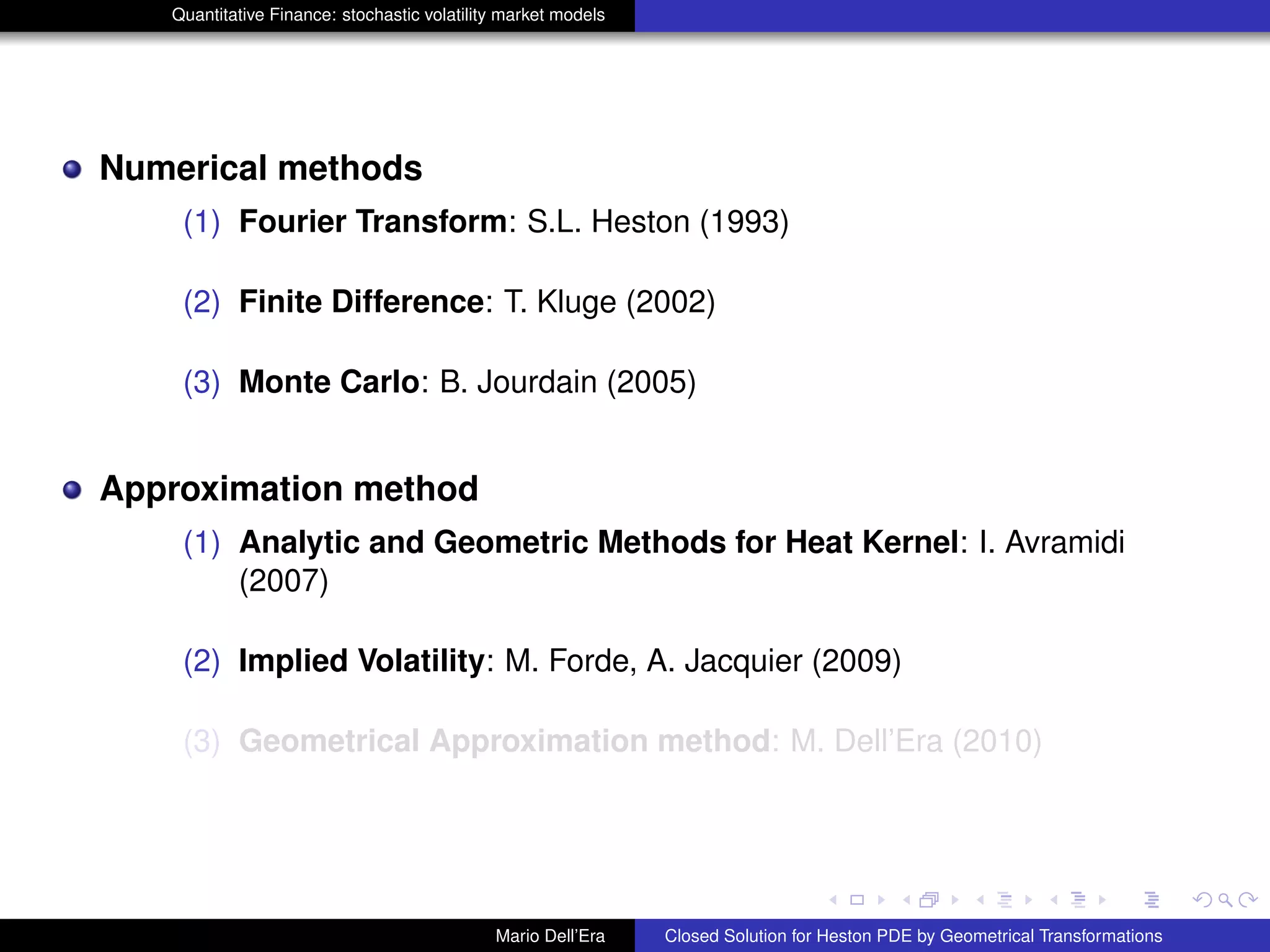

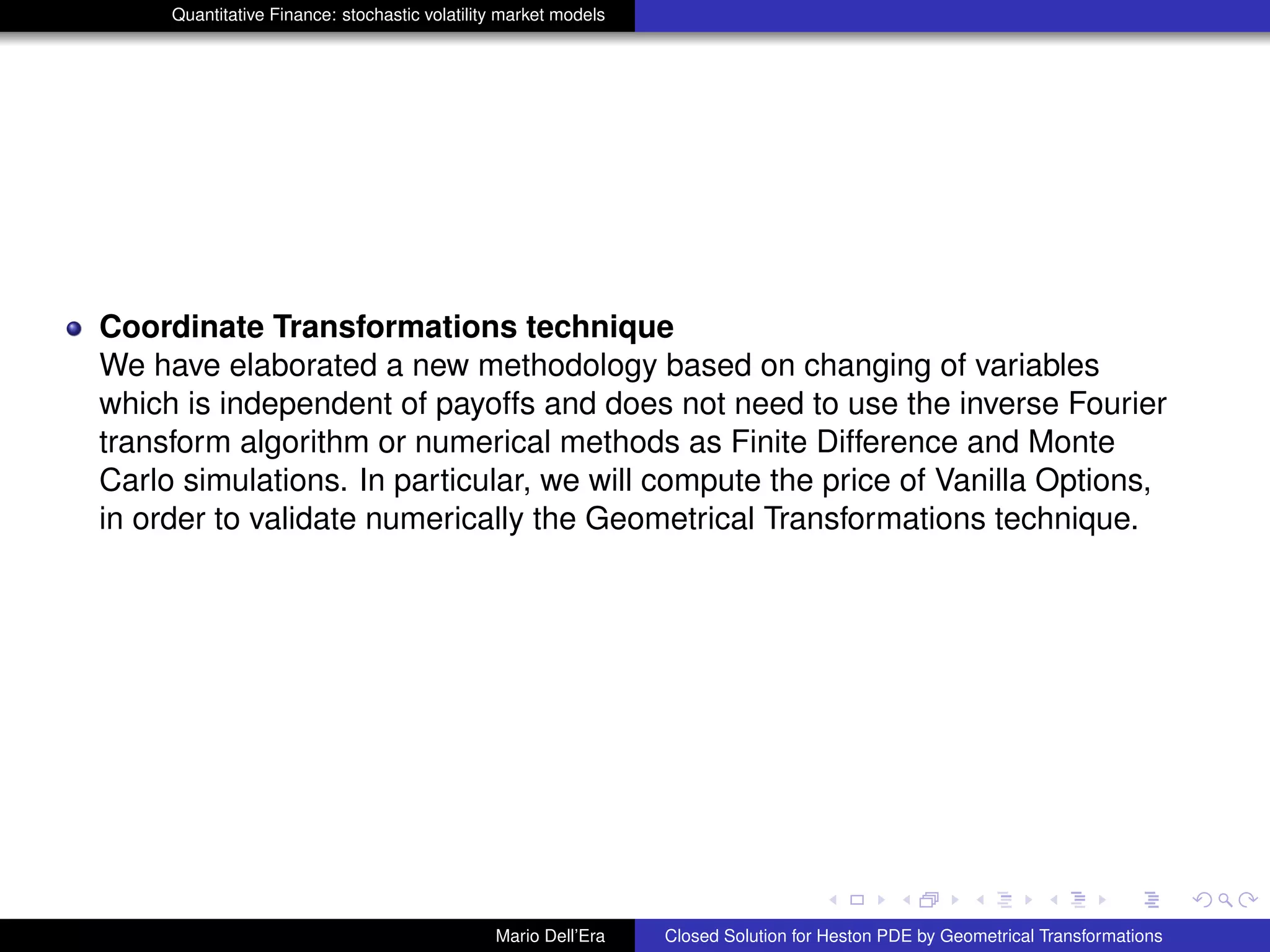

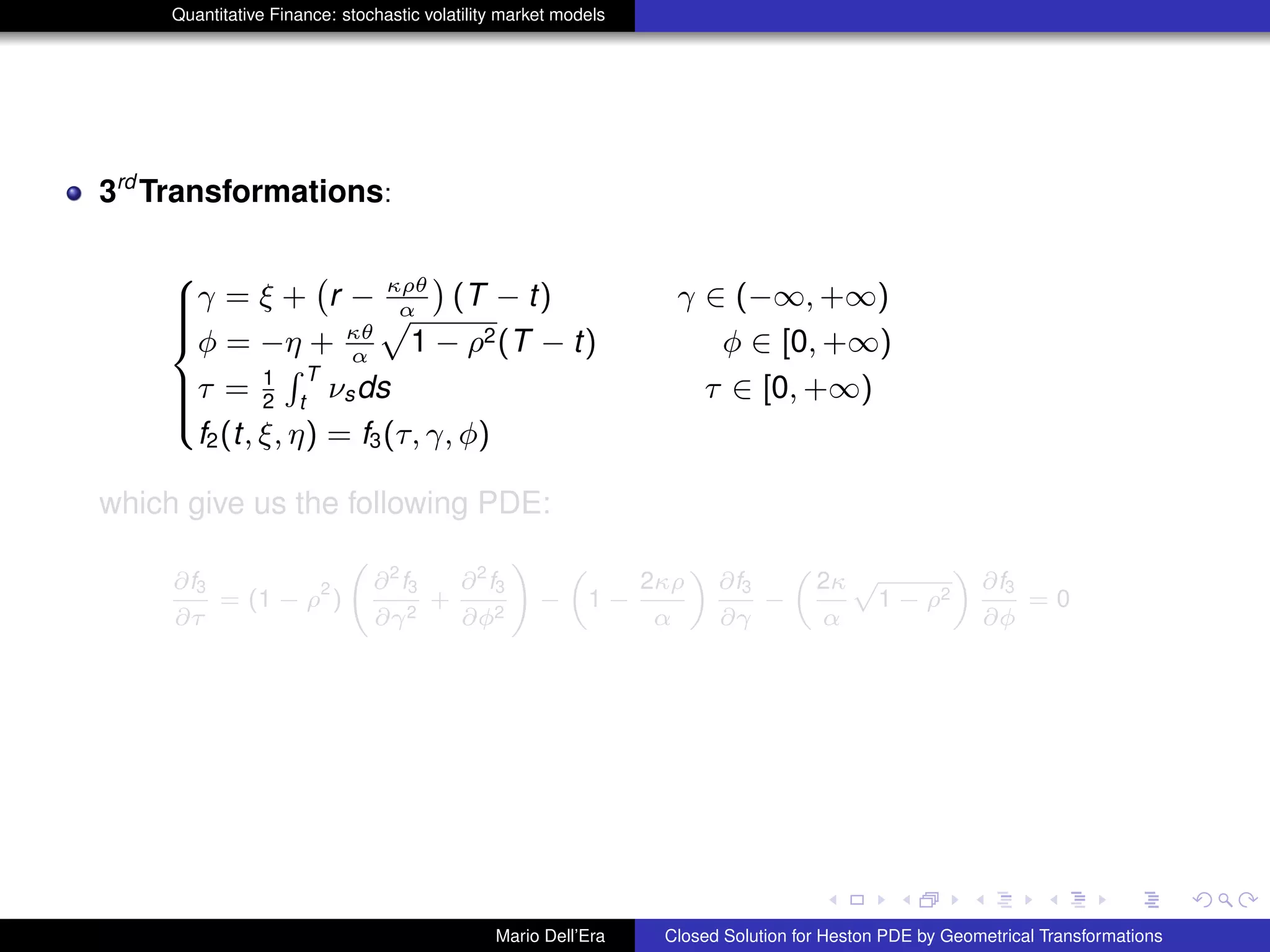

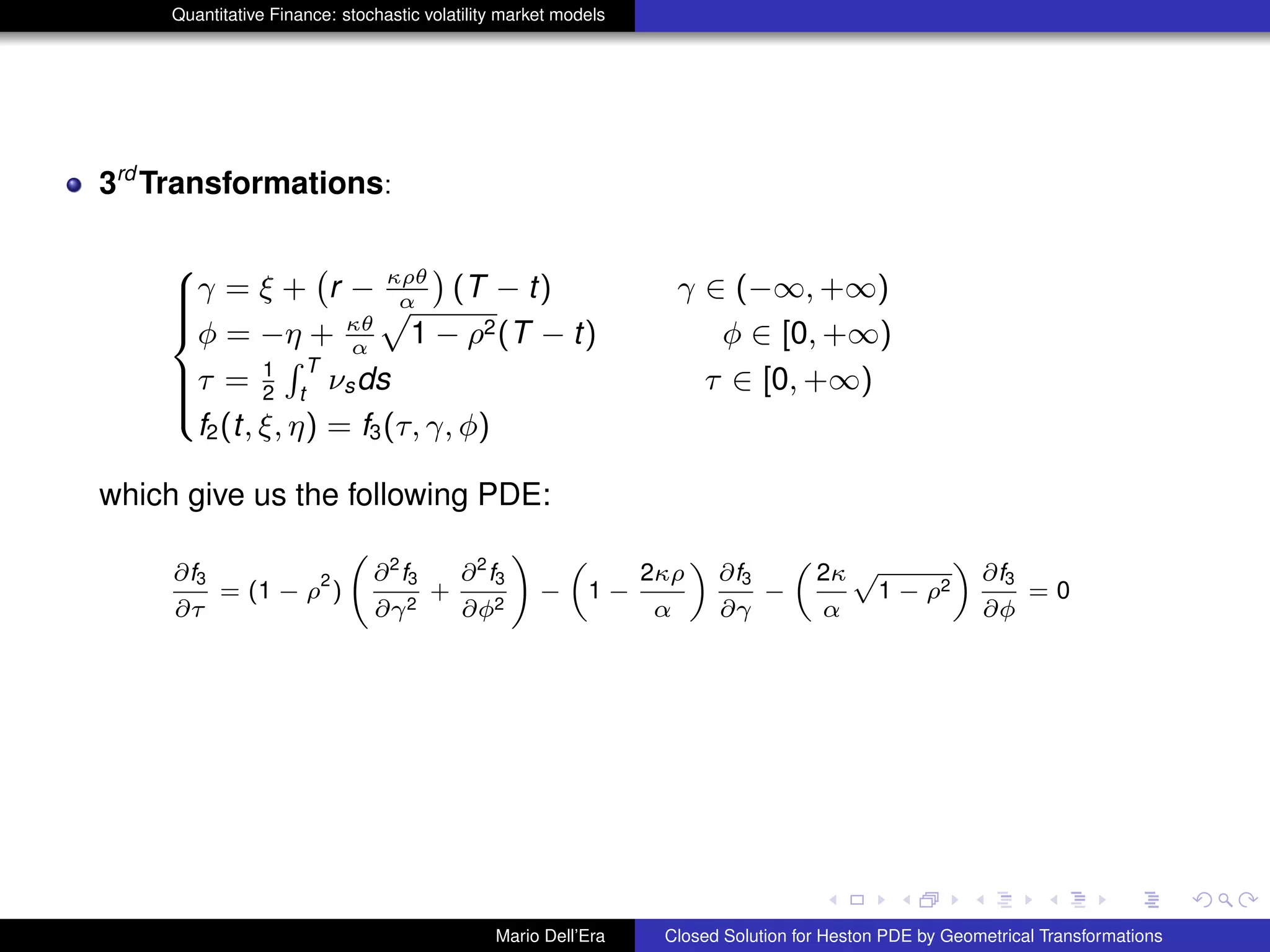

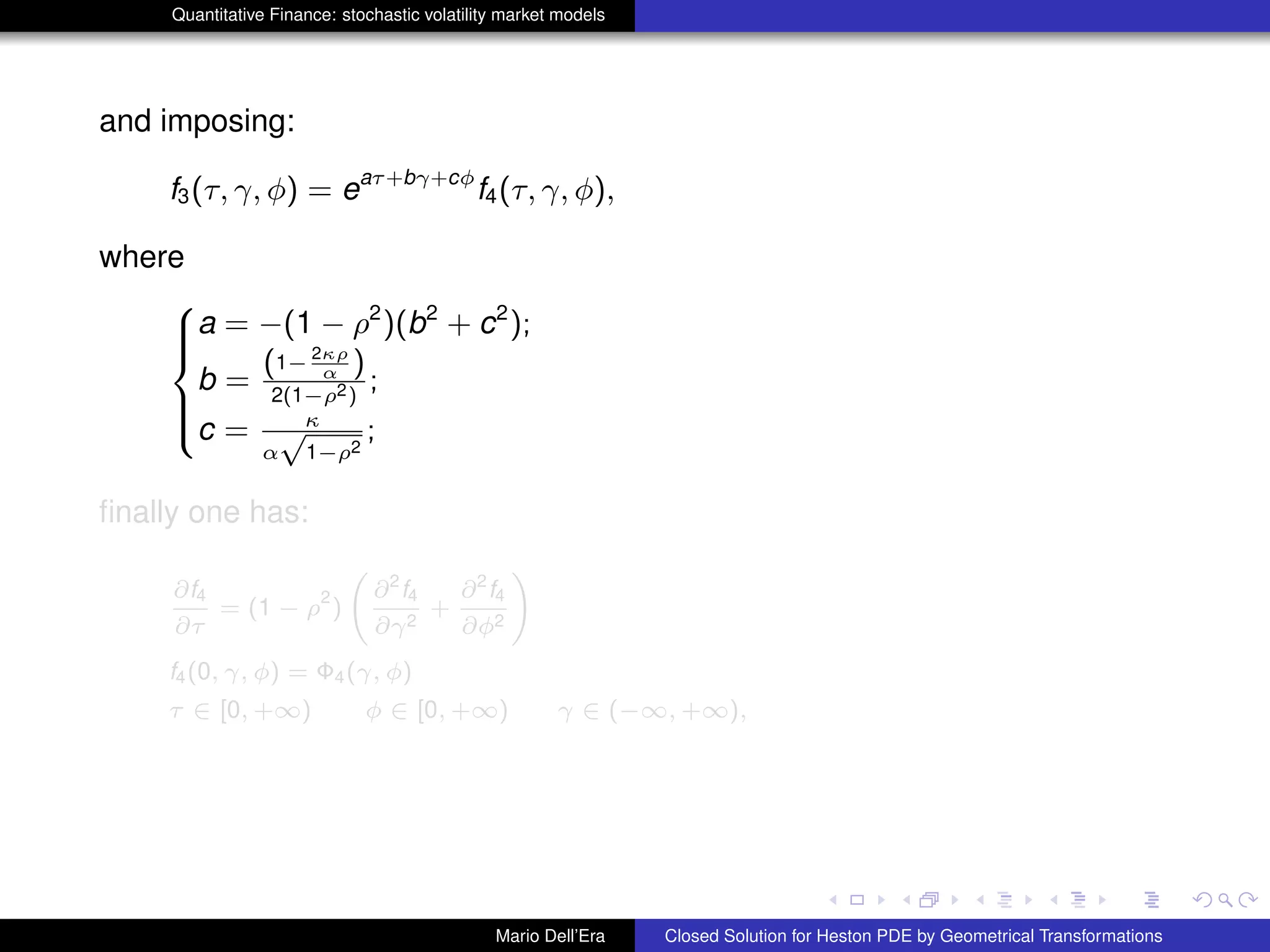

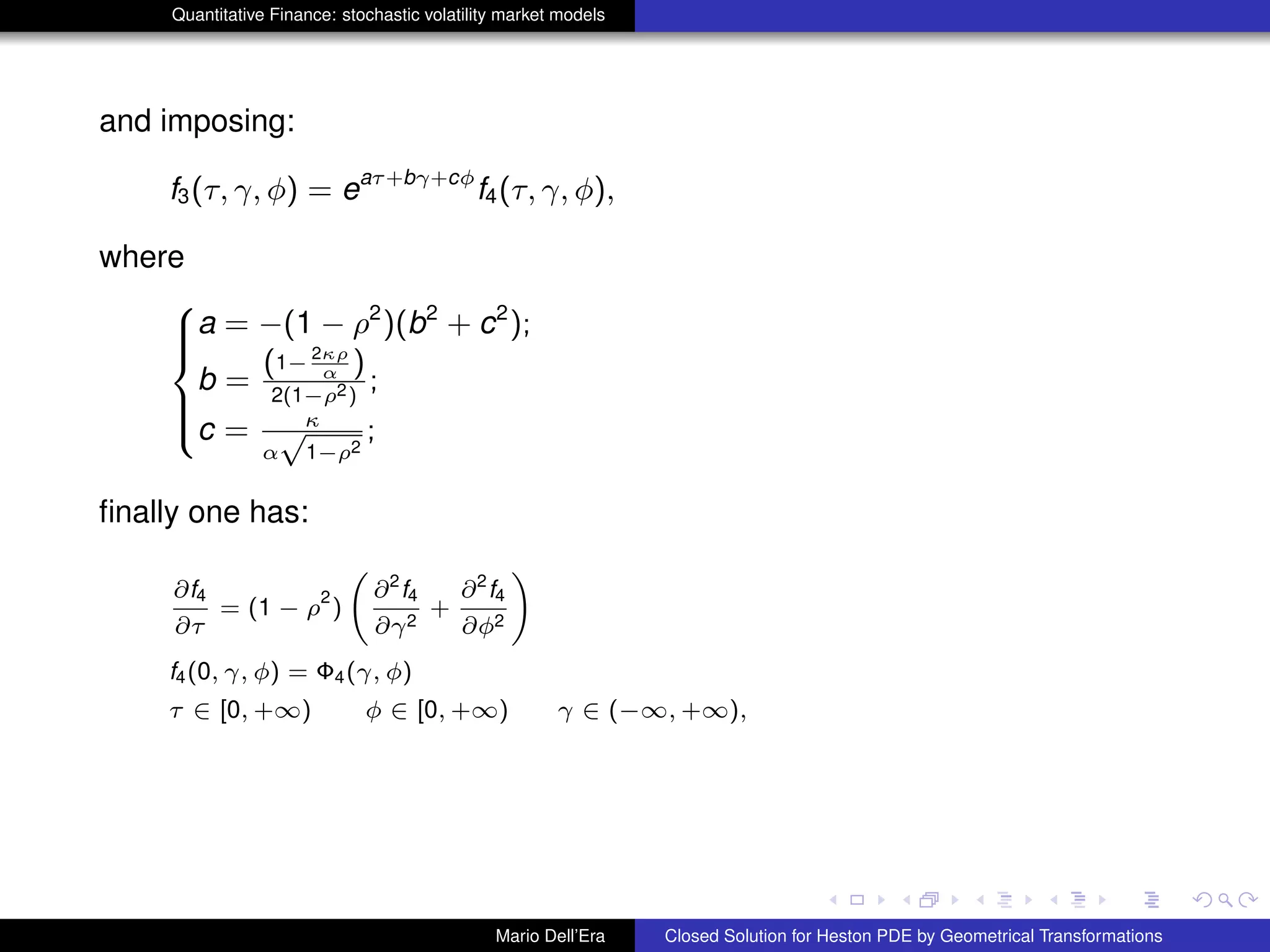

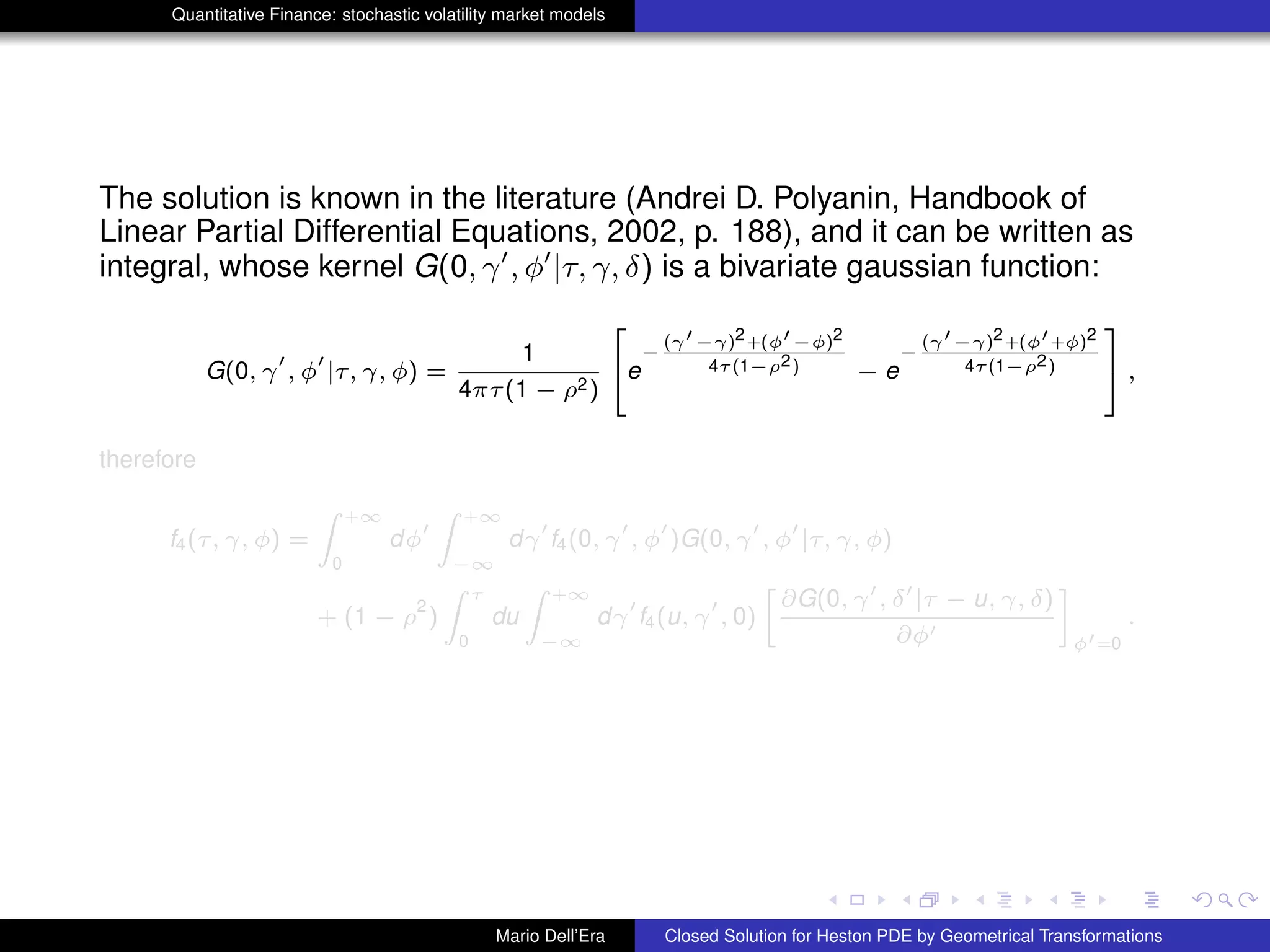

This document summarizes Mario Dell'Era's presentation on finding a closed solution for the Heston PDE using geometrical transformations. It describes the Heston model and the resulting PDE. Existing methods for solving the PDE numerically are outlined. Dell'Era then presents a new methodology using coordinate transformations to solve the PDE, applying three successive transformations to simplify the PDE. This results in an exponential solution for the transformed PDE.

![Quantitative Finance: stochastic volatility market models

1st

Transformations:

8

><

>:

x = ln S, x ∈ (−∞, +∞)

˜ν = ν/α, ˜ν ∈ [0, +∞)

f(t, S, ν) = f1(t, x, ˜ν)e−r(T−t)

(1)

thus one has:

∂f1

∂t

+

1

2

˜ν

∂2

f1

∂x2

+ 2ρ

