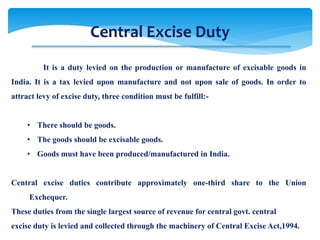

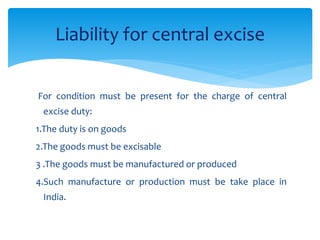

This document provides an overview of central excise duty in India. It discusses the three main laws governing central excise - the Central Excise Act of 1994, the Central Excise Tariff Act of 1985, and the Central Excise Rules of 1944. It also defines key terms like levy, collection, excisable goods, manufacture, and manufacturer. The document outlines the conditions for liability of central excise duty and concludes that the provisions and procedures related to central excise have remained largely stable in recent years.