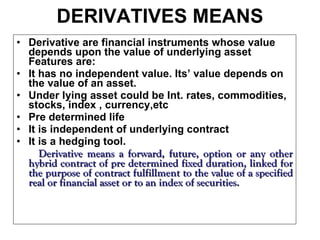

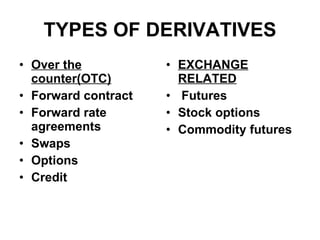

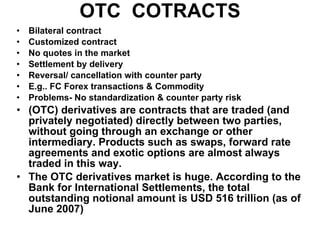

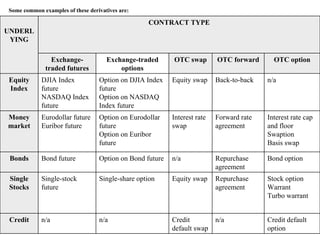

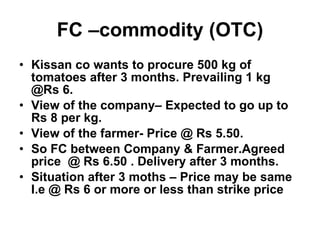

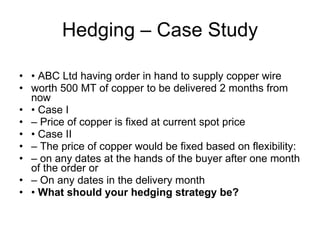

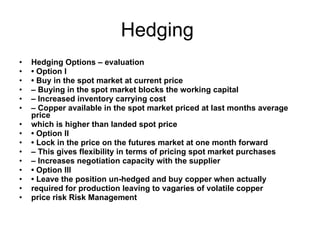

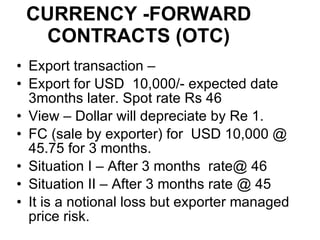

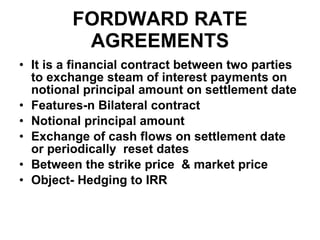

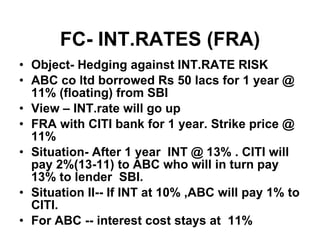

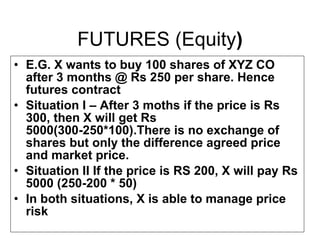

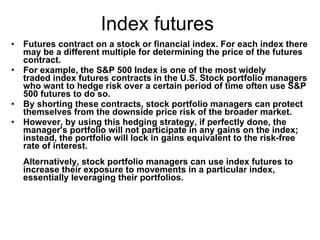

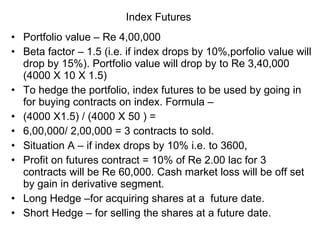

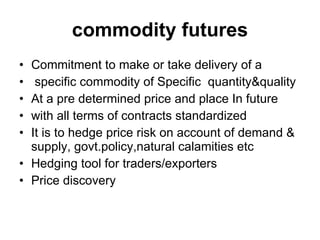

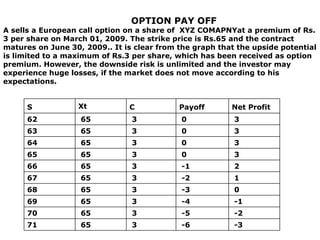

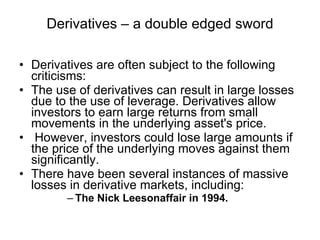

The document discusses various types of derivatives instruments used to manage financial risk, including forwards, futures, options, and swaps. It provides examples of how these derivatives are used to hedge risks related to commodities, interest rates, currencies, equities, indexes, and other underlying assets. The key types of derivatives discussed are over-the-counter contracts and exchange-traded contracts, along with examples of each like forwards, futures, and options.