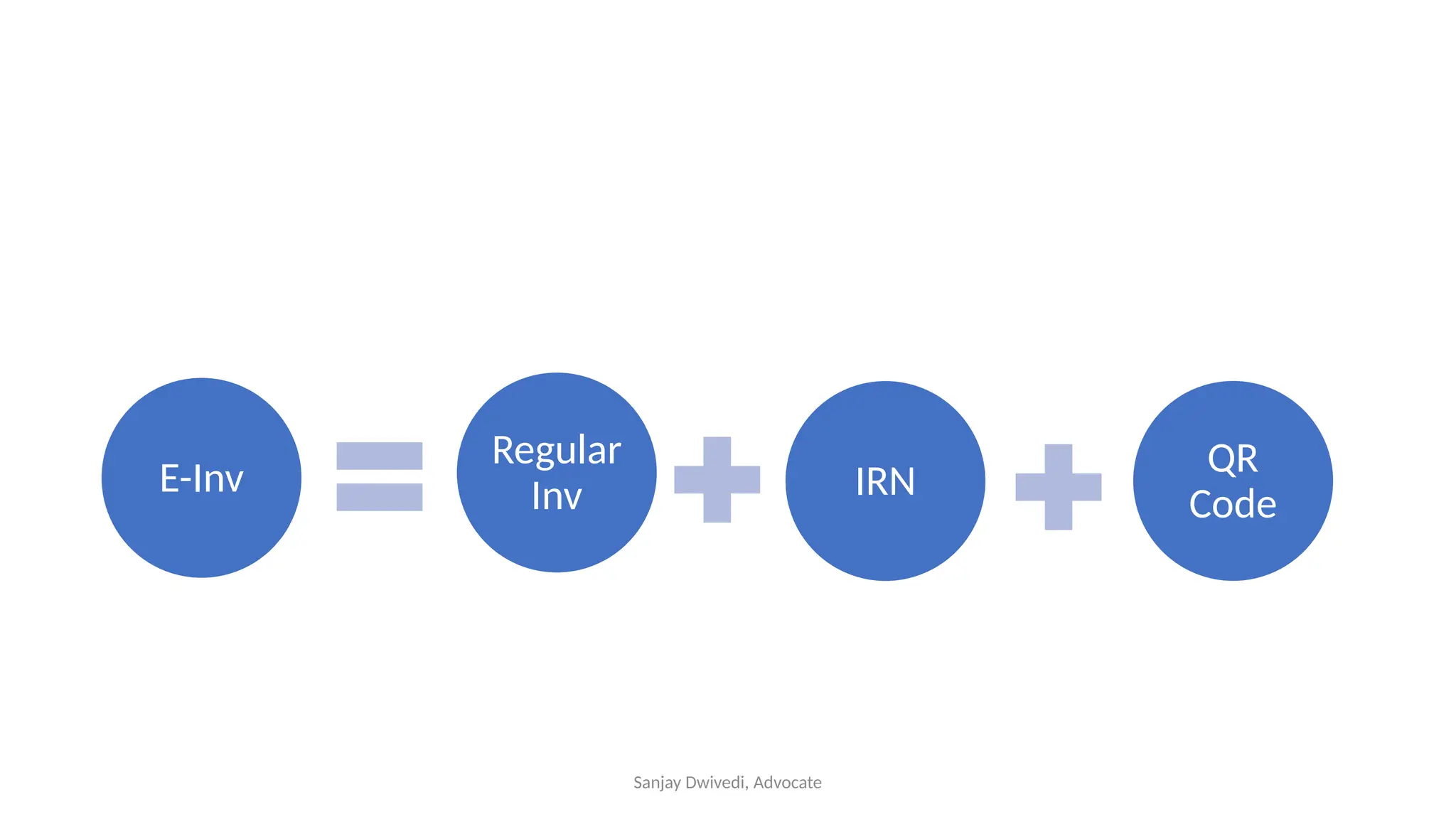

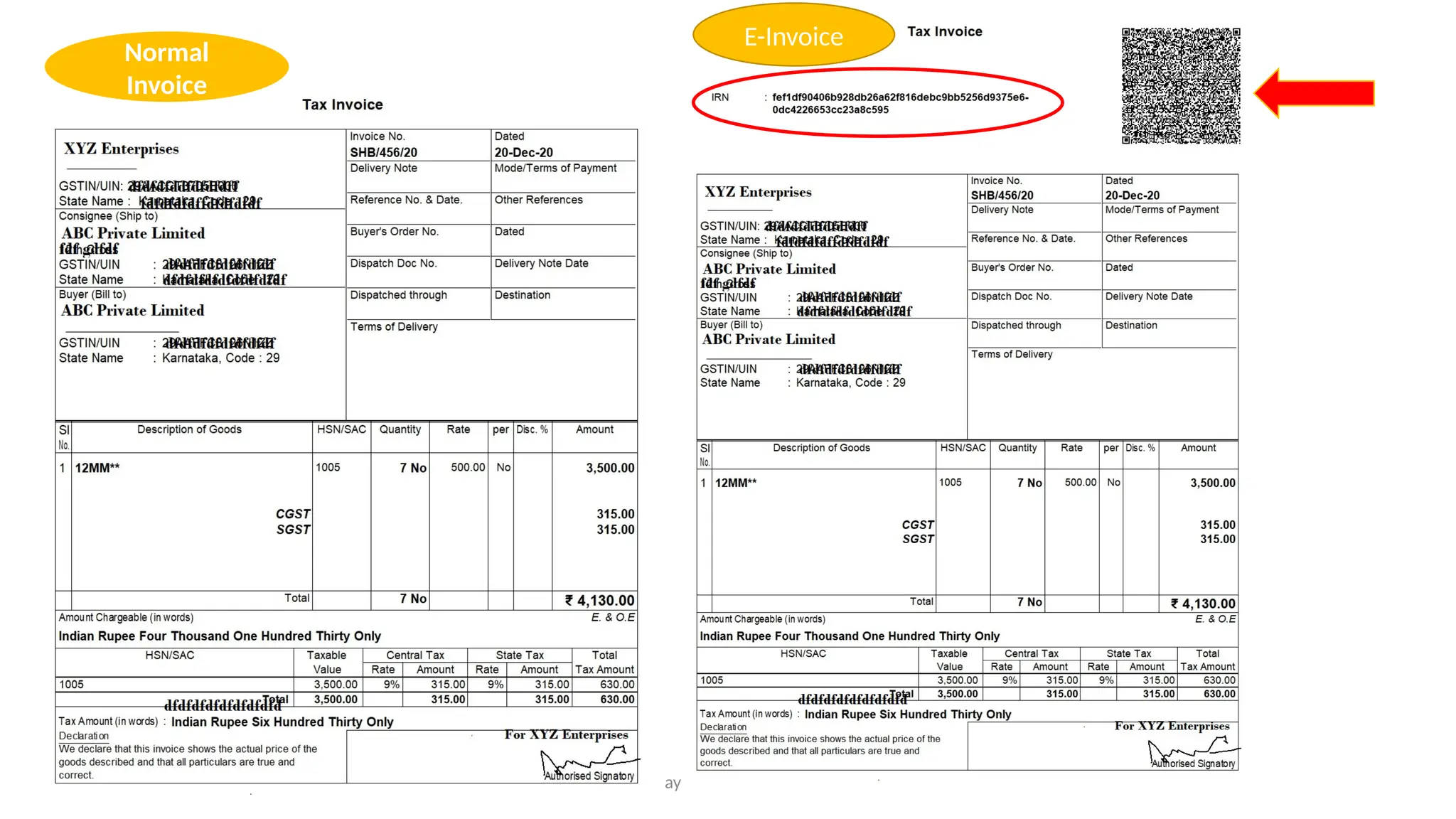

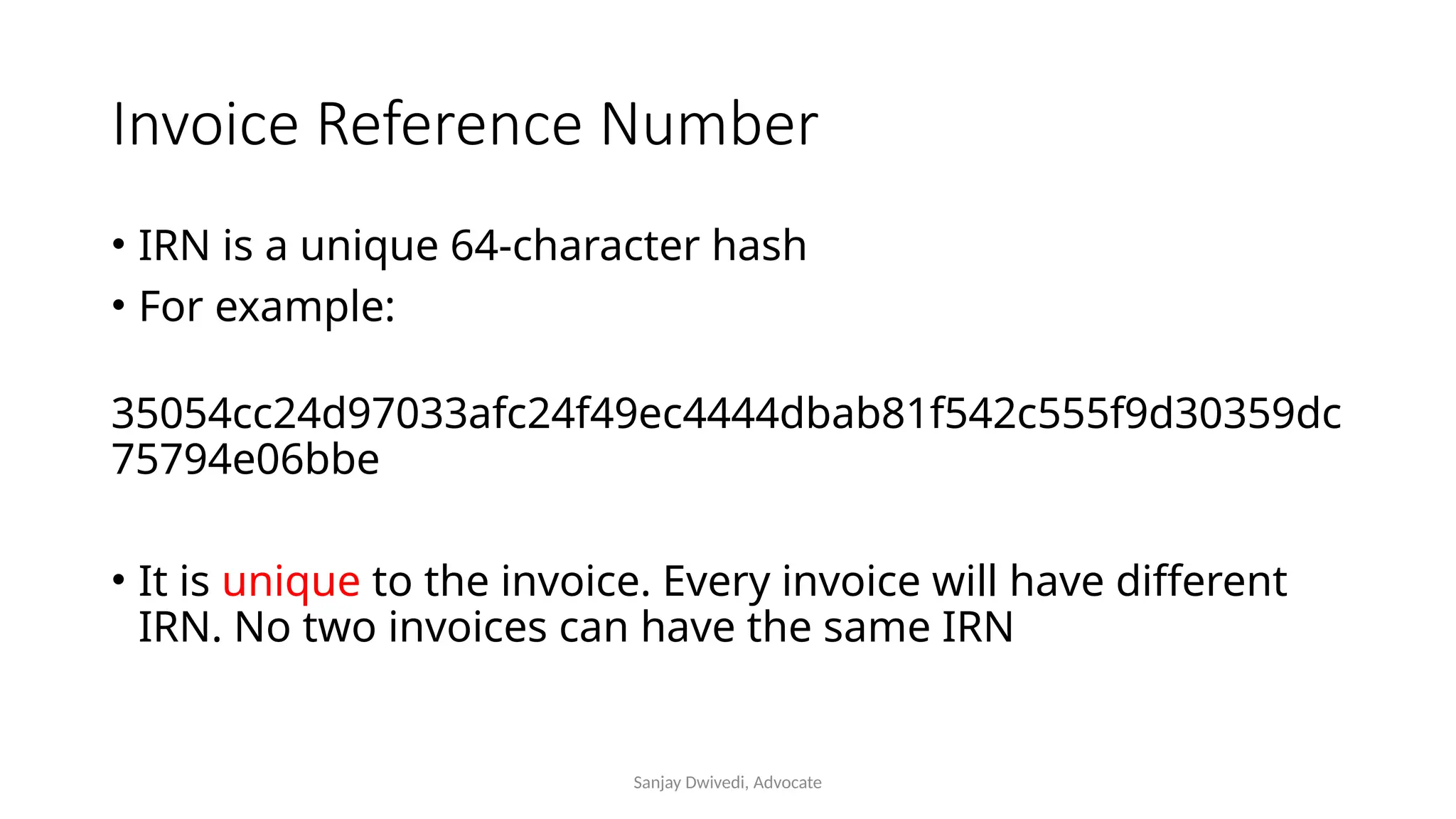

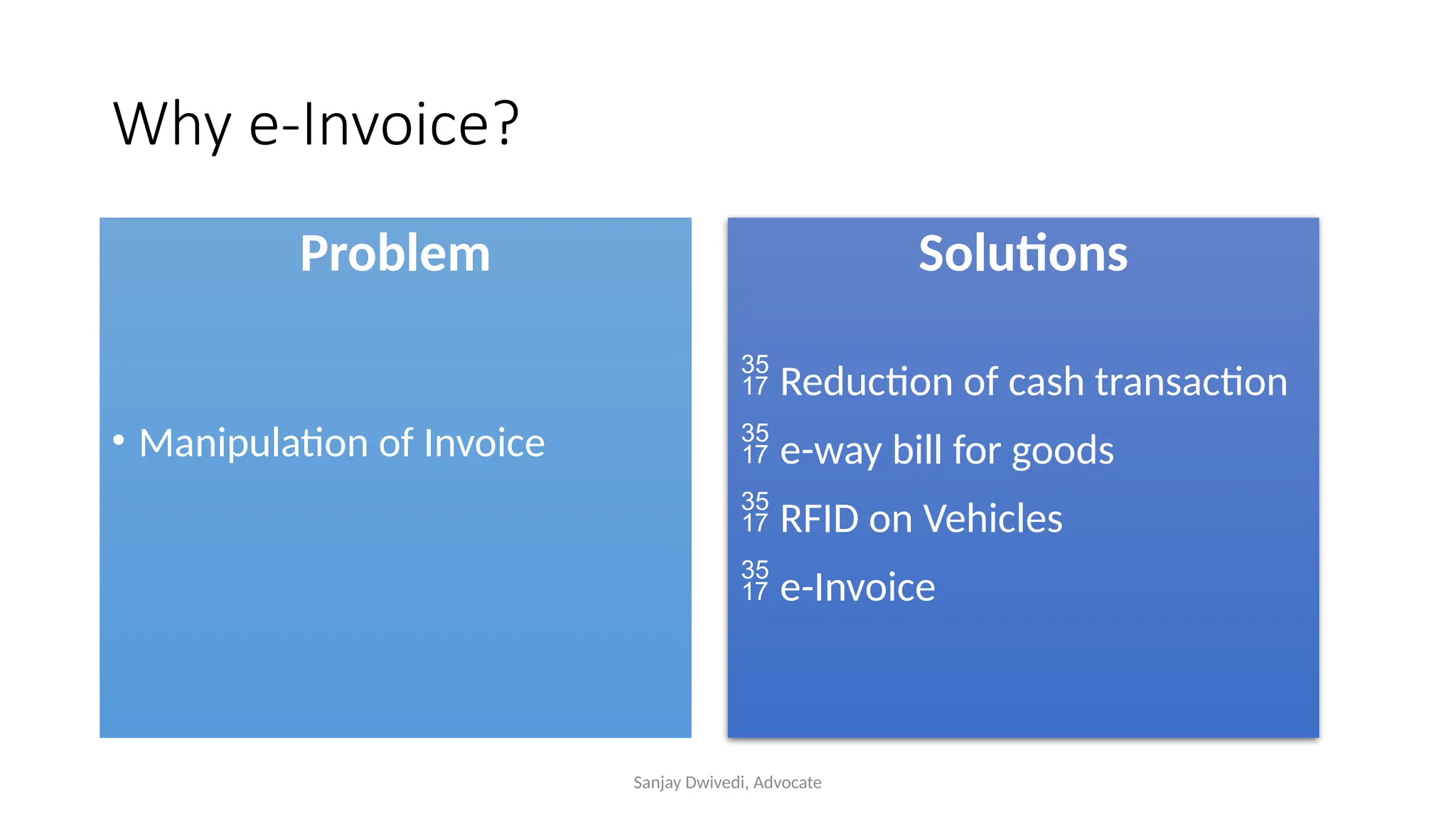

