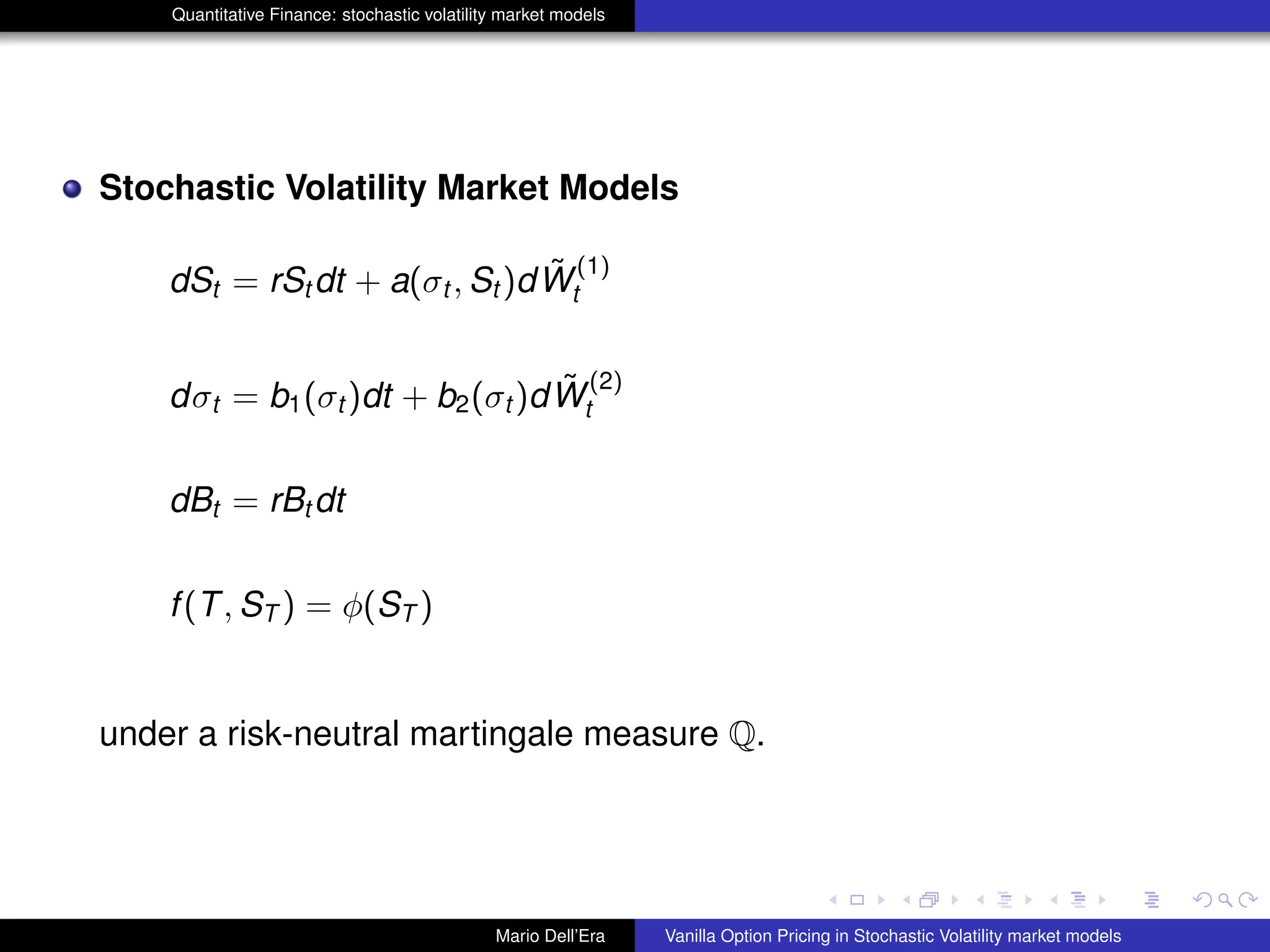

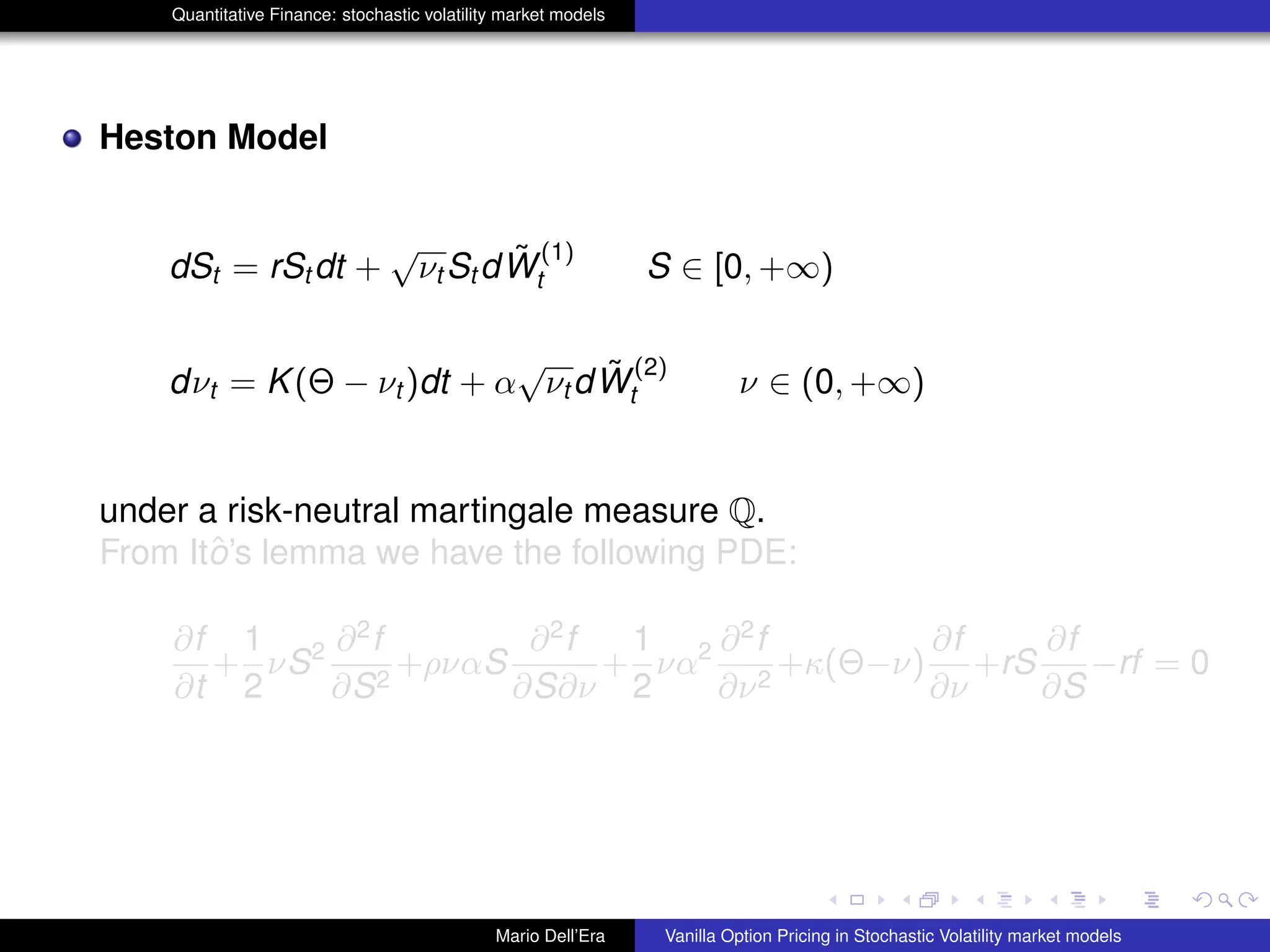

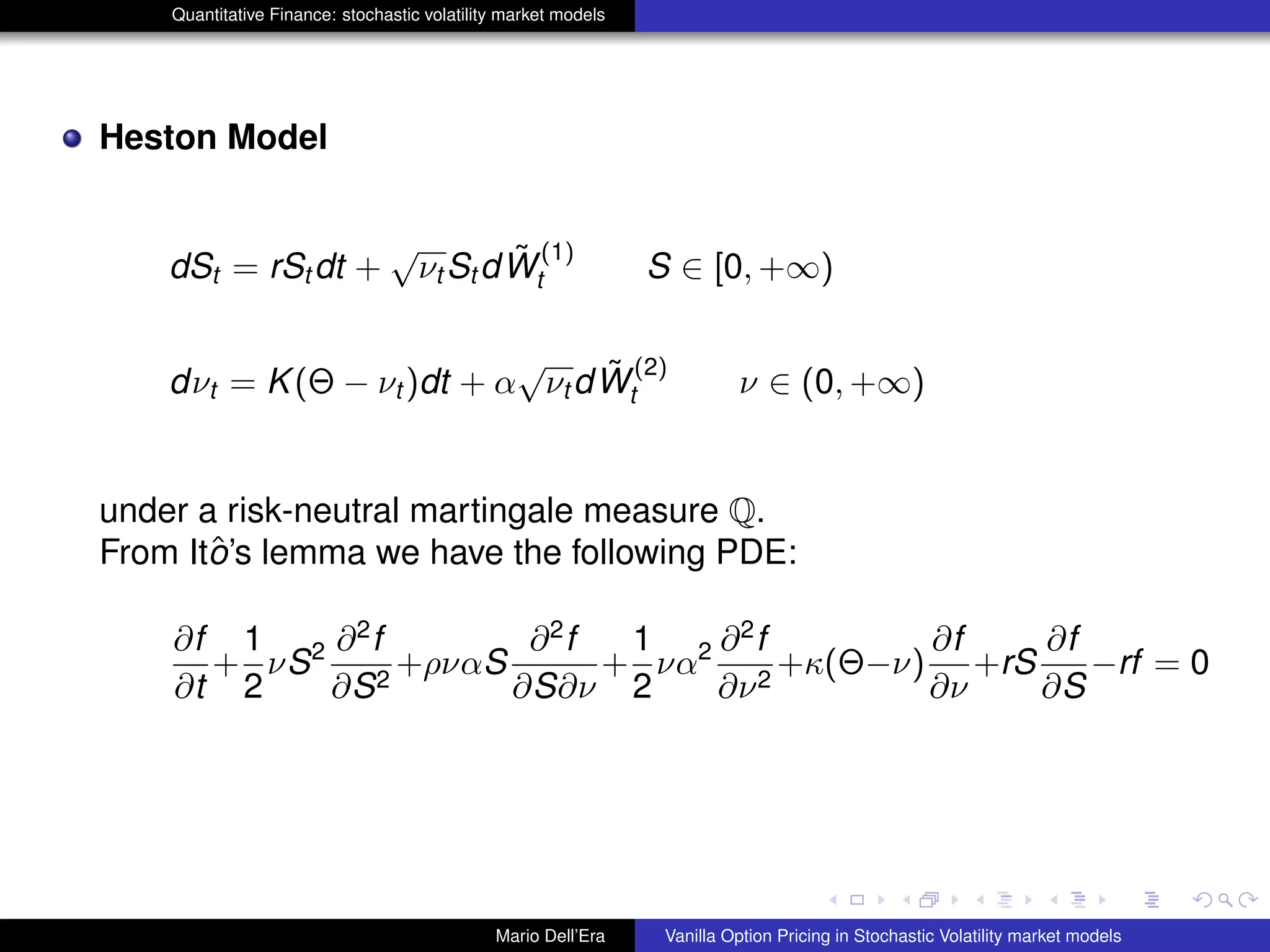

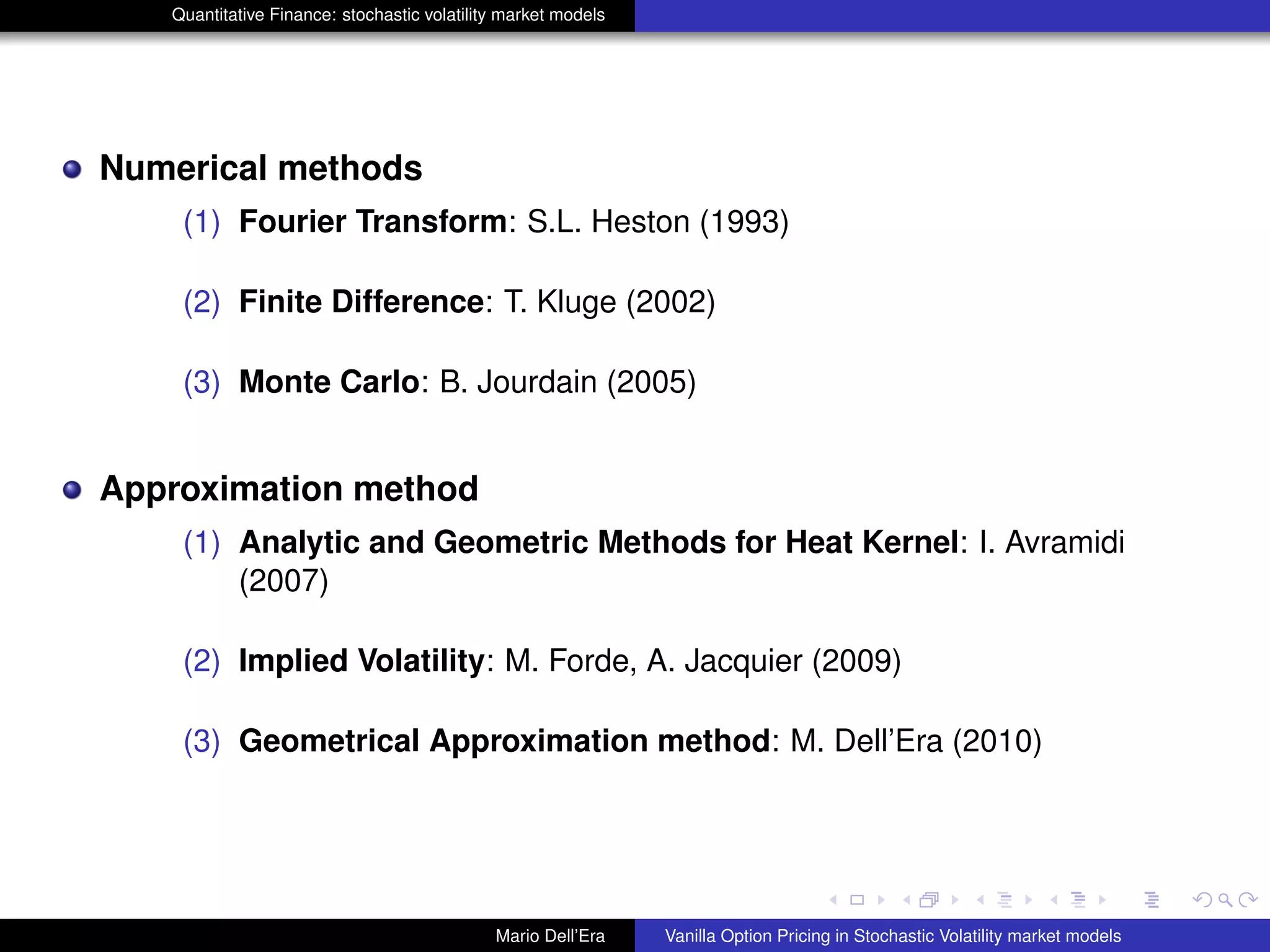

