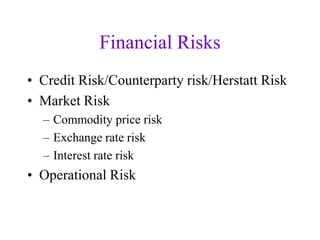

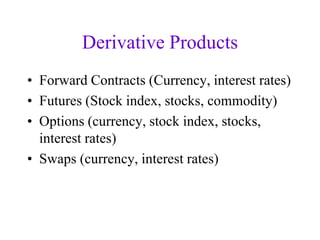

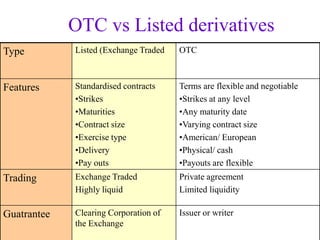

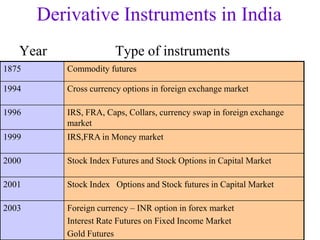

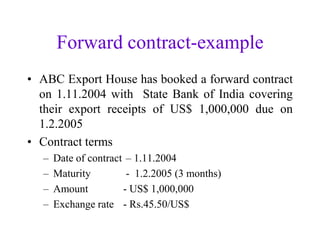

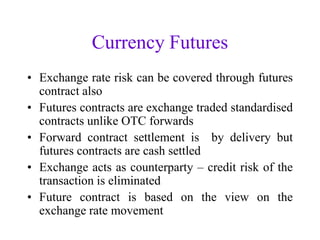

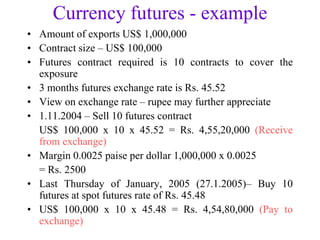

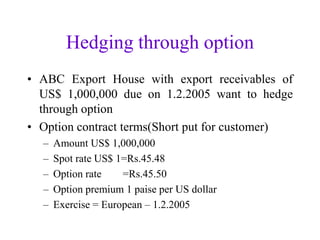

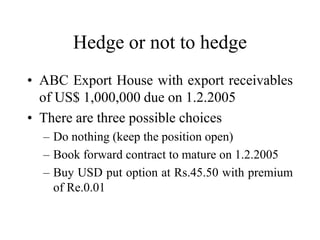

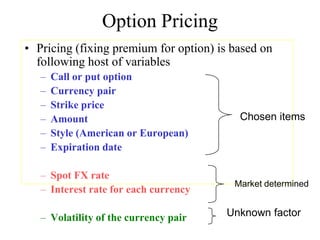

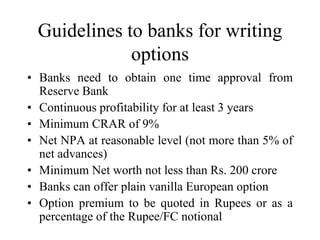

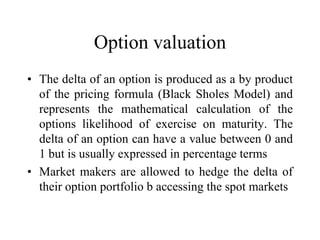

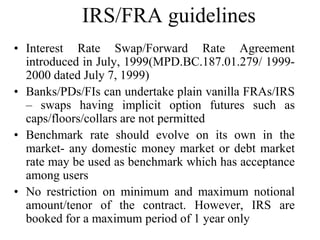

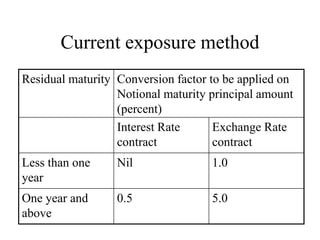

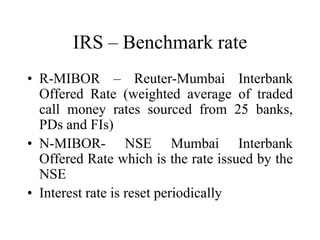

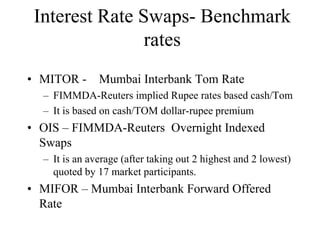

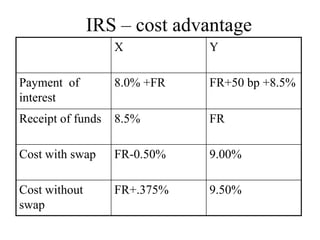

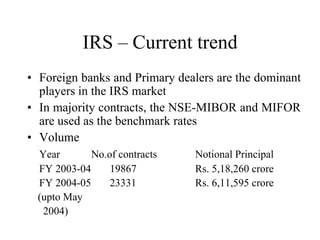

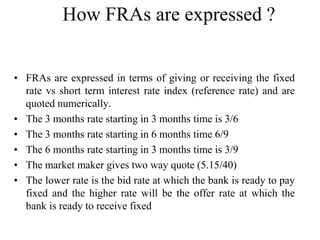

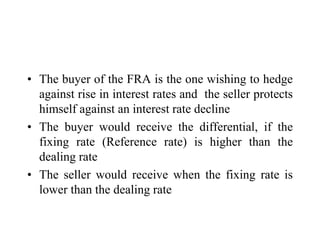

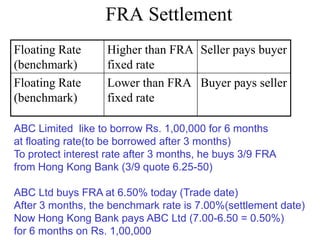

The document discusses various financial derivatives used for risk management, including credit, market, and operational risks, as well as different types of derivative products like forwards, futures, options, and swaps. It highlights the evolution of derivative instruments in India, the features of OTC versus exchange-traded derivatives, and options' exercise styles. Additionally, it addresses interest rate swaps, forward rate agreements, and limitations faced by public sector banks in participating in the derivatives market.