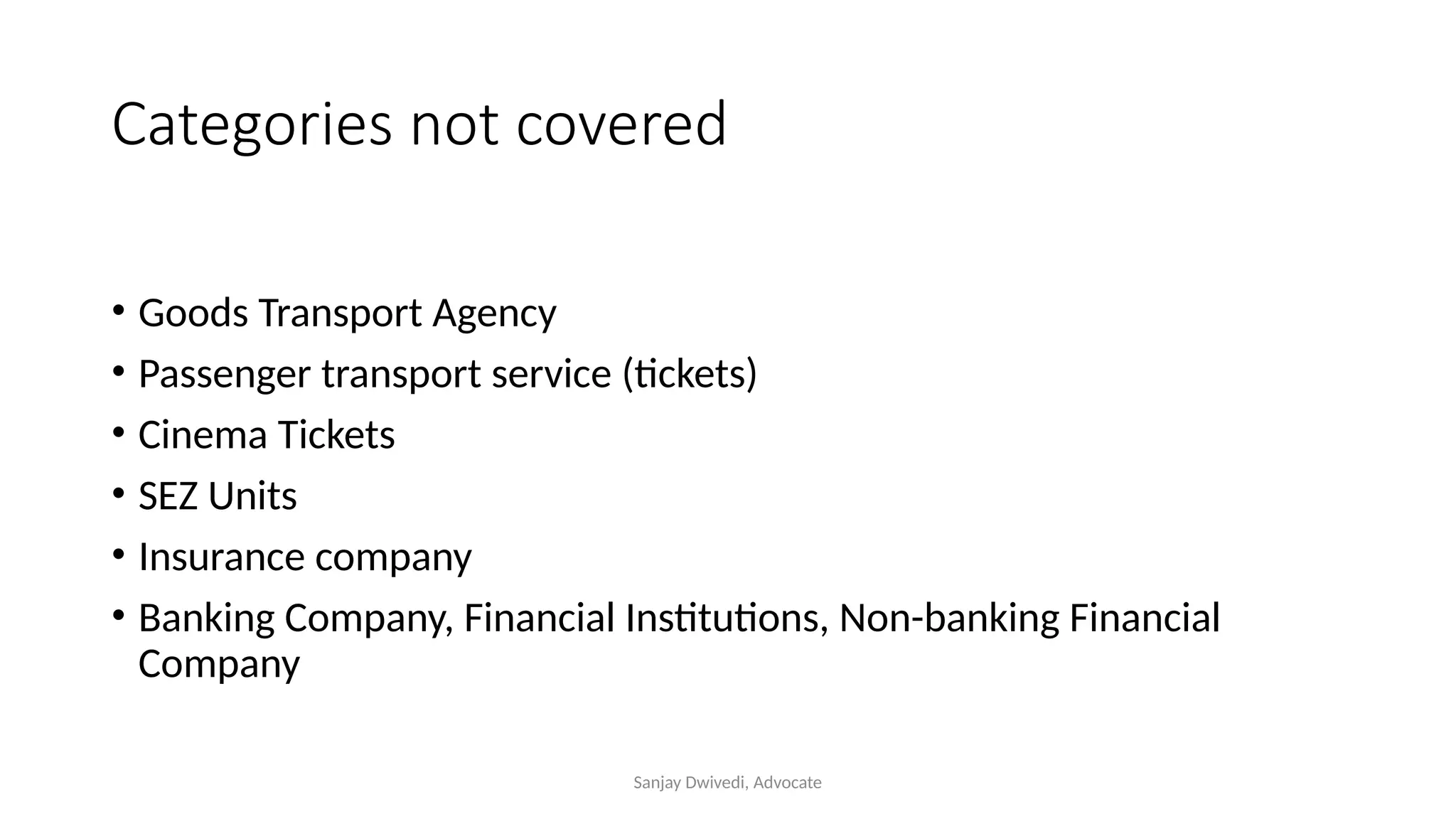

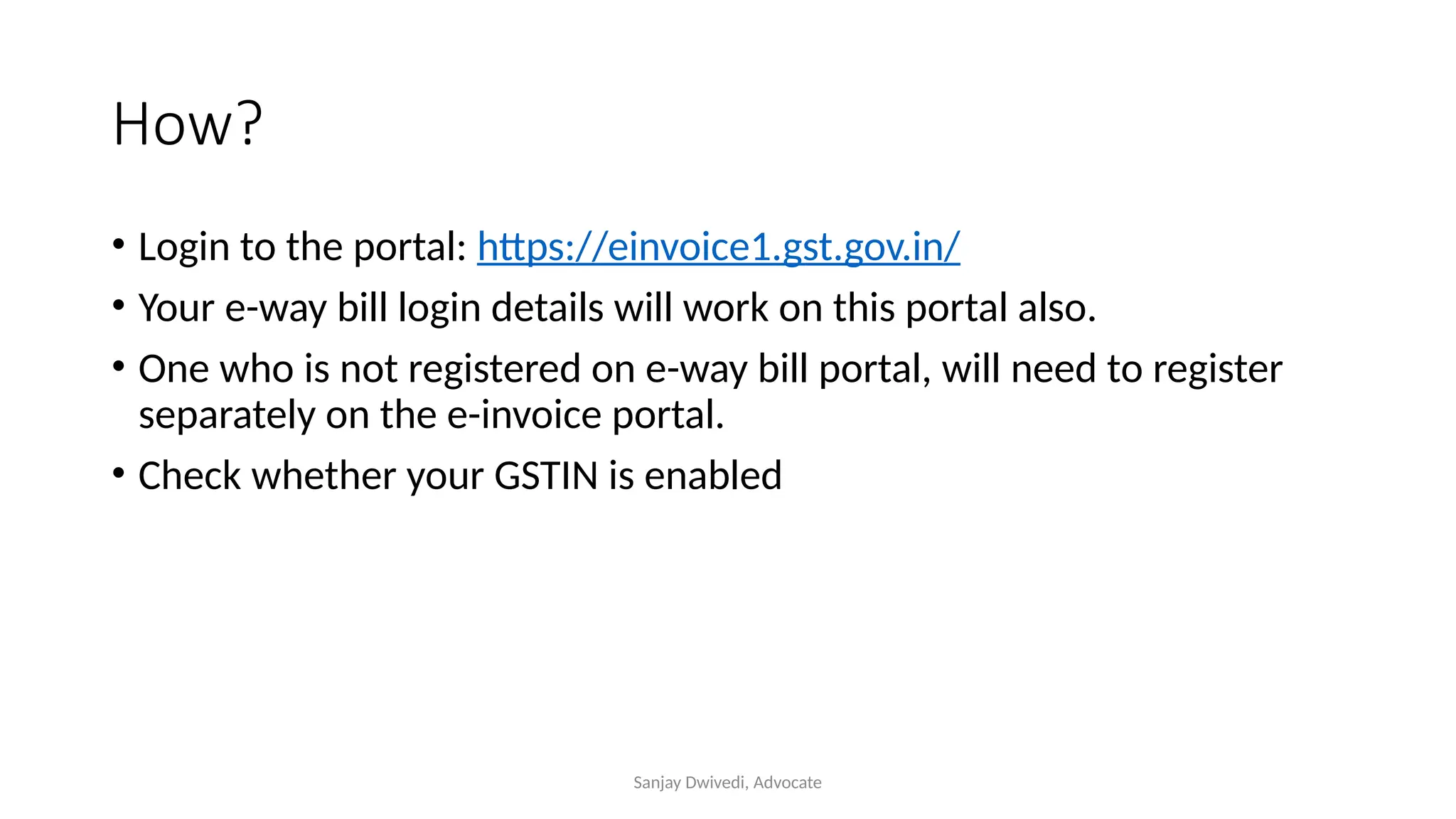

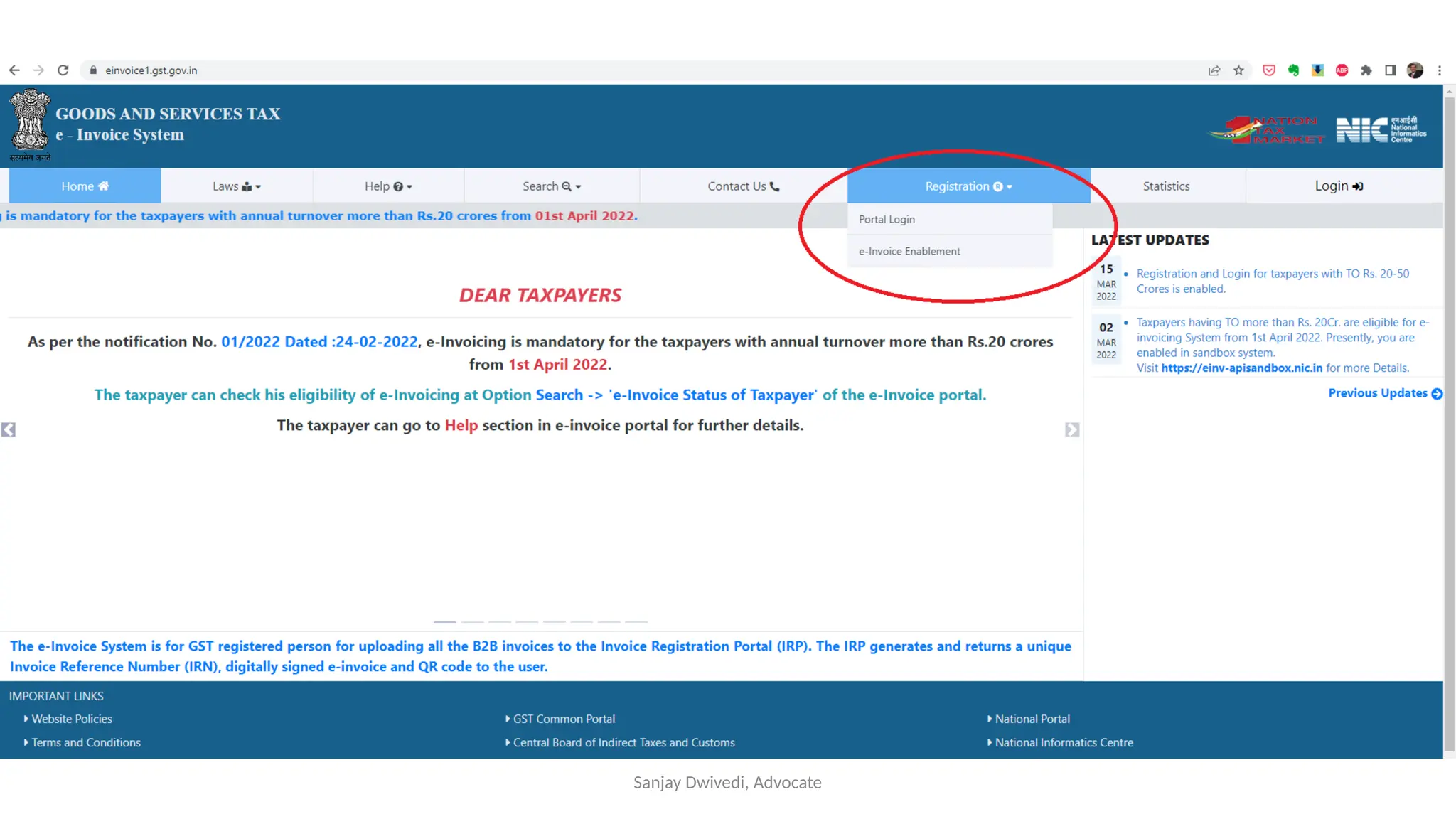

