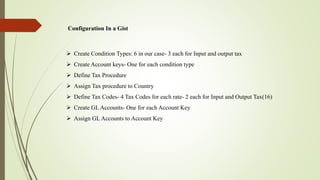

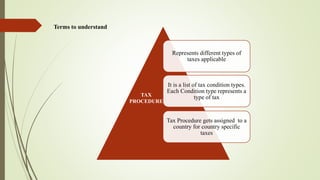

This document discusses the key steps to configure taxation in SAP, including:

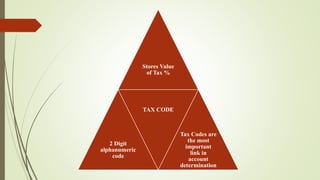

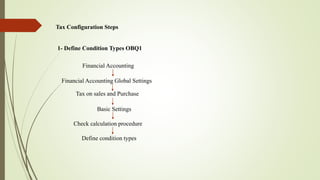

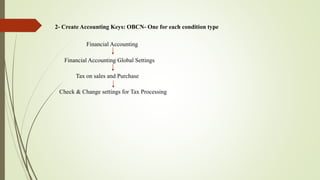

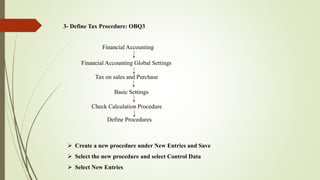

1. Defining condition types, accounting keys, tax procedures, and tax codes. This establishes the different tax rates and accounts.

2. Assigning tax procedures to countries and defining tax rates in tax codes. This determines which taxes apply where.

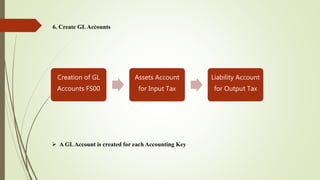

3. Creating general ledger accounts mapped to each accounting key. This provides accounts for tax posting.

The configuration ensures taxes are automatically calculated, recorded to the right accounts, and reported correctly based on the transaction details.

![ Tax Jurisdiction-

• In certain cases, applicable tax percentage may depend upon which tax authority the

business transaction belongs to. [Different rate in different jurisdiction]

• In sap, each tax authority is created as tax jurisdiction code.

• Tax Jurisdiction code is defined for each Tax Procedure.

• In case of GST, Tax rate is determined centrally. Therefore we don’t need to define

Tax Jurisdiction*](https://image.slidesharecdn.com/taxinsap-190118131618/85/Tax-in-sap-8-320.jpg)

![5. Define Tax Code

Financial Accounting

Tax on sales and Purchase

Calculation

Financial Accounting Global Settings

Define Tax Codes for Sales and Purchase

Steps:

1. Enter Country [ which has already been assigned a tax procedure]

2. Enter a distinct 2 digit alphanumeric code

3. Define Properties in the next screen. Eg Tax type, Target tax code, status- active/inactive.

4. Next Screen- Maintain Tax code screen- Enter Tax Rates](https://image.slidesharecdn.com/taxinsap-190118131618/85/Tax-in-sap-15-320.jpg)