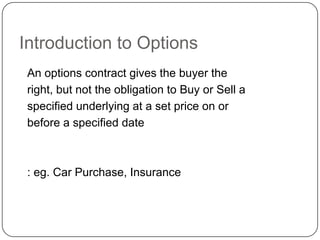

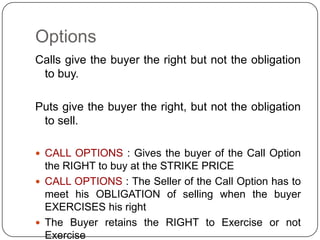

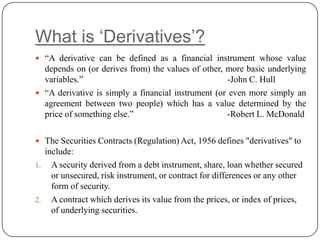

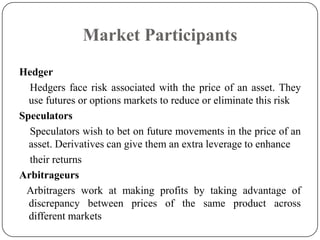

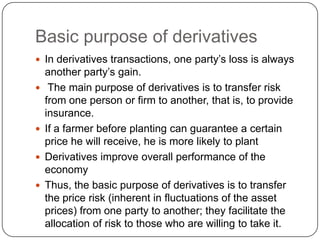

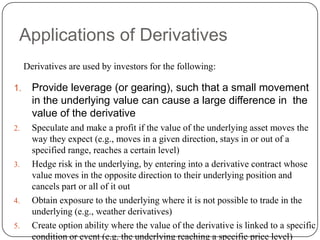

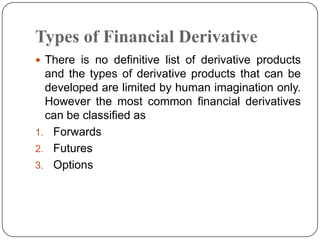

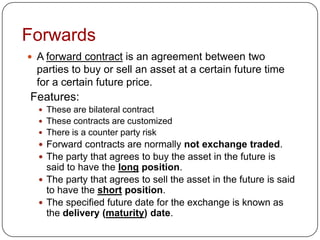

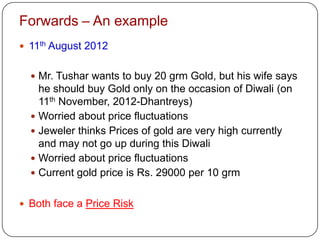

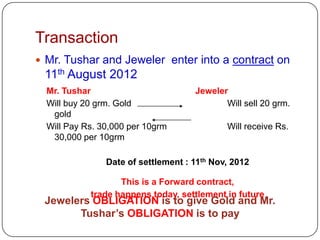

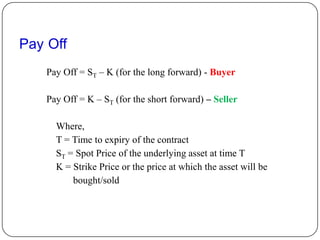

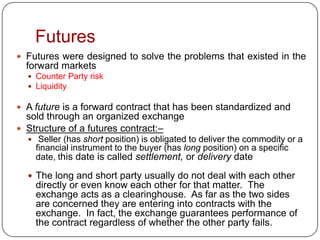

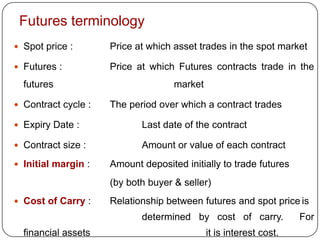

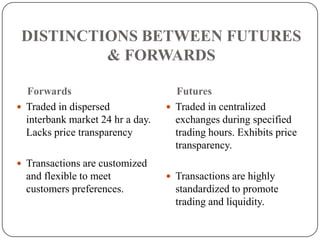

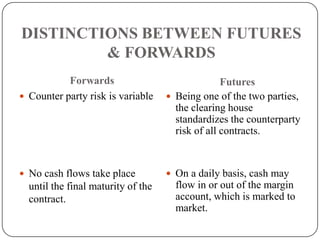

This document provides an introduction to derivatives. It defines derivatives as financial instruments whose value is derived from an underlying asset. The three main types of derivatives discussed are forwards, futures, and options. Forwards are customized bilateral contracts to buy or sell an asset in the future at a predetermined price. Futures are standardized exchange-traded versions of forwards that have no counterparty risk. Daily mark-to-market settlements determine profits and losses on futures positions. Options provide the right but not the obligation to buy or sell an asset at a future date.

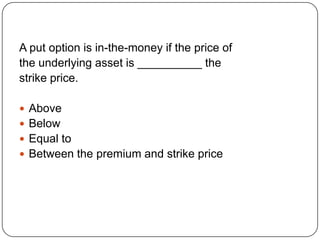

![Points to remember……….

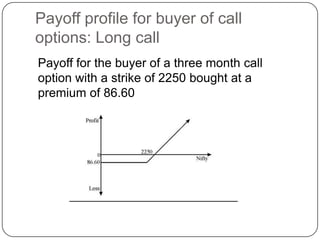

Long – Buy …(going long) [Bullish view]

Short – Sell …(going short) [Bearish view]

Squaring off (turn around trades) – opposite

transaction to the previous one

Buy low, sell high - gives a profit

Sell high, buy low - also gives a profit

Sell low, buy high – gives a loss

Buy high, sell low – also gives a loss](https://image.slidesharecdn.com/introductiontoderivatives-120812134457-phpapp01/85/Introduction-to-derivatives-32-320.jpg)

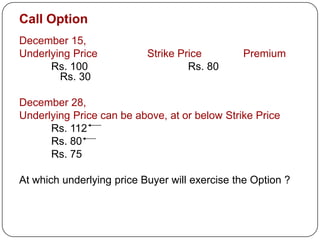

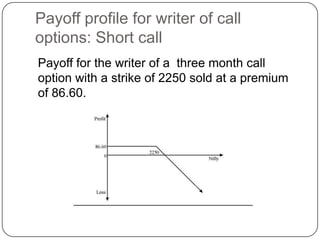

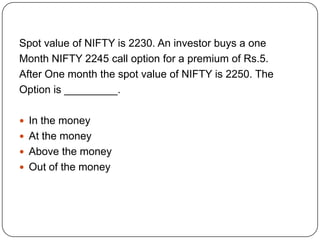

![Options

Example :-

TATA is launching a car – Nano

Price is Rs. 1Lakh. [Purchase price]

You can book the car by paying Rs. 20,000 [deposit]

By booking the car, what have you bought?

o A RIGHT to buy the car

When booking matures, can TATA force you to buy

Nano?

o TATA has only OBLIGATION

Can you force TATA to sell Nano?](https://image.slidesharecdn.com/introductiontoderivatives-120812134457-phpapp01/85/Introduction-to-derivatives-41-320.jpg)