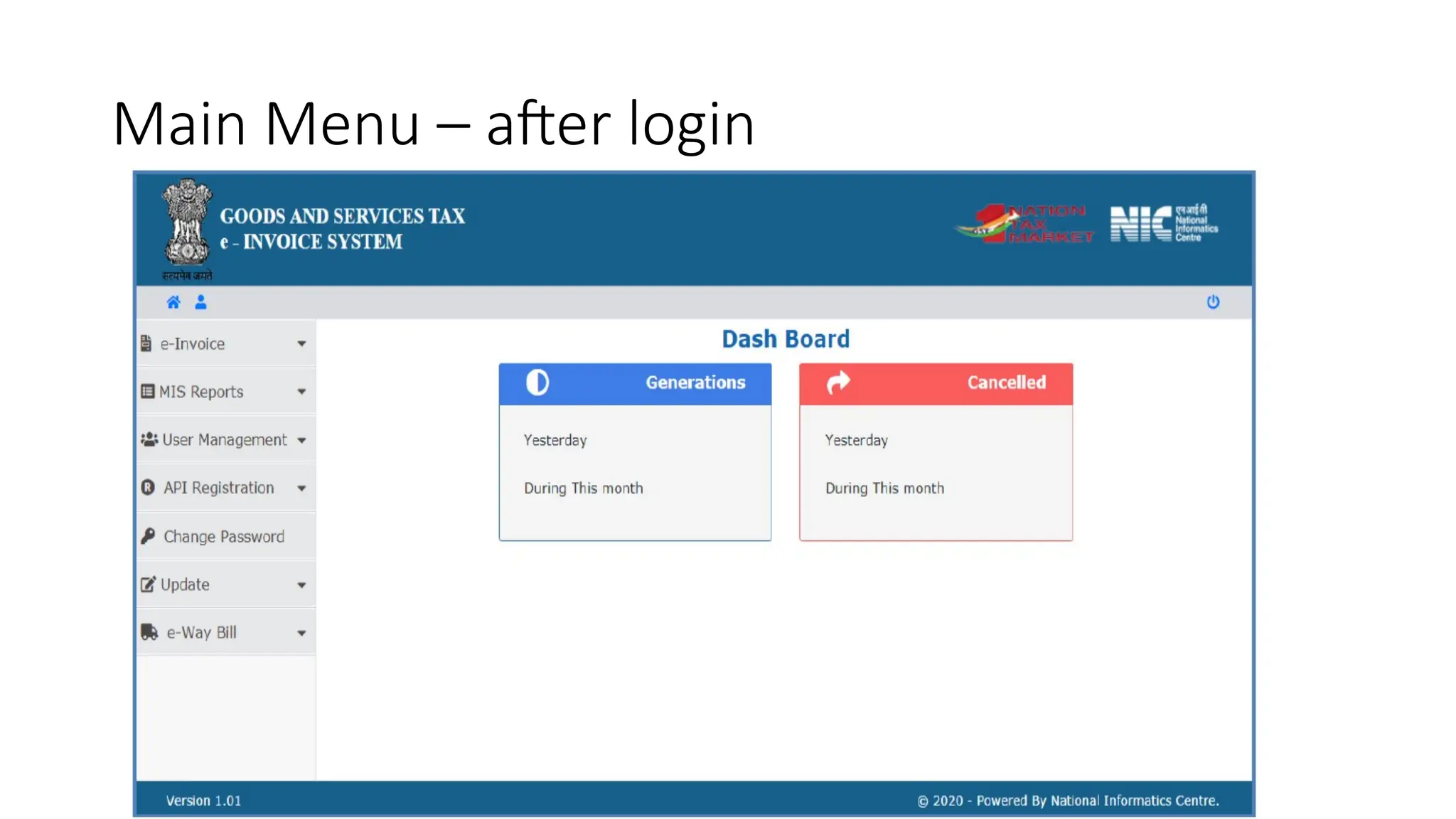

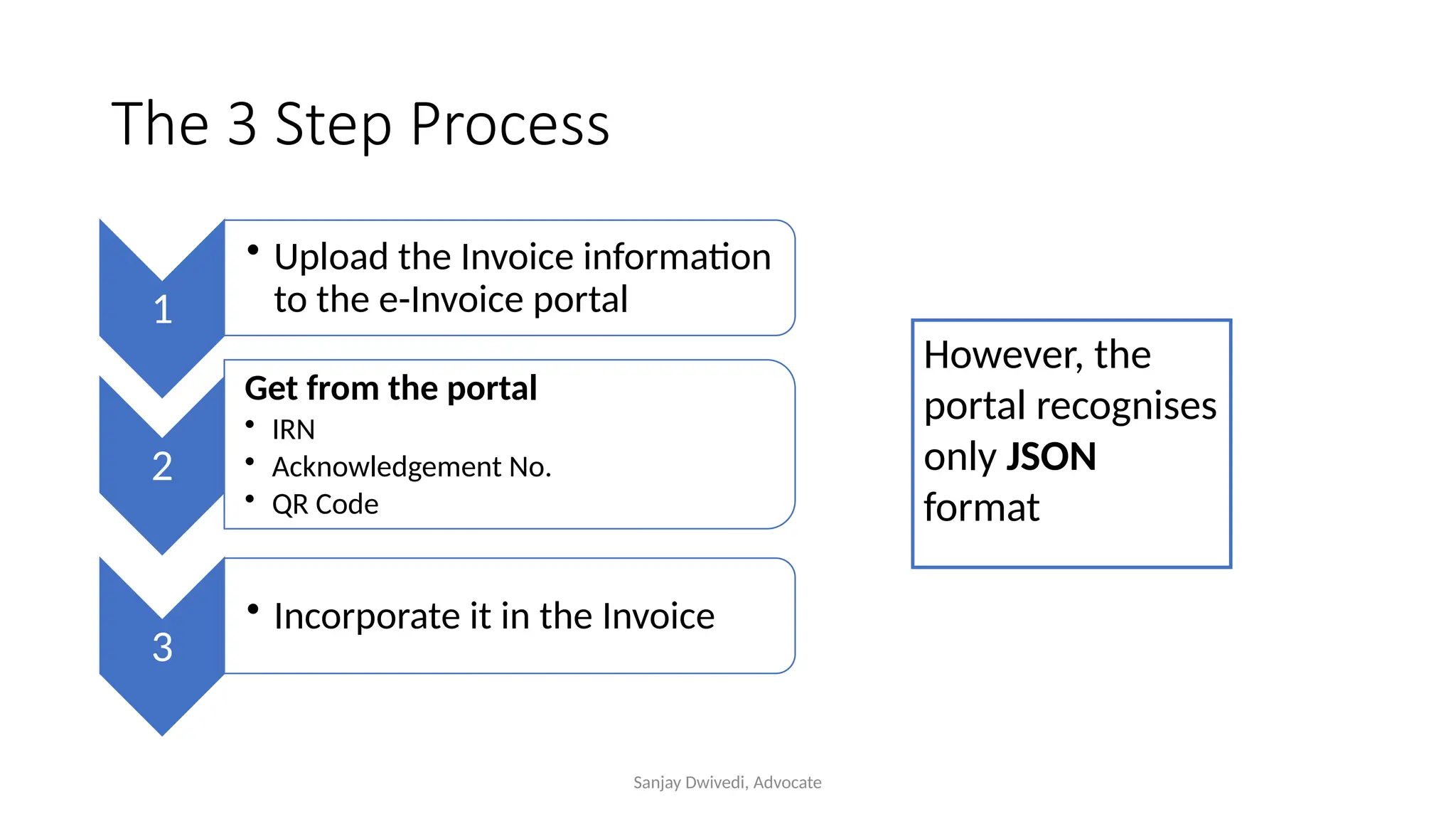

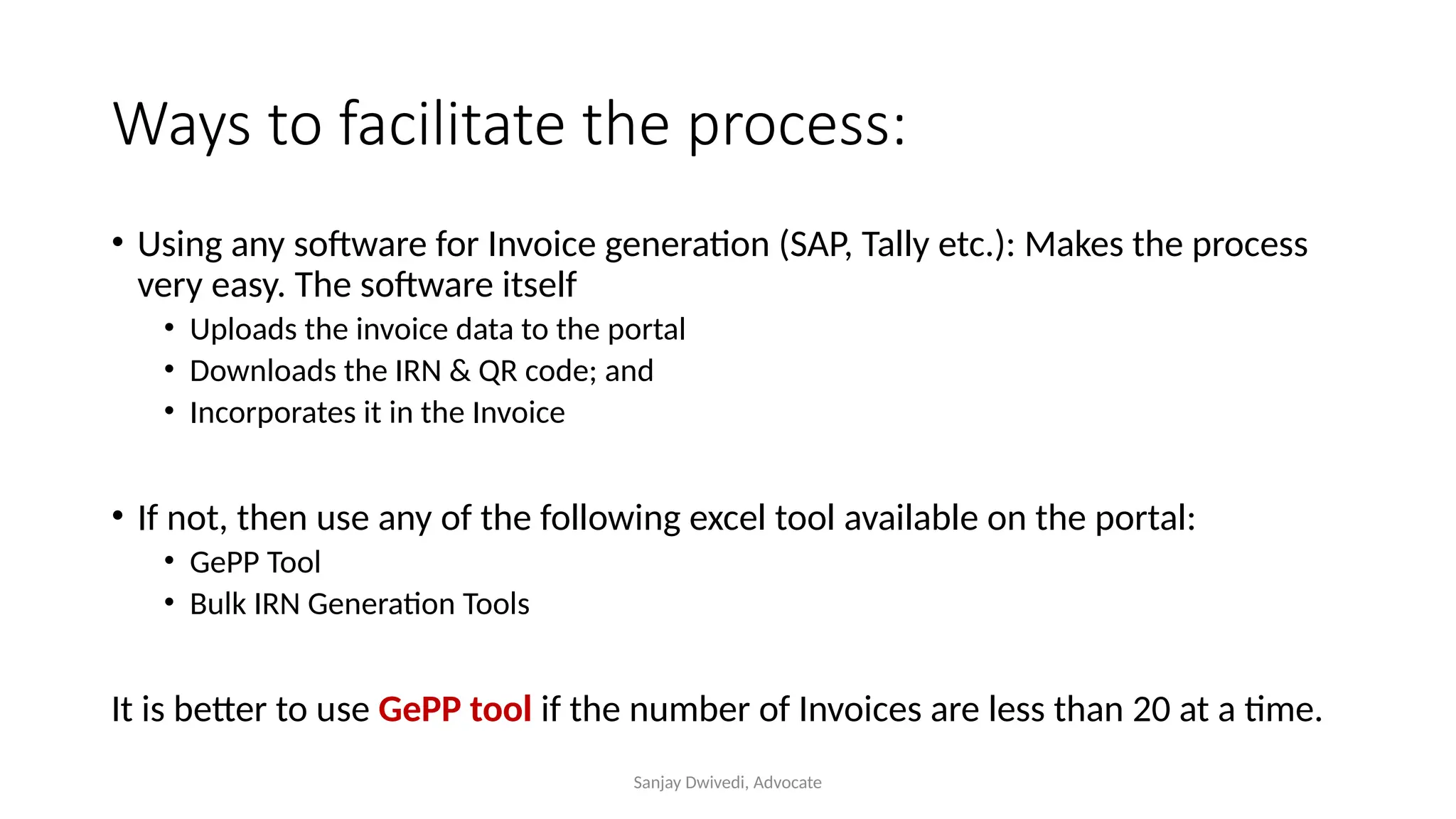

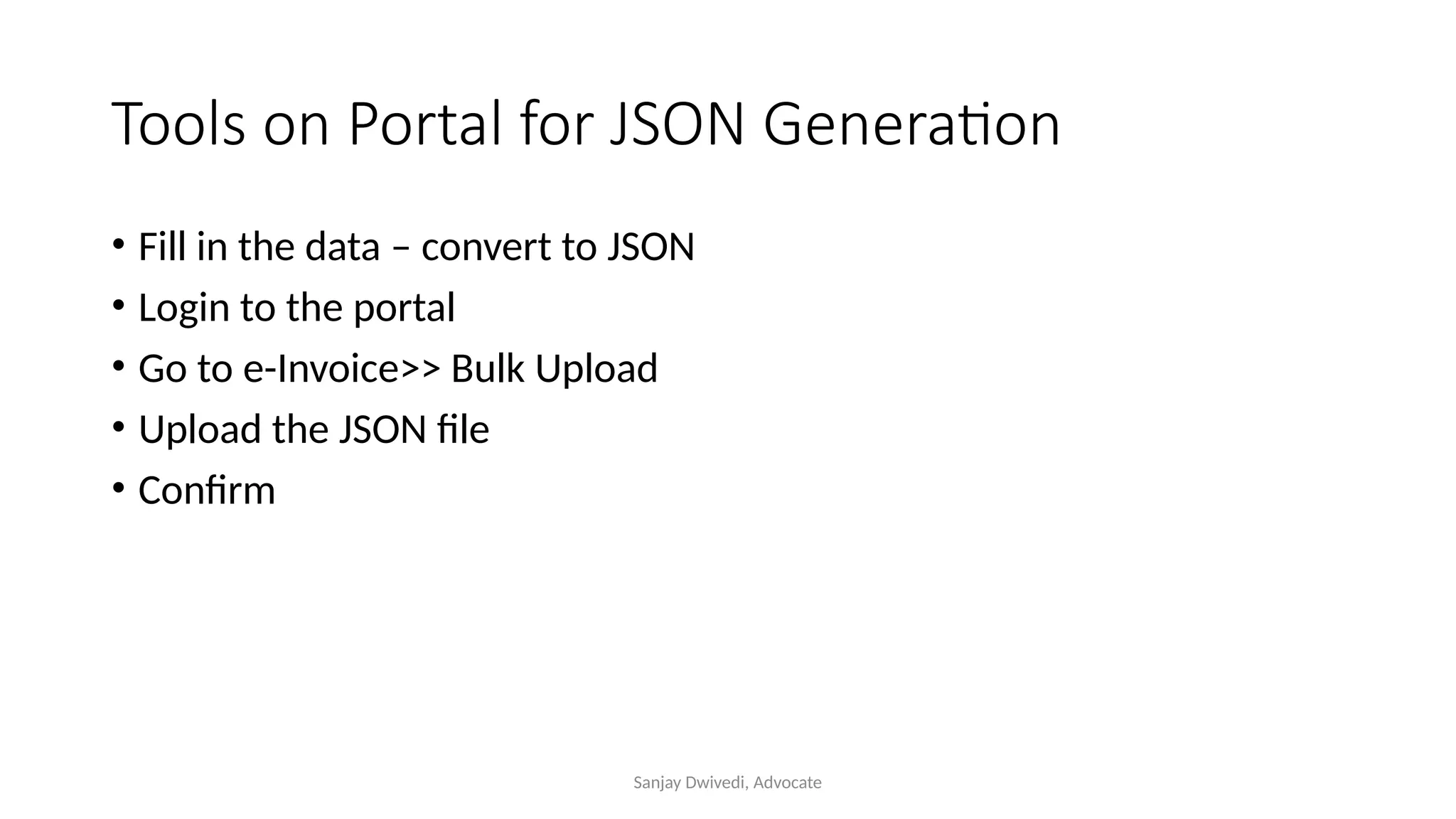