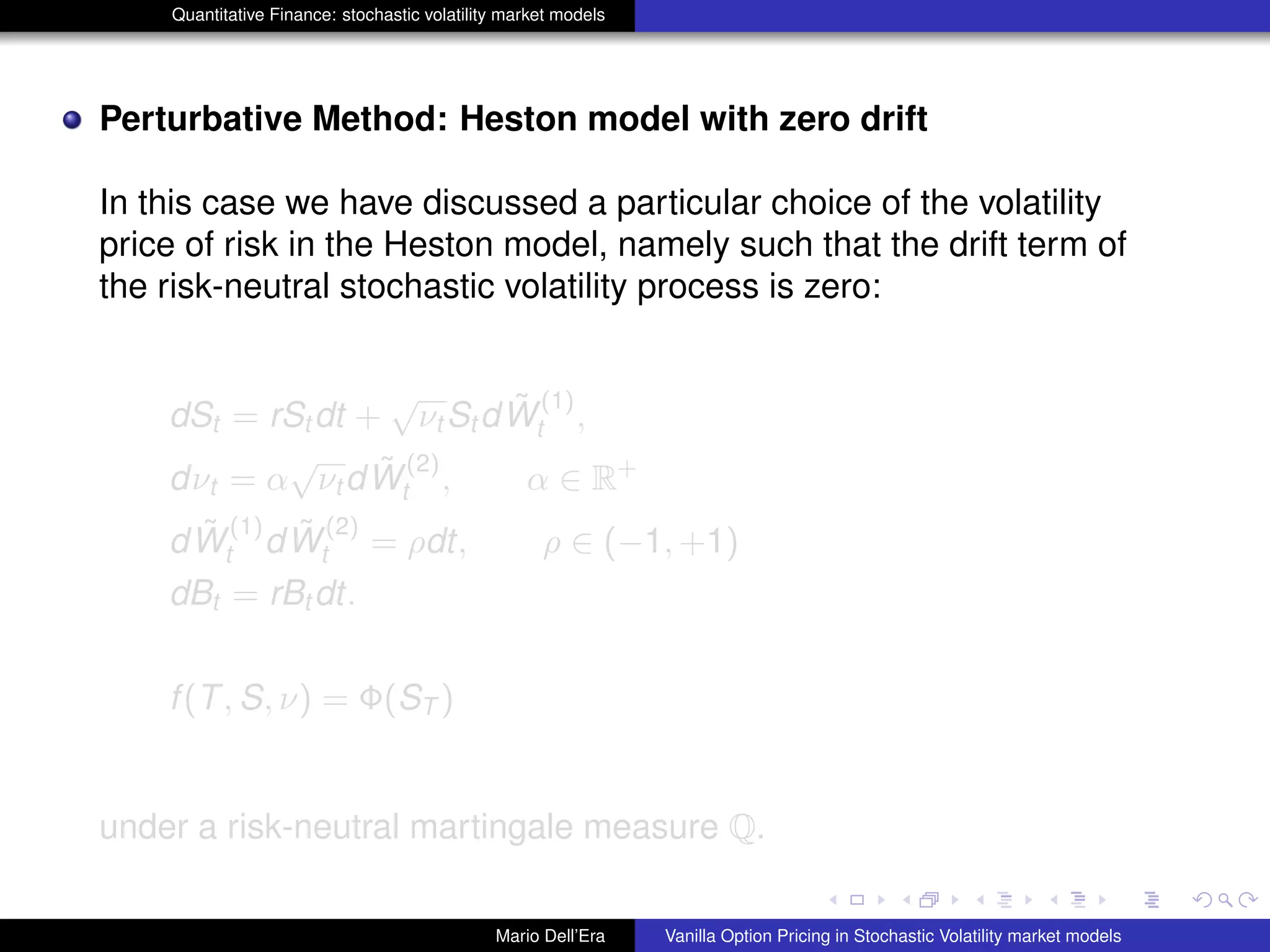

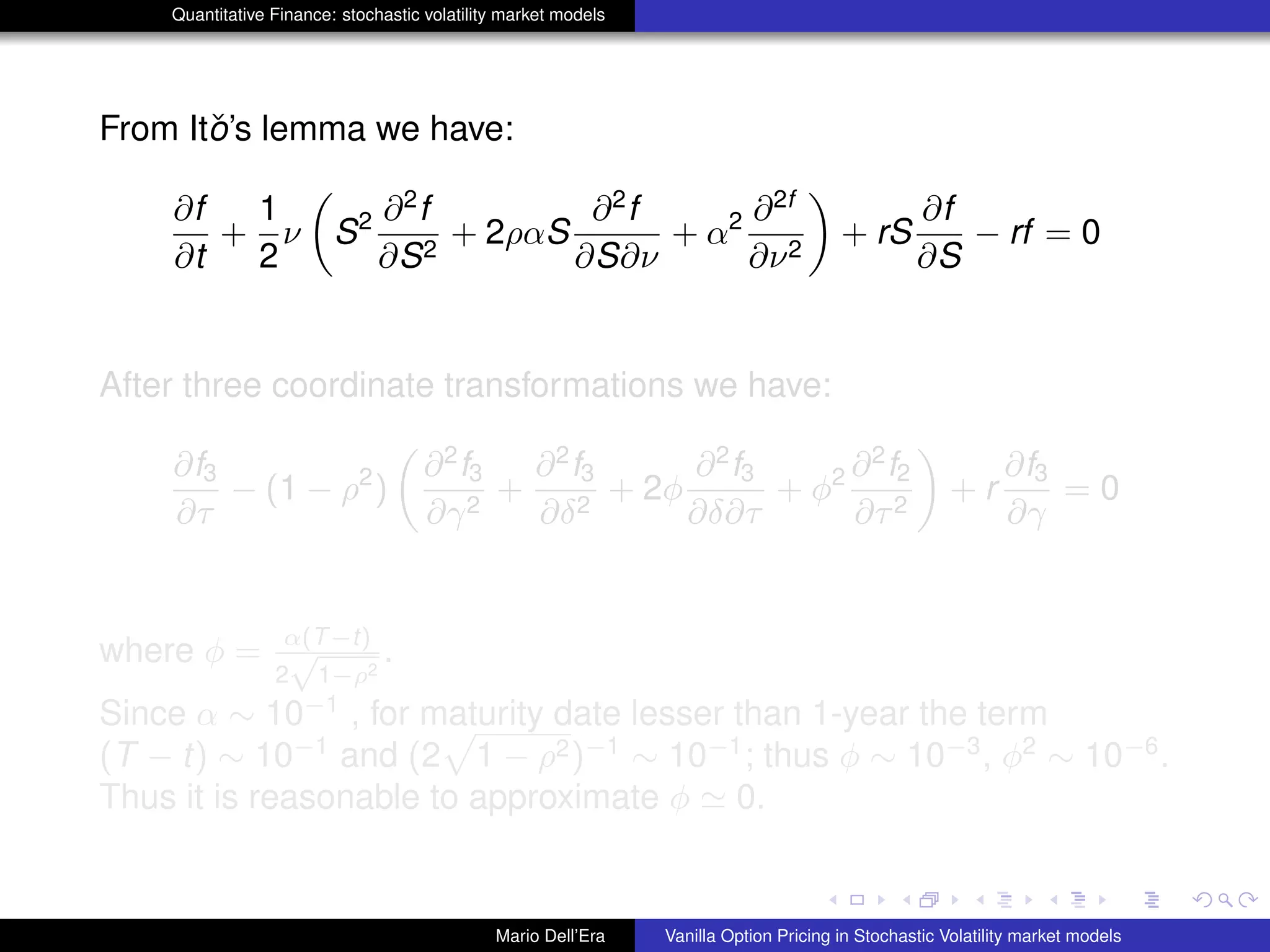

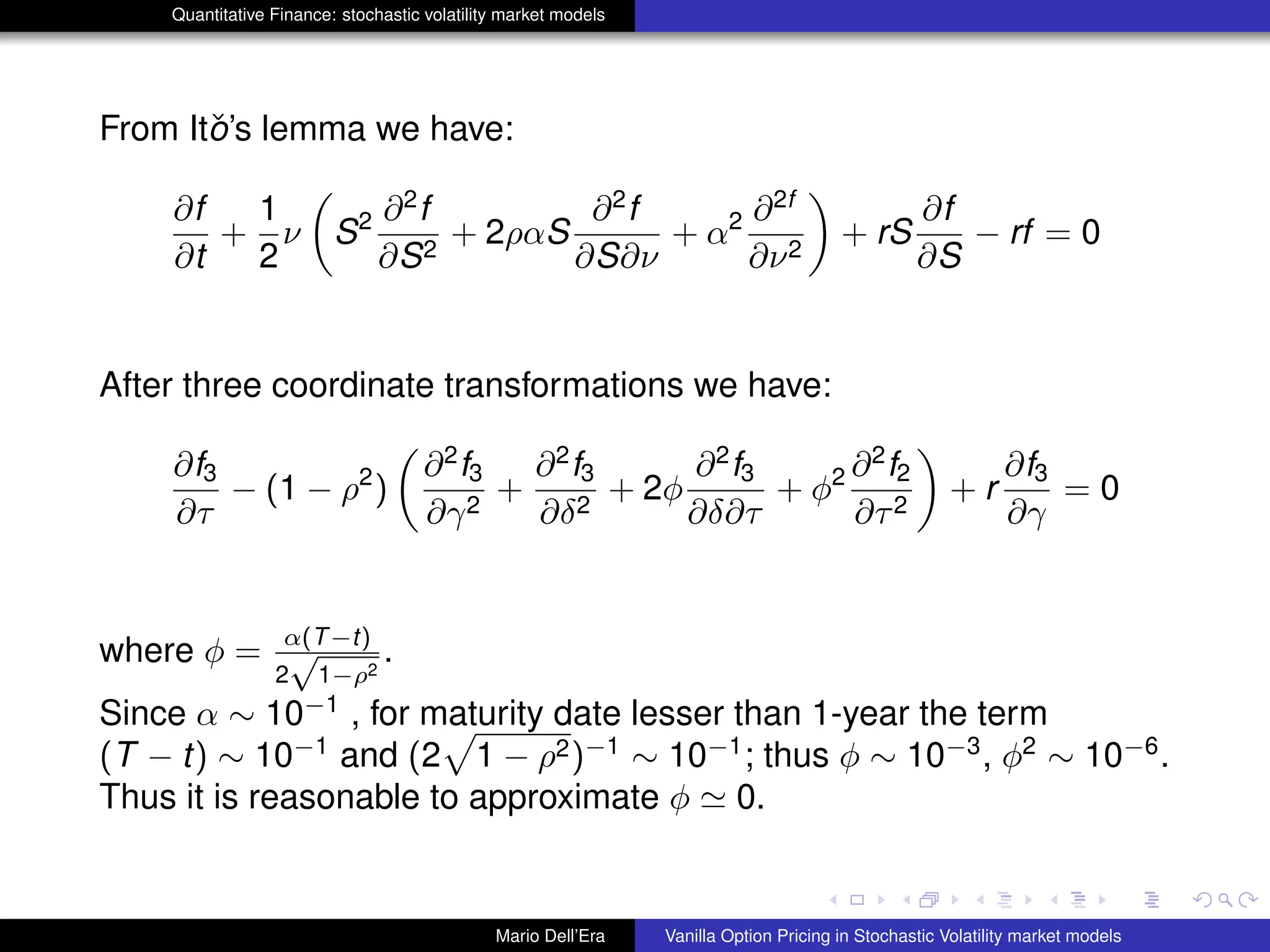

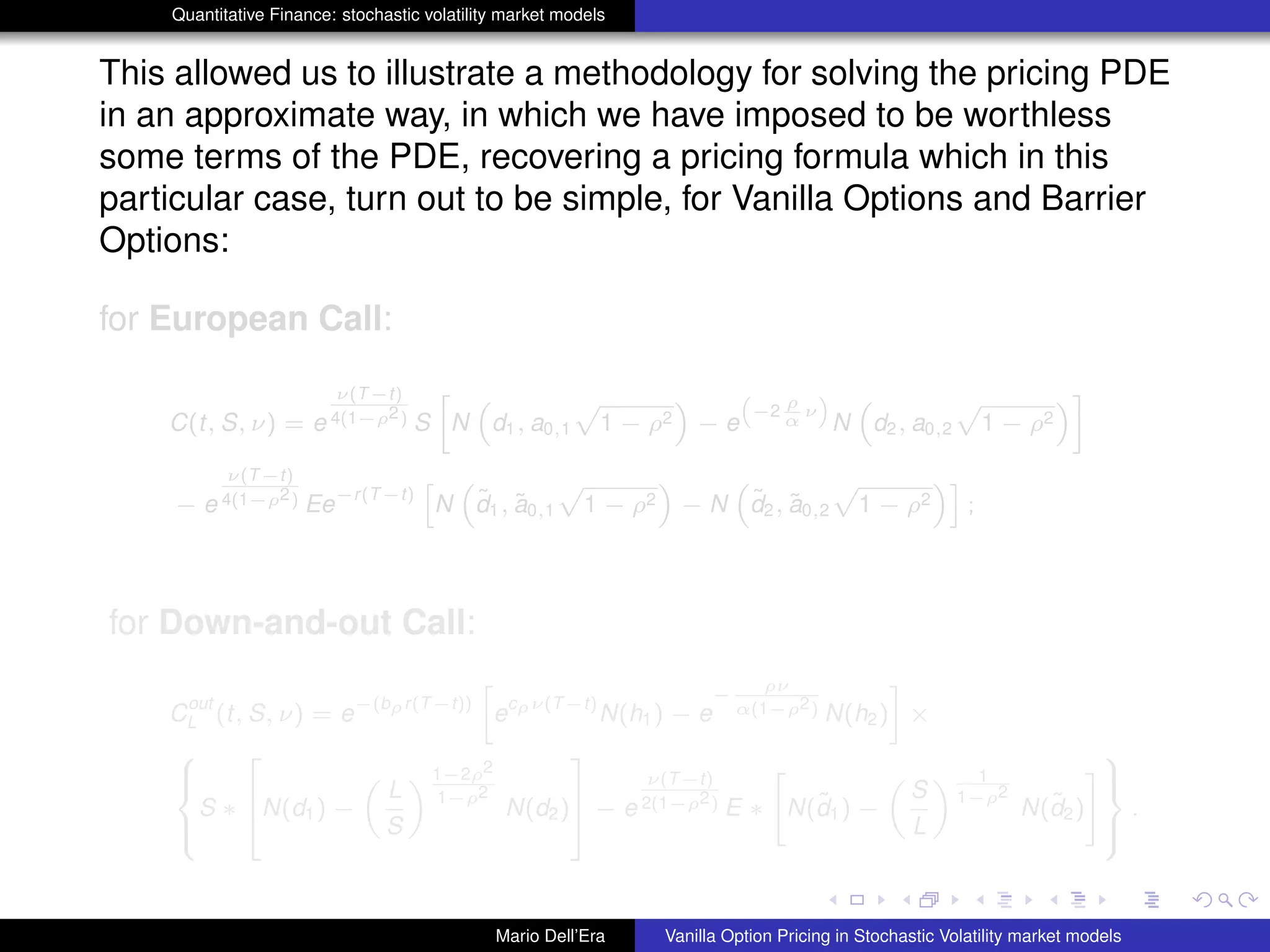

