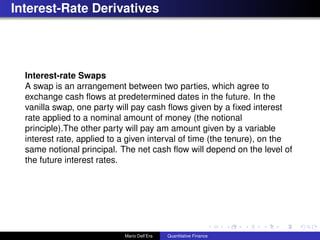

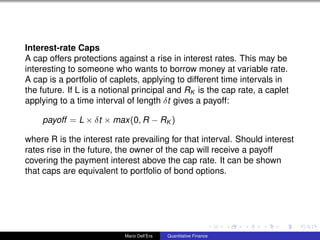

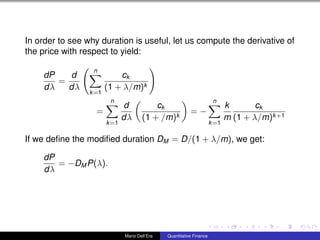

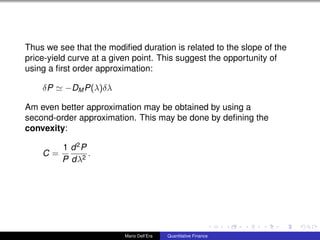

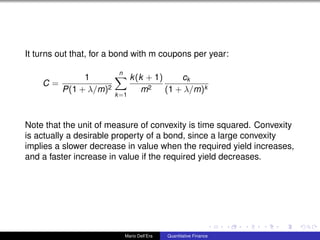

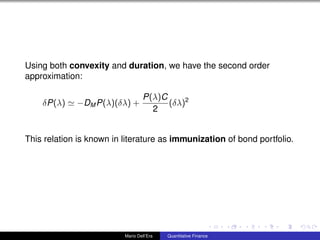

This document discusses quantitative finance topics including bond duration and immunization. It provides an example showing how duration and convexity can be used to approximate changes in bond prices from changes in yields. The document also discusses how to construct a bond portfolio with a target duration and convexity. Finally, it briefly defines interest rate swaps, bond options, interest rate caps, and floors.

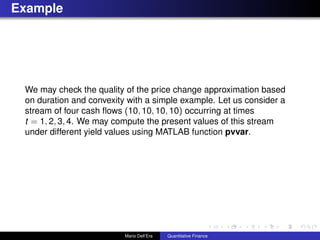

![>> cf= [10 10 10 10]

cf=

10 10 10 10

>> p1=pvvar([0, cf], 0.05 )

p1=

35.4595

>> p2=pvvar([0, cf], 0.055 )

p2=

35.0515

>>p2-p1

ans=

-0.4080

we see that increasing the yield by 0.005 results in a price drop of

0.4080.

Mario Dell’Era Quantitative Finance](https://image.slidesharecdn.com/duration-convexity-140625154039-phpapp01/85/Duration-and-Convexity-9-320.jpg)

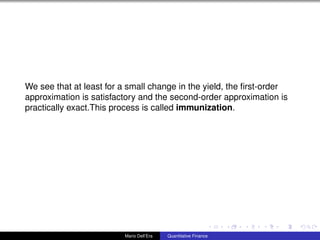

![Now we may compute the modified duration and the convexity using

the function cfdur and cfconv. The function cfdur returns both

Macauley and modified duration; for our purposes, we must pick up

the second output value:

>> [d1 dm]=cfdur(cf, 0.05)

d1=

2.4391

dm=

2.3229

>> cv= cfconv(cf, 0.05)

cv=

8.7397

>> −dm ∗ p1 ∗ 0.005

ans=

-0.4118

>> −dm ∗ p1 ∗ 0.005 + 0.5 ∗ cv ∗ p1 ∗ (0.005)2

and=

-0.4080

Mario Dell’Era Quantitative Finance](https://image.slidesharecdn.com/duration-convexity-140625154039-phpapp01/85/Duration-and-Convexity-10-320.jpg)

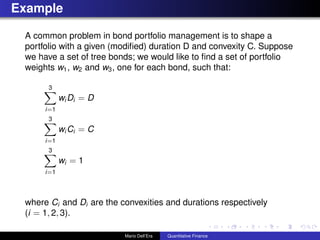

![% SET BOND FEATURES (bondimmum.m)

settle= ’28-Aug-2007’;

maturities=[’15-Jun-2012’ ; ’31-Oct-2017’ ; ’01-Mar-2027’];

couponRates=[0.07; 0.06 ; 0.08];

yields=[0.06 ; 0.07 ; 0.075];

Mario Dell’Era Quantitative Finance](https://image.slidesharecdn.com/duration-convexity-140625154039-phpapp01/85/Duration-and-Convexity-13-320.jpg)

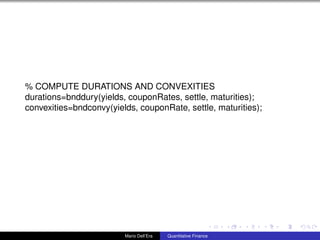

![% COMPUTE PORTFOLIO WEIGHTS

A=[duration’ convexities’ 1 1 1];

b=[10 160 1];

wieghts=A / b

Mario Dell’Era Quantitative Finance](https://image.slidesharecdn.com/duration-convexity-140625154039-phpapp01/85/Duration-and-Convexity-15-320.jpg)