Accounting standard 6 Presentation

•Download as PPTX, PDF•

4 likes•24,546 views

This document summarizes Accounting Standard 6 (AS-6) on depreciation accounting. It defines depreciation and outlines the key features and causes of depreciation. It discusses depreciable assets and the applicability of AS-6. The document also explains the different methods for calculating depreciation and conditions for changing the depreciation method. It provides guidance on the disclosure requirements for depreciation as per AS-6 and concludes with important points about the standard.

Report

Share

Report

Share

Recommended

Accounting for depreciation 1

This document provides an overview of depreciation accounting. It defines depreciation and related terms like depletion, amortization, and obsolescence. It discusses the causes and objectives of charging depreciation. The document also explains factors affecting depreciation amounts and relevant accounting principles. Finally, it describes the straight line and written down value methods for allocating depreciation over the useful life of an asset.

Fund flow statement

The document provides information on fund flow statements, including their meaning, definition, purpose, and preparation. It defines a fund flow statement as a report on the movement of funds or working capital during an accounting period. It explains how working capital is raised and used. The summary then outlines some key points on the meaning of funds, items that constitute sources and uses of funds, and the objectives and limitations of fund flow statements.

PPT on Depreciation.ppt

This document summarizes the key aspects of Accounting Standard AS-6 on depreciation accounting in India. It defines depreciation and explains how it is allocated over the useful life of a depreciable asset. It covers the applicability of AS-6, methods of calculating depreciation, factors affecting depreciation, and disclosure requirements regarding depreciation policies and amounts in financial statements. The document also discusses accounting treatments for changes in depreciation methods or estimates of useful life.

As 6

This document discusses depreciation accounting standards in India. It defines depreciation as the wearing out, consumption or loss of value of an asset due to use, time, or obsolescence. Depreciable assets have a limited useful life. The document outlines the causes and needs for depreciating assets, and factors to consider such as cost, useful life, and residual value. It describes common depreciation methods like straight-line and written down value, and notes disclosure requirements for depreciation policies in financial statements.

5.capital and revenue

Capital and revenue expenditures and receipts must be distinguished to determine which items appear in which financial statements. Capital items appear on the balance sheet, while revenue items appear on the profit and loss account. This distinction is also important for determining net profit, which equals revenue receipts minus revenue expenses. Capital receipts include contributions of capital and loans, while revenue receipts are generated from a firm's regular activities like sales. Capital expenditures acquire or improve long-term assets, increasing earning capacity, while revenue expenditures maintain assets and earnings over a single accounting period.

As 10

This document provides an overview of Accounting Standard 10 (AS 10) regarding accounting for fixed assets in India. AS 10 applies to companies listed on a recognized stock exchange and large commercial enterprises. It defines fixed assets as assets used for producing goods and services, not held for sale. It discusses the components that make up the cost of a fixed asset, treatment of improvements and repairs, and disclosure requirements regarding fixed assets in financial statements.

Company Final accounts

This document provides an overview of financial statements that companies are required to prepare under the Companies Act. It discusses the key components of the income statement and balance sheet, including revenues, expenses, assets, liabilities, and equity. Sample income statements and balance sheets are presented with explanatory notes. Key terms related to revenues, expenses, assets, liabilities, equity, and other items are also defined.

Indian Accounting standards

The document discusses Indian accounting standards, including the meaning and benefits of accounting standards. It provides details on several specific accounting standards such as AS1 on disclosure of accounting policies, AS6 on depreciation accounting, AS9 on revenue recognition, and AS10 on accounting for fixed assets. The standards cover topics such as selection and disclosure of accounting policies, methods of depreciation, timing of revenue recognition, calculation of costs of fixed assets, and revaluation of fixed assets. The overall objective of the accounting standards is to standardize different accounting policies and practices in India.

Recommended

Accounting for depreciation 1

This document provides an overview of depreciation accounting. It defines depreciation and related terms like depletion, amortization, and obsolescence. It discusses the causes and objectives of charging depreciation. The document also explains factors affecting depreciation amounts and relevant accounting principles. Finally, it describes the straight line and written down value methods for allocating depreciation over the useful life of an asset.

Fund flow statement

The document provides information on fund flow statements, including their meaning, definition, purpose, and preparation. It defines a fund flow statement as a report on the movement of funds or working capital during an accounting period. It explains how working capital is raised and used. The summary then outlines some key points on the meaning of funds, items that constitute sources and uses of funds, and the objectives and limitations of fund flow statements.

PPT on Depreciation.ppt

This document summarizes the key aspects of Accounting Standard AS-6 on depreciation accounting in India. It defines depreciation and explains how it is allocated over the useful life of a depreciable asset. It covers the applicability of AS-6, methods of calculating depreciation, factors affecting depreciation, and disclosure requirements regarding depreciation policies and amounts in financial statements. The document also discusses accounting treatments for changes in depreciation methods or estimates of useful life.

As 6

This document discusses depreciation accounting standards in India. It defines depreciation as the wearing out, consumption or loss of value of an asset due to use, time, or obsolescence. Depreciable assets have a limited useful life. The document outlines the causes and needs for depreciating assets, and factors to consider such as cost, useful life, and residual value. It describes common depreciation methods like straight-line and written down value, and notes disclosure requirements for depreciation policies in financial statements.

5.capital and revenue

Capital and revenue expenditures and receipts must be distinguished to determine which items appear in which financial statements. Capital items appear on the balance sheet, while revenue items appear on the profit and loss account. This distinction is also important for determining net profit, which equals revenue receipts minus revenue expenses. Capital receipts include contributions of capital and loans, while revenue receipts are generated from a firm's regular activities like sales. Capital expenditures acquire or improve long-term assets, increasing earning capacity, while revenue expenditures maintain assets and earnings over a single accounting period.

As 10

This document provides an overview of Accounting Standard 10 (AS 10) regarding accounting for fixed assets in India. AS 10 applies to companies listed on a recognized stock exchange and large commercial enterprises. It defines fixed assets as assets used for producing goods and services, not held for sale. It discusses the components that make up the cost of a fixed asset, treatment of improvements and repairs, and disclosure requirements regarding fixed assets in financial statements.