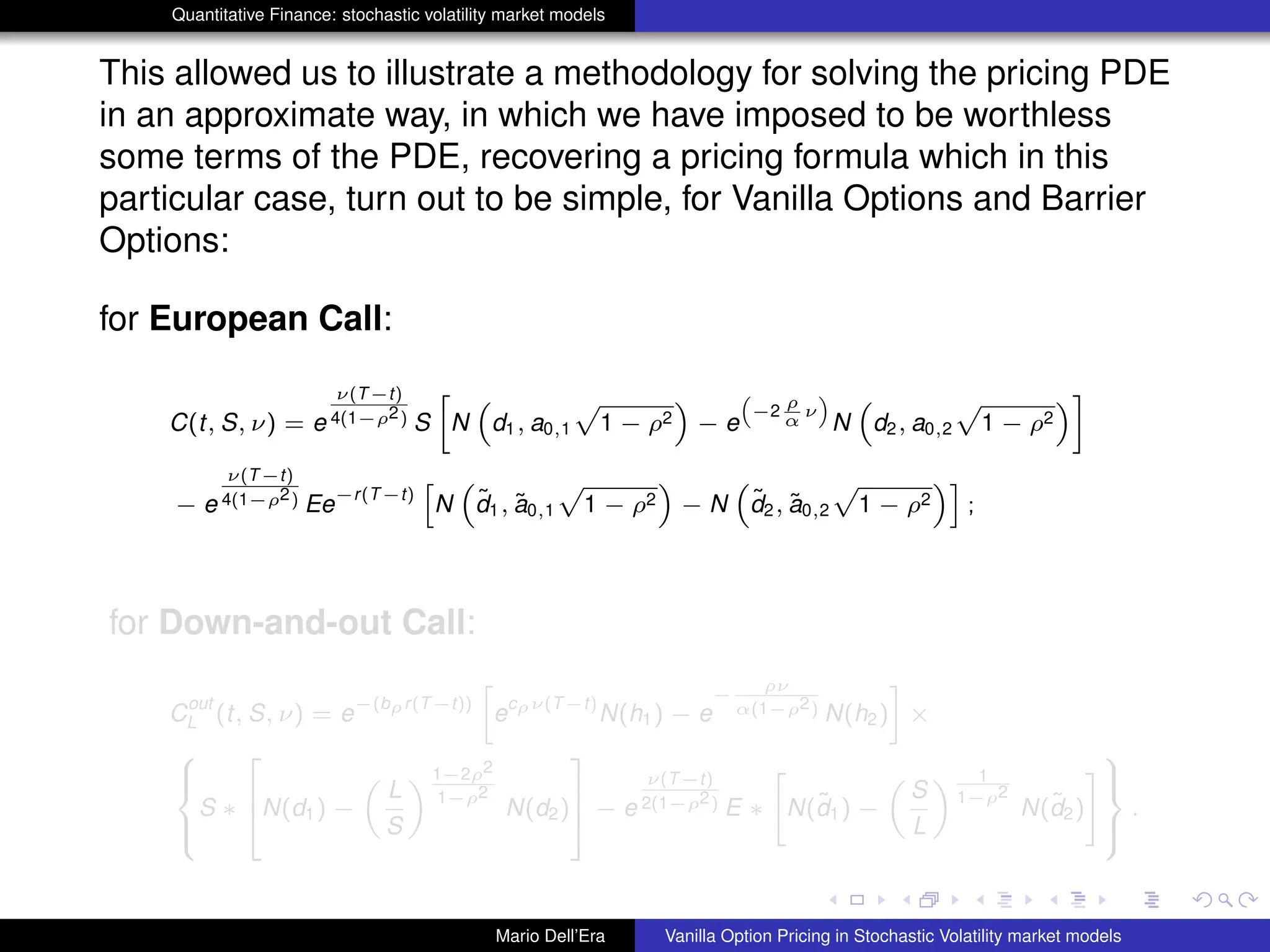

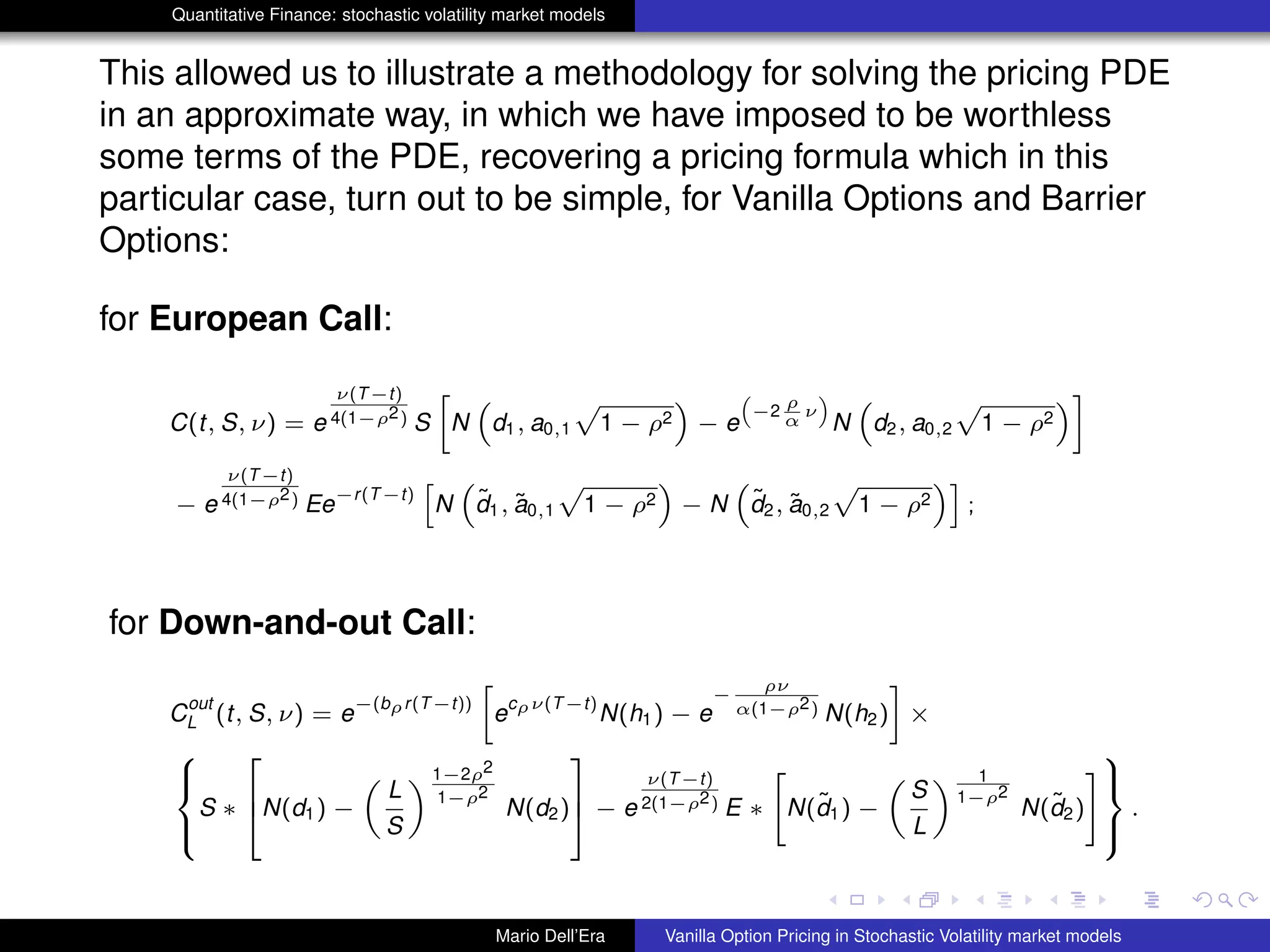

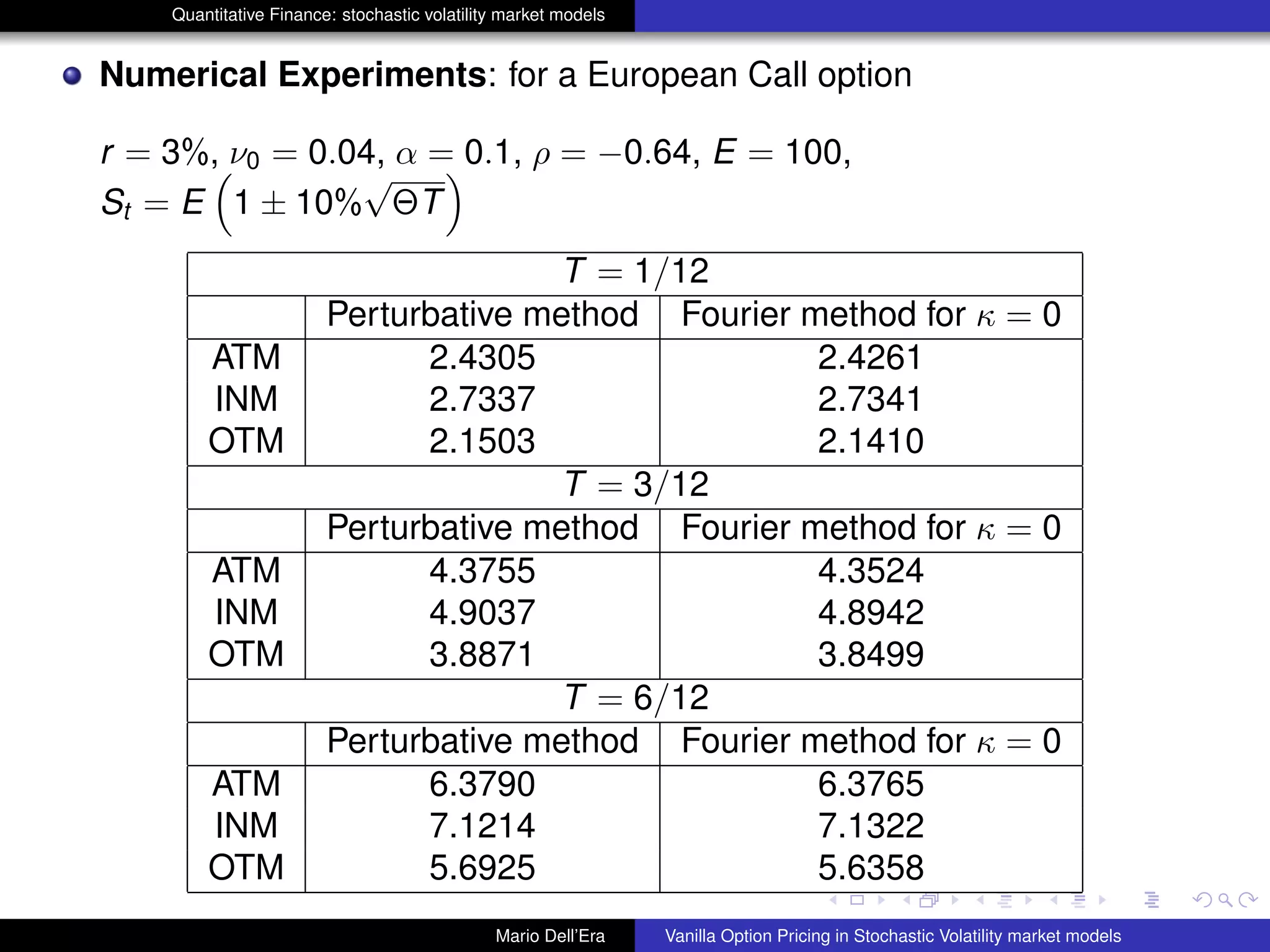

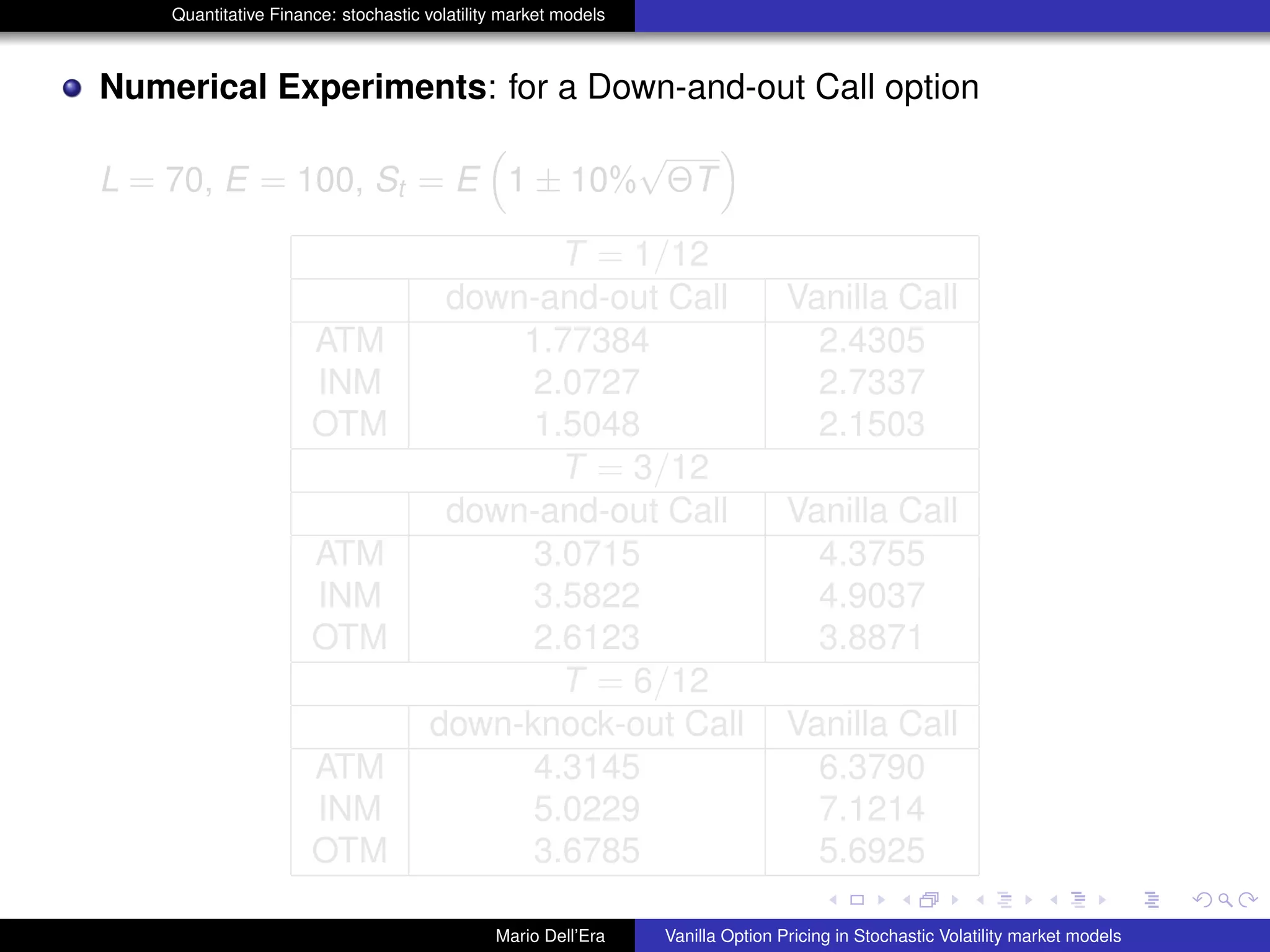

