The document discusses the configuration of withholding tax in SAP for a company in India. It describes defining tax keys, tax types, recipient types, tax codes, and assigning them to vendors based on the applicable tax rates for section 194C (1% for HUF/Individual, 2% for others), 194I (2% for plant/machinery rent, 10% for land/building/furniture rent), and 194J (10% professional/technical fees). It also discusses creating a general ledger account for taxes payable and assigning exemptions to vendors if total annual payments are below certain thresholds.

![Important Terms

TAX KEYS:

• Tax keys are defined to identify different Sections under which TDS is levied

• It is required for Reporting Tax details for respective Sections under ITA

Recipient Types:

• Different persons are defined under recipient types [Example: Company, Individual/HUF]

• Recipient type is assigned to respective vendor

• Used in case different tax types are applicable to different persons

(Individual/HUF/Company)

Exemption Reason Code:

• Exemptions, if any, are defined as exemption reason code.

• Exemption Reason code gets assigned to respective Vendor master record

Business Place:

• Business Place are location where tax is deducted

• A Business place is created for each TAN number that a company has.](https://image.slidesharecdn.com/withholdingtaxinsap-190122124644/85/Withholding-tax-in-sap-4-320.jpg)

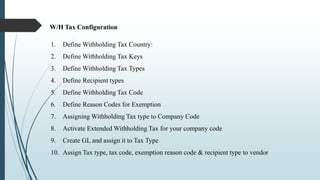

![What to define for configuring W/H Tax for the given case?

1. Tax keys: 3 Tax keys by the name 194C, 194I & 194J shall be defined under basic

settings of Extended Withholding Tax

2. Tax Types: In the given case, we shall define 3 Tax types for Invoice and 3 Tax types

for Payment. [Additional Tax types will be defined for recipient types-next point].

3. Recipient Types: For Tax key 194C, different rates are prescribed for different

persons. Therefore, we should define 2 Recipient types- i) Individual/HUF ii) Others.

2 Additional Tax Types (1 for Invoice & 1 for Payment) shall be defined before

creating recipient types.

4. Tax Codes: In the given case, there are 5 different tax rates applicable. Therefore, we

shall define 5 tax codes twice, for each Tax type of Invoice & Payment.](https://image.slidesharecdn.com/withholdingtaxinsap-190122124644/85/Withholding-tax-in-sap-8-320.jpg)