Company Final accounts

This document provides an overview of financial statements that companies are required to prepare under the Companies Act. It discusses the key components of the income statement and balance sheet, including revenues, expenses, assets, liabilities, and equity. Sample income statements and balance sheets are presented with explanatory notes. Key terms related to revenues, expenses, assets, liabilities, equity, and other items are also defined.

Indian Accounting standards

The document discusses Indian accounting standards, including the meaning and benefits of accounting standards. It provides details on several specific accounting standards such as AS1 on disclosure of accounting policies, AS6 on depreciation accounting, AS9 on revenue recognition, and AS10 on accounting for fixed assets. The standards cover topics such as selection and disclosure of accounting policies, methods of depreciation, timing of revenue recognition, calculation of costs of fixed assets, and revaluation of fixed assets. The overall objective of the accounting standards is to standardize different accounting policies and practices in India.

As – 6 Depreciation Accounting

THIS IS ALL ABOUT ACCOUNTING STANDARD - 6 I.E., DEPRECIATION ACCOUNTING.

THE RULES AND REGULATIONS TO BE FOLLOWED WHILE CALCULATING DEPRECIATION OF A DEPRECIABLE FIXED ASSET.

Indian Accounting Standards Introduction and Relevance

This document provides an overview of accounting standards in India. It discusses the need for and objectives of accounting standards, which are to bring uniformity in accounting methods, improve reliability of financial statements, and simplify accounting information. It summarizes some key Indian Accounting Standards (Ind AS), including Ind AS 1 on disclosure of accounting policies, Ind AS 2 on valuation of inventories, and Ind AS 101 on first-time adoption of accounting standards. Ind AS 2 specifies that inventories should be measured at the lower of cost and net realizable value. The document also outlines the phases for adoption of Ind AS for companies in India based on their net worth.

Accounting concept and convention

This document discusses key accounting concepts and conventions. It defines 8 accounting concepts: business entity, money measurement, accounting period, accounting cost, going concern, dual aspect, realization, and matching. It also discusses 4 accounting conventions: consistency, materiality, conservatism, and full disclosure. The concepts and conventions establish standard principles and practices for preparing accurate financial statements and reports.

Ifrs presentation

International Financial Reporting Standards (IFRS) are designed as a common global language for business affairs so that company accounts are understandable and comparable across international boundaries.

IFRS were issued by the Board of the International Accounting Standards Committee (IASC), known as International Accounting Standard Board(IASB).

Reconciliation of cost and financial accounts

This document discusses the reconciliation of cost and financial accounts. It defines reconciliation as tallying or equating the results shown in cost accounts and financial accounts. There can be disagreements between the profits in the two accounts due to items only being included in one set of accounts or differences in stock valuation or depreciation methods. Reconciling the accounts ensures accuracy and reliability. The two main methods of reconciliation are preparing a reconciliation statement, which adds or subtracts reconciling items to the base profit of one account to match the other account's profit, and preparing a memorandum reconciliation account in ledger format.

Capital Budgeting Decisions

1) Capital budgeting is the process of planning for capital expenditures that are expected to generate returns over multiple years. It involves evaluating potential long-term investment projects and determining which ones to undertake.

2) The document discusses various capital budgeting techniques for evaluating projects, including payback period, accounting rate of return, net present value, and internal rate of return. It also outlines the typical capital budgeting process of identifying, screening, evaluating, approving, implementing, and reviewing projects.

3) Key factors in capital budgeting include properly accounting for the time value of money, risk analysis, and ensuring projects will maximize long-term profitability for the company. Both traditional and modern discounted cash flow methods have advantages and

Ias 36 impairment of assets

This document summarizes IAS 36 on impairment of assets. The key points are:

1) IAS 36 aims to ensure assets are carried at no more than their recoverable amount, which is defined as the higher of an asset's fair value less costs of disposal and its value in use.

2) An impairment loss occurs when an asset's carrying amount exceeds its recoverable amount and must be recognized.

3) Recoverable amount is determined based on external factors like market changes or internal factors like physical damage.

4) A cash-generating unit is the smallest group of assets that generates cash inflows independently of other assets.

Absorption Costing and Marginal Costing ppt

Marginal costing and absorption costing are two different costing methods. Absorption costing treats all manufacturing costs, including both fixed and variable costs, as product costs. Marginal costing only treats variable manufacturing costs as product costs and treats fixed costs as period costs. Absorption costing results in higher inventory valuations as it includes fixed overhead costs in product costs. Marginal costing is useful for decision making as it focuses only on variable costs relevant to production changes. While marginal costing is simpler, absorption costing follows accounting standards by fully allocating costs.

Marginal costing and break even analysis

Under this technique all costs are classified into fixed costs and variable costs. Only variable costs are considered product costs and are allocated to products manufactured. These costs include direct materials, direct labor, direct expenses and variable overhead. Fixed costs are not considered for computing the cost of products or valuation of inventory.

Valuation of goodwill

Valuation of Goodwill, types of goodwill, factors affecting goodwill, features of goodwill, methods of calculating goodwill

Depreciation made easy !

This document defines depreciation as the reduction in the value of an asset due to wear and tear, usage, or obsolescence over time. It discusses the allocation of an asset's cost over its useful life, with depreciation being a non-cash expense. Various methods of calculating depreciation are presented, along with factors that determine the depreciation amount such as the asset's cost, useful life, and salvage value. The document also notes disclosure requirements for depreciation in financial statements and regulations around changing depreciation methods.

Methods and techniques of Costing

A power point presentation describing some basic definitions, father of cost accounting, Indian aspect of cost accounting and Various Methods and Techniques of costing.

Presented by: Aquib Ali, Ajay Gupta and Ashwin Showi. (M.Com students)

at the Bhopal School of Social Sciences(BSSS) on 6 September, 2017

Inventories – ias 2

- IAS 2 Inventories prescribes the accounting treatment for inventories and provides guidance on determining inventory costs and recognizing them as expenses. It applies to all inventories except work-in-progress for construction contracts and biological assets related to agricultural activity.

