Embed presentation

Downloaded 54 times

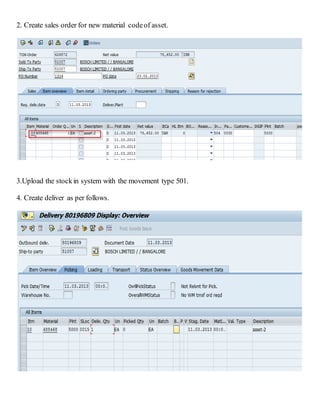

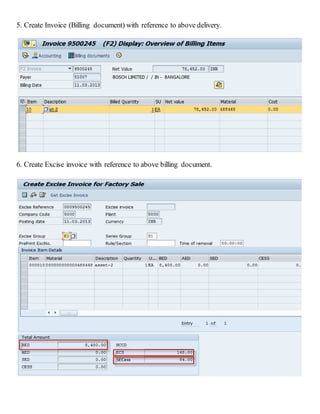

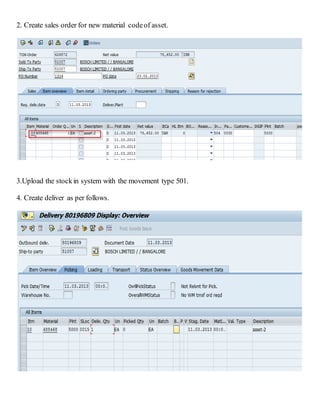

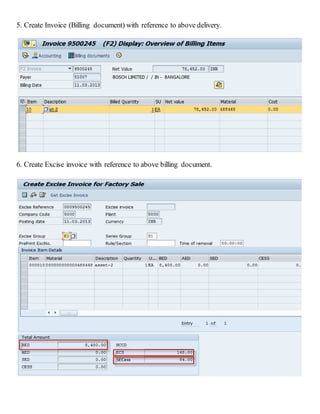

Create an asset through finance T-Code AS01 by entering the acquisition value and planned depreciation. The asset can be directly sold through finance or using a sales order to capture excise or generate an invoice. To sell using a sales order, create a non-valuated material code for the asset with an asset account assignment group. Then create a sales order, upload stock, create a delivery, invoice, excise invoice, and retire the asset using T-Code ABAON to check the financial impact.