∂2

f1

∂x∂˜ν

+

∂2

f1

∂˜ν2

!

+

„

r −

1

2

α˜ν

«

∂f1

∂x

+

κ

α

(θ − α˜ν)

∂f1

∂˜ν

= 0

f1(T, x, ˜ν) = Φ1(x) ρ ∈ (−1, +1), α ∈ R

+

x ∈ (−∞, +∞) ˜ν ∈ [0, +∞) t ∈ [0, T]

Mario Dell’Era Closed Solution for Heston PDE by Geometrical Transformations](https://image.slidesharecdn.com/slide2013-140625155016-phpapp02/75/Workshop-2013-of-Quantitative-Finance-13-2048.jpg)

![Quantitative Finance: stochastic volatility market models

1st

Transformations:

8

><

>:

x = ln S, x ∈ (−∞, +∞)

˜ν = ν/α, ˜ν ∈ [0, +∞)

f(t, S, ν) = f1(t, x, ˜ν)e−r(T−t)

(1)

thus one has:

∂f1

∂t

+

1

2

˜ν

∂2

f1

∂x2

+ 2ρ

∂2

f1

∂x∂˜ν

+

∂2

f1

∂˜ν2

!

+

„

r −

1

2

α˜ν

«

∂f1

∂x

+

κ

α

(θ − α˜ν)

∂f1

∂˜ν

= 0

f1(T, x, ˜ν) = Φ1(x) ρ ∈ (−1, +1), α ∈ R

+

x ∈ (−∞, +∞) ˜ν ∈ [0, +∞) t ∈ [0, T]

Mario Dell’Era Closed Solution for Heston PDE by Geometrical Transformations](https://image.slidesharecdn.com/slide2013-140625155016-phpapp02/75/Workshop-2013-of-Quantitative-Finance-14-2048.jpg)