- Inventories must be measured at the lower of cost and net realizable value. Cost includes costs of purchase, costs of conversion, and other costs to bring inventories to their present location and condition. Net realizable value is the estimated selling price less costs to complete and sell.

- When inventories are sold, their carrying amount must be recognized as an expense. Write-downs to net realizable value and inventory losses must also be recognized as expenses.

Reconciliation of cost and financial accounts

This document discusses the reconciliation of cost accounts and financial accounts. When these two sets of accounts are maintained separately, the profits or losses reported may differ. A reconciliation statement is prepared to identify reasons for any differences. Common reasons for differences include items recorded in one set of accounts but not the other, different valuation methods for inventory, and over- or under-absorption of overhead costs. The reconciliation statement calculates the adjustments needed to make the profit/loss figures reported by the two sets of accounts agree.

Ppt on accounting standards

The document provides an overview of accounting standards in India and other countries. It discusses 32 accounting standards issued by the Institute of Chartered Accountants of India that are based on the 41 International Financial Reporting Standards. The standards cover various topics such as disclosure of accounting policies, treatment of inventories, cash flow statements, revenue recognition, accounting for fixed assets, foreign exchange rates, and financial instruments. The objectives, evolution, and key aspects of many individual accounting standards are summarized.

Depreciation

This document discusses depreciation, including its concept, objectives, causes, and methods. It defines depreciation as the permanent fall in value of fixed assets due to wear and tear from use in business. The objectives of depreciation include calculating proper profits, maintaining the original investment, and providing for asset replacement. Causes include wear and tear, obsolescence, and the passage of time. Common depreciation methods discussed are the straight-line method, declining balance method, and sum of years digits method.

Accounting Concepts & Conventions

1) The document discusses key accounting concepts and conventions. It defines 11 accounting concepts including business entity, money measurement, going concern, and historical cost.

2) It also explains 3 common accounting conventions: full disclosure, consistency, and conservatism. Conventions represent generally accepted practices adopted through agreement, while concepts provide a theoretical foundation.

3) The main difference between concepts and conventions is that concepts cannot involve personal bias and are not uniformly adopted, while conventions are uniformly adopted based on customs or legal guidelines.

Method of costing

The document discusses various methods and concepts in cost accounting, including:

1. Different types of costing methods like unit costing, job costing, contract costing, batch costing, operating costing, process costing, and multiple/uniform costing.

2. The need to reconcile cost and financial accounts when they are maintained separately, to check for differences in reported profit/loss.

3. Key aspects of cost sheets like classifying cost components, ascertaining product costs, fixing selling prices, and aiding cost control and management decisions.

Marginal and absorption costing

Marginal costing is an alternative to absorption costing. Under marginal costing, only variable costs are charged as cost of sales and contribution is calculated. Fixed costs are treated as period costs. Contribution is the difference between sales revenue and variable costs, and it goes towards recovering fixed costs and generating profit. The key principles of marginal costing are that fixed costs do not change with volume, so increasing or decreasing sales only impacts profits by the amount of the variable cost per unit. Inventory is valued at marginal/variable cost under marginal costing.

Final account ppt

This PPT is for Students of 11th, 12th and BBA. This ppt includes basic information for Final Account.

Accounting standard depreciation

This document summarizes Accounting Standard 6 on depreciation accounting in India. It defines depreciation and outlines the key aspects of depreciation accounting such as depreciable assets, useful life, methods of calculating depreciation, and changes in depreciation rates. The standard provides guidance on determining depreciable amounts, selecting depreciation methods, calculating depreciation on additions/extensions, and disclosure requirements for depreciation in financial statements.

fixed assets (FINAL).doc

This document provides information about accounting for fixed assets and depreciation. It defines depreciation as a measure of the wearing out of an asset's value from use over time. Depreciable assets must be used for more than one period and have a limited useful life. Depreciation is calculated based on the historical cost, useful life, and estimated residual value of an asset. Common depreciation methods include straight-line and declining balance. The document also compares depreciation standards between AS-6, GAAP, and IAS-16.

More Related Content

What's hot

As – 6 Depreciation Accounting

THIS IS ALL ABOUT ACCOUNTING STANDARD - 6 I.E., DEPRECIATION ACCOUNTING.

THE RULES AND REGULATIONS TO BE FOLLOWED WHILE CALCULATING DEPRECIATION OF A DEPRECIABLE FIXED ASSET.

Indian Accounting Standards Introduction and Relevance

This document provides an overview of accounting standards in India. It discusses the need for and objectives of accounting standards, which are to bring uniformity in accounting methods, improve reliability of financial statements, and simplify accounting information. It summarizes some key Indian Accounting Standards (Ind AS), including Ind AS 1 on disclosure of accounting policies, Ind AS 2 on valuation of inventories, and Ind AS 101 on first-time adoption of accounting standards. Ind AS 2 specifies that inventories should be measured at the lower of cost and net realizable value. The document also outlines the phases for adoption of Ind AS for companies in India based on their net worth.

Accounting concept and convention

This document discusses key accounting concepts and conventions. It defines 8 accounting concepts: business entity, money measurement, accounting period, accounting cost, going concern, dual aspect, realization, and matching. It also discusses 4 accounting conventions: consistency, materiality, conservatism, and full disclosure. The concepts and conventions establish standard principles and practices for preparing accurate financial statements and reports.

Ifrs presentation

International Financial Reporting Standards (IFRS) are designed as a common global language for business affairs so that company accounts are understandable and comparable across international boundaries.

IFRS were issued by the Board of the International Accounting Standards Committee (IASC), known as International Accounting Standard Board(IASB).

Reconciliation of cost and financial accounts

This document discusses the reconciliation of cost and financial accounts. It defines reconciliation as tallying or equating the results shown in cost accounts and financial accounts. There can be disagreements between the profits in the two accounts due to items only being included in one set of accounts or differences in stock valuation or depreciation methods. Reconciling the accounts ensures accuracy and reliability. The two main methods of reconciliation are preparing a reconciliation statement, which adds or subtracts reconciling items to the base profit of one account to match the other account's profit, and preparing a memorandum reconciliation account in ledger format.

