Embed presentation

Download as PDF, PPTX

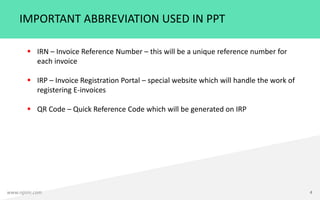

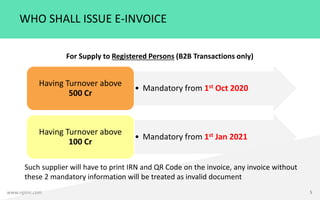

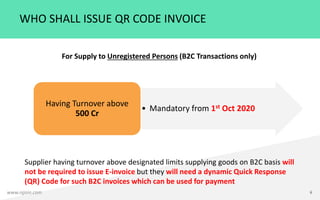

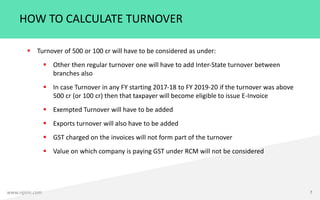

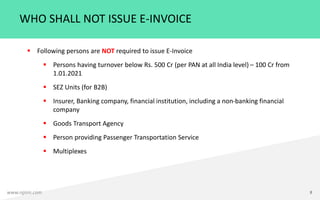

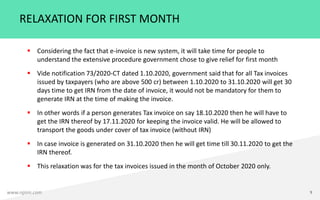

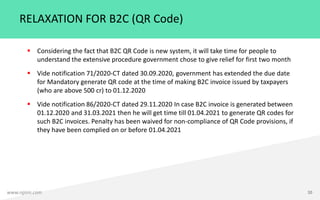

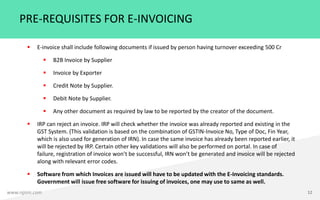

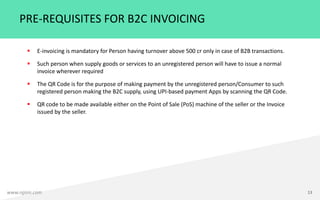

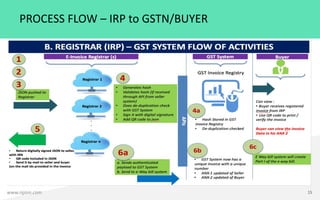

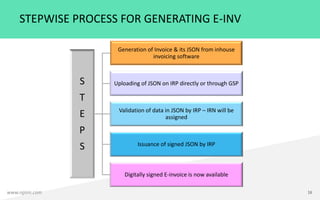

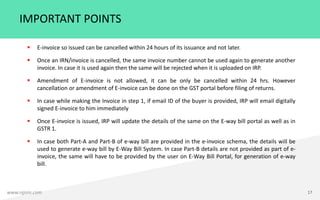

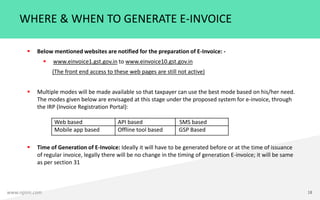

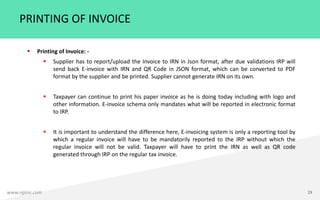

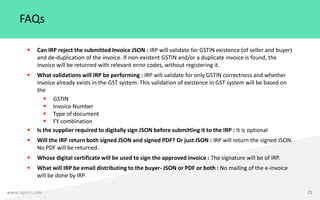

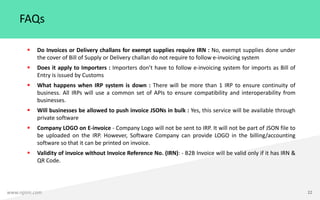

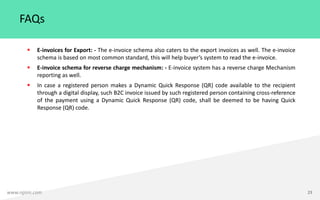

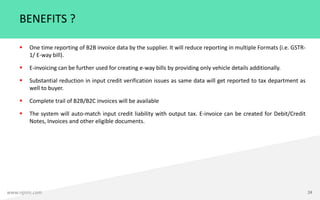

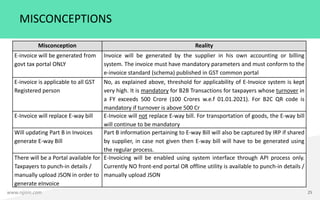

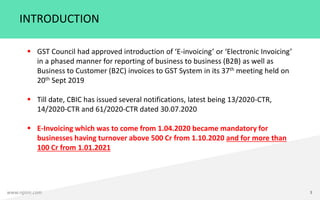

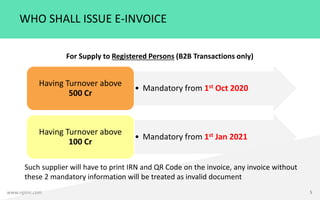

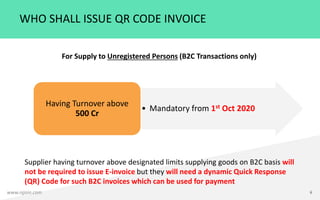

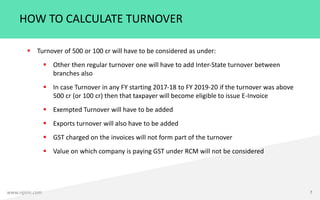

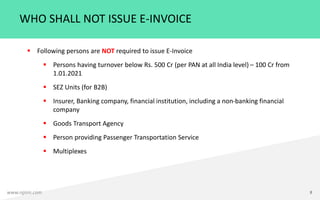