![Quantitative Finance: stochastic volatility market models

2nd

Transformations:

8

><

>:

ξ = x − ρ˜ν ξ ∈ (−∞, +∞)

η = −˜ν

p

1 − ρ2 η ∈ (−∞, 0]

f1(t, x, ˜ν) = f2(t, ξ, η)

(2)

Again we have:

∂f2

∂t

−

αη

2

p

1 − ρ2

(1 − ρ

2

)

∂2

f2

∂ξ2

+

∂2

f2

∂η2

!

+

αη

2

p

1 − ρ2

„

1 −

2κρ

α

«

∂f2

∂ξ

−

αη

2

p

1 − ρ2

„

2κ

α

p

1 − ρ2

«

∂f2

∂η

+

„

r −

κρθ

α

«

∂f2

∂ξ

−

θκ

α

p

1 − ρ2

∂f2

∂η

= 0

f2(T, ξ, η) = Φ2(ξ, η), ρ ∈ (−1, +1), α ∈ R

+

.

ξ ∈ (−∞, +∞), η ∈ (−∞, 0], t ∈ [0, T].

Mario Dell’Era Closed Solution for Heston PDE by Geometrical Transformations](https://image.slidesharecdn.com/slide2013-140625155016-phpapp02/75/Workshop-2013-of-Quantitative-Finance-15-2048.jpg)

![Quantitative Finance: stochastic volatility market models

2nd

Transformations:

8

><

>:

ξ = x − ρ˜ν ξ ∈ (−∞, +∞)

η = −˜ν

p

1 − ρ2 η ∈ (−∞, 0]

f1(t, x, ˜ν) = f2(t, ξ, η)

(2)

Again we have:

∂f2

∂t

−

αη

2

p

1 − ρ2

(1 − ρ

2

)

∂2

f2

∂ξ2

+

∂2

f2

∂η2

!