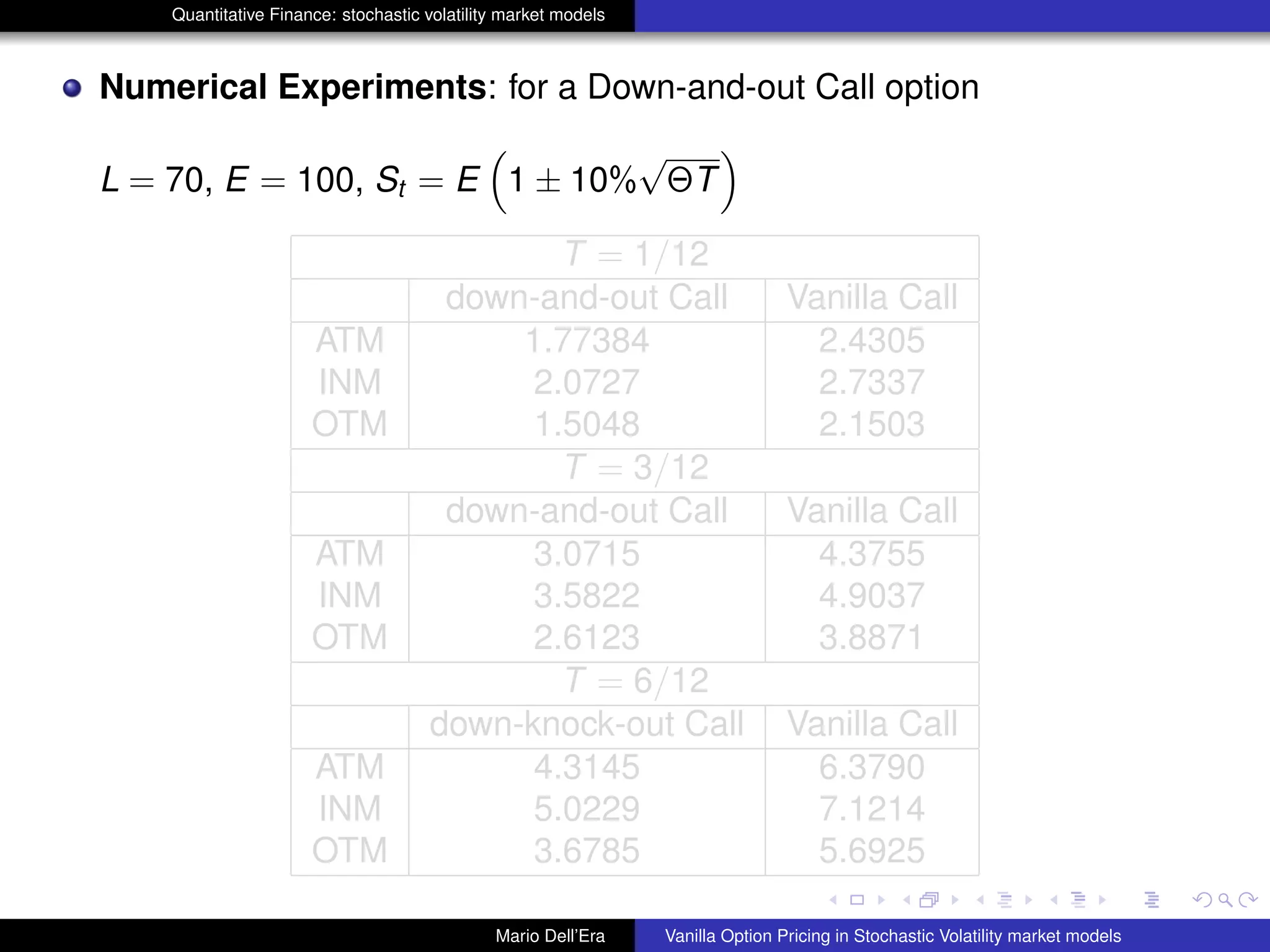

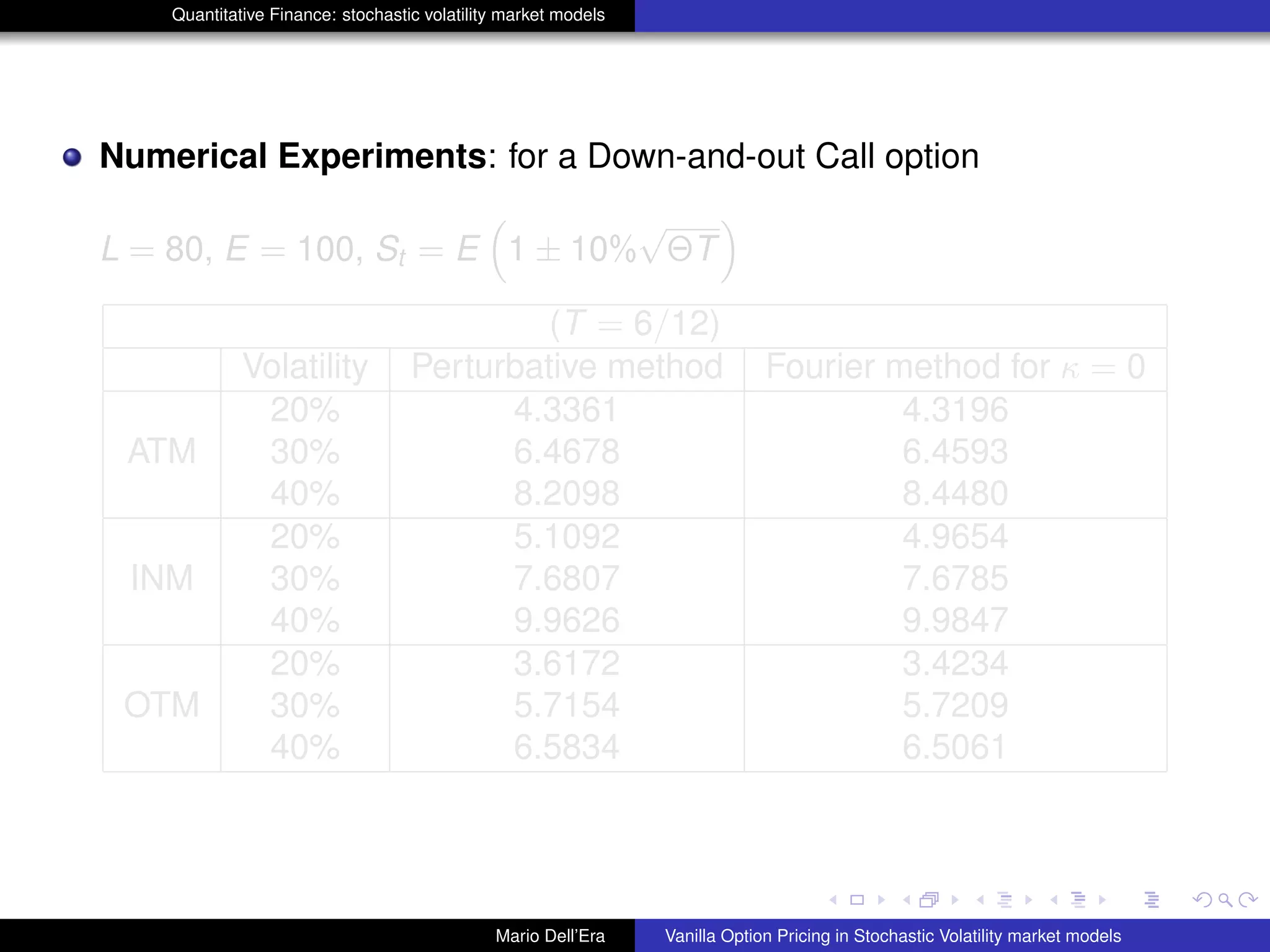

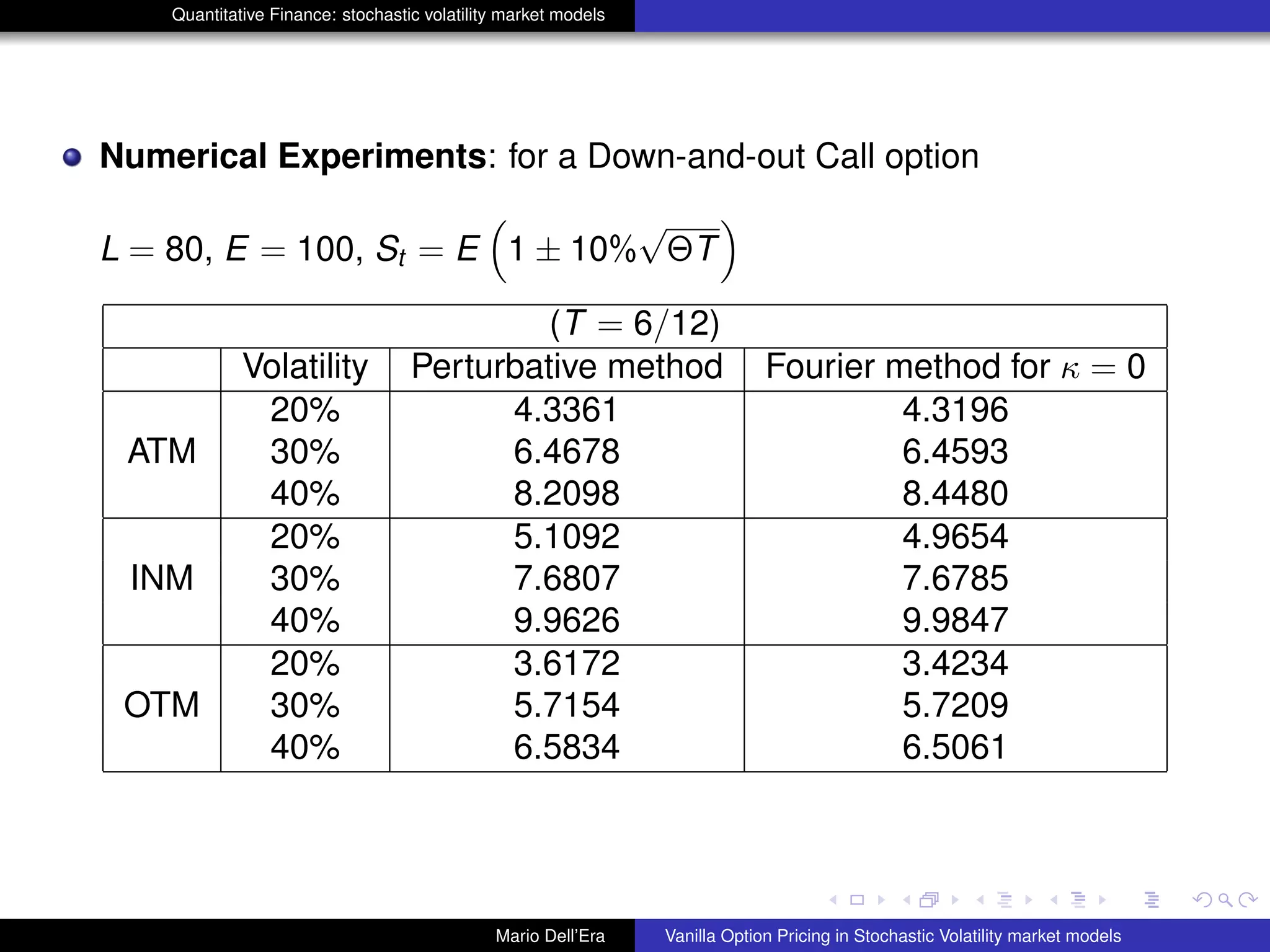

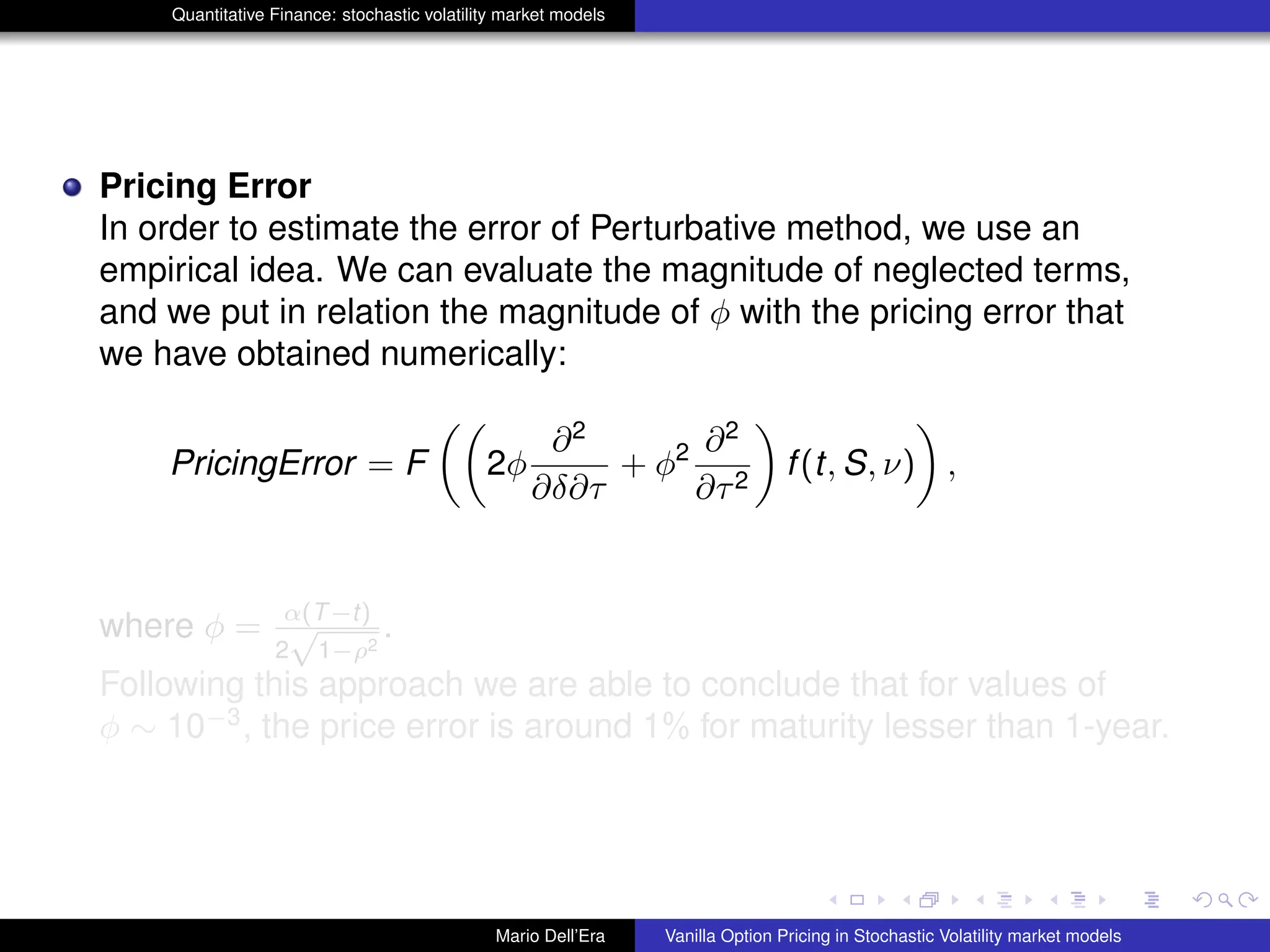

