The document discusses asset accounting in SAP, including:

- Asset accounting is a subsidiary ledger of financial accounting that updates general ledger accounts.

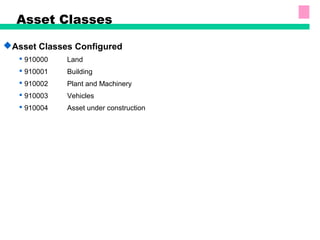

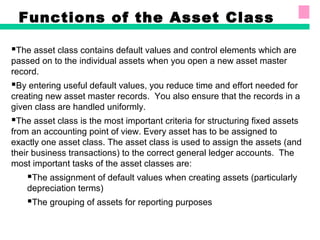

- Asset classes are used to group assets, assign accounts and default values, and structure assets for reporting.

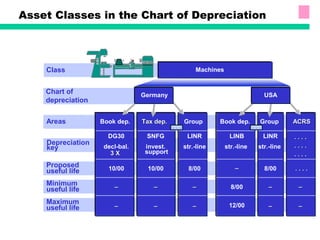

- Charts of depreciation define depreciation areas for book, tax, and other purposes across asset classes.

- Master data includes creating asset records via asset classes or copying, and time-dependent assignments.

- Asset acquisitions can integrate with accounts payable/receivable or use a clearing account.