+

αη

2

p

1 − ρ2

„

1 −

2κρ

α

«

∂f2

∂ξ

−

αη

2

p

1 − ρ2

„

2κ

α

p

1 − ρ2

«

∂f2

∂η

+

„

r −

κρθ

α

«

∂f2

∂ξ

−

θκ

α

p

1 − ρ2

∂f2

∂η

= 0

f2(T, ξ, η) = Φ2(ξ, η), ρ ∈ (−1, +1), α ∈ R

+

.

ξ ∈ (−∞, +∞), η ∈ (−∞, 0], t ∈ [0, T].

Mario Dell’Era Closed Solution for Heston PDE by Geometrical Transformations](https://image.slidesharecdn.com/slide2013-140625155016-phpapp02/75/Workshop-2013-of-Quantitative-Finance-16-2048.jpg)

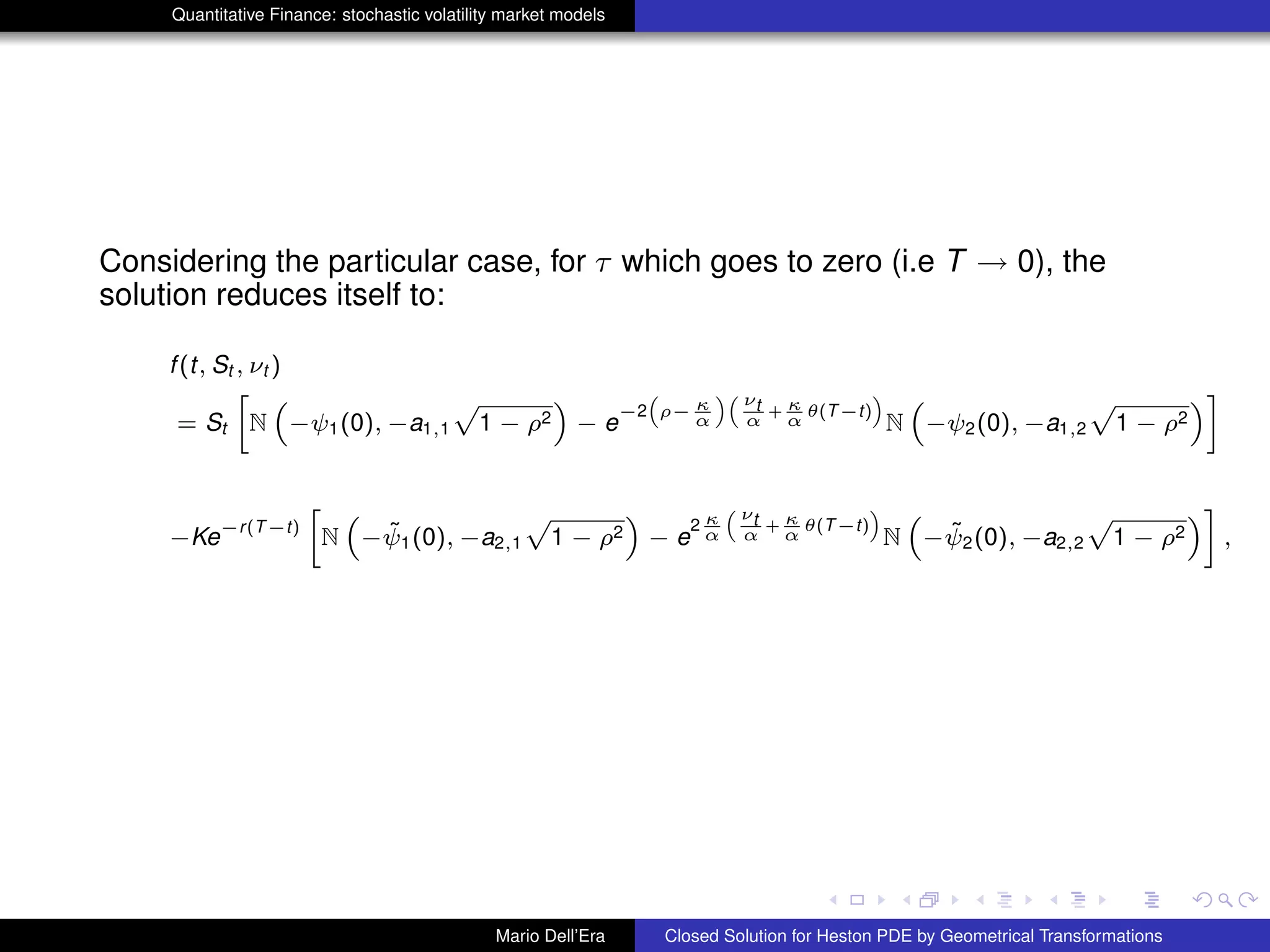

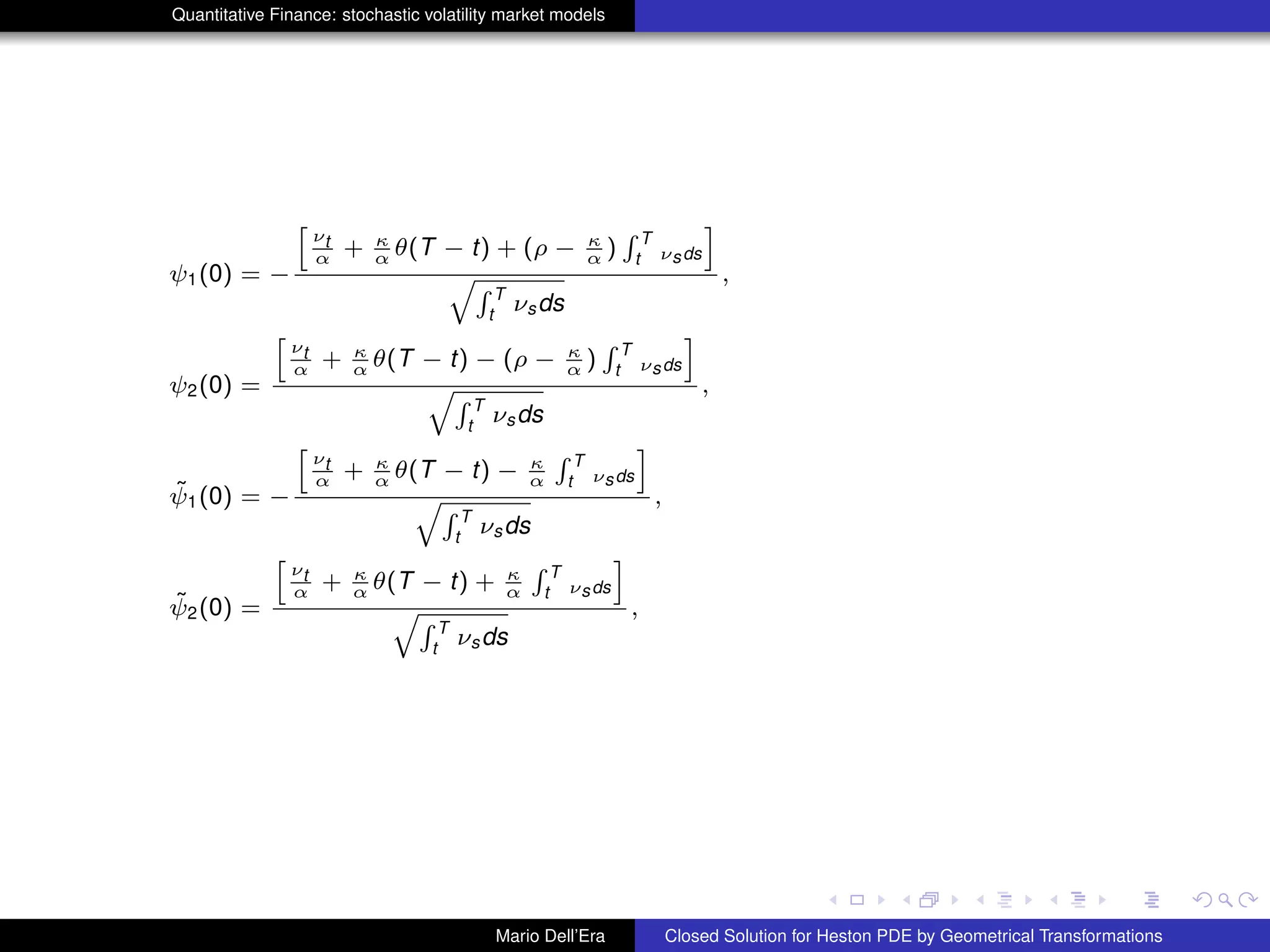

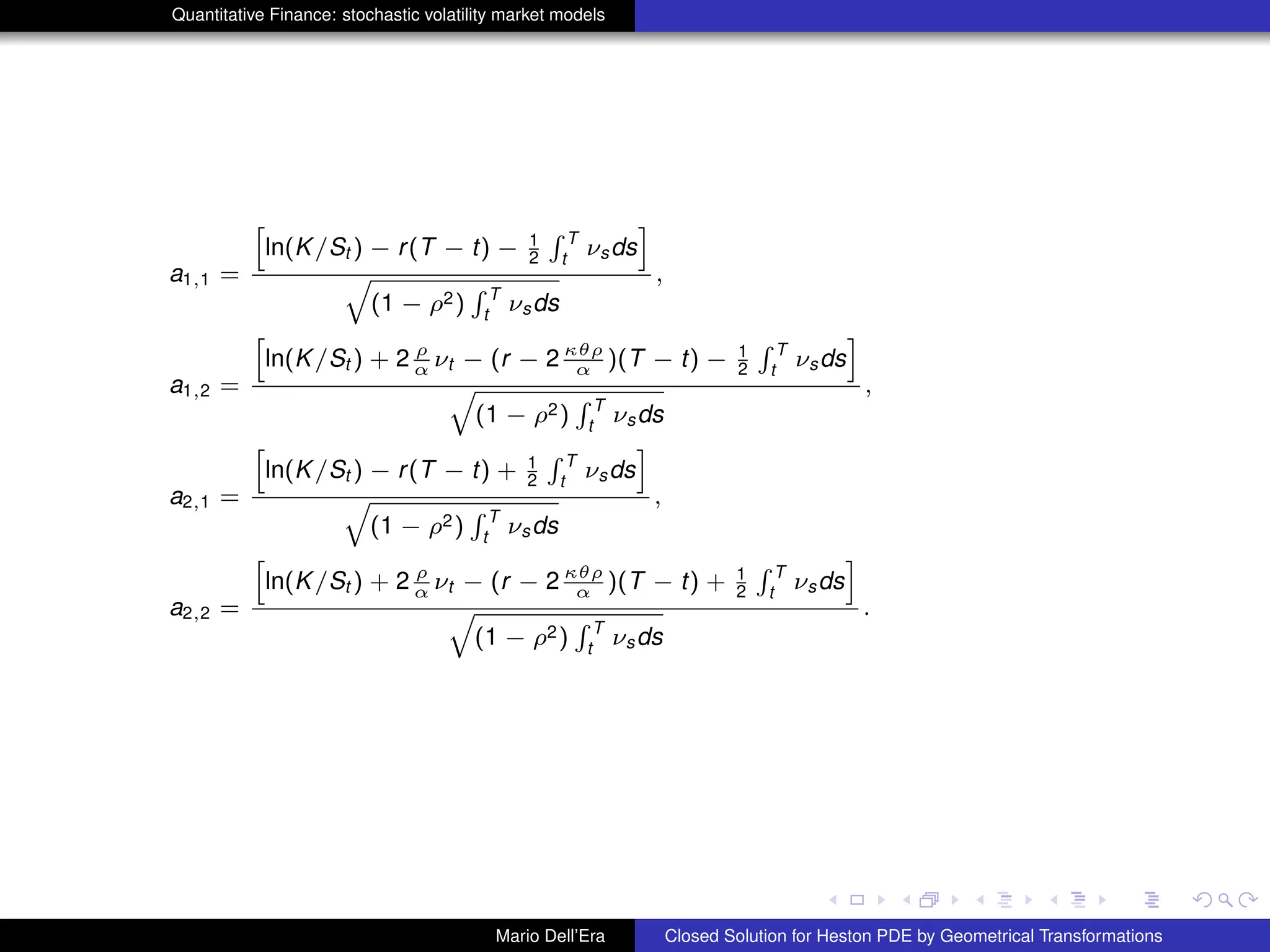

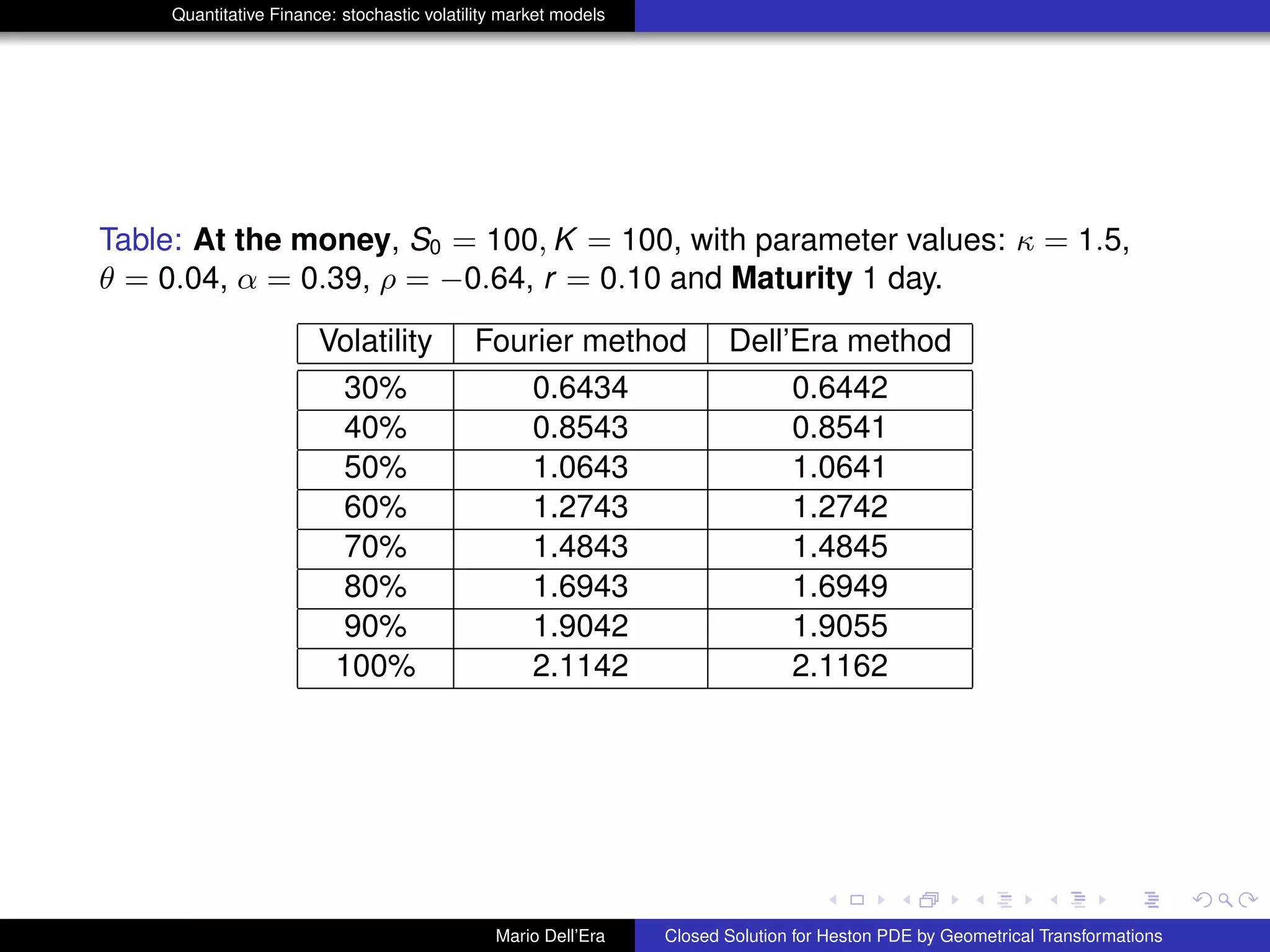

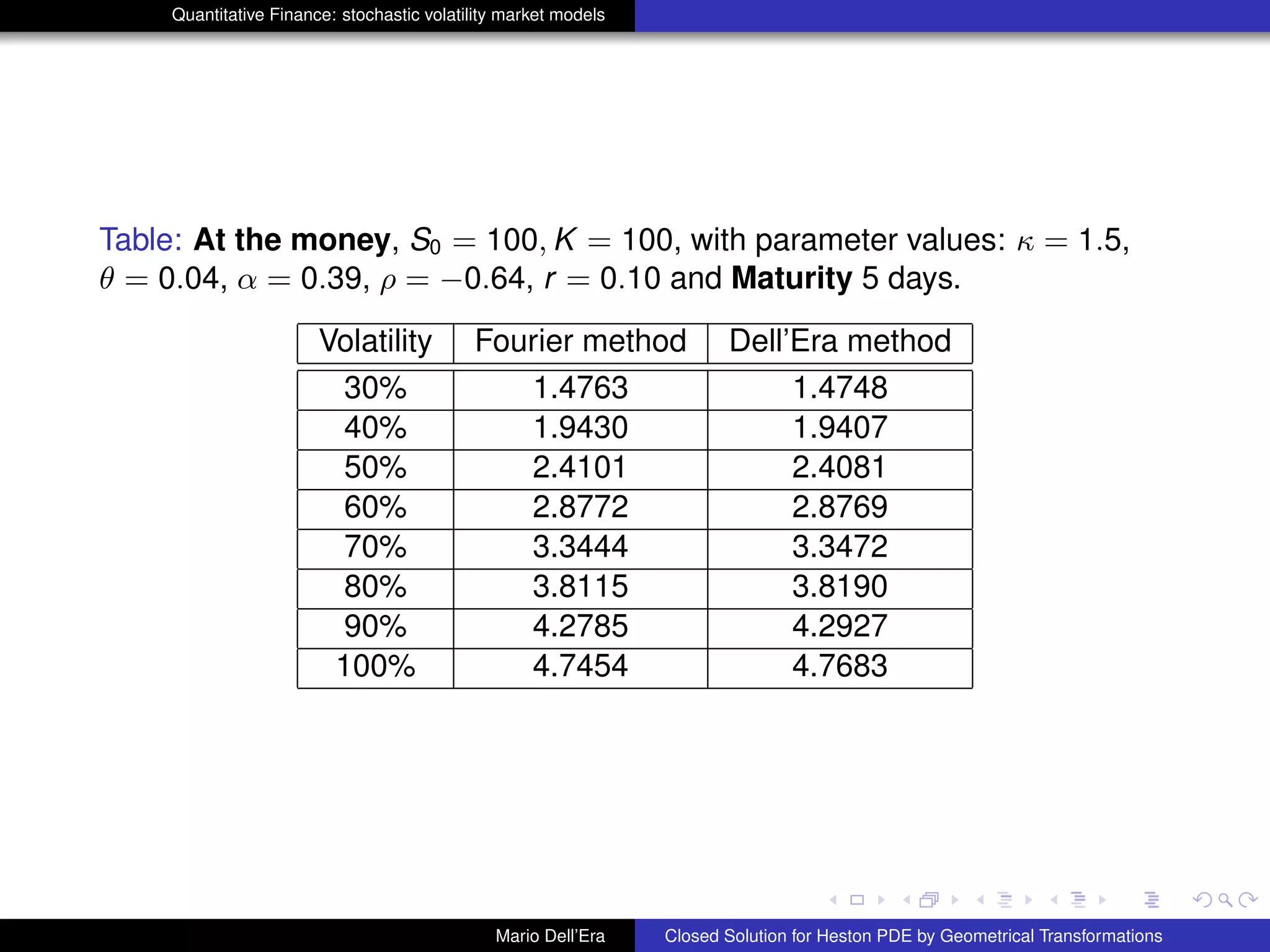

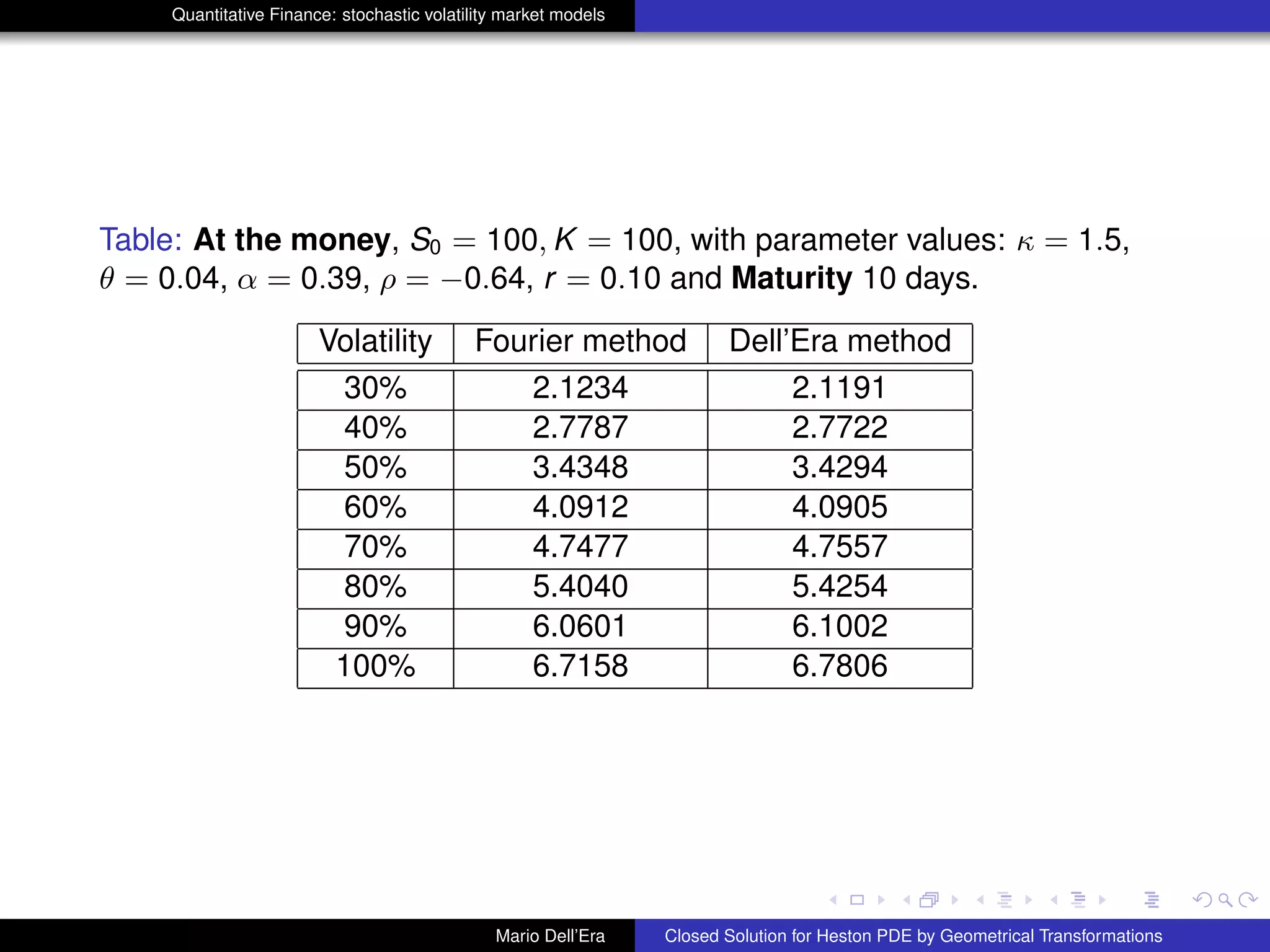

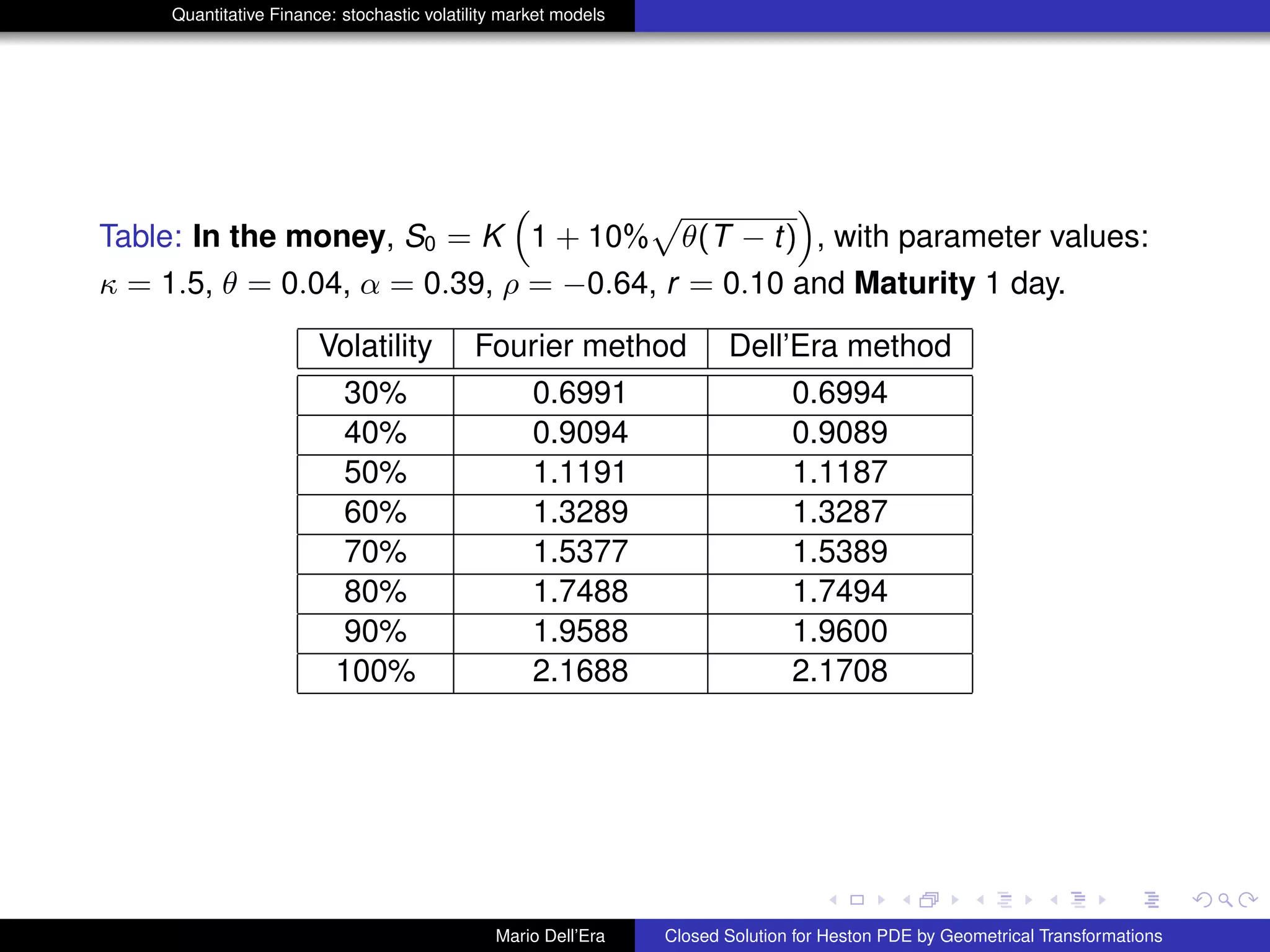

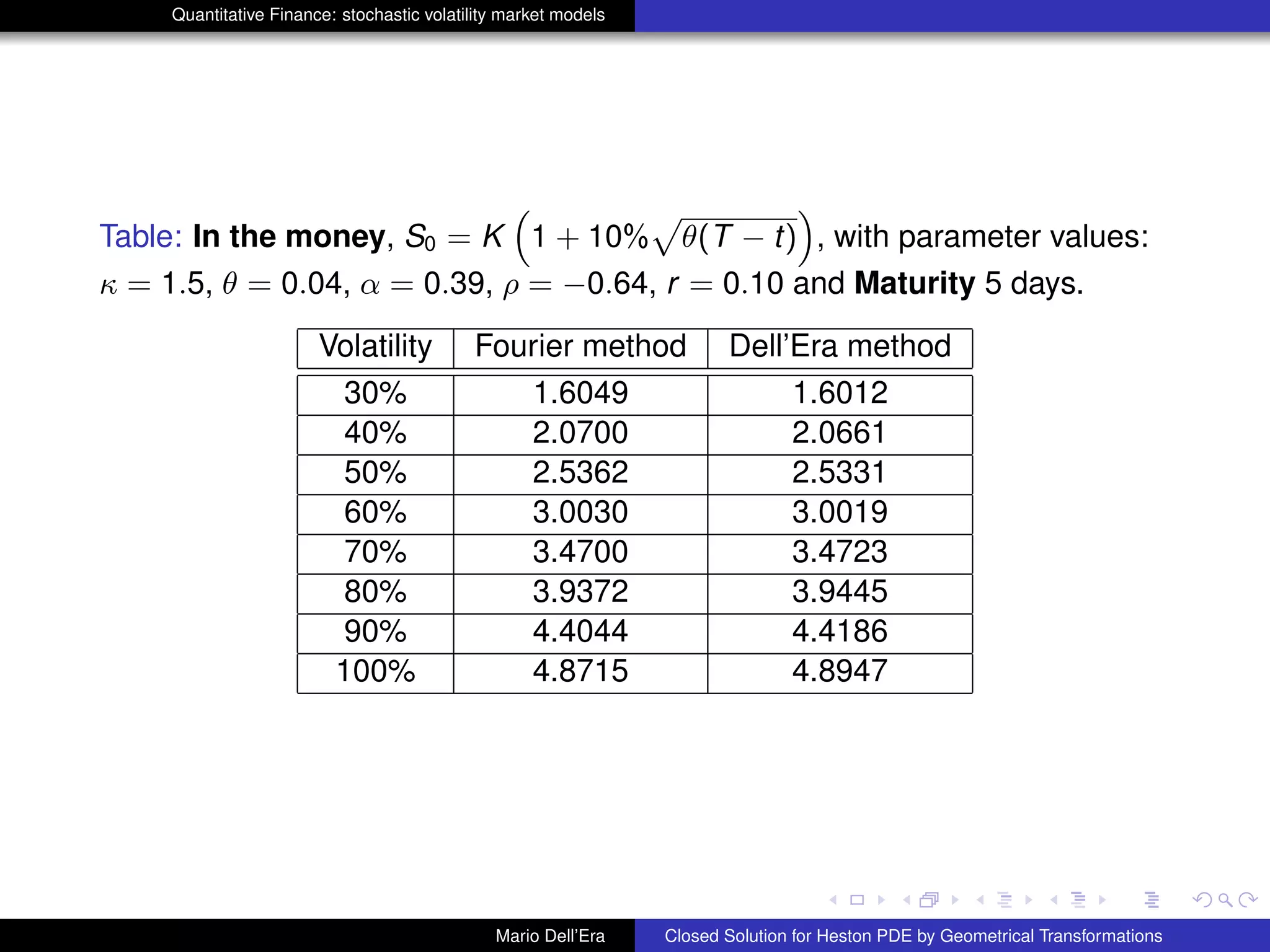

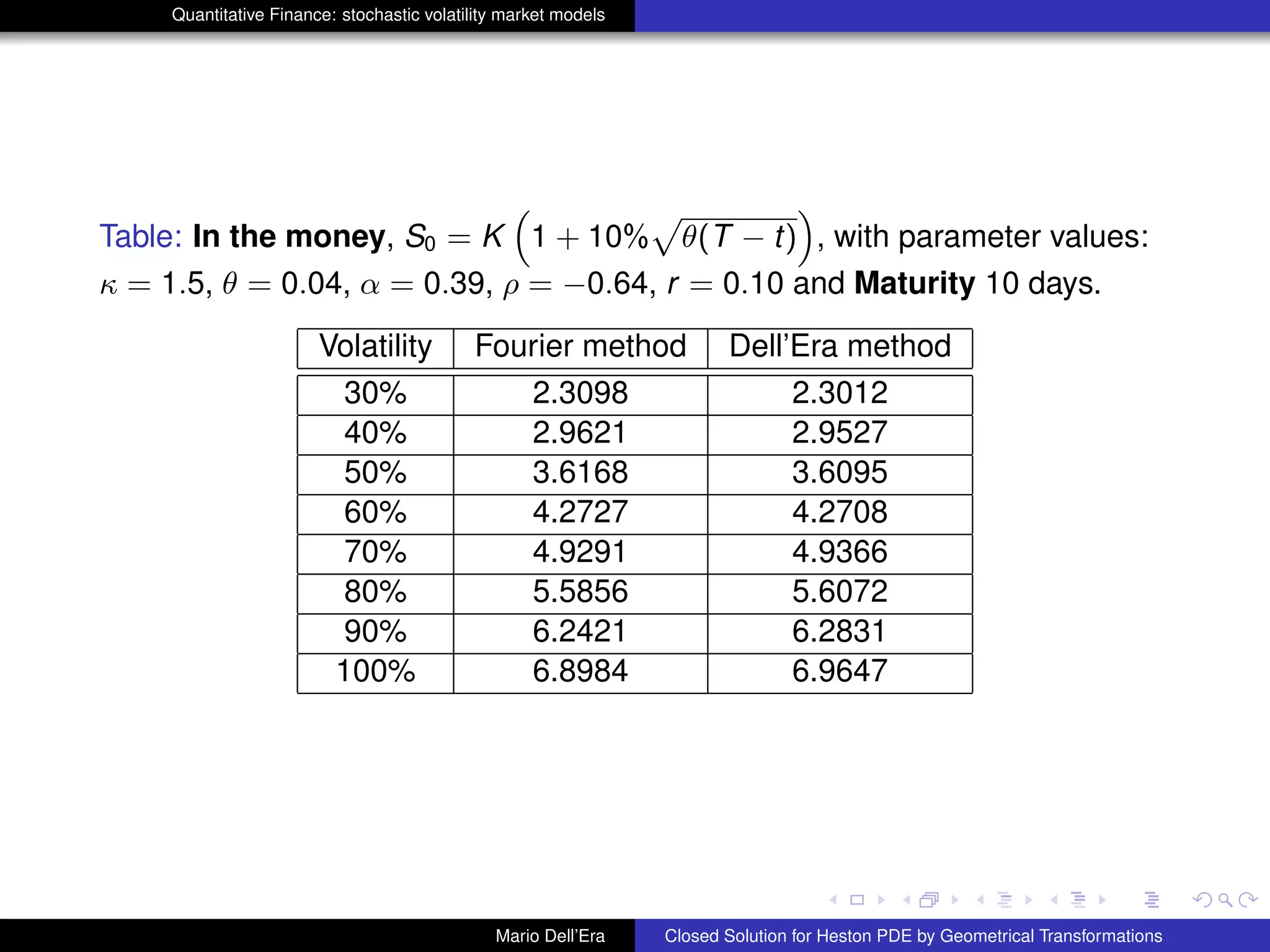

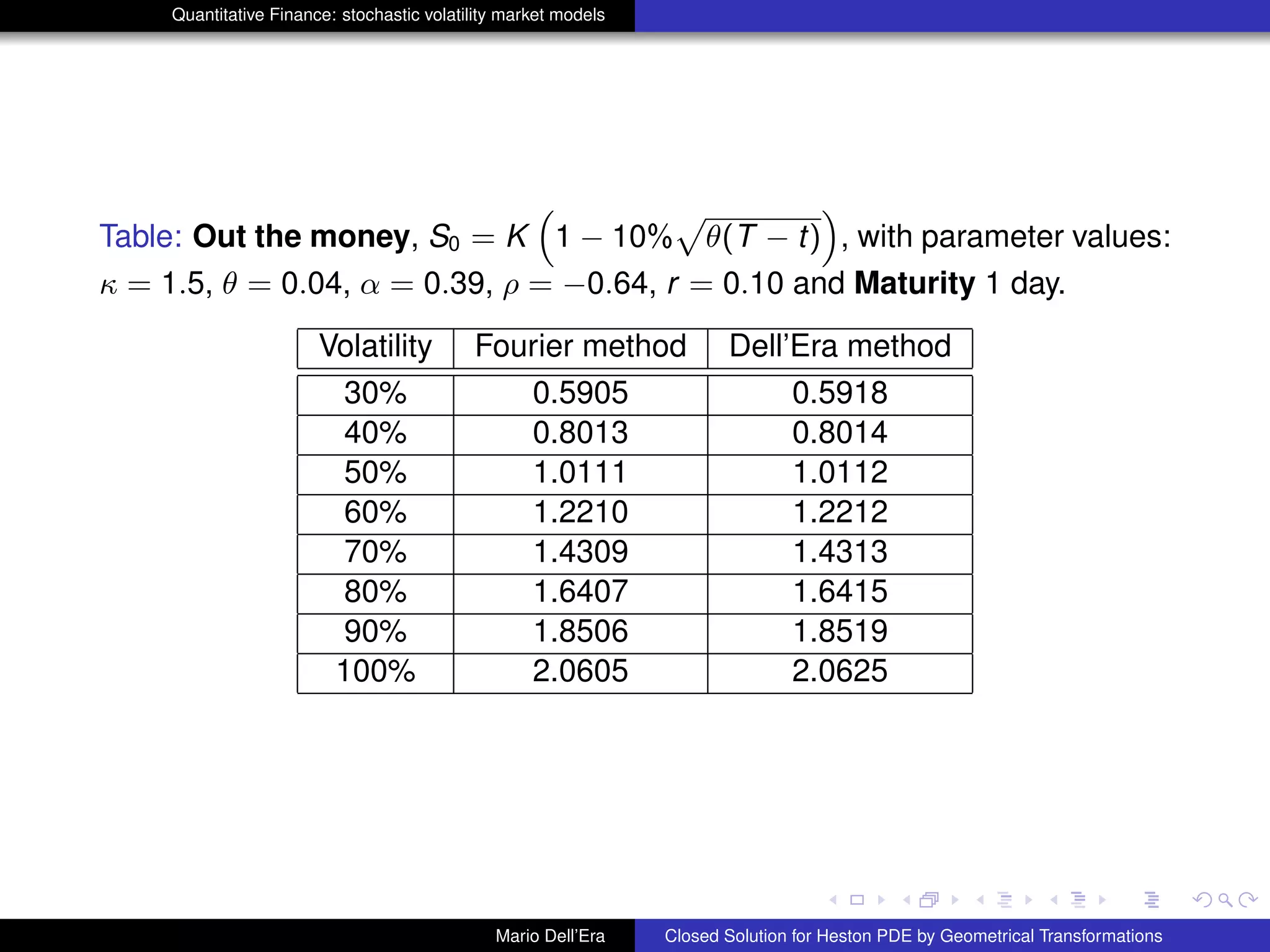

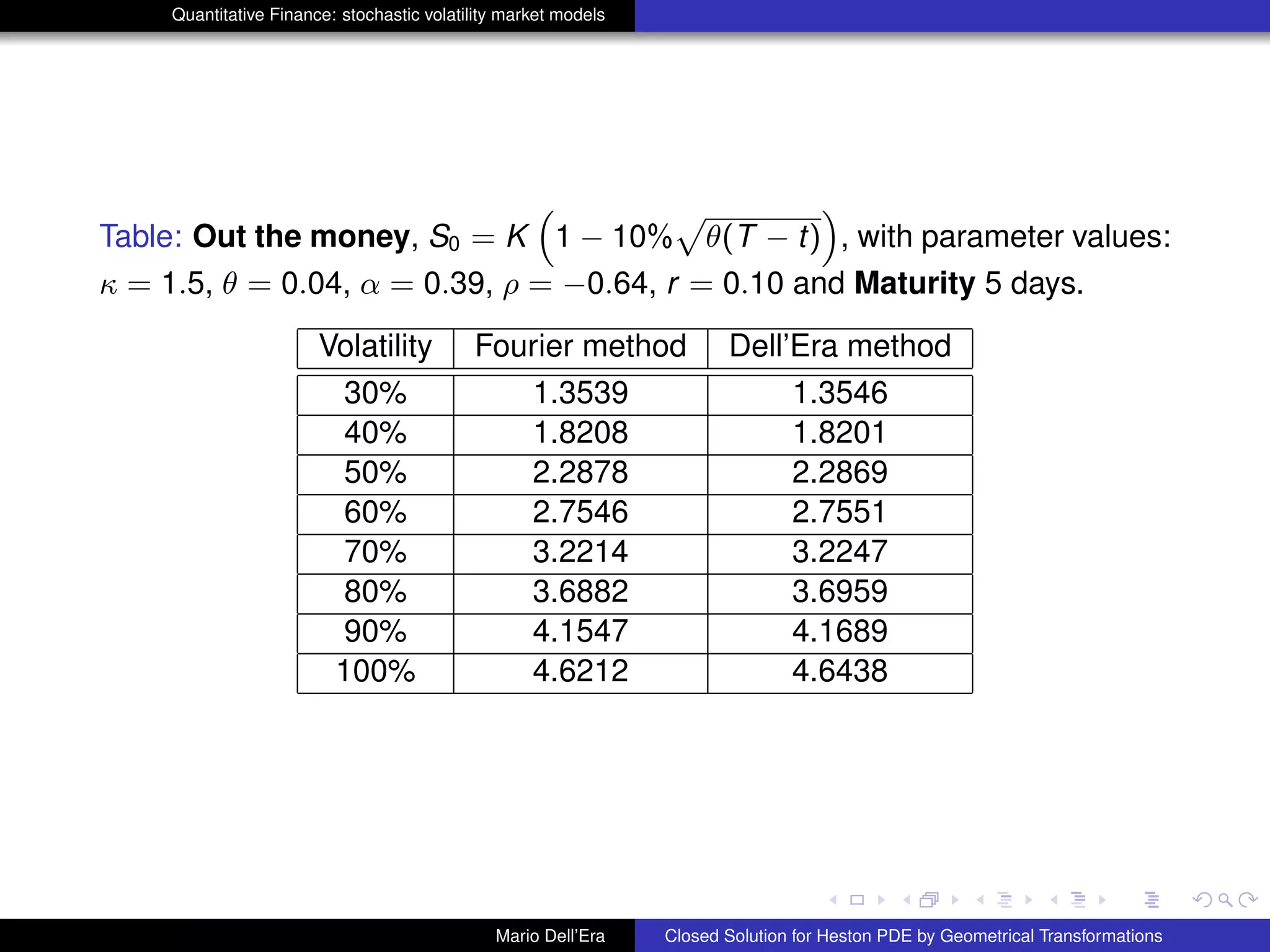

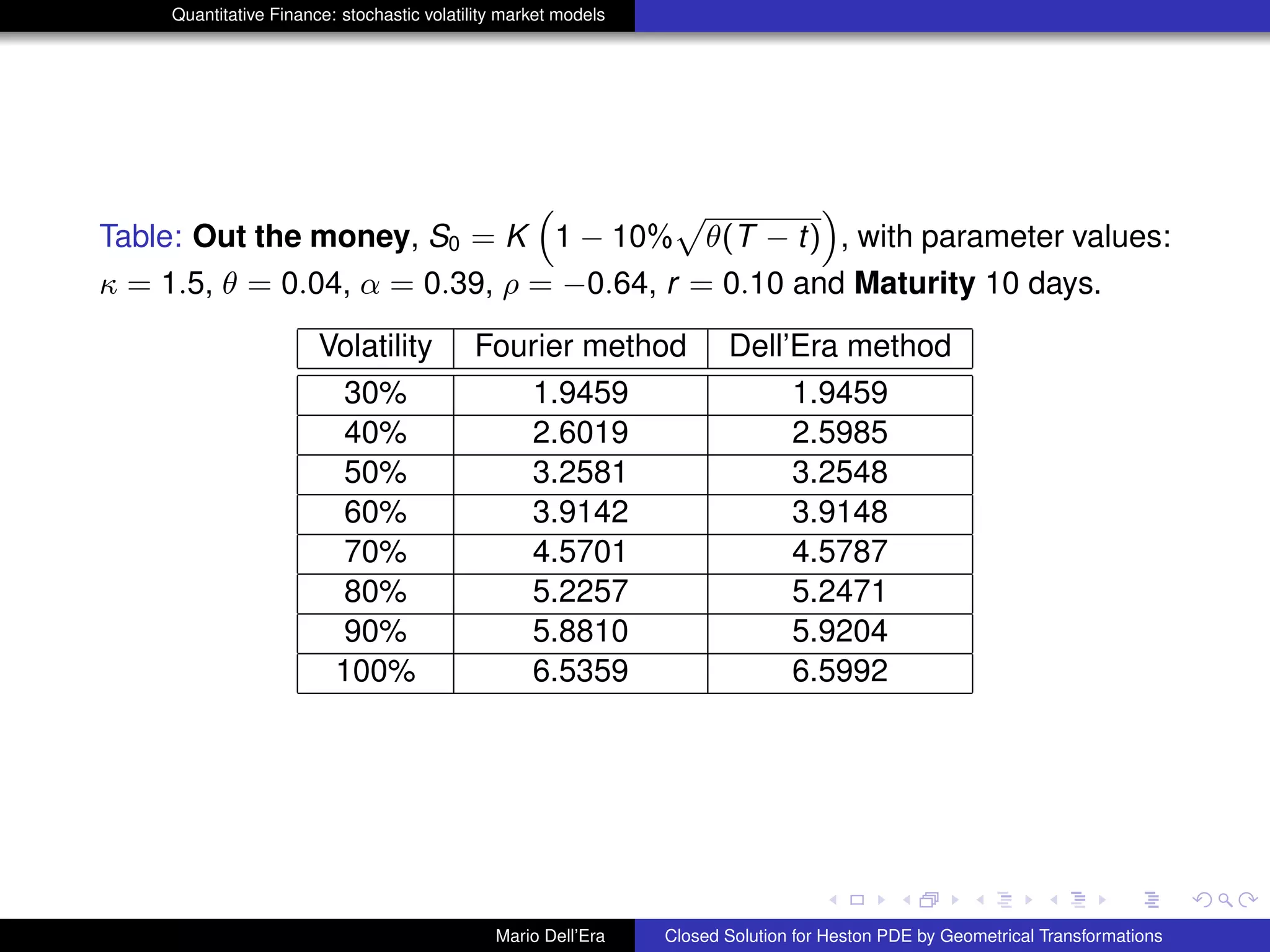

![Quantitative Finance: stochastic volatility market models

Numerical Validation

The approximation τ → 0 will be here interpreted as option pricing for few

days. From 1 day up to 10 days are suitable maturities to prove our validation

hypothesis, at varying of volatility. Parameter values are those in Bakshi, Cao

and Chen (1997) namely κ = 1.15, Θ = 0.04, α = 0.39 and ρ = −0.64. We

