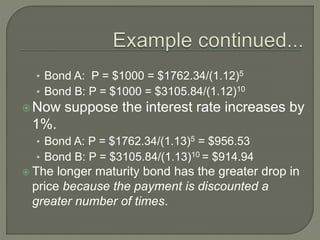

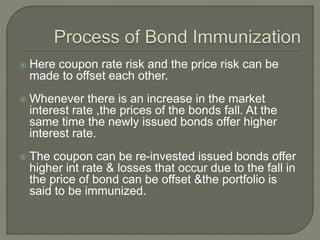

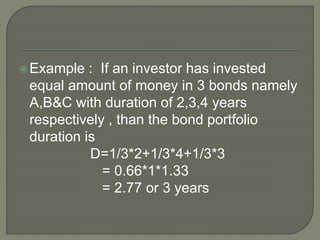

Bond immunization is an investment strategy used to minimize the impact of interest rate changes on bond portfolios. It works by adjusting the portfolio duration to match the investor's time horizon. When a portfolio is immunized, its duration equals the investor's time horizon. Maintaining an immunized portfolio requires rebalancing the average duration whenever interest rates change, to keep it equal to the investor's time horizon. This offsets losses from falling bond prices against gains from reinvesting coupon payments at higher rates.