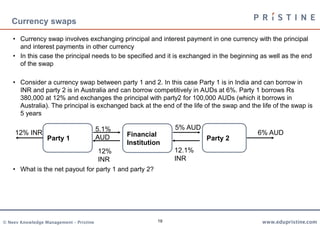

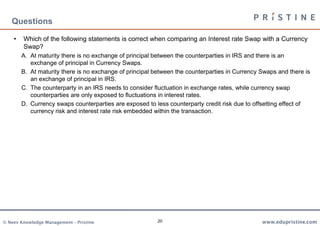

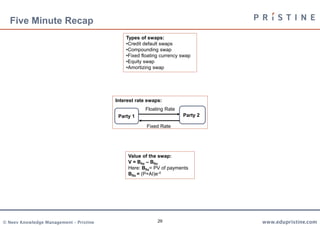

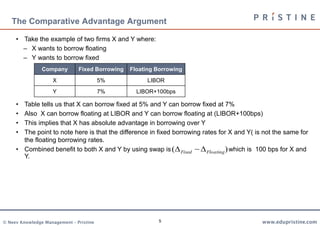

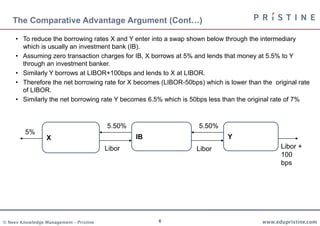

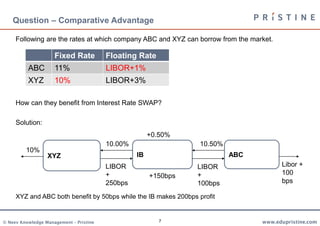

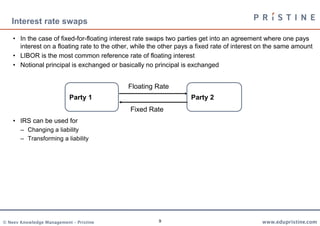

The document provides an extensive overview of swaps, particularly focusing on interest rate and currency swaps, and their valuation methods. It explains the concept of comparative advantage in borrowing costs, swap mechanisms, and the role of financial intermediaries in facilitating these transactions. Additionally, it touches on various types of swaps, credit risk associated with swaps, and techniques for valuing them using bonds and forward rate agreements.

![17

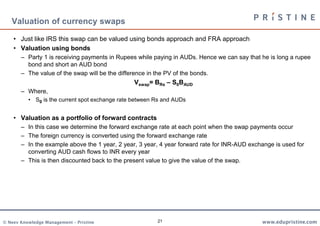

Answer

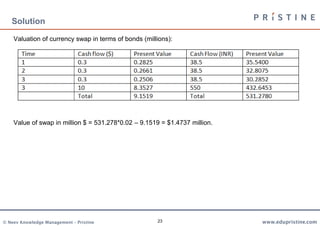

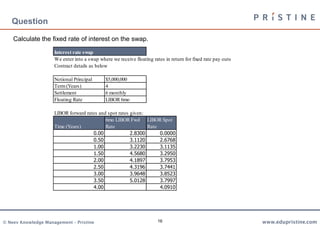

Calculation of fixedrate

based on LIBOR forward rates we receive the following 8 cash inflows.

We discount each using the [LIBOR] spot rates.

Time (Years)

6mo LIBOR Fwd

Rate Cash Flow In

LIBOR

Spot Rate

Discount

Factor PVof Cash In

0.00 2.8300 0 0.0000 0 0

0.50 3.1120 $141,500 2.6768 0.9868 $139,631

1.00 3.2230 $155,600 3.1135 0.9696 $150,866

1.50 4.5680 $161,150 3.2950 0.9522 $153,441

2.00 4.1897 $228,400 3.7953 0.9276 $211,855

2.50 4.3196 $209,485 3.7441 0.9114 $190,932

3.00 3.9648 $215,980 3.8523 0.8918 $192,619

3.50 5.0128 $198,240 3.7997 0.8766 $173,771

4.00 $250,640 4.0910 0.8505 $213,157

$1,426,272

In no arbitrage case the PV of fixed payment should be:

$1,426,272 .

Hence,

$1,426,272 = annual payment * Sum ( Discountfactors )

$1,426,272 = annual payment* 7.3664

$193,619 = annual payment

Thus, the fixed interest rate is $193,619 / $5,000,000

3.87%

Total PV of Floating Payments](https://image.slidesharecdn.com/swaps-130430045557-phpapp01/85/Swaps-explained-for-FRM-CFA-level-1-17-320.jpg)