have chosen r = 10% K = 100, and three different maturities T. In what

follows we use the expected value of the variance process EP[νs] instead of

νs in the term

R T

t

νsds. In the tables hereafter one can see the results of

numerical experiments:

Mario Dell’Era Closed Solution for Heston PDE by Geometrical Transformations](https://image.slidesharecdn.com/slide2013-140625155016-phpapp02/75/Workshop-2013-of-Quantitative-Finance-29-2048.jpg)

![Quantitative Finance: stochastic volatility market models

Numerical Validation

The approximation τ → 0 will be here interpreted as option pricing for few

days. From 1 day up to 10 days are suitable maturities to prove our validation

hypothesis, at varying of volatility. Parameter values are those in Bakshi, Cao

and Chen (1997) namely κ = 1.15, Θ = 0.04, α = 0.39 and ρ = −0.64. We

have chosen r = 10% K = 100, and three different maturities T. In what

follows we use the expected value of the variance process EP[νs] instead of

νs in the term

R T

t

νsds. In the tables hereafter one can see the results of

numerical experiments:

Mario Dell’Era Closed Solution for Heston PDE by Geometrical Transformations](https://image.slidesharecdn.com/slide2013-140625155016-phpapp02/75/Workshop-2013-of-Quantitative-Finance-30-2048.jpg)

![Quantitative Finance: stochastic volatility market models

Conclusions

The proposed method is straightforward from theoretical viewpoint and