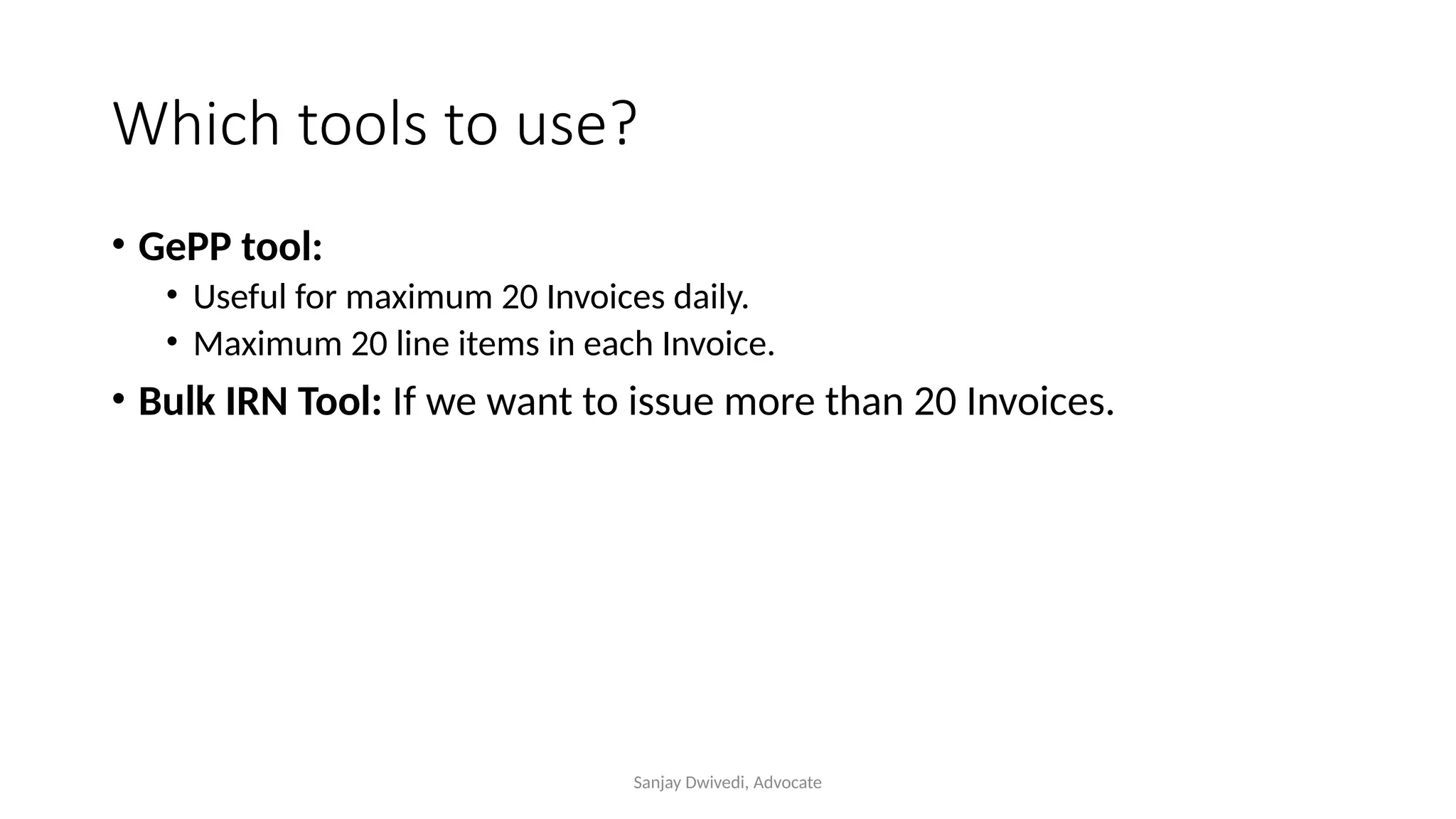

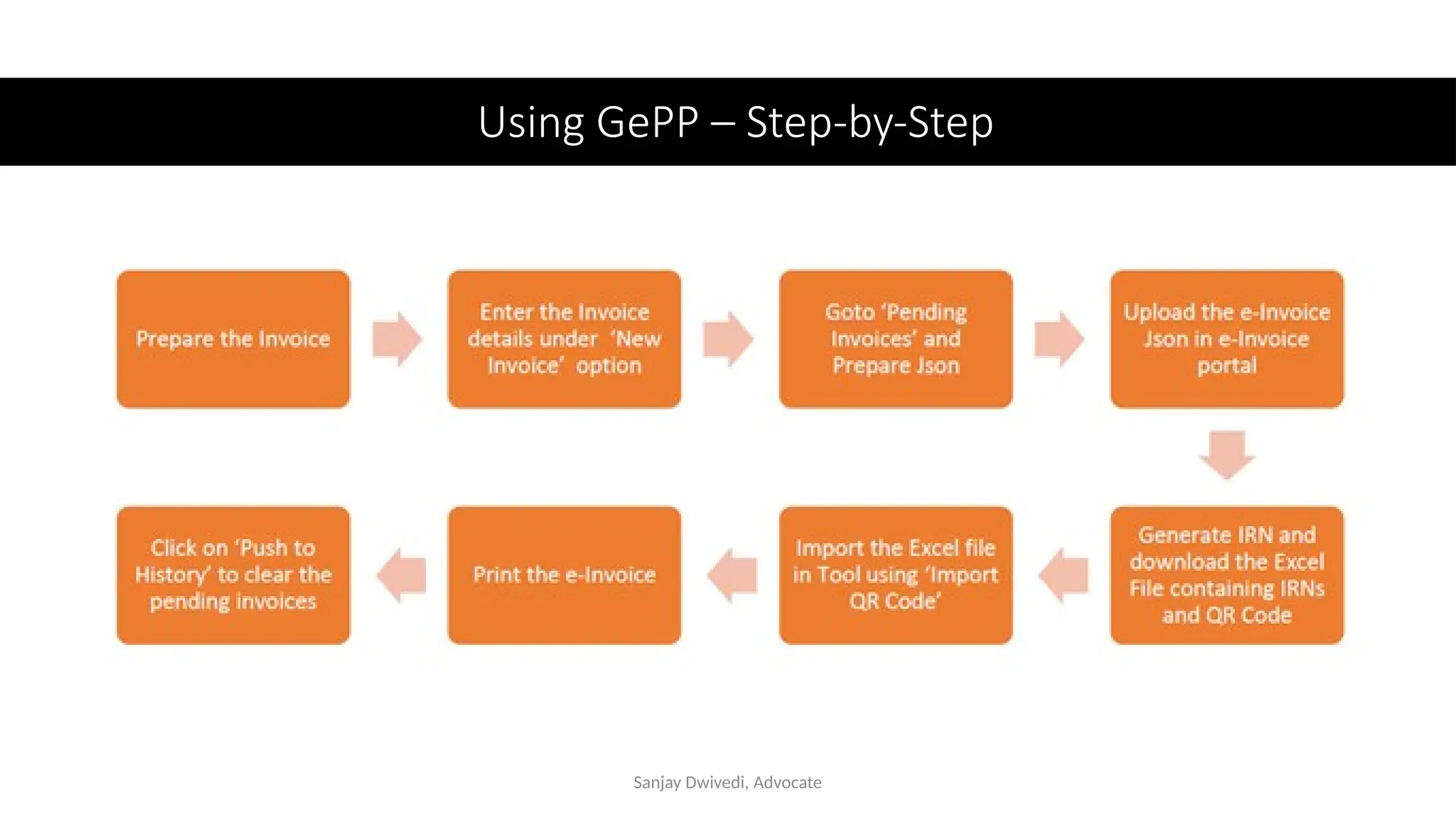

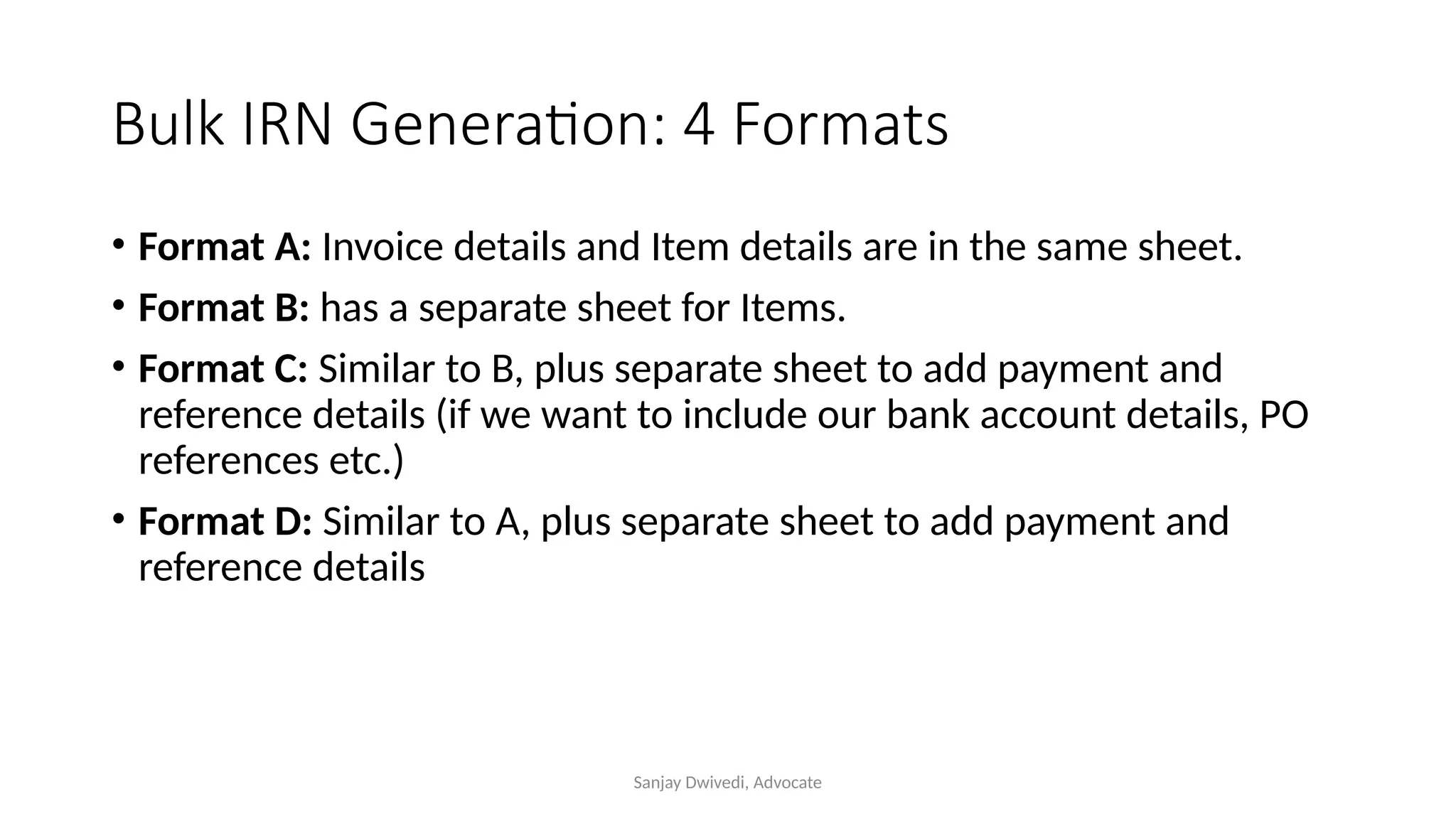

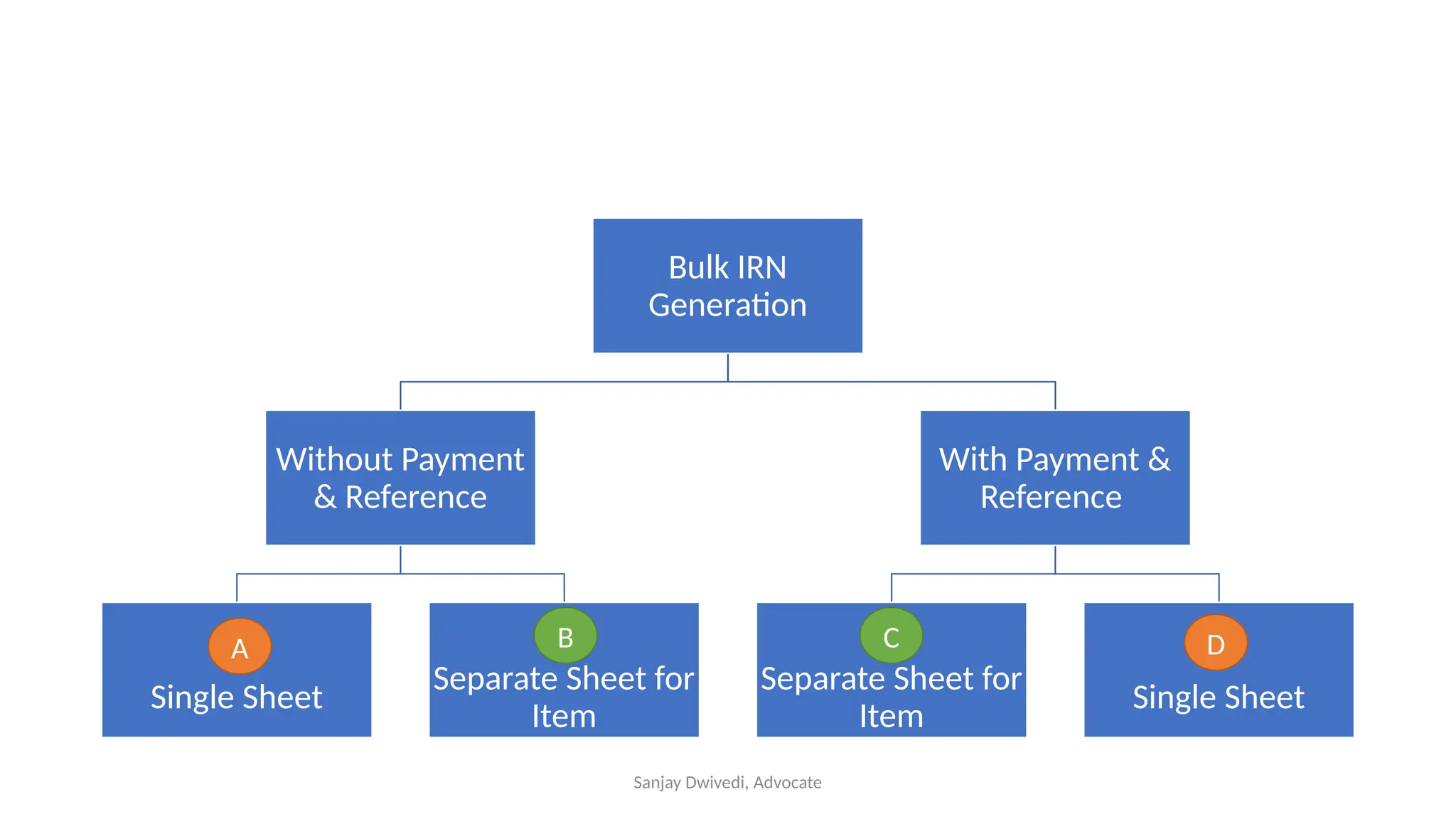