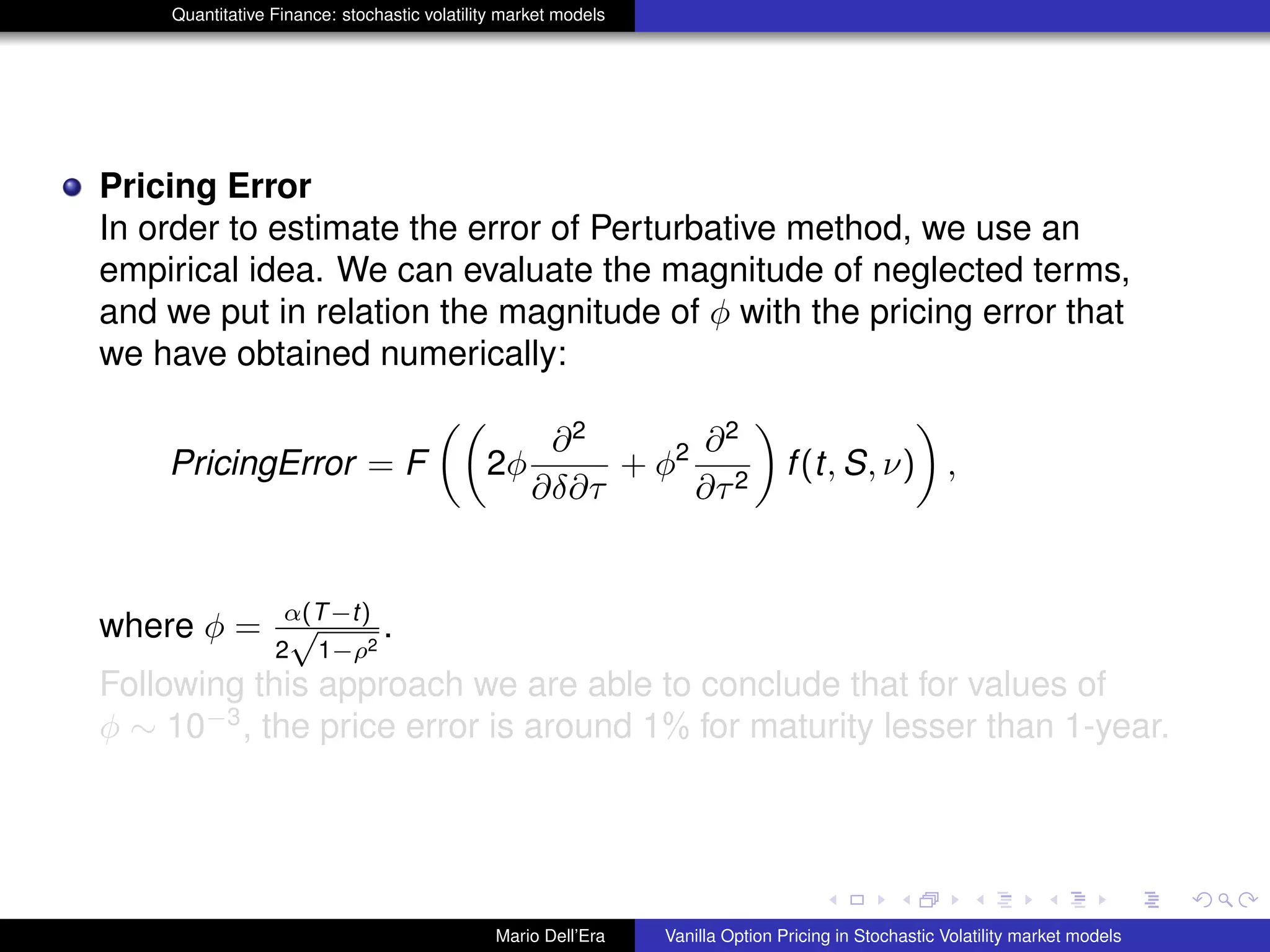

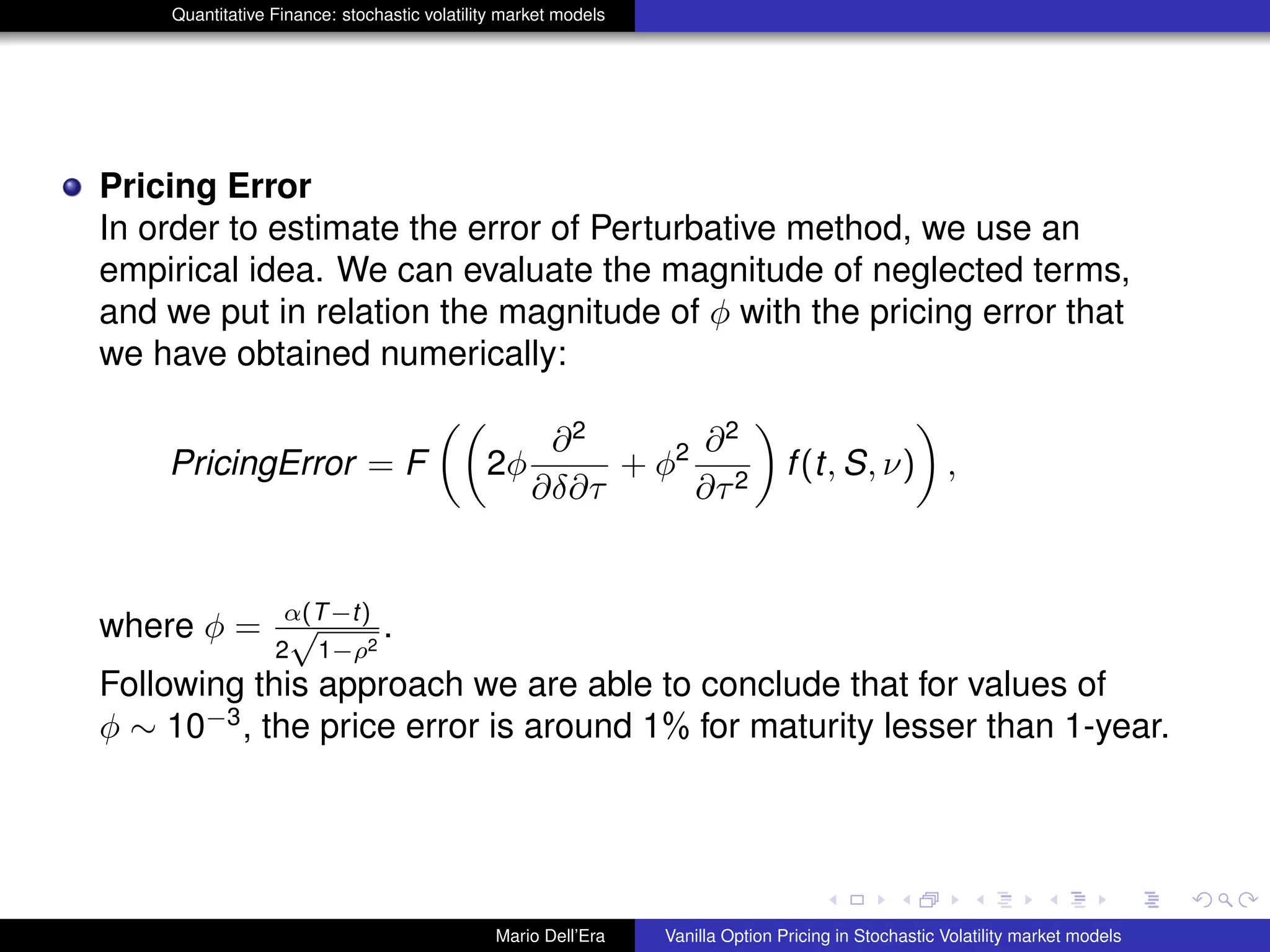

The document discusses pricing vanilla options in stochastic volatility market models. It presents the Heston model equations for the stock price and volatility processes. Applying Ito's lemma yields a PDE for option pricing. Several numerical methods are listed to solve this PDE, including Fourier transforms, finite differences, and Monte Carlo methods. The document also presents an approximation method where some PDE terms are set to zero, yielding simple closed-form pricing formulas for European and barrier options under the Heston model.