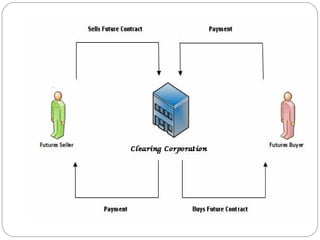

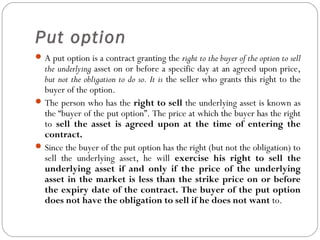

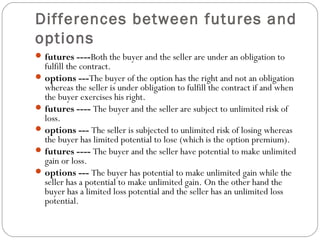

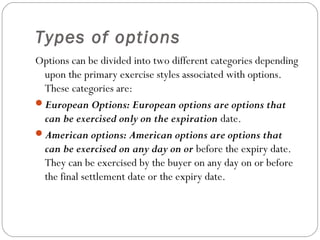

This document defines derivatives and describes the key types of derivatives: forwards, futures, and options. It explains that derivatives derive their value from underlying assets like equities, debt, currencies, or indices. Forwards involve a private agreement to buy/sell an asset at a future date at a pre-agreed price. Futures are standardized contracts traded on exchanges that require margin from both parties. Options provide the right but not obligation to buy/sell an asset at a strike price by a specified date for a premium.