Capital Budgeting Decisions

1) Capital budgeting is the process of planning for capital expenditures that are expected to generate returns over multiple years. It involves evaluating potential long-term investment projects and determining which ones to undertake.

2) The document discusses various capital budgeting techniques for evaluating projects, including payback period, accounting rate of return, net present value, and internal rate of return. It also outlines the typical capital budgeting process of identifying, screening, evaluating, approving, implementing, and reviewing projects.

3) Key factors in capital budgeting include properly accounting for the time value of money, risk analysis, and ensuring projects will maximize long-term profitability for the company. Both traditional and modern discounted cash flow methods have advantages and

Ias 36 impairment of assets

This document summarizes IAS 36 on impairment of assets. The key points are:

1) IAS 36 aims to ensure assets are carried at no more than their recoverable amount, which is defined as the higher of an asset's fair value less costs of disposal and its value in use.

2) An impairment loss occurs when an asset's carrying amount exceeds its recoverable amount and must be recognized.

3) Recoverable amount is determined based on external factors like market changes or internal factors like physical damage.

4) A cash-generating unit is the smallest group of assets that generates cash inflows independently of other assets.

Absorption Costing and Marginal Costing ppt

Marginal costing and absorption costing are two different costing methods. Absorption costing treats all manufacturing costs, including both fixed and variable costs, as product costs. Marginal costing only treats variable manufacturing costs as product costs and treats fixed costs as period costs. Absorption costing results in higher inventory valuations as it includes fixed overhead costs in product costs. Marginal costing is useful for decision making as it focuses only on variable costs relevant to production changes. While marginal costing is simpler, absorption costing follows accounting standards by fully allocating costs.

Marginal costing and break even analysis

Under this technique all costs are classified into fixed costs and variable costs. Only variable costs are considered product costs and are allocated to products manufactured. These costs include direct materials, direct labor, direct expenses and variable overhead. Fixed costs are not considered for computing the cost of products or valuation of inventory.

Valuation of goodwill

Valuation of Goodwill, types of goodwill, factors affecting goodwill, features of goodwill, methods of calculating goodwill

Depreciation made easy !

This document defines depreciation as the reduction in the value of an asset due to wear and tear, usage, or obsolescence over time. It discusses the allocation of an asset's cost over its useful life, with depreciation being a non-cash expense. Various methods of calculating depreciation are presented, along with factors that determine the depreciation amount such as the asset's cost, useful life, and salvage value. The document also notes disclosure requirements for depreciation in financial statements and regulations around changing depreciation methods.

Methods and techniques of Costing

A power point presentation describing some basic definitions, father of cost accounting, Indian aspect of cost accounting and Various Methods and Techniques of costing.

Presented by: Aquib Ali, Ajay Gupta and Ashwin Showi. (M.Com students)

at the Bhopal School of Social Sciences(BSSS) on 6 September, 2017

Inventories – ias 2

- IAS 2 Inventories prescribes the accounting treatment for inventories and provides guidance on determining inventory costs and recognizing them as expenses. It applies to all inventories except work-in-progress for construction contracts and biological assets related to agricultural activity.

- Inventories must be measured at the lower of cost and net realizable value. Cost includes costs of purchase, costs of conversion, and other costs to bring inventories to their present location and condition. Net realizable value is the estimated selling price less costs to complete and sell.

- When inventories are sold, their carrying amount must be recognized as an expense. Write-downs to net realizable value and inventory losses must also be recognized as expenses.

Reconciliation of cost and financial accounts

This document discusses the reconciliation of cost accounts and financial accounts. When these two sets of accounts are maintained separately, the profits or losses reported may differ. A reconciliation statement is prepared to identify reasons for any differences. Common reasons for differences include items recorded in one set of accounts but not the other, different valuation methods for inventory, and over- or under-absorption of overhead costs. The reconciliation statement calculates the adjustments needed to make the profit/loss figures reported by the two sets of accounts agree.

Ppt on accounting standards

The document provides an overview of accounting standards in India and other countries. It discusses 32 accounting standards issued by the Institute of Chartered Accountants of India that are based on the 41 International Financial Reporting Standards. The standards cover various topics such as disclosure of accounting policies, treatment of inventories, cash flow statements, revenue recognition, accounting for fixed assets, foreign exchange rates, and financial instruments. The objectives, evolution, and key aspects of many individual accounting standards are summarized.

Depreciation

This document discusses depreciation, including its concept, objectives, causes, and methods. It defines depreciation as the permanent fall in value of fixed assets due to wear and tear from use in business. The objectives of depreciation include calculating proper profits, maintaining the original investment, and providing for asset replacement. Causes include wear and tear, obsolescence, and the passage of time. Common depreciation methods discussed are the straight-line method, declining balance method, and sum of years digits method.

Accounting Concepts & Conventions

1) The document discusses key accounting concepts and conventions. It defines 11 accounting concepts including business entity, money measurement, going concern, and historical cost.

2) It also explains 3 common accounting conventions: full disclosure, consistency, and conservatism. Conventions represent generally accepted practices adopted through agreement, while concepts provide a theoretical foundation.

3) The main difference between concepts and conventions is that concepts cannot involve personal bias and are not uniformly adopted, while conventions are uniformly adopted based on customs or legal guidelines.

Method of costing

The document discusses various methods and concepts in cost accounting, including:

1. Different types of costing methods like unit costing, job costing, contract costing, batch costing, operating costing, process costing, and multiple/uniform costing.

2. The need to reconcile cost and financial accounts when they are maintained separately, to check for differences in reported profit/loss.

3. Key aspects of cost sheets like classifying cost components, ascertaining product costs, fixing selling prices, and aiding cost control and management decisions.

