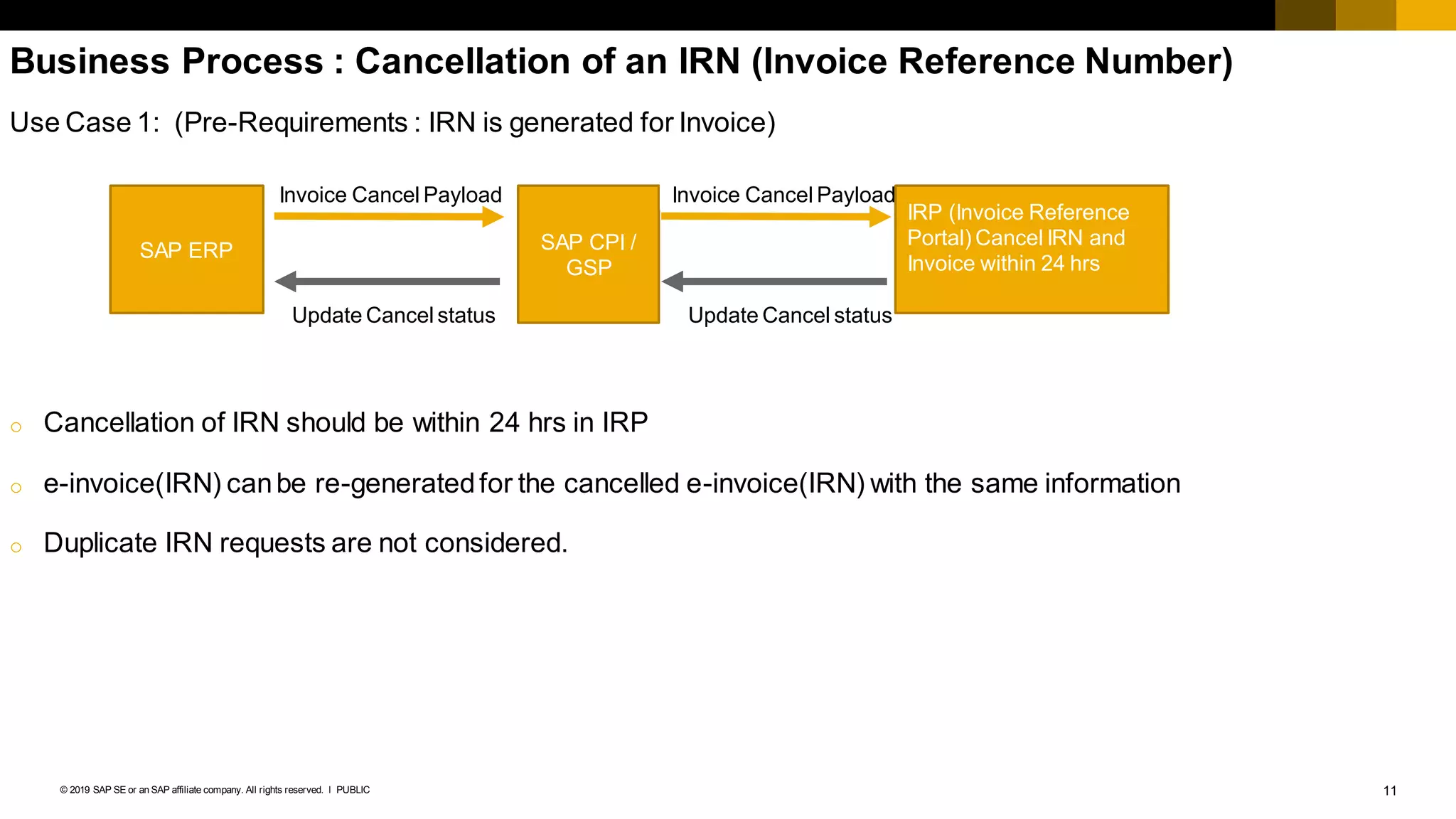

- eInvoices will require a unique 64-digit IRN number and QR code to be considered valid for input tax credit.

