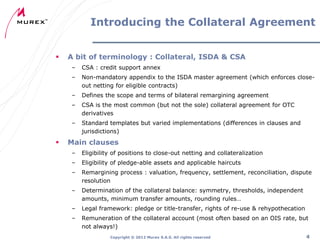

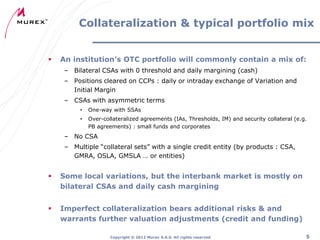

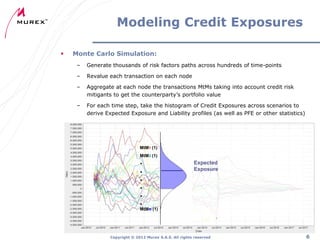

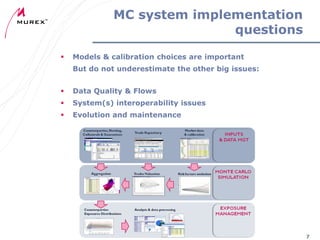

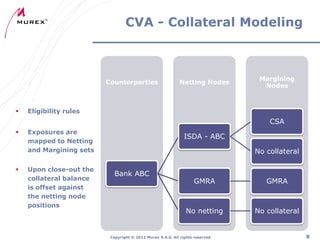

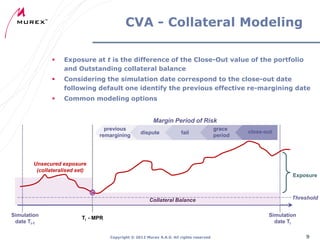

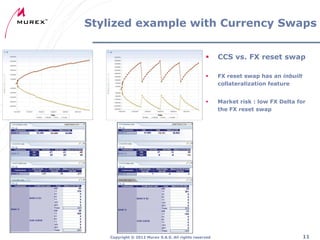

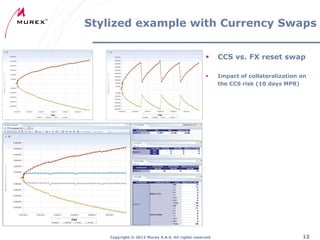

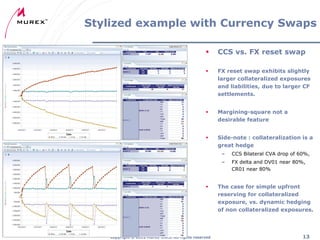

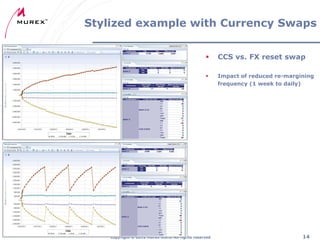

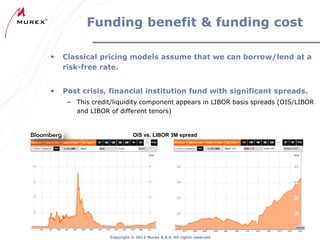

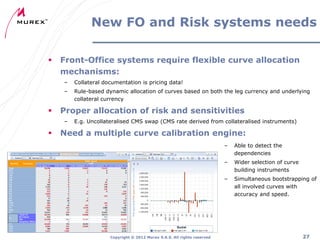

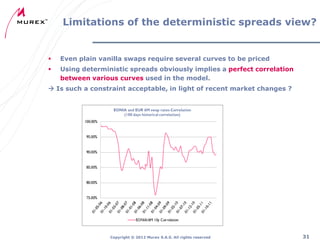

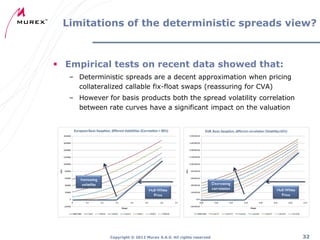

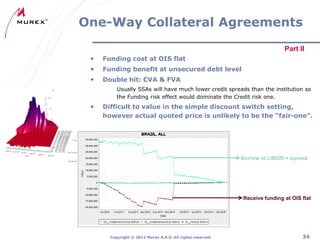

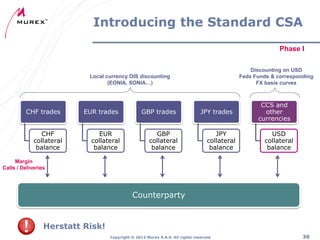

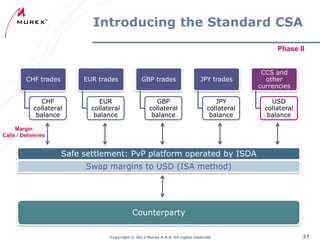

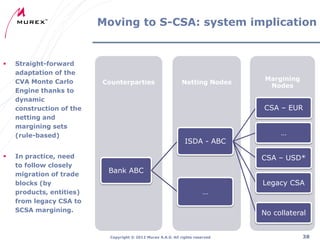

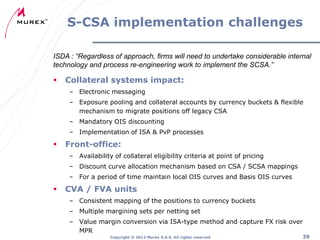

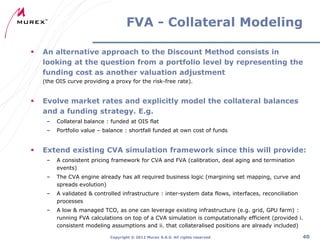

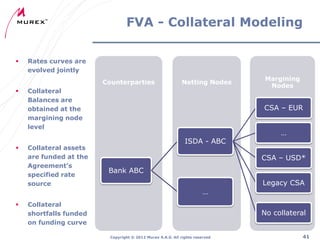