Marginal and absorption costing

Marginal costing is an alternative to absorption costing. Under marginal costing, only variable costs are charged as cost of sales and contribution is calculated. Fixed costs are treated as period costs. Contribution is the difference between sales revenue and variable costs, and it goes towards recovering fixed costs and generating profit. The key principles of marginal costing are that fixed costs do not change with volume, so increasing or decreasing sales only impacts profits by the amount of the variable cost per unit. Inventory is valued at marginal/variable cost under marginal costing.

Final account ppt

This PPT is for Students of 11th, 12th and BBA. This ppt includes basic information for Final Account.

What's hot (20)

Indian Accounting Standards Introduction and Relevance

Indian Accounting Standards Introduction and Relevance

Similar to Accounting standard 6 Presentation

Accounting standard depreciation

This document summarizes Accounting Standard 6 on depreciation accounting in India. It defines depreciation and outlines the key aspects of depreciation accounting such as depreciable assets, useful life, methods of calculating depreciation, and changes in depreciation rates. The standard provides guidance on determining depreciable amounts, selecting depreciation methods, calculating depreciation on additions/extensions, and disclosure requirements for depreciation in financial statements.

fixed assets (FINAL).doc

This document provides information about accounting for fixed assets and depreciation. It defines depreciation as a measure of the wearing out of an asset's value from use over time. Depreciable assets must be used for more than one period and have a limited useful life. Depreciation is calculated based on the historical cost, useful life, and estimated residual value of an asset. Common depreciation methods include straight-line and declining balance. The document also compares depreciation standards between AS-6, GAAP, and IAS-16.

Depreciation

This document discusses depreciation of fixed assets. It defines depreciation as a permanent decline in the value of fixed assets over time due to factors like wear and tear, age, and obsolescence. It explains that depreciation is calculated to allocate the cost of a fixed asset over its useful life. The key methods of depreciation discussed are the straight-line method, where depreciation is equal each period, and the reducing balance method, where depreciation decreases each period as the asset's value declines.

FM-Unit 2_Long Term Investment Decision.pptx

This document outlines a unit on long-term investment decisions for a financial management course. It covers key concepts in capital budgeting including nature and meaning, principles and techniques, estimation of relevant cash flows, and evaluation techniques such as accounting rate of return, net present value, internal rate of return, payback period and profitability index method. Examples are provided to demonstrate calculation of accounting rate of return and payback period. The document emphasizes that capital budgeting involves evaluating major projects requiring large investments and having long-term effects on company profitability.

Depreciation accounting

This document discusses depreciation accounting under Indian Accounting Standard AS-6, US GAAP, and IFRS. It defines depreciation and outlines the key differences between the three standards. AS-6 allows revaluation of assets while GAAP prohibits it. A change in depreciation method is treated as a change in accounting policy under AS-6 and GAAP, but as a change in estimates under IFRS. IFRS also allows use of a revaluation model where assets can be revalued to fair market value.

Capital budgeting

This document discusses capital budgeting and various techniques used to evaluate capital expenditure projects. It defines capital budgeting as evaluating long-term investments to maximize shareholder wealth. Various criteria used to evaluate projects are discussed, including traditional non-discounted methods like average rate of return and payback period, as well as discounted cash flow methods like net present value, internal rate of return, and profitability index. The advantages and disadvantages of each method are also summarized.

Chapter 06

The document discusses various aspects of depreciation. It defines depreciation as the permanent and continuing diminution in the quality, quantity or value of a fixed asset over time due to factors like usage, obsolescence and changes in technology. It then explains the need to charge depreciation to accurately calculate profits, show asset values reasonably and maintain the original investment in the asset. The document also discusses the factors affecting the computation of depreciation and various methods of calculating depreciation like the straight line method, written down value method, and sum of years' digit method.

Auditing depreciation for b.com

This document provides an overview of depreciation accounting. It defines depreciation as the permanent decrease in the value of an asset due to factors like wear and tear, obsolescence, or the passage of time. The document outlines various causes of depreciation including wear and tear, exhaustion, effluxion of time, weather effects, and permanent declines in asset value. It also discusses objectives of recording depreciation such as correctly calculating profits, complying with legal requirements, and maintaining the integrity of capital. Finally, the document introduces different depreciation methods used in accounting like the straight-line method, declining balance method, and annuity method.

5_6073641780169933819.ppt

This document discusses depreciation accounting concepts, objectives, causes, and methods. It defines depreciation as the allocation of an asset's cost over its useful life. Objectives of depreciation include matching revenues and expenses to determine profit, and recovering an asset's cost over the periods it benefits the company. Causes of depreciation include wear and tear, aging, and obsolescence. Common depreciation methods include straight-line, written down value, and sum of years digits. The document also covers depreciation calculations, accounting entries, and policies for different asset types.

As 3

Cash flow statements show the inflows and outflows of cash over a period of time. They classify cash flows into three categories: operating, investing, and financing activities. Cash flow statements are prepared using either the direct or indirect method. They are useful for short-term financial planning, preparing cash budgets, comparing actual cash flows to budgets, and assessing a company's ability to generate cash.

Depreciation accounting

Depreciation is the allocation of the cost of tangible and intangible assets over their useful lives. There are different methods for calculating depreciation under accounting standards in India (AS-6), US GAAP, and IFRS. Key differences include how revaluations are treated and whether changes in estimates are considered changes in accounting policies. Uniformity in depreciation accounting standards worldwide could improve comparability between companies.

Accounting standards

The document summarizes Accounting Standard 6 regarding depreciation accounting in India. It defines depreciation as the wearing out or loss of value of an asset due to use over time. Depreciable assets must be used for more than one accounting period and have a limited useful life. The standard outlines acceptable depreciation methods like straight-line and written down value. It specifies when a change in depreciation method is appropriate and how to account for it. The document also discusses factors to consider in determining an asset's useful life and residual value for depreciation purposes.

As 1 Disclosure of Accounting Policy

1) The document discusses the key aspects of Accounting Standard 1 (AS-1) regarding disclosure of accounting policies, including the meaning of accounting policies, disclosure requirements of fundamental accounting assumptions, factors to consider when selecting accounting policies, and disclosing changes in accounting policies.

