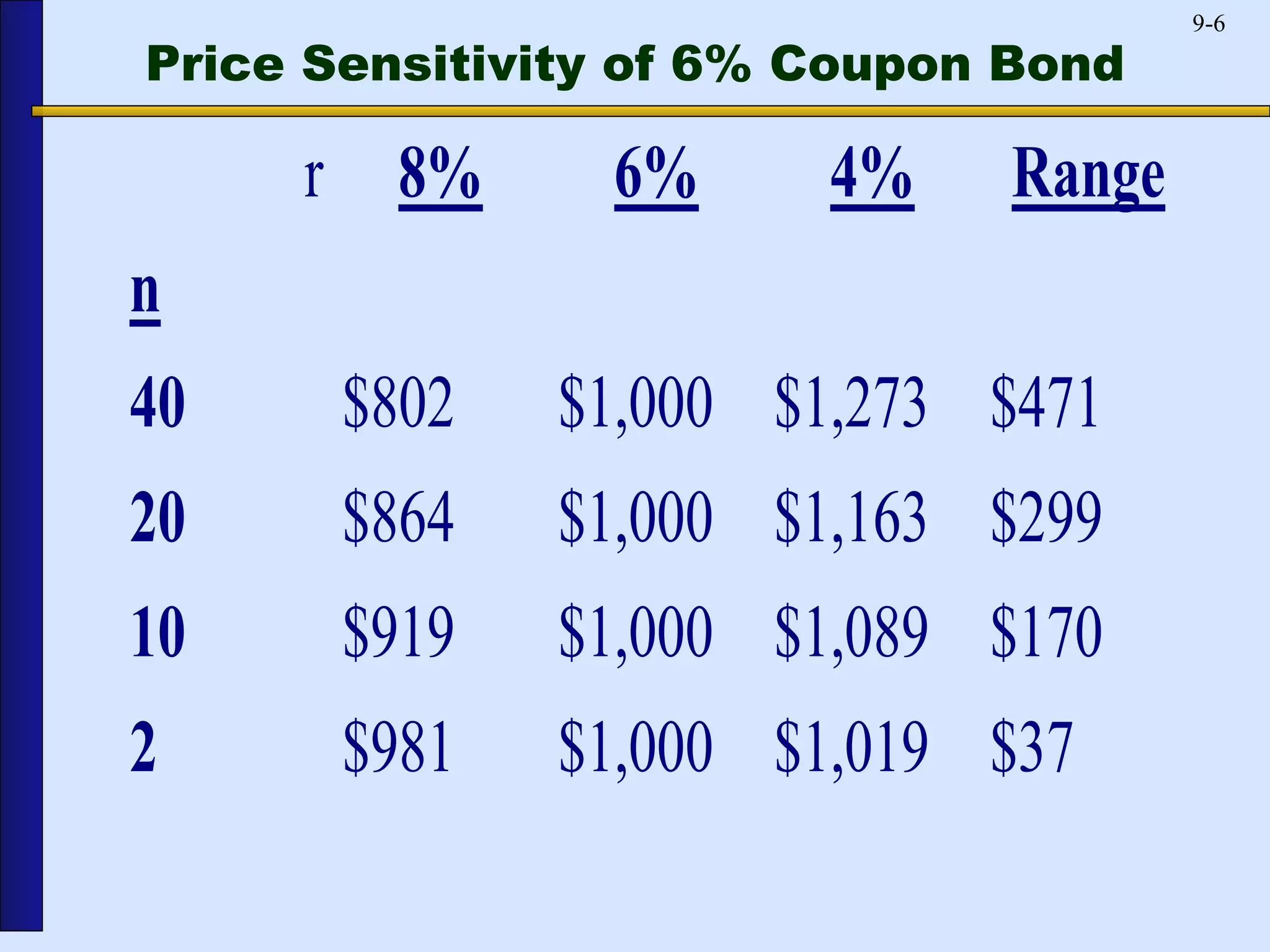

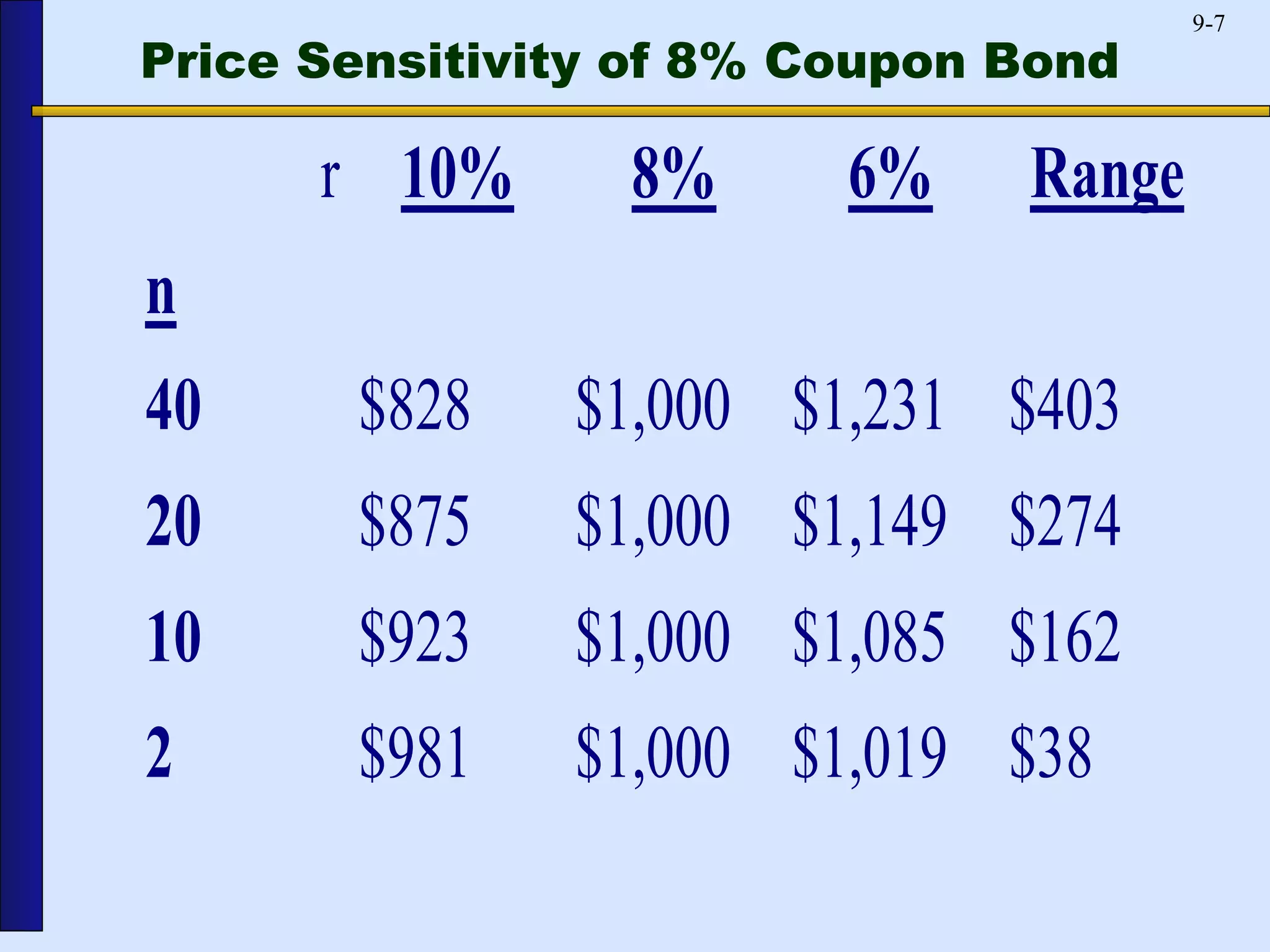

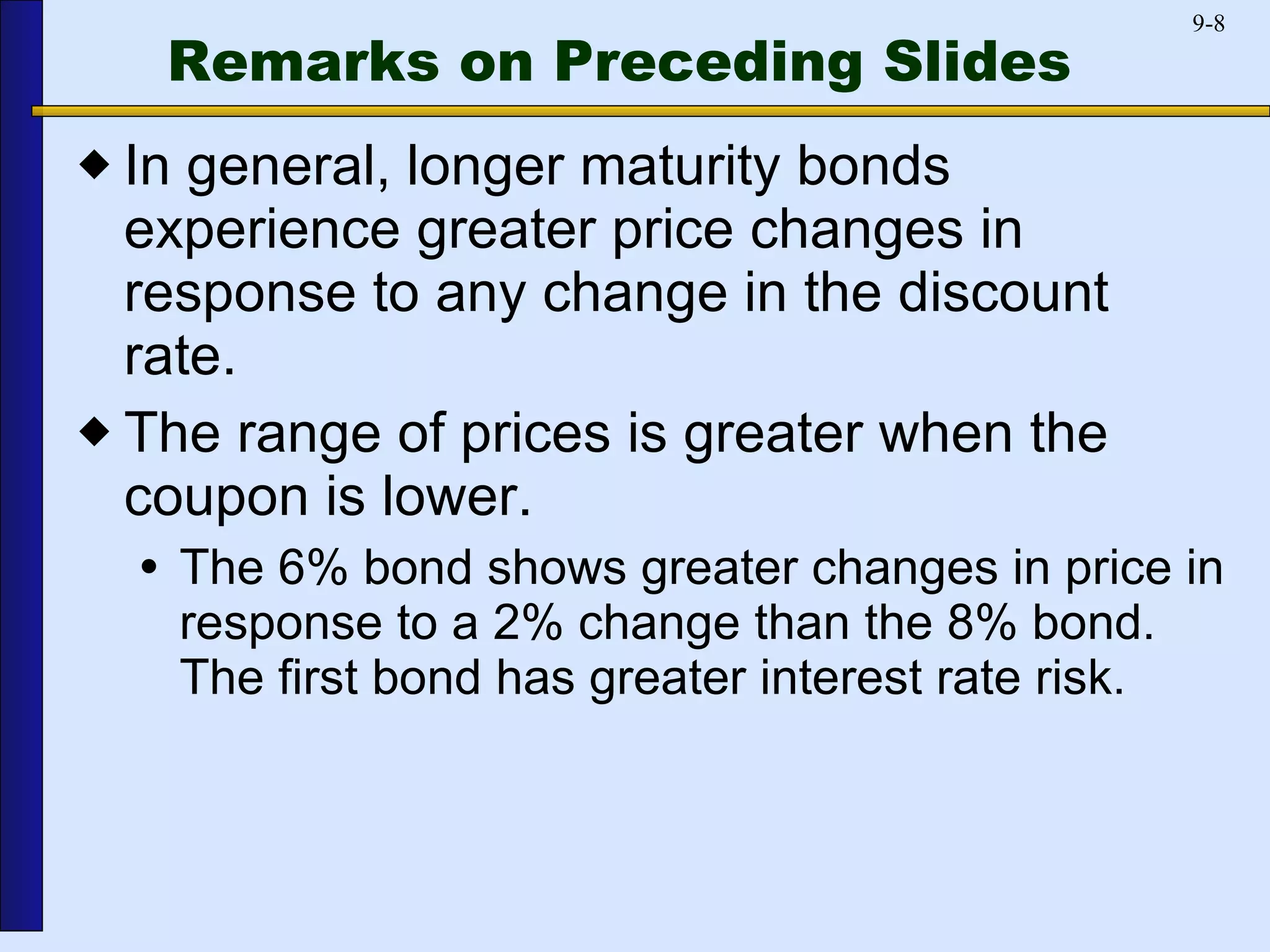

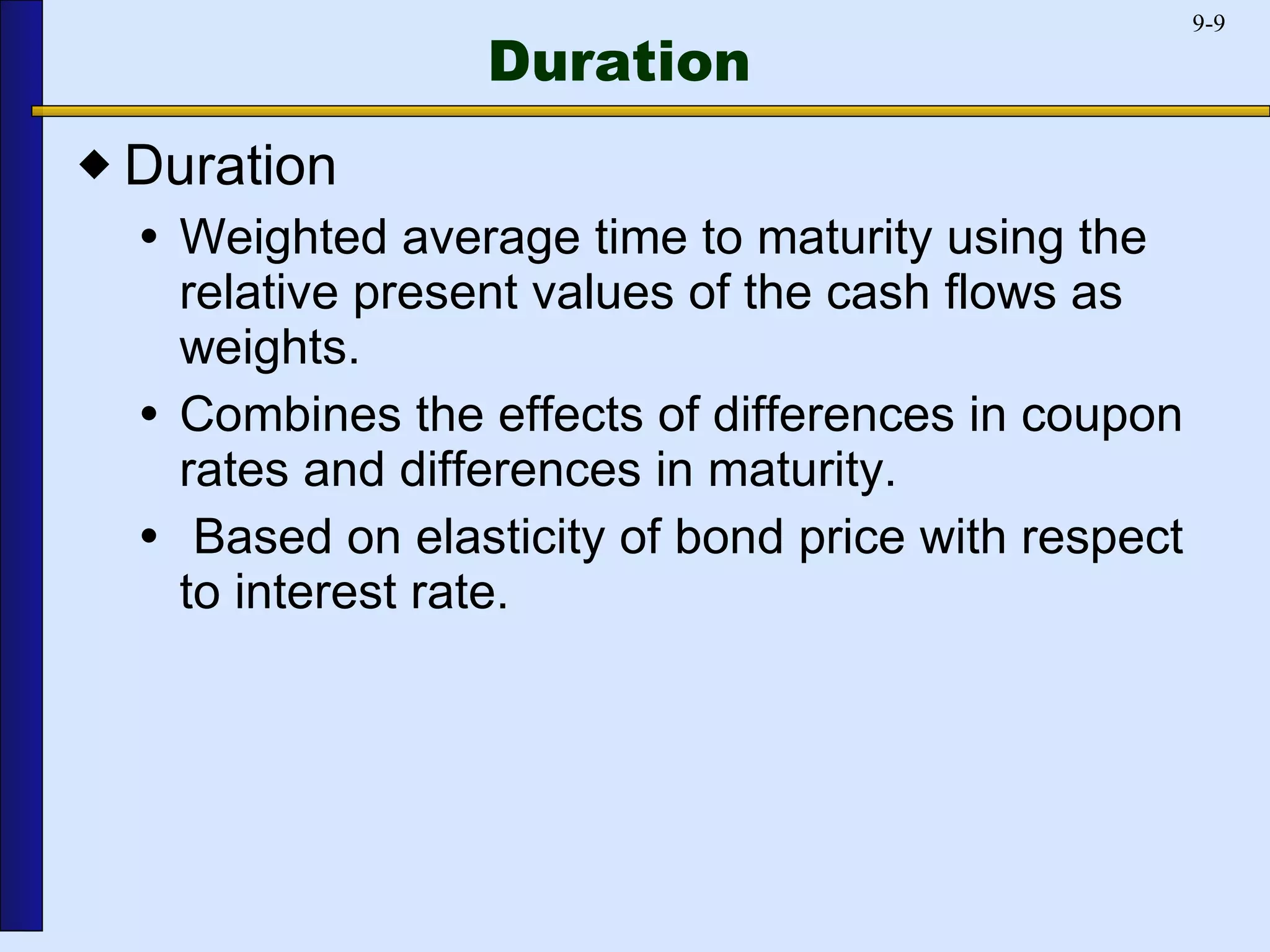

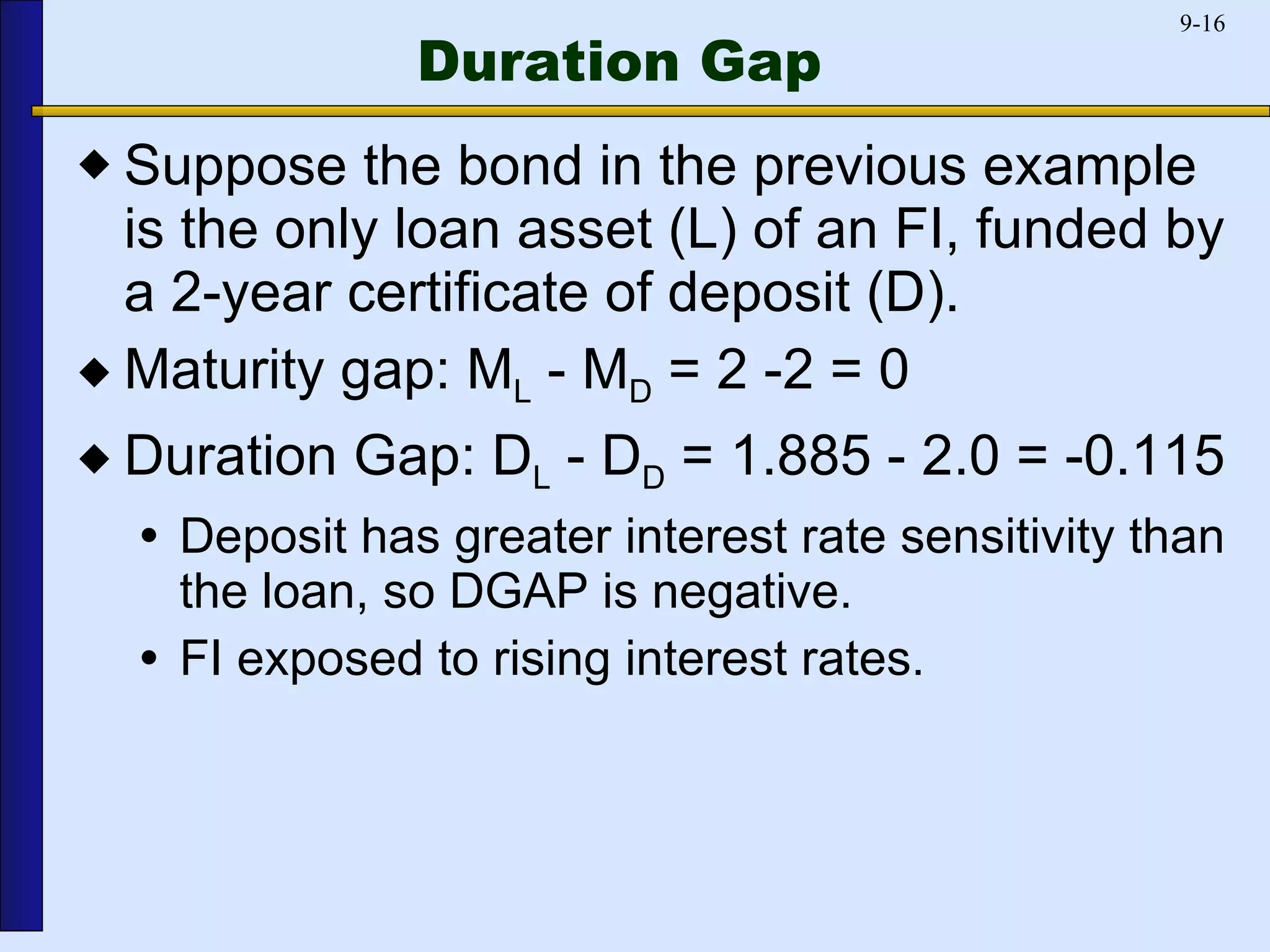

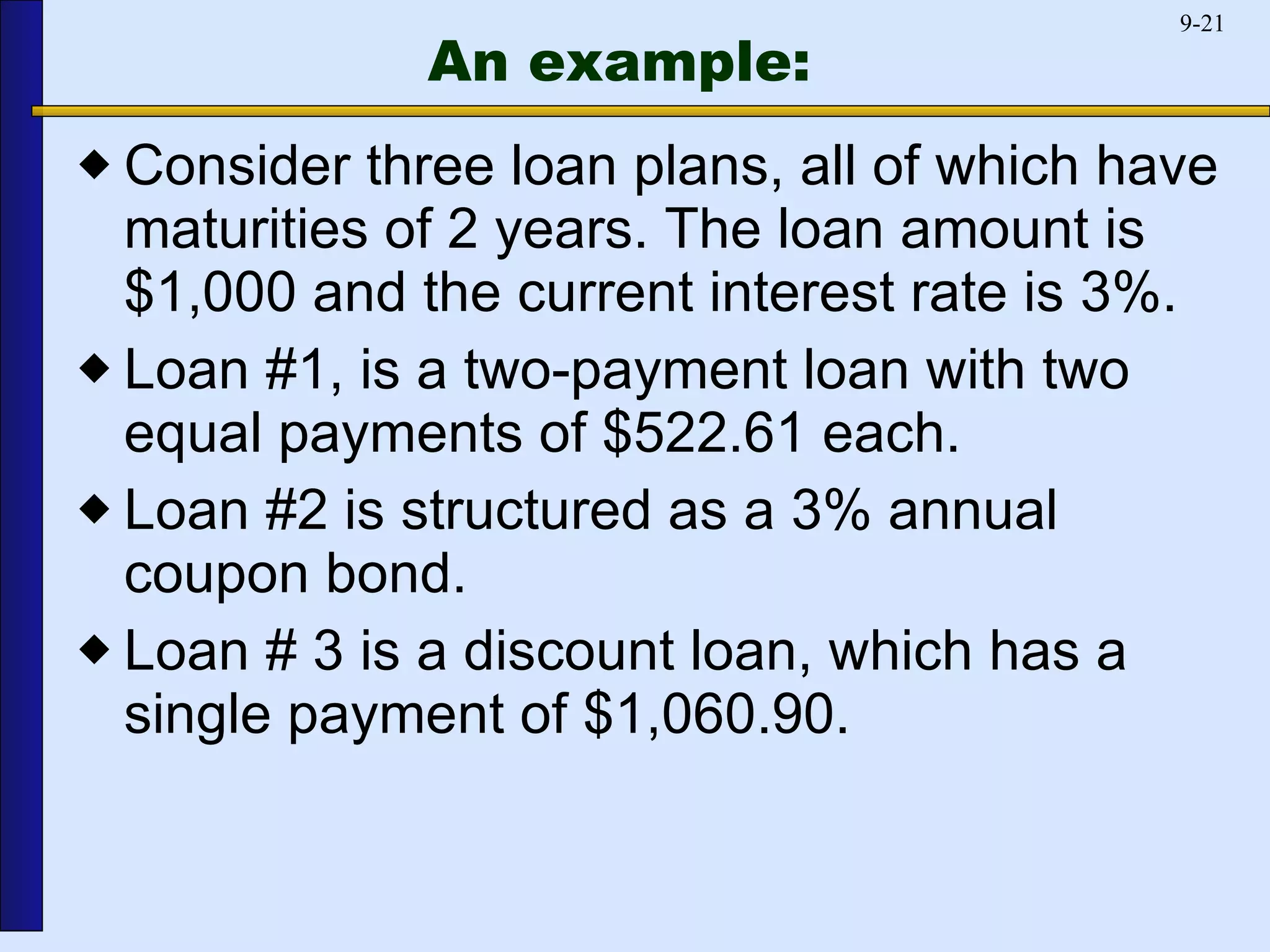

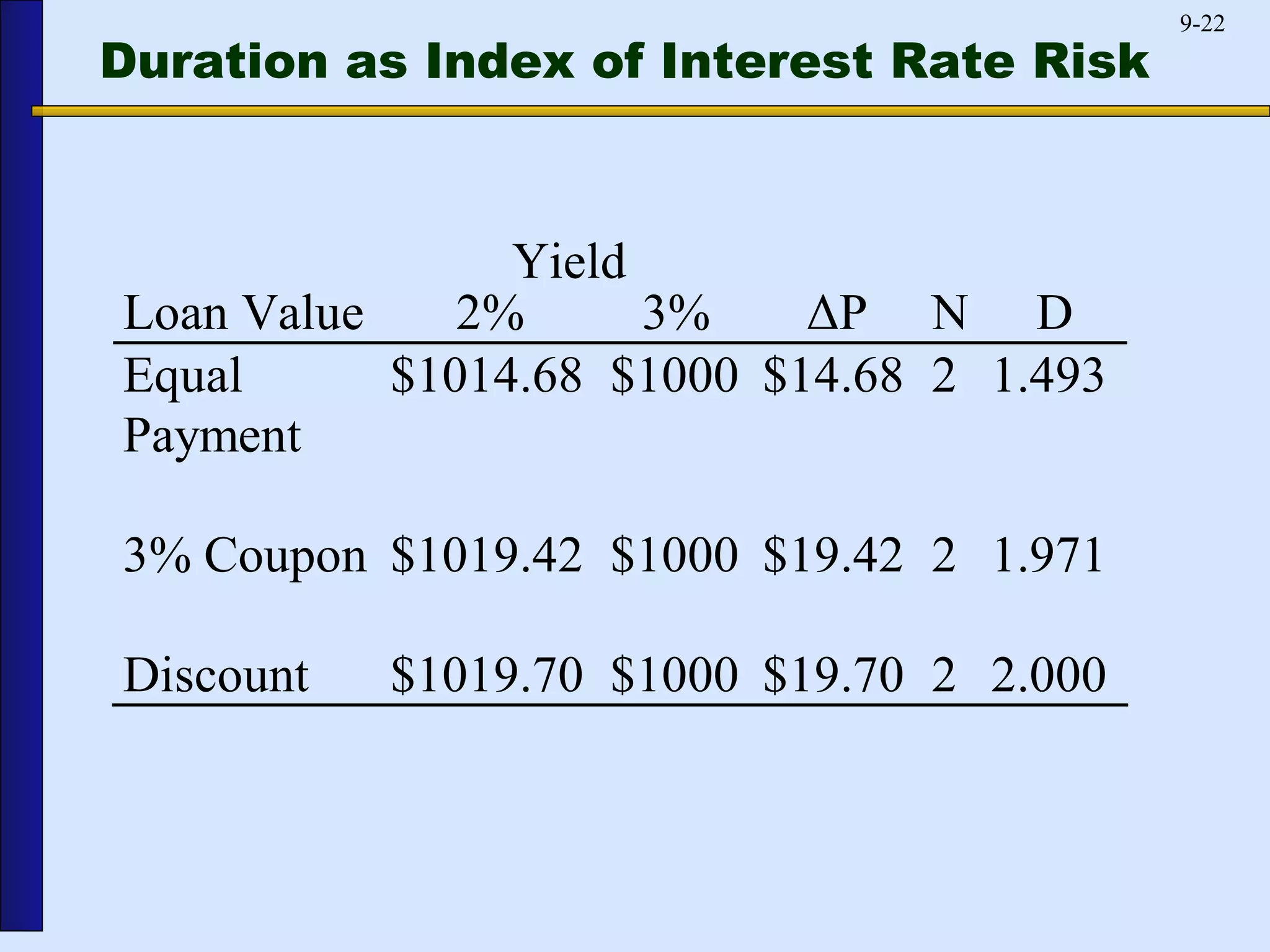

This document discusses duration, a model for measuring interest rate risk. Duration is a measure of how the price of a bond or loan will change in response