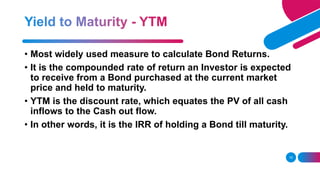

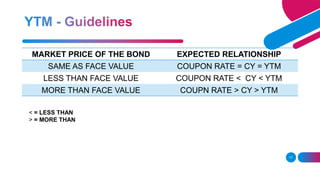

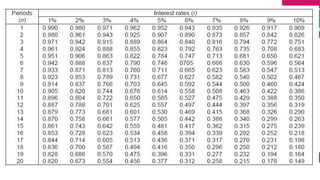

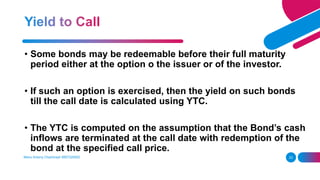

- The document discusses various types of bonds such as government bonds, corporate bonds, convertible bonds, and stripped bonds. It also covers bond valuation metrics like yield to maturity, current yield, and spot interest rate.

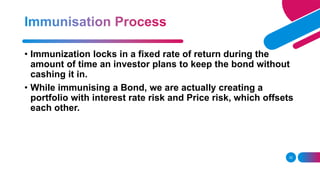

- Key bond risk factors are discussed like default risk, interest rate risk, and reinvestment risk. Bond immunization strategies are also summarized which aim to minimize interest rate risk by matching duration.

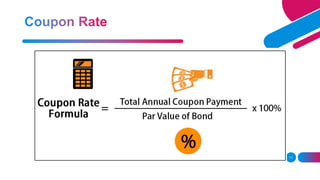

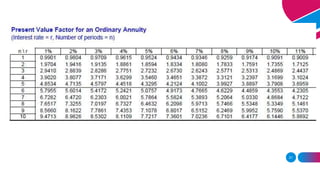

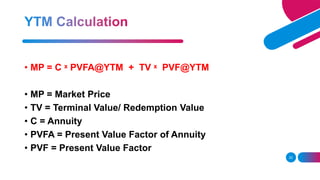

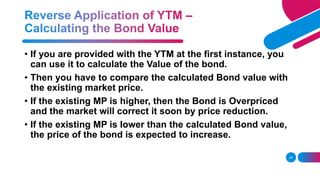

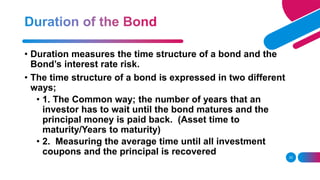

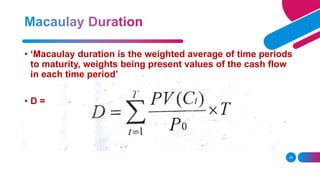

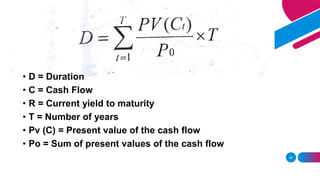

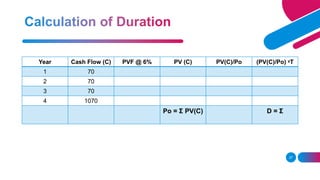

- The document provides examples of bond valuation using the bond price formula and defines duration as a measure of interest rate sensitivity for bonds.