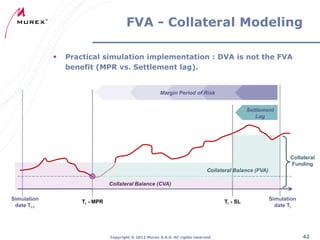

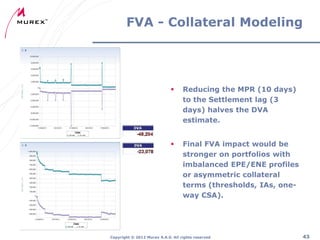

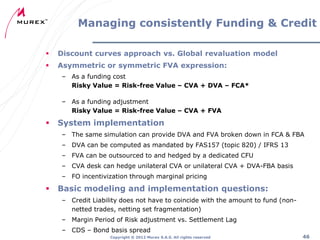

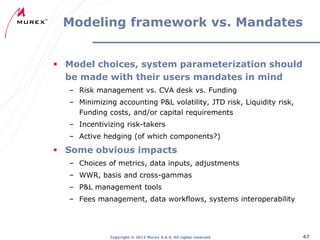

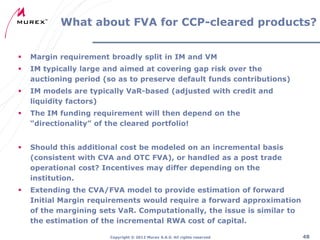

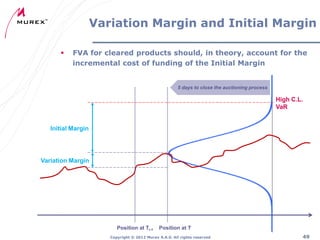

The document discusses the implementation issues surrounding OTC collateralization in Credit Valuation Adjustments (CVA) and Funding Valuation Adjustments (FVA), highlighting complexities such as varying CSA clauses, collateral modeling, risks related to lack of standardization, and the challenges of managing credit and funding risks. It elaborates on the implications of collateral agreements, netting, and market practices, emphasizing the importance of collateral management in mitigating risks associated with derivative transactions. Additionally, it suggests the introduction of a standard CSA to enhance consistency and efficiency in collateral management.