to changes in interest rates. It represents the weighted average time until cash flows are received. Longer maturity bonds and loans have higher durations, meaning their prices are more sensitive to interest rate changes. Bonds with higher coupons have lower durations. Duration can be used to immunize a financial institution's balance sheet against interest rate risk by matching asset and liability durations.

![Duration Duration D = N t=1 [CF t • t/(1+R) t ]/ N t=1 [CF t /(1+R) t ] Where D = duration t = number of periods in the future CF t = cash flow to be delivered in t periods N= time-to-maturity R = yield to maturity.](https://image.slidesharecdn.com/durationmodel-110731051915-phpapp01/75/Duration-model-10-2048.jpg)

![Duration Since the price (P) of the bond must equal the present value of all its cash flows, we can state the duration formula another way: D = N t=1 [t (Present Value of CF t /P)] Notice that the weights correspond to the relative present values of the cash flows.](https://image.slidesharecdn.com/durationmodel-110731051915-phpapp01/75/Duration-model-11-2048.jpg)

![Economic Interpretation Duration is a measure of interest rate sensitivity or elasticity of a liability or asset: [ Δ P/P] [ Δ R/(1+R)] = -D Or equivalently, Δ P/P = -D[ Δ R/(1+R)] = -MD × Δ R where MD is modified