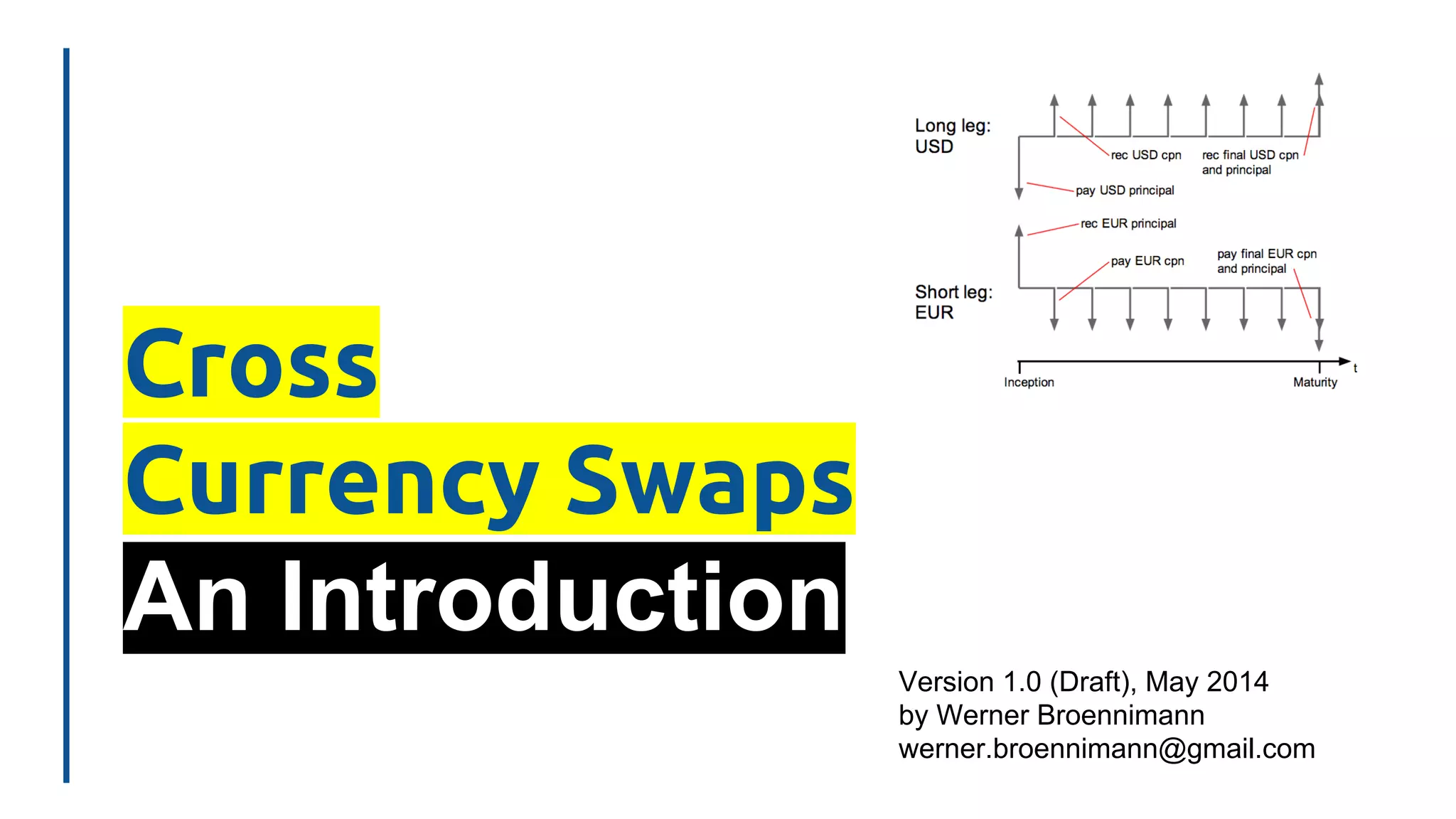

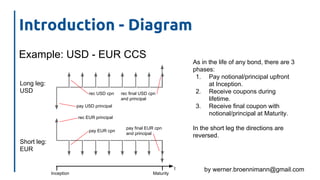

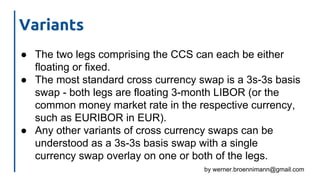

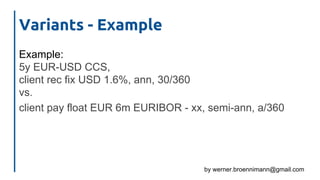

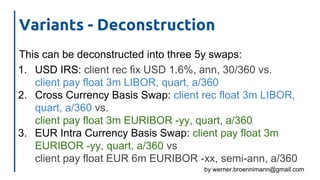

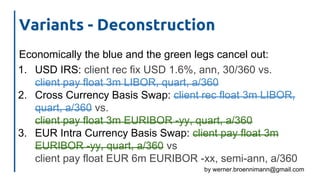

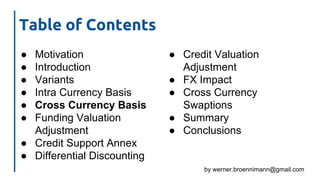

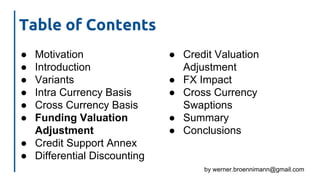

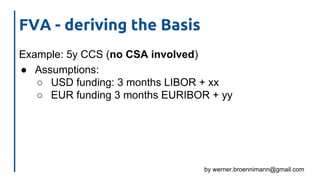

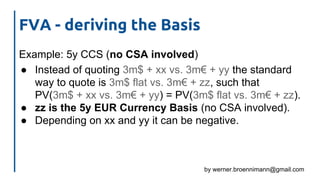

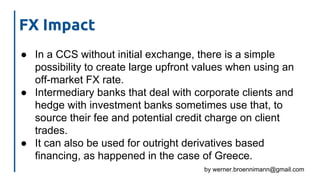

The document provides an introduction to cross currency swaps (CCS), detailing their function as important financial instruments in OTC markets and their application in hedging and speculative trades. It covers various aspects such as variants, intra and cross currency basis, funding valuation adjustments, and the impacts of credit support annexes and differential discounting on valuation. The pricing of CCS is influenced by the market maker's funding rate rather than standard benchmarks like LIBOR.