seems to be promising from that numerical. We reduce the Heston’s PDE in

a simpler, using , in a right order, suitable changing of variables, whose

Jacobian has not singularity points, unless for ρ = ±1. This evidence gives

us the safety that the variables chosen are well defined.

Besides, the idea to use the expected value of the variance process EP[νs],

instead of νt , provides us, in concrete, a closed solution very easy to

compute; and so, we are also able to know what is the error using the

geometric transformation technique; which is equal to the variance of the

variance process νt : Err = EP[(νt − EP[νt ])2

]. While, using Fourier technique

we are not able to know the numeric error directly, but we need to compare

Fourier prices with Monte Carlo prices, for which one can manage the

variance.

We want to remark that the shown technique is independent to the payoff and

therefore, the pricing activities have the same algorithmic complexity for

every derivatives, unlike using Fourier Transform method, for which the

complexity is tied to the payoff.

Mario Dell’Era Closed Solution for Heston PDE by Geometrical Transformations](https://image.slidesharecdn.com/slide2013-140625155016-phpapp02/75/Workshop-2013-of-Quantitative-Finance-40-2048.jpg)

![Quantitative Finance: stochastic volatility market models

Conclusions

The proposed method is straightforward from theoretical viewpoint and

seems to be promising from that numerical. We reduce the Heston’s PDE in

a simpler, using , in a right order, suitable changing of variables, whose

Jacobian has not singularity points, unless for ρ = ±1. This evidence gives

us the safety that the variables chosen are well defined.

Besides, the idea to use the expected value of the variance process EP[νs],

instead of νt , provides us, in concrete, a closed solution very easy to

compute; and so, we are also able to know what is the error using the

geometric transformation technique; which is equal to the variance of the

variance process νt : Err = EP[(νt − EP[νt ])2

]. While, using Fourier technique

we are not able to know the numeric error directly, but we need to compare

Fourier prices with Monte Carlo prices, for which one can manage the

variance.

We want to remark that the shown technique is independent to the payoff and

therefore, the pricing activities have the same algorithmic complexity for

every derivatives, unlike using Fourier Transform method, for which the

complexity is tied to the payoff.

Mario Dell’Era Closed Solution for Heston PDE by Geometrical Transformations](https://image.slidesharecdn.com/slide2013-140625155016-phpapp02/75/Workshop-2013-of-Quantitative-Finance-41-2048.jpg)

![Quantitative Finance: stochastic volatility market models

Conclusions

The proposed method is straightforward from theoretical viewpoint and

seems to be promising from that numerical. We reduce the Heston’s PDE in

a simpler, using , in a right order, suitable changing of variables, whose

Jacobian has not singularity points, unless for ρ = ±1. This evidence gives

us the safety that the variables chosen are well defined.

Besides, the idea to use the expected value of the variance process EP[νs],

instead of νt , provides us, in concrete, a closed solution very easy to

compute; and so, we are also able to know what is the error using the

geometric transformation technique; which is equal to the variance of the

variance process νt : Err = EP[(νt − EP[νt ])2

]. While, using Fourier technique

we are not able to know the numeric error directly, but we need to compare

Fourier prices with Monte Carlo prices, for which one can manage the

variance.

We want to remark that the shown technique is independent to the payoff and

therefore, the pricing activities have the same algorithmic complexity for

every derivatives, unlike using Fourier Transform method, for which the

complexity is tied to the payoff.

Mario Dell’Era Closed Solution for Heston PDE by Geometrical Transformations](https://image.slidesharecdn.com/slide2013-140625155016-phpapp02/75/Workshop-2013-of-Quantitative-Finance-42-2048.jpg)