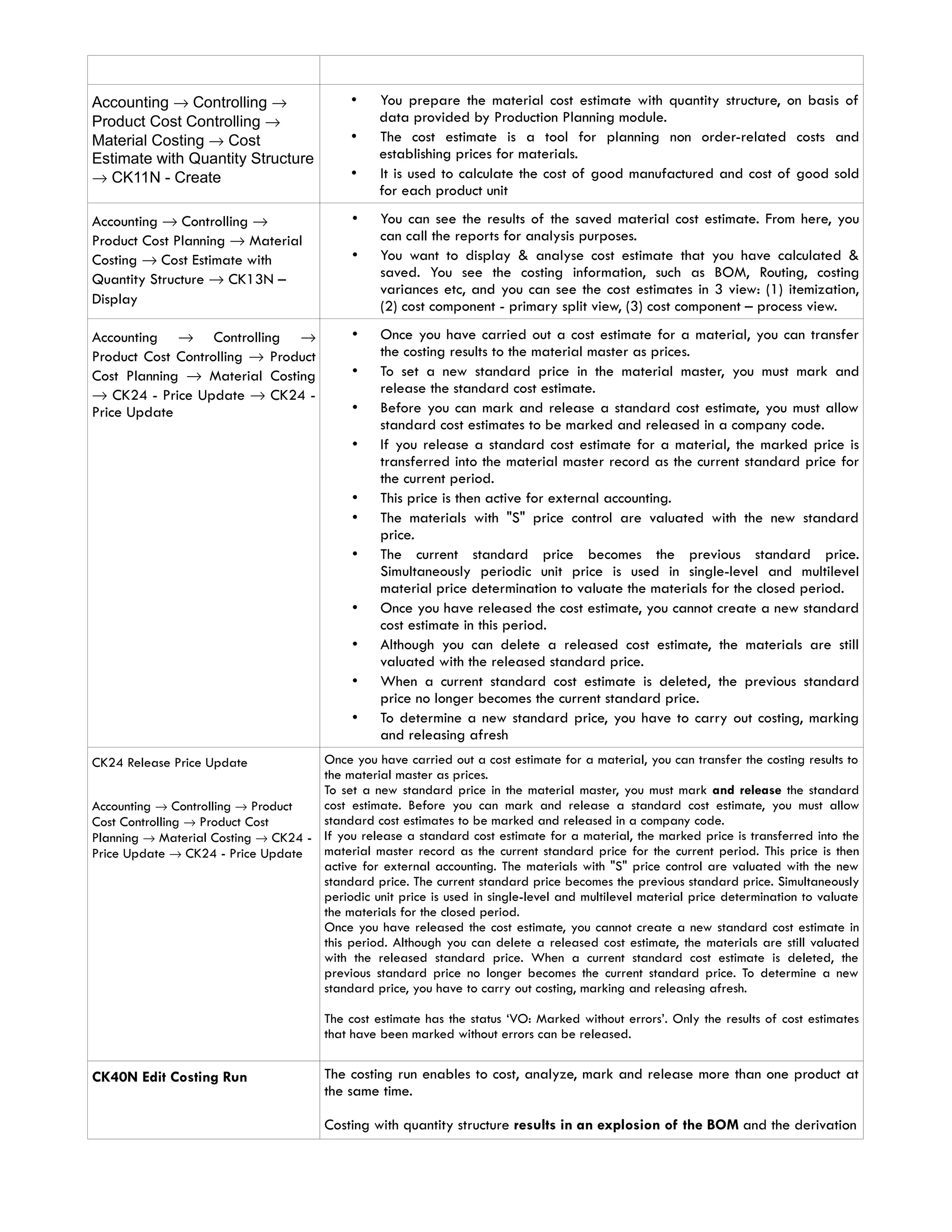

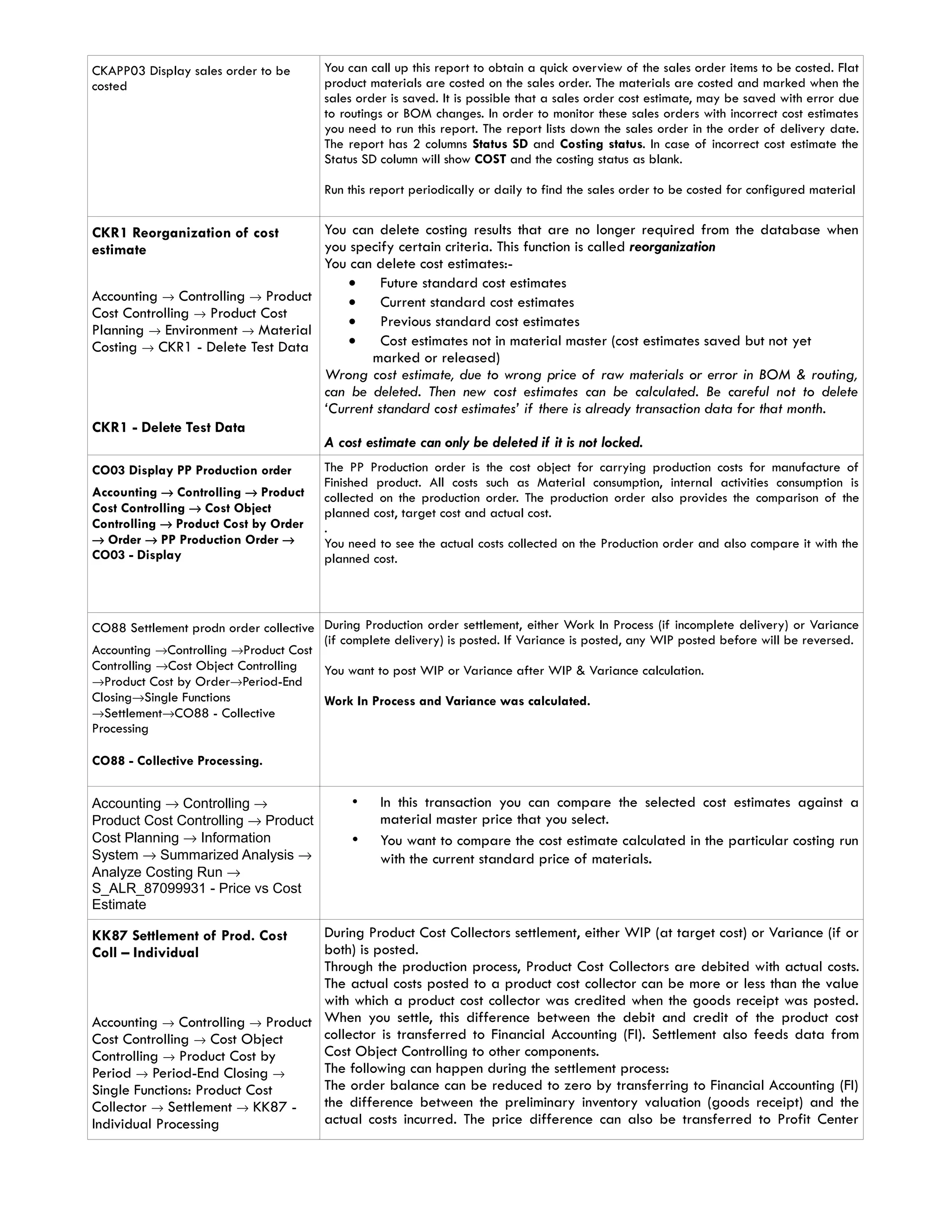

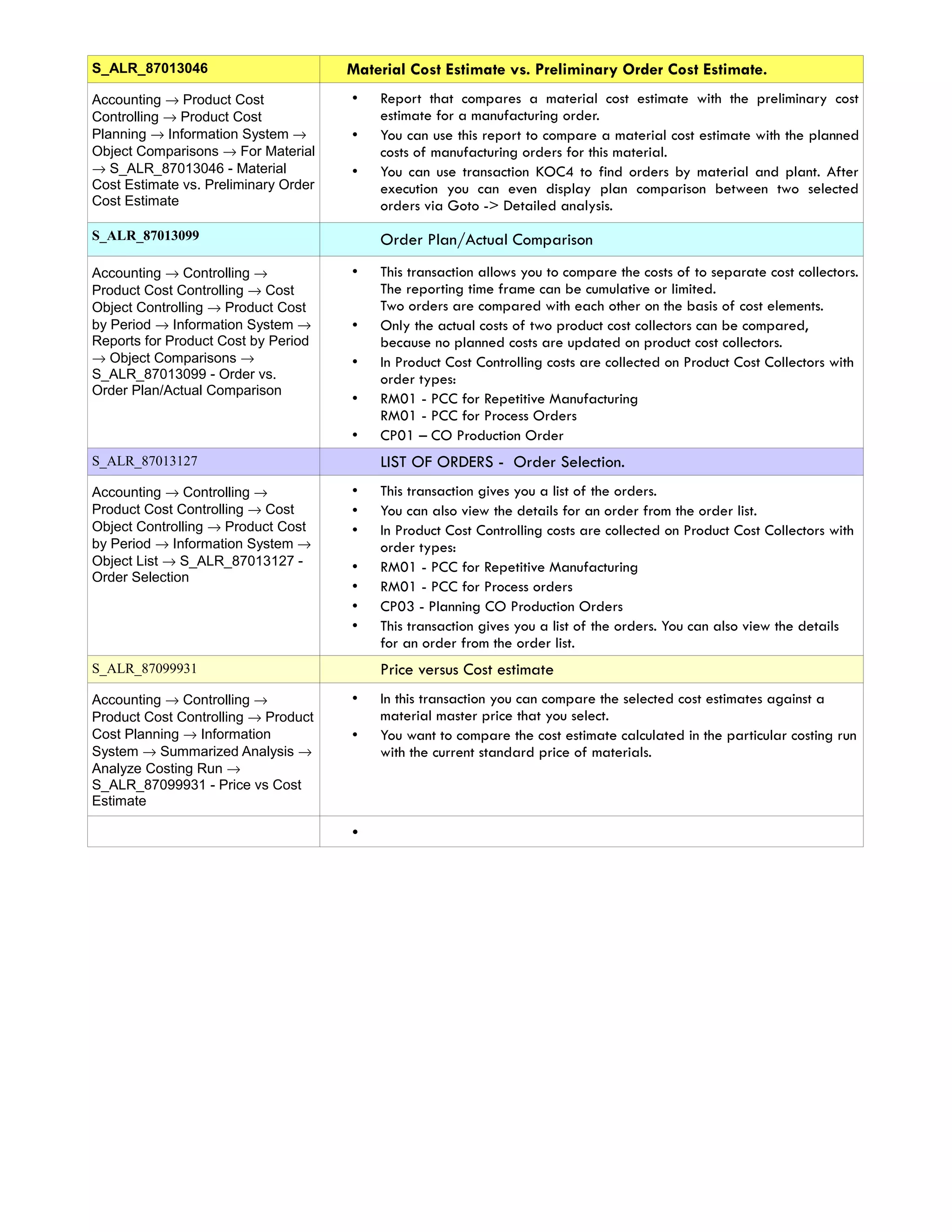

The document discusses cost estimation in SAP, including standard cost estimation, tools used like costing variants and cost component splits, and how to perform a cost estimate with or without a quantity structure. It also covers how to update material master prices by running a costing run or price update after completing a cost estimate. The key steps are to 1) create a cost estimate using tools like costing variants, 2) save and display the estimate results, and 3) update material prices by running a price update or costing run to transfer costs to the material master.