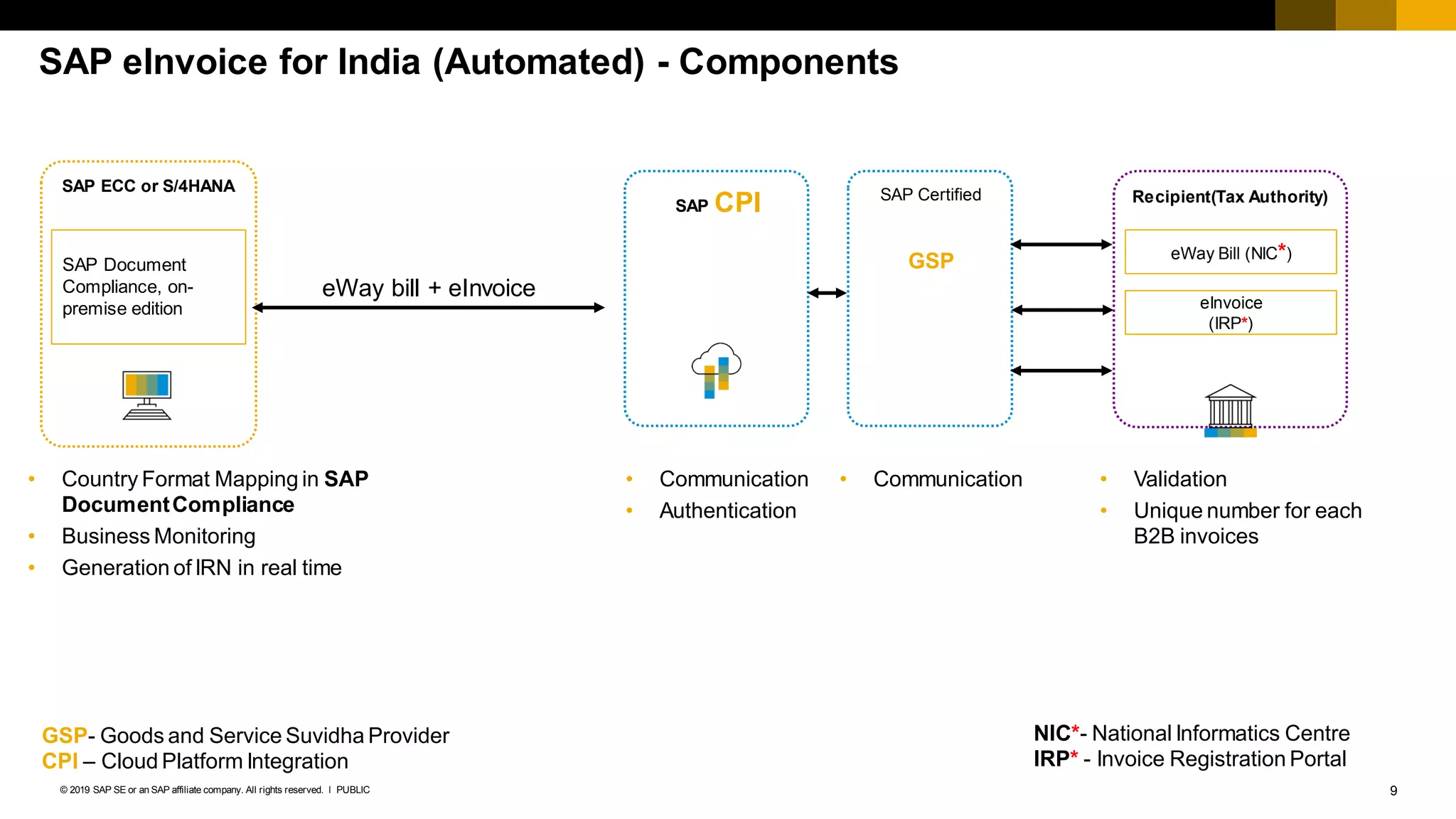

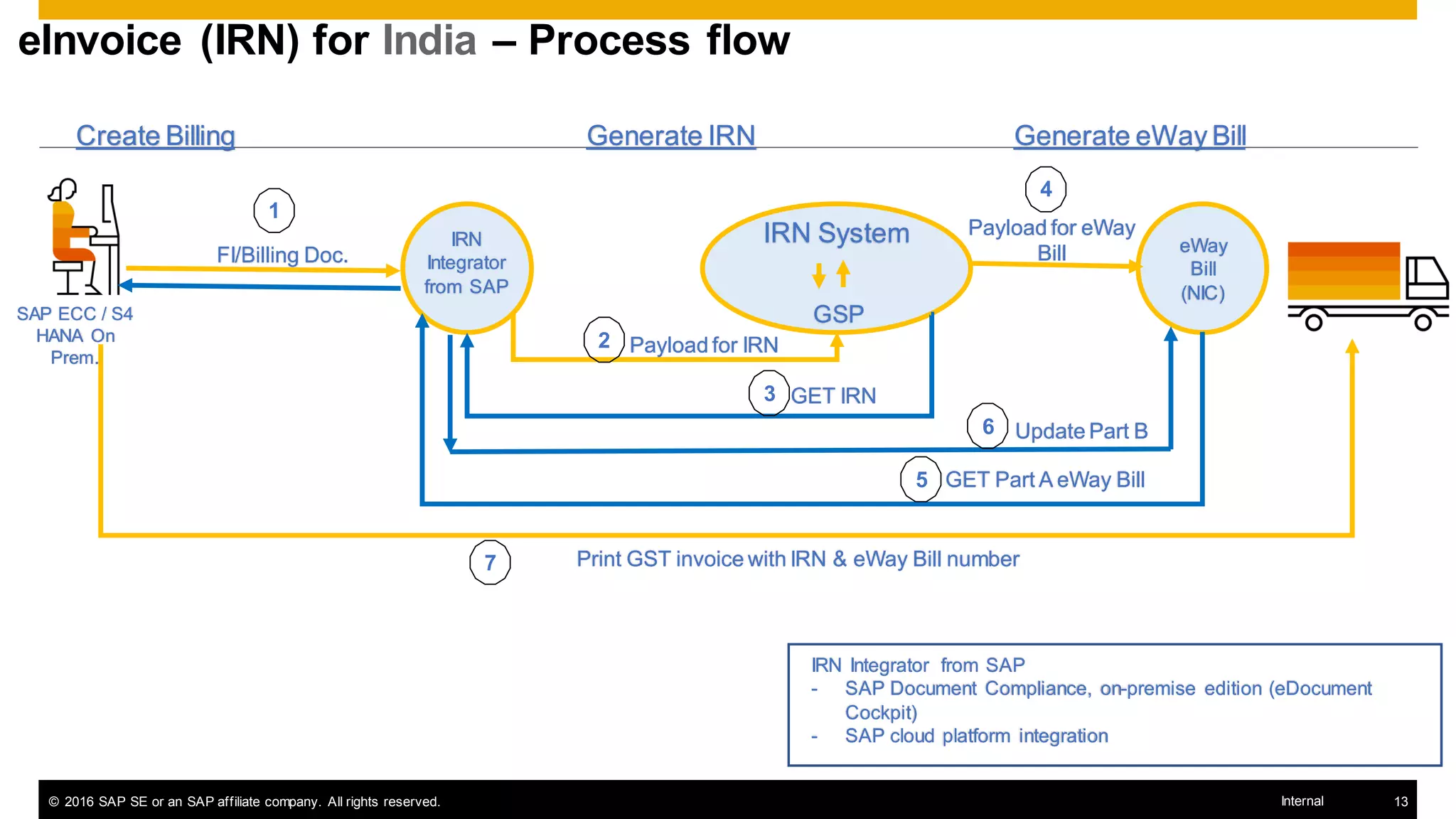

- SAP offers both manual and automated solutions for generating eInvoices and IRNs in real-time directly from SAP ERP or S/4HANA systems.

- The automated solution uses SAP Document Compliance and cloud integration with the IRP portal to issue signed e