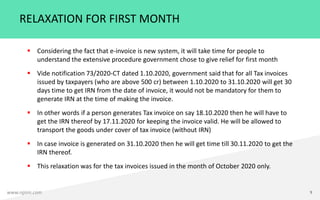

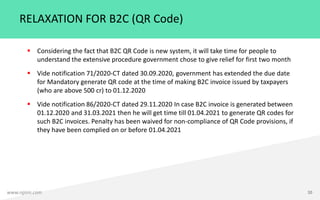

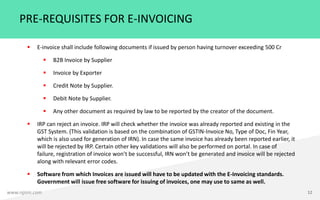

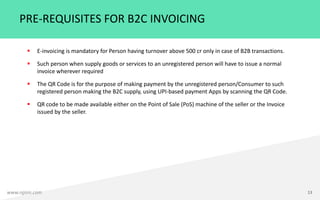

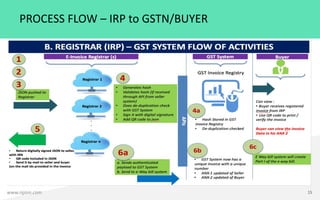

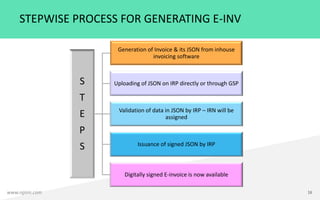

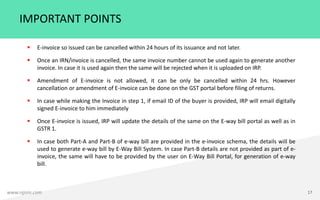

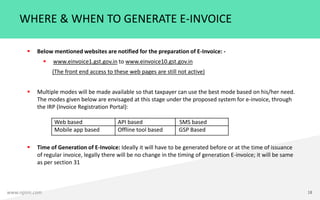

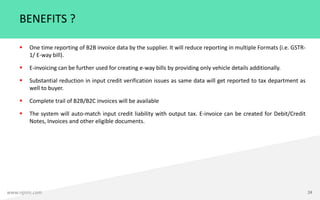

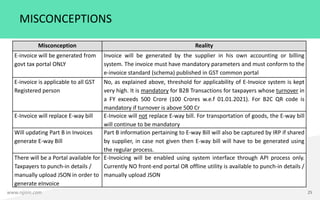

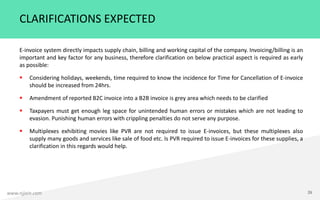

The document discusses India's introduction of electronic invoicing or e-invoicing requirements under the GST system. Key points include: - E-invoicing will be mandatory for businesses with annual turnover above Rs. 500 Cr from October 2020 and above Rs. 100 Cr from January 2021. - E-invoices must contain an Invoice Reference Number (IRN) and QR code generated from the Invoice Registration Portal (IRP). Invoices without these will not be valid. - For B2C invoices above the turnover limits, a dynamic QR code must be generated instead of a full e-invoice. Compliance for QR codes has been extended to April 2021.