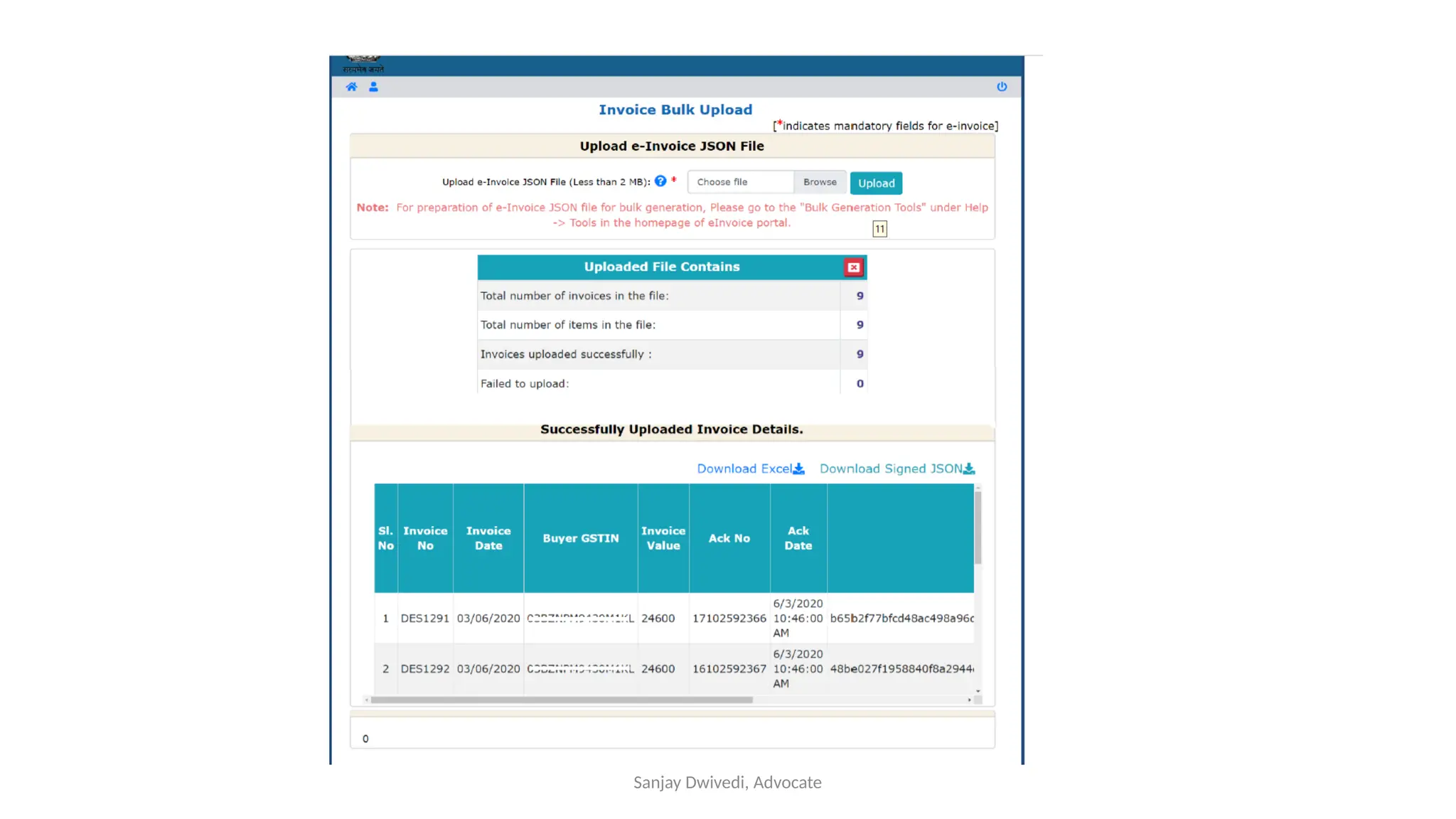

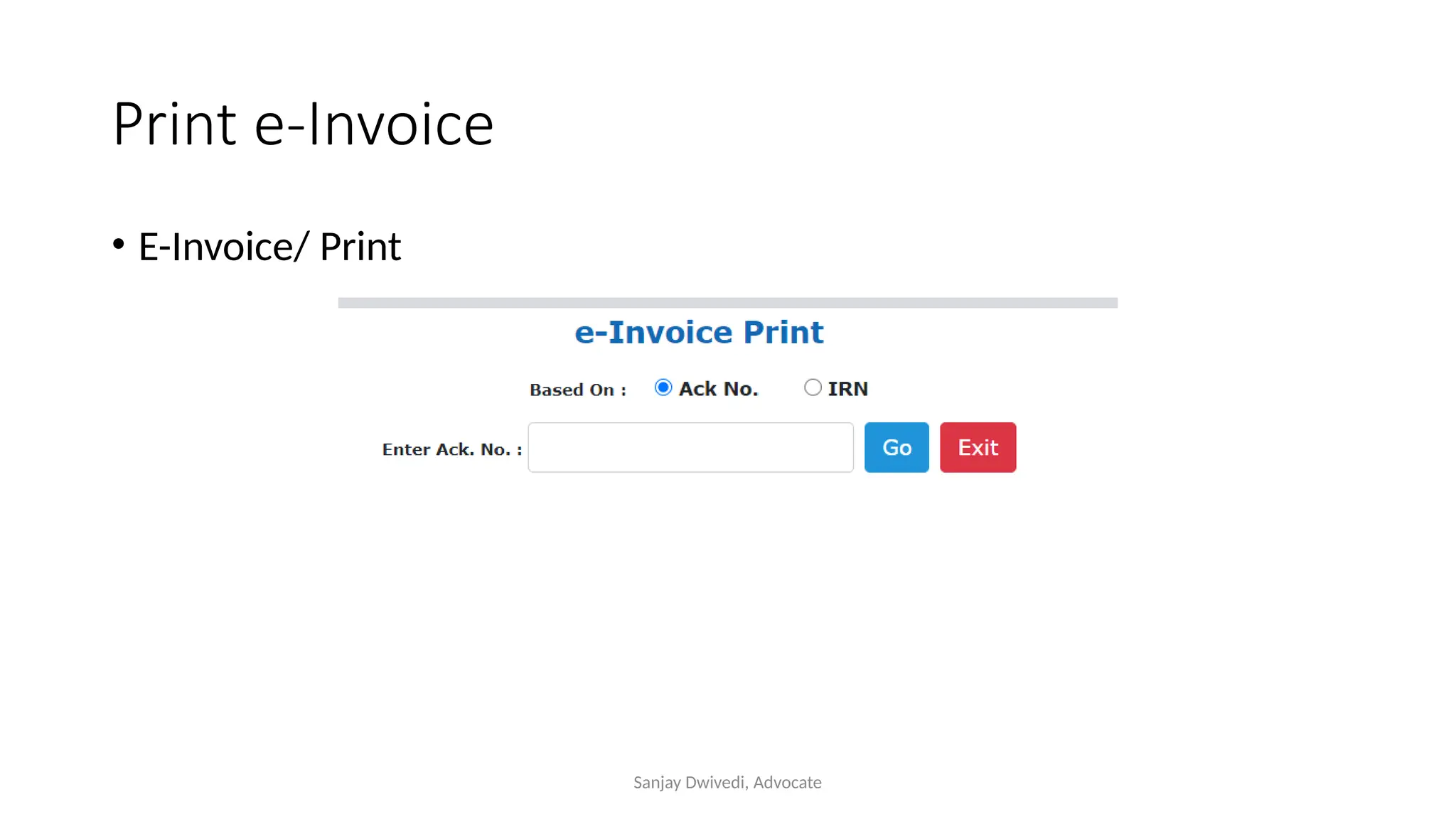

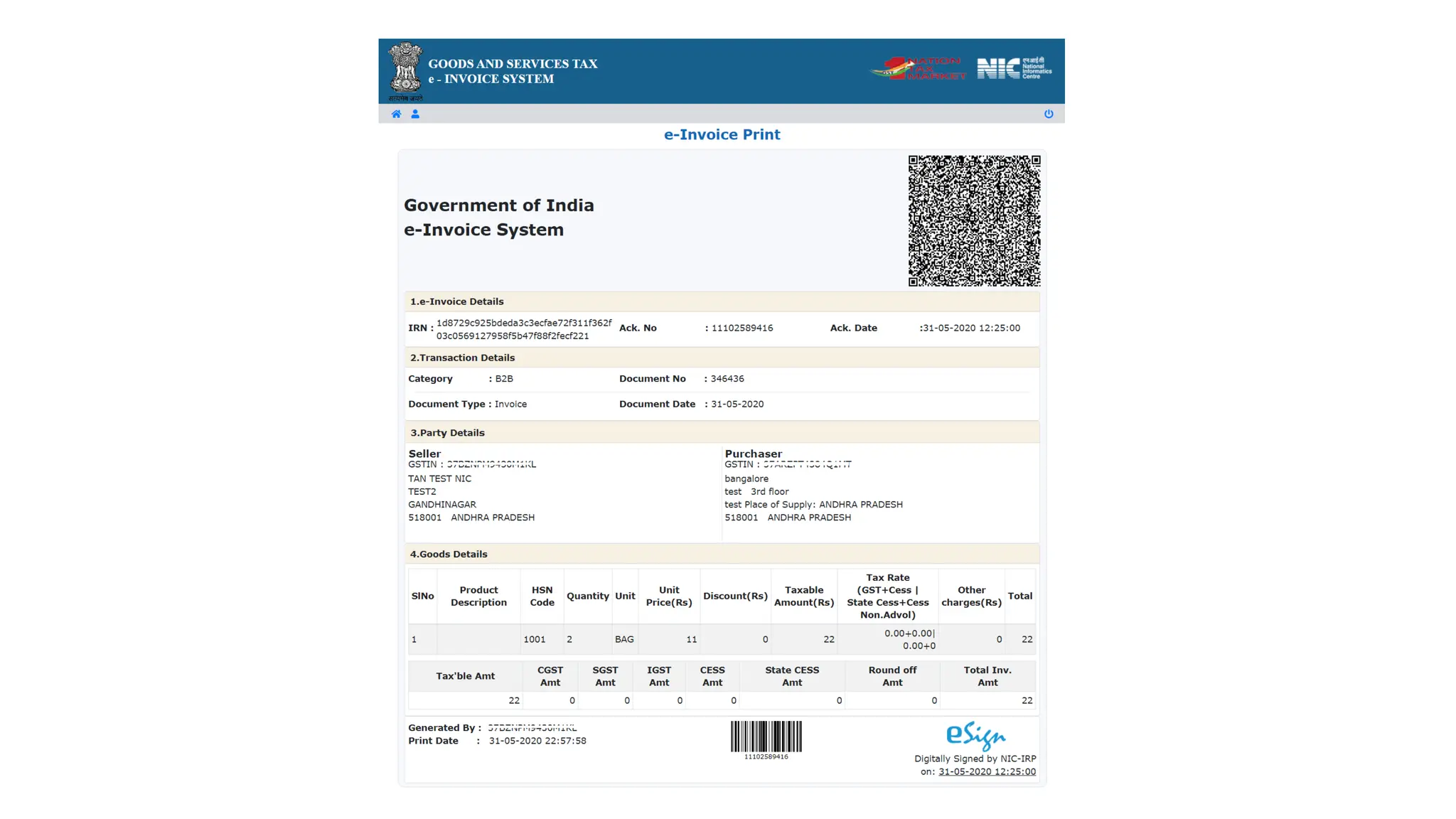

