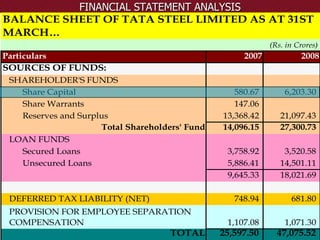

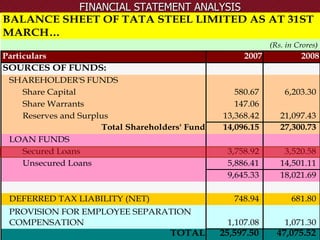

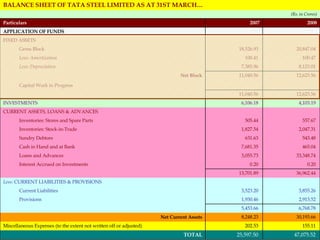

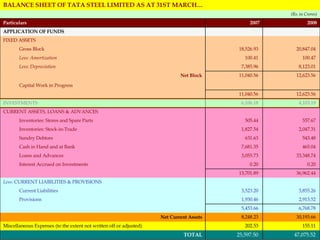

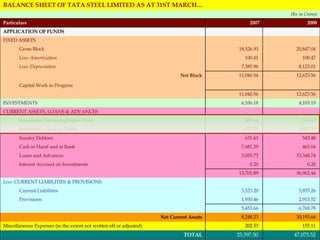

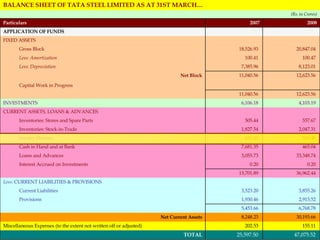

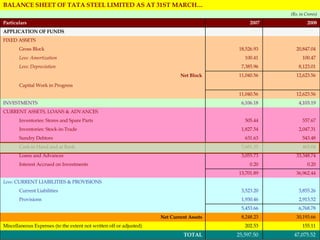

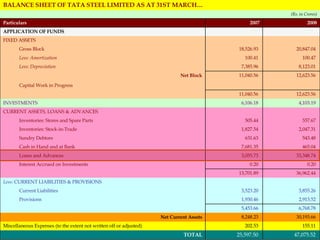

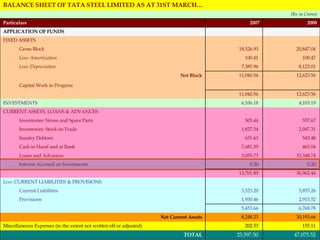

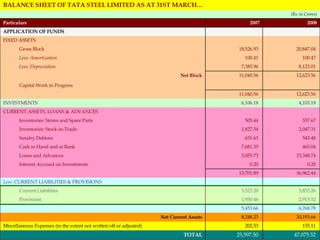

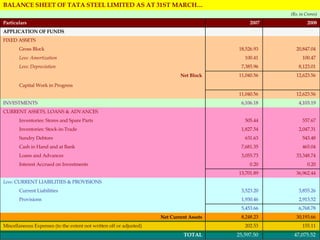

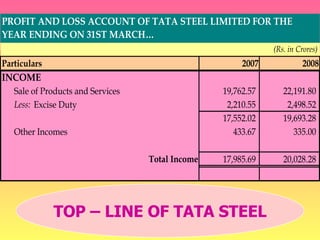

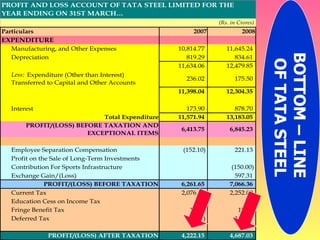

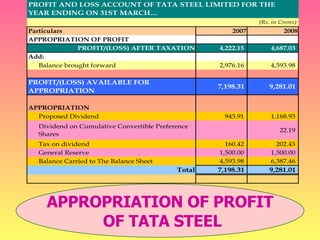

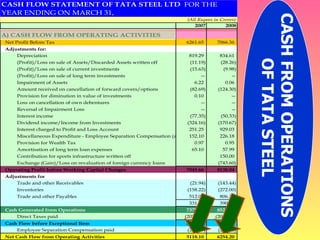

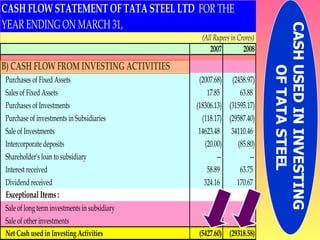

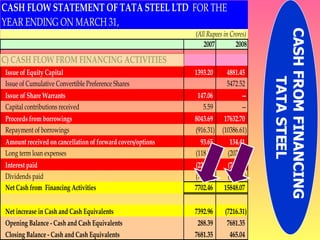

The document discusses analyzing the financial statements of Tata Steel, including the balance sheet, profit and loss account, and cash flow statement. It covers understanding sources and uses of funds in the balance sheet, top-line and bottom-line figures in the profit and loss account, and cash from/used in operations, investing, and financing in the cash flow statement. The overall goal is to understand Tata Steel's financial position and performance by analyzing these key financial statements.