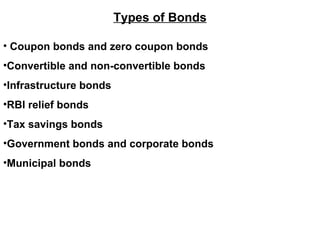

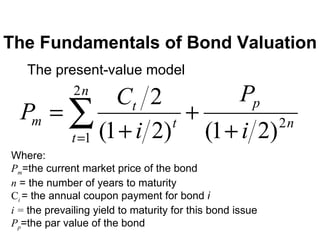

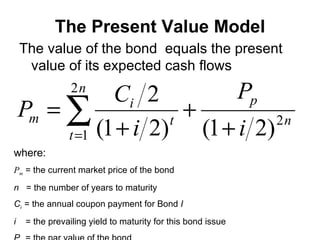

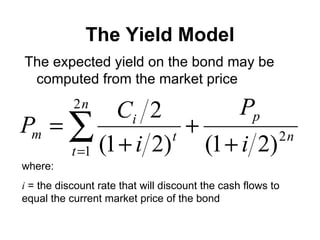

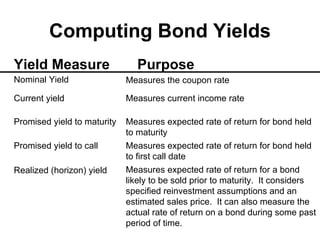

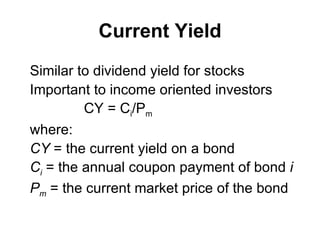

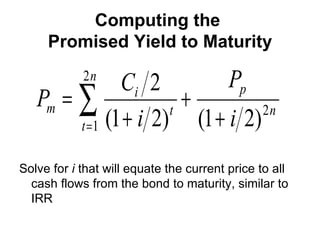

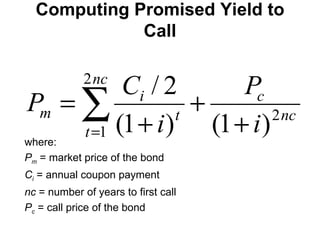

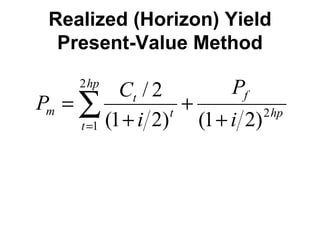

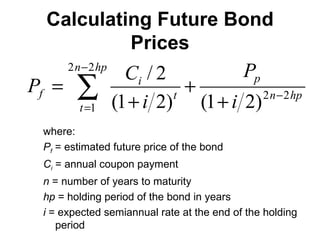

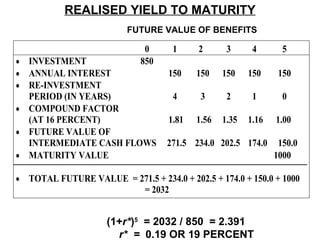

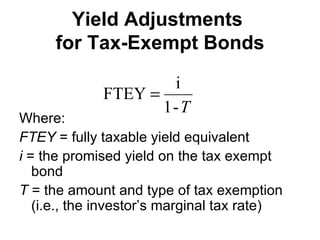

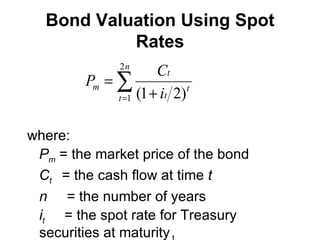

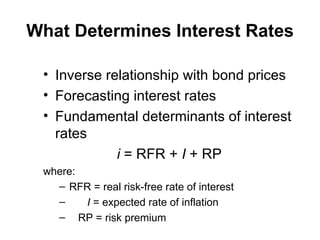

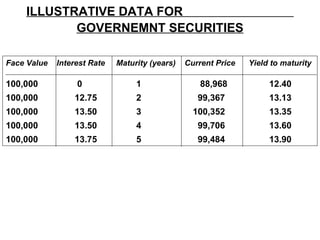

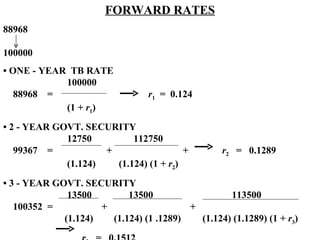

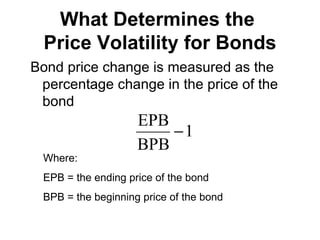

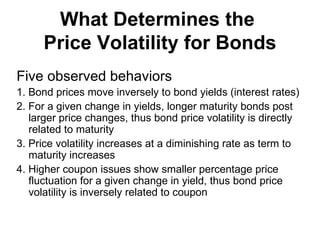

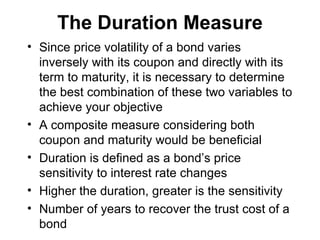

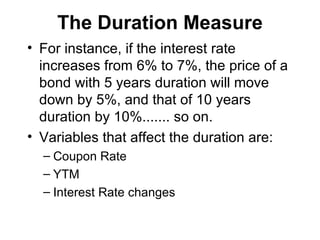

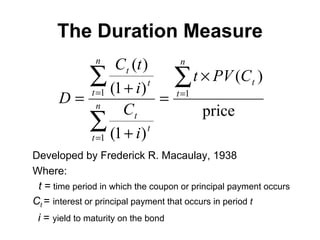

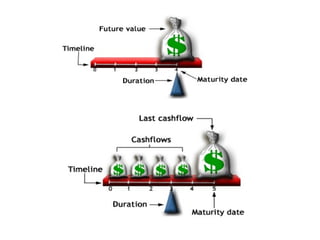

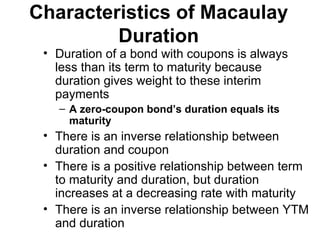

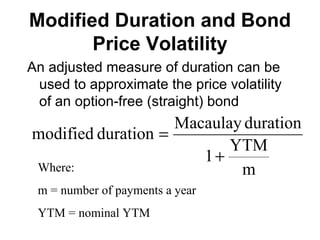

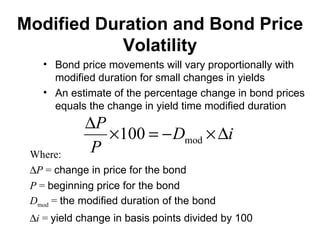

This document discusses different types of bonds and bond characteristics such as par value, coupon rate, maturity date, and callability. It explains how to calculate bond yields such as current yield, yield to maturity, and yield to call. The key valuation models discussed are the present value model, which values a bond based on its expected cash flows discounted at the yield to maturity, and the yield model, which solves for the yield given the bond's market price. The document also covers factors that impact bond prices such as interest rates, maturity, and coupon rate. Bond duration, a measure of price sensitivity to interest rates, is introduced along with related concepts like modified duration.