2) Fundamental accounting assumptions include going concern, consistency, and accrual. Significant accounting policies adopted must be disclosed as part of the financial statements in a single place.

3) Key considerations for selecting accounting policies are providing a true and fair view, prudence, substance over form, and materiality. Any changes in accounting policies that materially affect the financial statements must be disclosed along with the financial impact.

Depreciation 2

1. The document discusses various methods of accounting for depreciation of fixed assets, including straight-line, units-of-production, and declining balance methods.

2. It explains that depreciation involves allocating the cost of tangible assets over the periods they are expected to provide benefits.

3. Key factors that determine depreciation expenses each year include initial asset cost, estimated residual value, useful life, and the depreciation method used.

Accounting standard 1st lecture (1)

This document provides an overview of accounting standards in India. It discusses that accounting standards are issued by the Institute of Chartered Accountants of India and are written policies that standardize accounting policies and ensure reliability, comparability and disclosure in financial statements. Specifically, it outlines standards for disclosure of accounting policies, valuation of inventories, cash flow statements, treatment of contingencies and events, and depreciation accounting. The objectives and key aspects of each standard are summarized.

Accounts depriciation ppt

depriciation . defination , methods , numericals, need, etc .

for bcom students

accounting and finance basic chapter of depriciation

Chap 8

Complete presentation of chapter 8 "Analysis of Long-Lived Assets: Analysis of Depreciation & Impairment" from "Analysis and Use of Financial Statement by White & Sondhi Edition 3

International Accounting Standards CIE Guidance for teachers 9706 A an AS Le...

International Accounting Standards CIE Guidance for teachers 9706 A an AS Level Accounting

ZIMSEC

Alpro Cambridge

Methods of charging Depreciation

Methods of charging Depreciation

There are many methods of applying depreciation, some of the main methods are as follows:

(1) Fixed Instalment Method / Straight Line Method

(2) Written Down Value / Diminishing Balance Method

(3) Annuity Method

(4) Depreciation Fund Method

(5) Insurance Policy Method

(6) Revaluation Method

(7) Depletion Unit or Production Unit Method

(8) Machine Hour Method

(9) The sum of the years Digits Method

(10) The use or Mileage Method

(11) Group Depreciation Method

Here we will study only fixed installment method and amortizing method, which are most popular.

Straight Line Method or Fixed Instalment Method

There are many names of this method, such as—

(i) Straight Line Method,

(ii) Original Cost Method,

(iii) Equal Instalment Method,

(iv) Fixed Instalment Method. Fixed Instalment Method. Under this method, depreciation is calculated at a fixed percentage on the original cost of the asset every year. Obviously, there will be the same amount of depreciation each year. That is why it is called a fixed instalment or ‘prime cost’ method. If the depreciation is marked on the graph paper and all the points are joined then a straight line will be formed. That’s why it is called ‘straight line method’ or straight line method.

Similar to Accounting standard 6 Presentation (20)

International Accounting Standards CIE Guidance for teachers 9706 A an AS Le...

International Accounting Standards CIE Guidance for teachers 9706 A an AS Le...

Recently uploaded

Profiles of Iconic Fashion Personalities.pdf

The fashion industry is dynamic and ever-changing, continuously sculpted by trailblazing visionaries who challenge norms and redefine beauty. This document delves into the profiles of some of the most iconic fashion personalities whose impact has left a lasting impression on the industry. From timeless designers to modern-day influencers, each individual has uniquely woven their thread into the rich fabric of fashion history, contributing to its ongoing evolution.

Dpboss Matka Guessing Satta Matta Matka Kalyan panel Chart Indian Matka Dpbos...

Dpboss Matka Guessing Satta Matta Matka Kalyan panel Chart Indian Matka Dpbos...➒➌➎➏➑➐➋➑➐➐Dpboss Matka Guessing Satta Matka Kalyan Chart Indian Matka

Sattamatka.satta.matka.satta matka.kalyan weekly chart.kalyan chart.kalyan jodi chart.kalyan penal chart.kalyan today.kalyan open.fix satta.fix fix fix Satta matka nambarIndustrial Tech SW: Category Renewal and Creation

Every industrial revolution has created a new set of categories and a new set of players.

Multiple new technologies have emerged, but Samsara and C3.ai are only two companies which have gone public so far.

Manufacturing startups constitute the largest pipeline share of unicorns and IPO candidates in the SF Bay Area, and software startups dominate in Germany.

Sustainable Logistics for Cost Reduction_ IPLTech Electric's Eco-Friendly Tra...

Sustainable Logistics for Cost Reduction_ IPLTech Electric's Eco-Friendly Transport Solution

Income Tax exemption for Start up : Section 80 IAC

A presentation on the concept of Exemption of Profits of Start ups from Income Tax

Best Forex Brokers Comparison in INDIA 2024

Navigating the world of forex trading can be challenging, especially for beginners. To help you make an informed decision, we have comprehensively compared the best forex brokers in India for 2024. This article, reviewed by Top Forex Brokers Review, will cover featured award winners, the best forex brokers, featured offers, the best copy trading platforms, the best forex brokers for beginners, the best MetaTrader brokers, and recently updated reviews. We will focus on FP Markets, Black Bull, EightCap, IC Markets, and Octa.

Garments ERP Software in Bangladesh _ Pridesys IT Ltd.pdf

Pridesys Garments ERP is one of the leading ERP solution provider, especially for Garments industries which is integrated with

different modules that cover all the aspects of your Garments Business. This solution supports multi-currency and multi-location

based operations. It aims at keeping track of all the activities including receiving an order from buyer, costing of order, resource

planning, procurement of raw materials, production management, inventory management, import-export process, order

reconciliation process etc. It’s also integrated with other modules of Pridesys ERP including finance, accounts, HR, supply-chain etc.