duration.](https://image.slidesharecdn.com/durationmodel-110731051915-phpapp01/75/Duration-model-18-2048.jpg)

![Economic Interpretation To estimate the change in price, we can rewrite this as: Δ P = -D[ Δ R/(1+R)]P = -(MD) × ( Δ R) × (P) Note the direct linear relationship between Δ P and -D.](https://image.slidesharecdn.com/durationmodel-110731051915-phpapp01/75/Duration-model-19-2048.jpg)

![Semi-annual Coupon Payments With semi-annual coupon payments: ( Δ P/P)/( Δ R/R) = -D[ Δ R/(1+(R/2)]](https://image.slidesharecdn.com/durationmodel-110731051915-phpapp01/75/Duration-model-20-2048.jpg)

![Immunizing the Balance Sheet of an FI Duration Gap: From the balance sheet, E=A-L. Therefore, E= A- L. In the same manner used to determine the change in bond prices, we can find the change in value of equity using duration. E = [-D A A + D L L] R/(1+R) or E D A - D L k]A( R/(1+R))](https://image.slidesharecdn.com/durationmodel-110731051915-phpapp01/75/Duration-model-23-2048.jpg)

![An example: Suppose D A = 5 years, D L = 3 years and rates are expected to rise from 10% to 11%. (Rates change by 1%). Also, A = 100, L = 90 and E = 10. Find change in E. D A - D L k]A[ R/(1+R)] = -[5 - 3(90/100)]100[.01/1.1] = - $2.09. Methods of immunizing balance sheet. Adjust D A , D L or k.](https://image.slidesharecdn.com/durationmodel-110731051915-phpapp01/75/Duration-model-25-2048.jpg)