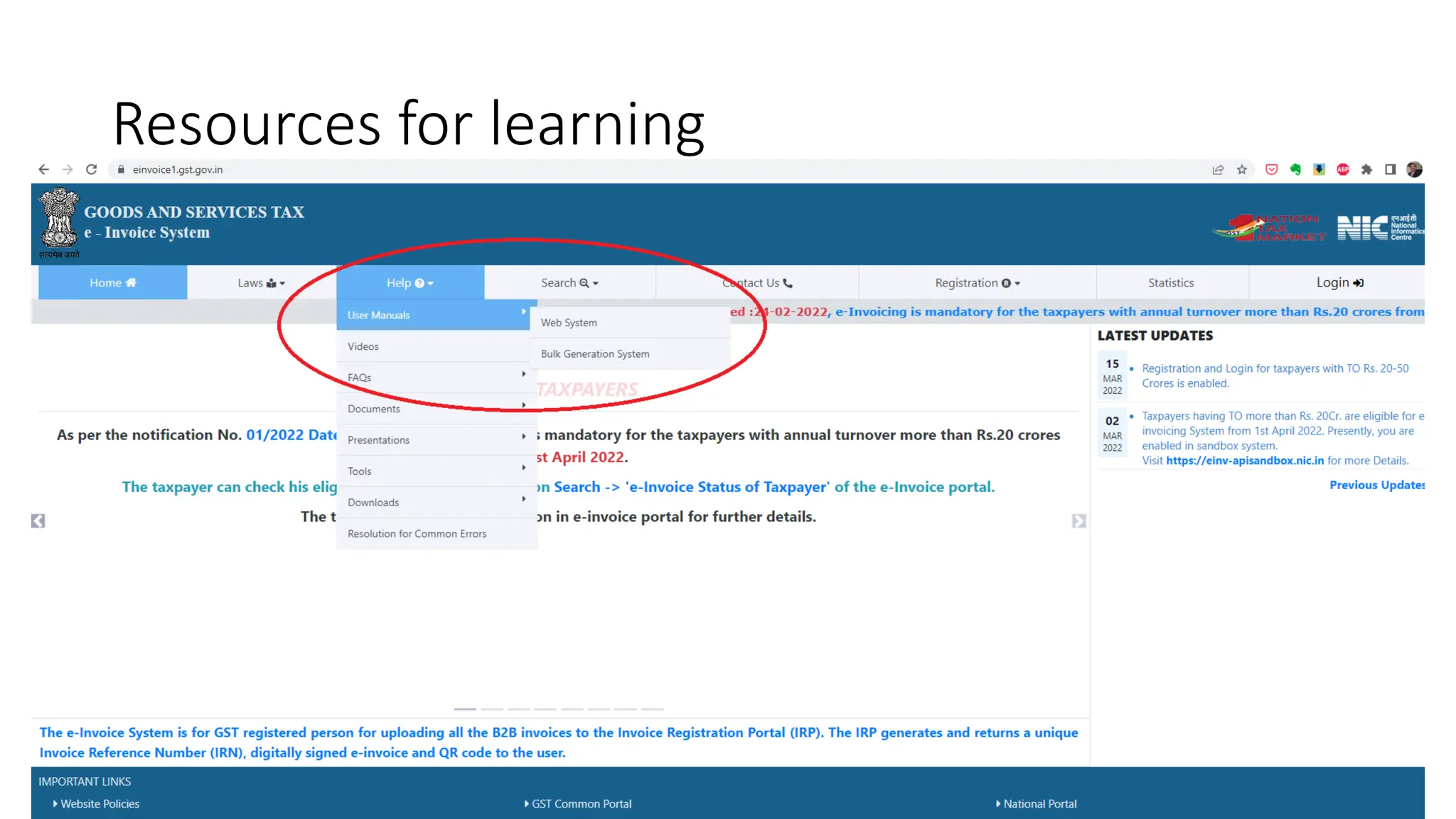

The document provides a comprehensive overview of e-invoicing under GST, detailing its definition, necessity, and the processes involved in generating e-invoices. It outlines the categories of taxpayers exempt from issuing e-invoices, various tools for creating them, and legal provisions related to e-invoicing. Additionally, it includes FAQs addressing common concerns and clarifying the implications of failing to issue e-invoices.