With this automated solution you can easily track your business activities and entire operations of your garments manufacturing

proces

2022 Vintage Roman Numerals Men Rings

Discover timeless style with the 2022 Vintage Roman Numerals Men's Ring. Crafted from premium stainless steel, this 6mm wide ring embodies elegance and durability. Perfect as a gift, it seamlessly blends classic Roman numeral detailing with modern sophistication, making it an ideal accessory for any occasion.

https://rb.gy/usj1a2

Satta Matka Dpboss Matka Guessing Kalyan Chart Indian Matka Kalyan panel Chart

Satta Matka Dpboss Matka Guessing Kalyan Chart Indian Matka Kalyan panel Chart➒➌➎➏➑➐➋➑➐➐Dpboss Matka Guessing Satta Matka Kalyan Chart Indian Matka

SATTA MATKA SATTA FAST RESULT KALYAN TOP MATKA RESULT KALYAN SATTA MATKA FAST RESULT MILAN RATAN RAJDHANI MAIN BAZAR MATKA FAST TIPS RESULT MATKA CHART JODI CHART PANEL CHART FREE FIX GAME SATTAMATKA ! MATKA MOBI SATTA 143 spboss.in TOP NO1 RESULT FULL RATE MATKA ONLINE GAME PLAY BY APP SPBOSS一比一原版(QMUE毕业证书)英国爱丁堡玛格丽特女王大学毕业证文凭如何办理

永久可查学历认证【微信:A575476】【(QMUE毕业证书)英国爱丁堡玛格丽特女王大学毕业证成绩单Offer】【微信:A575476】(留信学历认证永久存档查询)采用学校原版纸张、特殊工艺完全按照原版一比一制作(包括:隐形水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠,文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪)行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备,十五年致力于帮助留学生解决难题,业务范围有加拿大、英国、澳洲、韩国、美国、新加坡,新西兰等学历材料,包您满意。

【业务选择办理准则】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理一份就读学校的毕业证【微信:A575476】文凭即可

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理一份毕业证【微信:A575476】即可

三、进国企,银行,事业单位,考公务员等等,这些单位是必需要提供真实教育部认证的,办理教育部认证所需资料众多且烦琐,所有材料您都必须提供原件,我们凭借丰富的经验,快捷的绿色通道帮您快速整合材料,让您少走弯路。

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

→ 【关于价格问题(保证一手价格)

我们所定的价格是非常合理的,而且我们现在做得单子大多数都是代理和回头客户介绍的所以一般现在有新的单子 我给客户的都是第一手的代理价格,因为我想坦诚对待大家 不想跟大家在价格方面浪费时间

对于老客户或者被老客户介绍过来的朋友,我们都会适当给一些优惠。

选择实体注册公司办理,更放心,更安全!我们的承诺:可来公司面谈,可签订合同,会陪同客户一起到教育部认证窗口递交认证材料,客户在教育部官方认证查询网站查询到认证通过结果后付款,不成功不收费!

Innovation Management Frameworks: Your Guide to Creativity & Innovation

Innovation Management Frameworks: Your Guide to Creativity & InnovationOperational Excellence Consulting

[To download this presentation, visit:

https://www.oeconsulting.com.sg/training-presentations]

This PowerPoint compilation offers a comprehensive overview of 20 leading innovation management frameworks and methodologies, selected for their broad applicability across various industries and organizational contexts. These frameworks are valuable resources for a wide range of users, including business professionals, educators, and consultants.

Each framework is presented with visually engaging diagrams and templates, ensuring the content is both informative and appealing. While this compilation is thorough, please note that the slides are intended as supplementary resources and may not be sufficient for standalone instructional purposes.

This compilation is ideal for anyone looking to enhance their understanding of innovation management and drive meaningful change within their organization. Whether you aim to improve product development processes, enhance customer experiences, or drive digital transformation, these frameworks offer valuable insights and tools to help you achieve your goals.

INCLUDED FRAMEWORKS/MODELS:

1. Stanford’s Design Thinking

2. IDEO’s Human-Centered Design

3. Strategyzer’s Business Model Innovation

4. Lean Startup Methodology

5. Agile Innovation Framework

6. Doblin’s Ten Types of Innovation

7. McKinsey’s Three Horizons of Growth

8. Customer Journey Map

9. Christensen’s Disruptive Innovation Theory

10. Blue Ocean Strategy

11. Strategyn’s Jobs-To-Be-Done (JTBD) Framework with Job Map

12. Design Sprint Framework

13. The Double Diamond

14. Lean Six Sigma DMAIC

15. TRIZ Problem-Solving Framework

16. Edward de Bono’s Six Thinking Hats

17. Stage-Gate Model

18. Toyota’s Six Steps of Kaizen

19. Microsoft’s Digital Transformation Framework

20. Design for Six Sigma (DFSS)

To download this presentation, visit:

https://www.oeconsulting.com.sg/training-presentationsThe Most Inspiring Entrepreneurs to Follow in 2024.pdf

In a world where the potential of youth innovation remains vastly untouched, there emerges a guiding light in the form of Norm Goldstein, the Founder and CEO of EduNetwork Partners. His dedication to this cause has earned him recognition as a Congressional Leadership Award recipient.

The Steadfast and Reliable Bull: Taurus Zodiac Sign

Explore the steadfast and reliable nature of the Taurus Zodiac Sign. Discover the personality traits, key dates, and horoscope insights that define the determined and practical Taurus, and learn how their grounded nature makes them the anchor of the zodiac.

How to Buy an Engagement Ring.pcffbhfbfghfhptx

Dive into this presentation and learn about the ways in which you can buy an engagement ring. This guide will help you choose the perfect engagement rings for women.

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Indian Matka

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Indian Matka➒➌➎➏➑➐➋➑➐➐Dpboss Matka Guessing Satta Matka Kalyan Chart Indian Matka

9356872877Sattamatka.satta.matka.satta matka.kalyan weekly chart.kalyan chart.kalyan jodi chart.kalyan penal chart.kalyan today.kalyan open.fix satta.fix fix fix Satta matka nambar.Business storytelling: key ingredients to a story

Storytelling is an incredibly valuable tool to share data and information. To get the most impact from stories there are a number of key ingredients. These are based on science and human nature. Using these elements in a story you can deliver information impactfully, ensure action and drive change.

