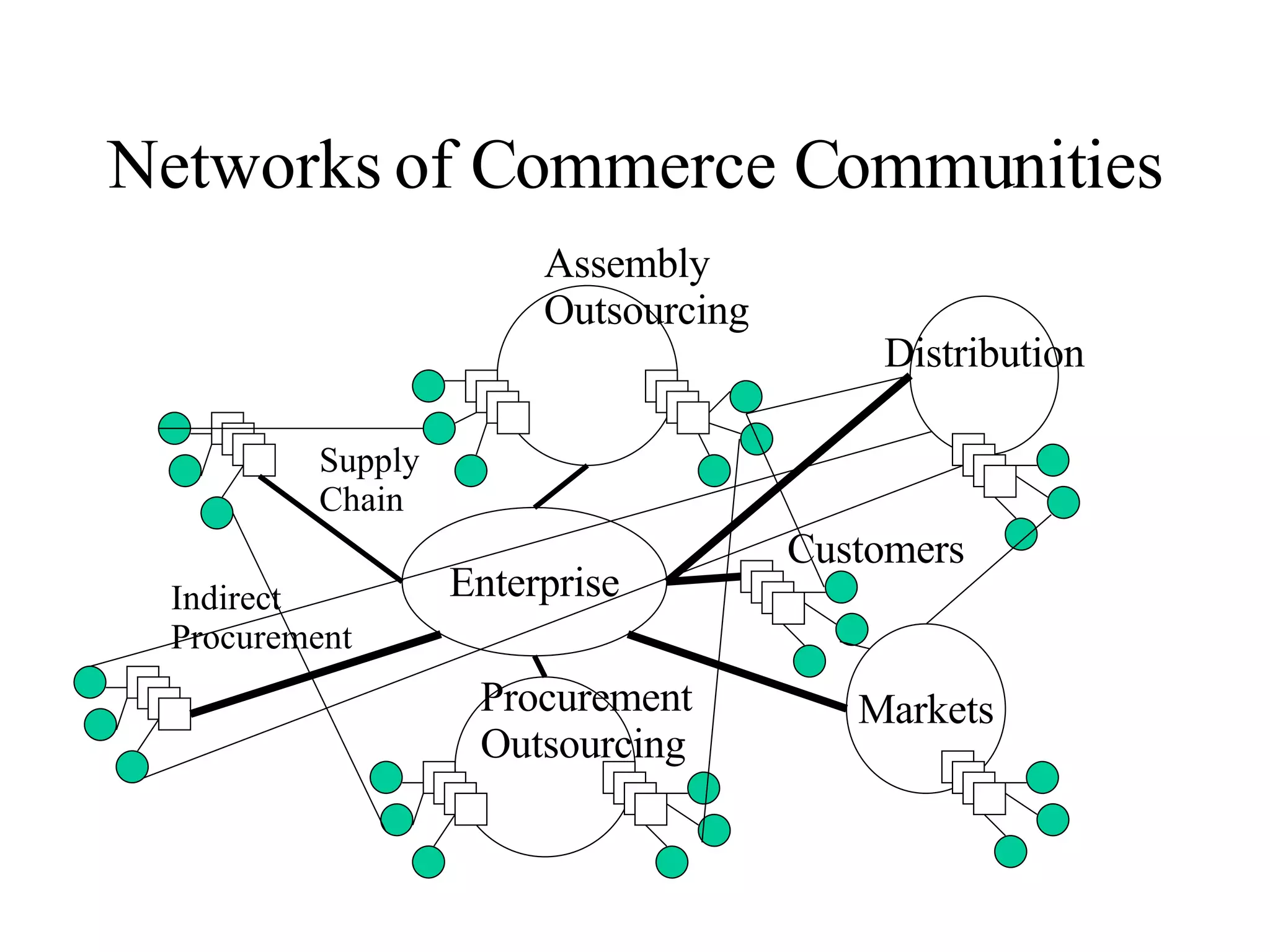

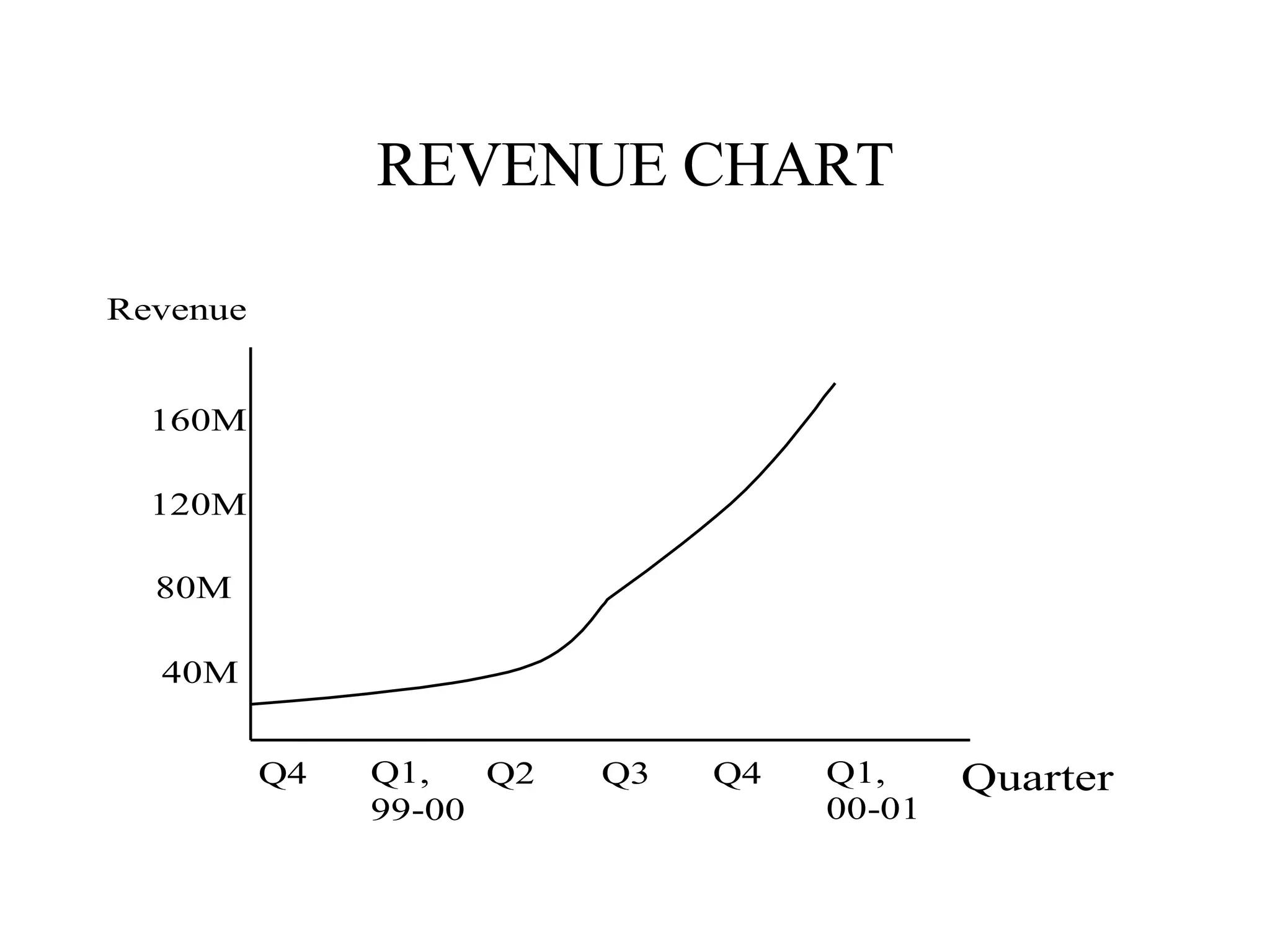

The document provides an overview of B2B e-commerce through a lecture on the topic. It defines B2B commerce and electronic marketplaces, discusses various business models for e-commerce including horizontal and vertical marketplaces, and describes several major companies in the space like Commerce One, Ariba, and Covisint. Revenue models for marketplaces and some unresolved issues facing Covisint are also summarized.