The document provides an overview of derivatives, including:

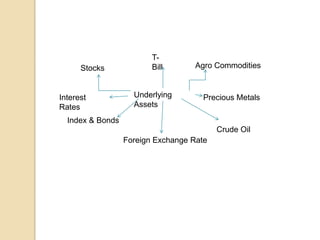

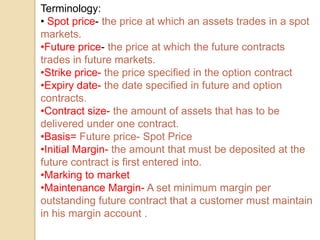

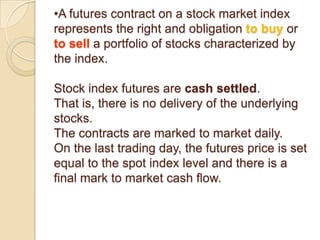

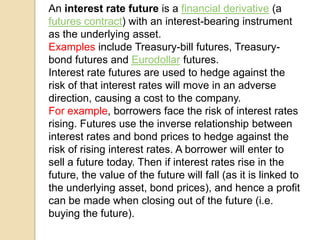

- Derivatives derive their value from an underlying asset such as stocks, bonds, commodities, currencies, or interest rates.

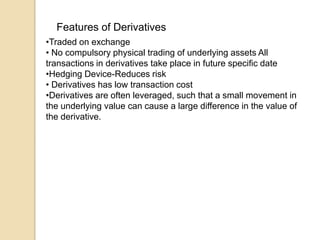

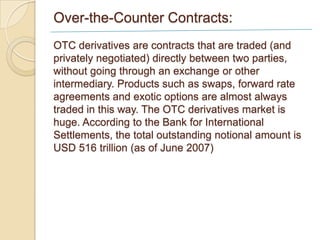

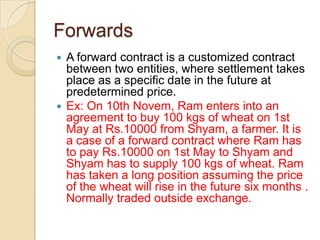

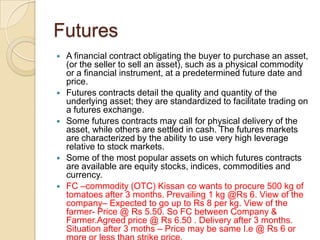

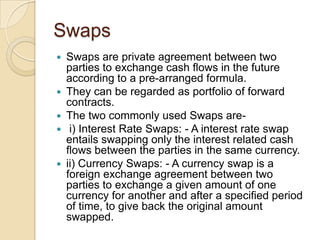

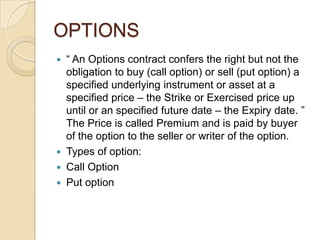

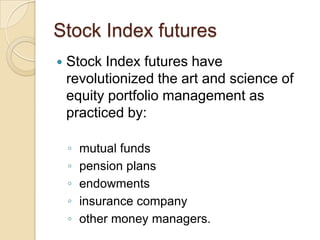

- The main types of derivatives are forwards, futures, options, and swaps. Forwards and futures are traded on exchanges while swaps and most options are over-the-counter.

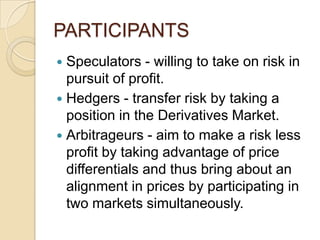

- Derivatives can be used for hedging risk or speculation. They allow investors to gain exposure to assets with greater leverage compared to investing directly in the underlying assets.