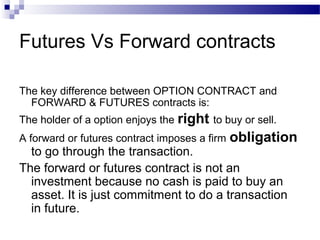

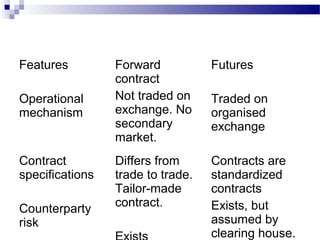

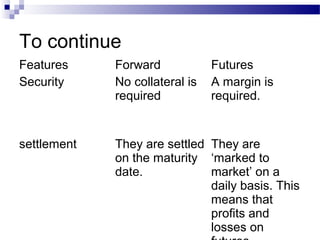

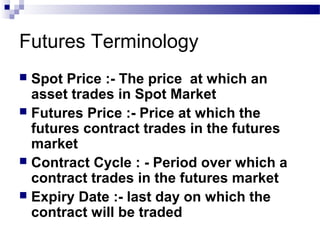

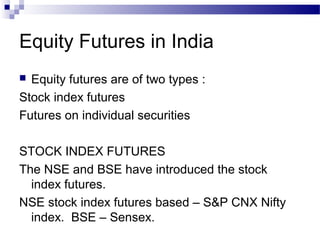

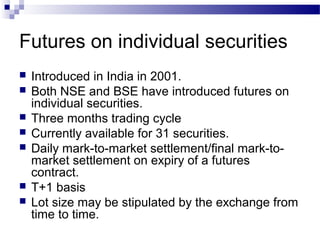

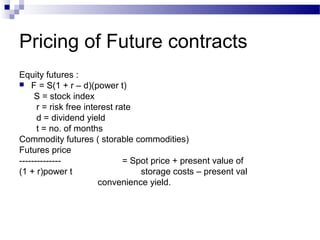

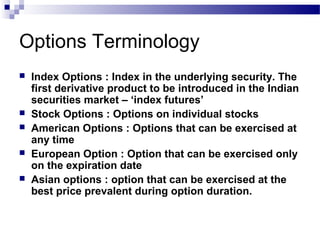

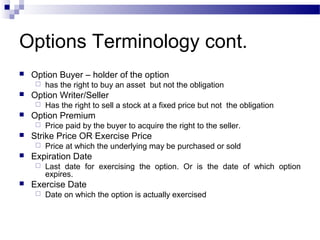

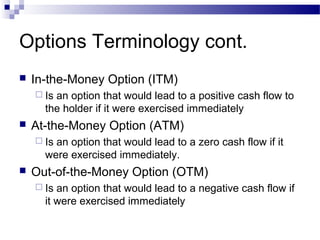

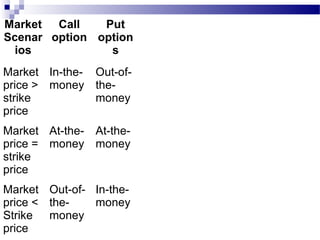

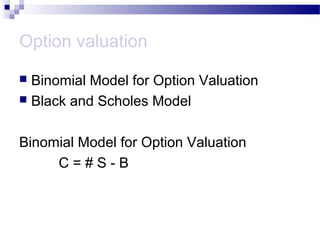

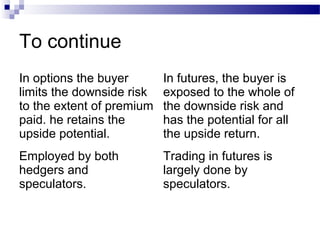

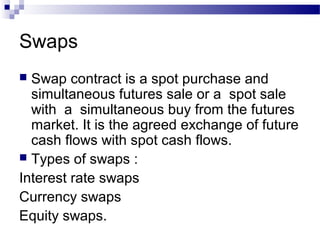

Derivatives derive their value from underlying assets. There are various types including forwards, futures, options, and swaps. Forward contracts are bilateral agreements to buy or sell an asset in the future at predetermined terms. Futures are standardized forward contracts that are traded on an exchange. Options provide the right but not obligation to buy or sell an asset by a specified date. Swaps involve exchanging cash flows of underlying assets like interest rates or currencies. Derivatives allow participants to hedge or speculate on price movements of the underlying assets.