The APCO Geopolitical Radar - Q3 2024 The Global Operating Environment for Bu...

The Radar reflects input from APCO’s teams located around the world. It distils a host of interconnected events and trends into insights to inform operational and strategic decisions. Issues covered in this edition include:

Recently uploaded (20)

Dpboss Matka Guessing Satta Matta Matka Kalyan panel Chart Indian Matka Dpbos...

Dpboss Matka Guessing Satta Matta Matka Kalyan panel Chart Indian Matka Dpbos...

Sustainable Logistics for Cost Reduction_ IPLTech Electric's Eco-Friendly Tra...

Sustainable Logistics for Cost Reduction_ IPLTech Electric's Eco-Friendly Tra...

Income Tax exemption for Start up : Section 80 IAC

Income Tax exemption for Start up : Section 80 IAC

Garments ERP Software in Bangladesh _ Pridesys IT Ltd.pdf

Garments ERP Software in Bangladesh _ Pridesys IT Ltd.pdf

Satta Matka Dpboss Matka Guessing Kalyan Chart Indian Matka Kalyan panel Chart

Satta Matka Dpboss Matka Guessing Kalyan Chart Indian Matka Kalyan panel Chart

Innovation Management Frameworks: Your Guide to Creativity & Innovation

Innovation Management Frameworks: Your Guide to Creativity & Innovation

The Most Inspiring Entrepreneurs to Follow in 2024.pdf

The Most Inspiring Entrepreneurs to Follow in 2024.pdf

The Steadfast and Reliable Bull: Taurus Zodiac Sign

The Steadfast and Reliable Bull: Taurus Zodiac Sign

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Indian Matka

Dpboss Matka Guessing Satta Matta Matka Kalyan Chart Indian Matka

The APCO Geopolitical Radar - Q3 2024 The Global Operating Environment for Bu...

The APCO Geopolitical Radar - Q3 2024 The Global Operating Environment for Bu...

Accounting standard 6 Presentation

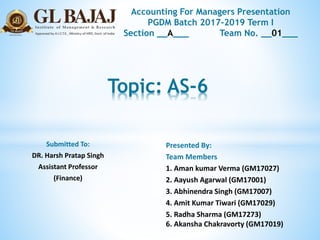

- 1. Topic: AS-6 Submitted To: DR. Harsh Pratap Singh Assistant Professor (Finance) Presented By: Team Members 1. Aman kumar Verma (GM17027) 2. Aayush Agarwal (GM17001) 3. Abhinendra Singh (GM17007) 4. Amit Kumar Tiwari (GM17029) 5. Radha Sharma (GM17273) 6. Akansha Chakravorty (GM17019) Accounting For Managers Presentation PGDM Batch 2017-2019 Term I Section __A___ Team No. __01___

- 2. *Meaning & Definition *Features & Causes of Depreciation *Depreciable Assets *Applicability of AS-6 *Calculation of Depreciation *Methods of Depreciation *Change in method of Depreciation *AS-6 Disclosure *Important points of AS-6

- 3. *Depreciation means decline in the value of fixed assets on a/c of use & effluxion of time. *Depreciation is a gradual, continuous & permanent decrease in the value of an asset. * It was issued in 1982 by ICAI & later on revised in 1994.

- 4. *AS-6,Depreciation Accounting defines depreciation as a measure of the wearing out consumption or other loss of value of a depreciable asset arising from use, effluxion of time or obsolescence through technology or market changes.

- 5. *Features of Depreciation Depreciation is a part of operating cost. It is a reduction in the value of an asset. The decrease in the value of an asset is gradual & continious. Causes of Depreciation Physical wear & tear Physical Deterioration Expiry of legal rights Obsolescence

- 6. Depreciable Assets are those assets which: 1. are expected to be used for more than 1 accounting period. 2. Have a limited useful life. 3. Are held for the purpose of production of goods & services.

- 7. AS-6 is applicable to all depreciable assets, except the following: i. Forests, Plantation ii. Wasting Assets, Minerals iii. Expenditure on R & D iv. Goodwill v. Live-stock cattle, Animal Husbandry

- 8. The amount of Depreciation is calculated as under: 1) Historical cost of the asset. 2) Estimated useful life of depreciable asset. 3) Estimated residual/scrap value of depreciable assets.

- 9. Depreciable Amount = Historical Cost- ERV E.g: Cost of asset=500000, ERV=25000 Depreciable Amount = H.C –ERV =500000-25000 = 475000. Depreciable amount is allocated over the estimated useful life of depreciable asset.

- 10. 1. Straight Line Method 2. Reducing Balance Method 3. Sinking Fund Method 4. Insurance Policy Method 5. Sums of the digit Method 6. Revaluation Method 7. Depletion Method 8. Machine Hour Rate Method 9. Replacement Method

- 11. Changes in Depreciation Method Change in method of Depreciation is done in the following conditions: For compliance of status For compliance of AS’s For more appropriate presentation of the financial statement

- 12. *The Depreciation method used, the total depreciation for the period, gross amount of depreciation of each class has to be disclosed in the Financial Statements. * If the asset is revalued , the provision for depreciation is based on the revalued amount. *A change in method of depreciation is treated as change in an accounting policy. *Accumulated Depreciation for each class of asset

- 13. *Any addition or extension becomes an integral part of the existing asset. Hence it is depreciated over the remaining useful life of the asset. *Depreciation on Items Below Rs 5000/- *Schedule 2 of Company Act 2013, individual items of fixed assets below Rs. 5000. There is no such concept.

- 14. *When the depreciable asset is disposed off, discarded, demolished, destroyed; the net surplus or deficit is charged to P/L A/C. *The useful life of a depreciable asset should be estimated after considering factors like wear & tear, obsolescence etc. *The useful life of major depreciable assets may be periodically reviewed.

- 15. *Increase or Decrease in long term liability on account of exchange fluctuations, price adjustments etc, the depreciation should be provided prospectively. *But when there is a change in historical cost due to revaluation, depreciation should be charged on the basis of revalued amount & on the estimate of the remaining useful life of such assets.