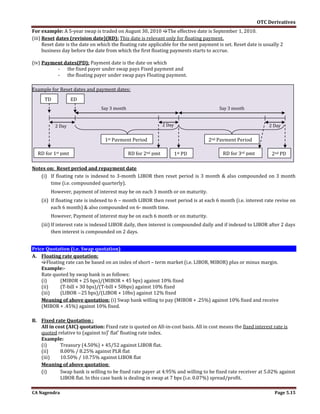

This document discusses interest rate swaps. It defines an interest rate swap as an agreement to exchange interest rate payments, with one leg fixed and the other floating. Common types include paying fixed rate interest to receive floating, and vice versa. Interest rate swaps are used to hedge against rising or falling interest rates by transforming fixed deposits/borrowings to floating, or floating to fixed. Examples show how swaps can benefit entities by reducing income/funding costs if rates move in the desired direction.

![OTC Derivatives

CA Nagendra Page 5.11

Hedging strategies with swaps

Nature Risk Hedging Action

Assets (i.e. deposit)

Fixed rate

(Refer example-1)

Rising interest rates Swap to transform nature of Deposit from

fixed rate to floating rate

Floating rate

(Refer example-2)

Falling interest rates Swap to transform nature of deposit from

floating rate to fixed rate

Liabilities (i.e. Borrowing)

Fixed rate

(Refer example-3)

Falling interest rates Swap to transform the Borrowing from fixed

rate to floating rate

Floating Rate

(Refer example-4)

Rising interest rates Swap to transform the Borrowing from

floating rate to fixed rate

Example 1:

[Transformation of Deposit interest form fixed income to floating income using swap]

Assume that Mr. Faltu has made an investment by subscribing to bonds carrying 9% fixed coupon.

Bonds have still some years to mature but the interest rate are showing a rising trend, which is expected to

continue. Mr. Faltu faces a potential loss of income. What can “Mr. Faltu” do?

Solution:

Changing the portfolio of bonds by selling fixed rate bonds and buying floating rate bonds is one solution.

Another solution is- enter the swap to pays fixed rate and receive floating.

The swap arrangement is shown below

The net receipts of floating due to swap = 9.00% - 8.5% + (MIBOR + .30%) = MIBOR + .80%

If MIBOR moves beyond 8.20 % in future, Faltu would be benefited from the situation.

In this case: Existing income = 9% and New income = 8.20% + 0.8% = 9%

Example 2:

[Transformation of Deposit interest form floating income to fixed income using swap]

Assume that Ms. Paltu has made an investment by subscribing to bonds carrying floating coupon “MIBOR+0.2%”.

Bonds have still some years to mature but the interest rate are showing a decreasing trend, which is expected to

continue. Mr. Paltu faces a potential loss of income. What can “Ms. Paltu” do?

MR. Faltu

Bank

(Seller of swap)

8.50%

MIBOR + .30%

9.00%

Bank is quoting following rate for swap:

MIBOR+.30% / MIBOR+.50% against 8.50% fixed.

Meaning of quotation:

Bank will pay MIBOR+.30% and receive MIBOR +0.50%.

In this swap bank pay floating rate, hence applicable rate is

MIBOR +0.30%

Note:

Payer of Fixed Buyer of swap

Payer of Floating Seller of swap

Swap

Agreement

If increases Also increases](https://image.slidesharecdn.com/interestrateswap-141120103243-conversion-gate01/85/Interest-rate-swap-2-320.jpg)

![OTC derivatives

CA Nagendra Page 5.12

Solution:

Changing the portfolio of bonds by selling floating rate bonds and buying fixed rate bonds is one solution.

Another solution is- enter the swap to pay floating and receive fixed rate.

The swap arrangement is shown below:

The net receipts of fixed due to swap = (MIBOR+0.2%) – (MIBOR+.5%) + 8.5%= 8.2%

If MIBOR falls beyond 8.00 % in future, Ms Paltu would be benefited from the situation.

In this case: Existing income = MIBOR+0.2% and New income = 8.2%

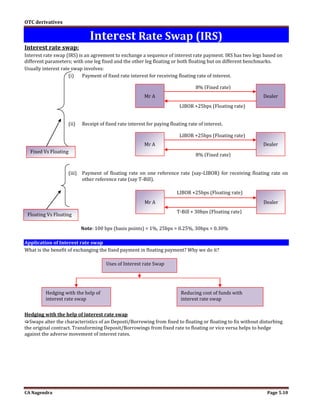

Example 3:

[Transformation of Borrowing from fixed commitment to floating commitment using swap]

Five years back, Fasteners Ltd had raised loans thorough 10-year debenture issue worth 100 crore with fixed

interest of 12%.

After the issue the interest rates remained constant for some time. But now they have been at around 10% and are

likely to come down further.

Fasteners Ltd wish to contain the cost of funding for the remaining 5 years.

A bank has offered a swap rate of “9.5% - 9.6% against MIBOR” (it is different type of quotation called “All-in-cost”: for detail about quotation

see subsequent page) for a period of 5 years.

Depict the swap arrangement and find out the new nature of liabilities the firm can have.

Solution:

Fasteners Ltd has liability on a fixed interest of 12%. By entering swap with the bank it may transform the liability

from fixed rate to floating rate based on MIBOR.

Ms. Paltu

Bank

(Buyer of swap)

8.50%

MIBOR + .50%

MIBOR+0.2%

Bank is quoting following rate for swap:

MIBOR+.30% / MIBOR+.50% against 8.50% fixed.

Meaning of quotation:

Bank will pay MIBOR+.30% and receive MIBOR +0.50%.

In this swap bank receives floating rate, hence applicable

rate is MIBOR +0.50%

Swap

Agreement

8%+0.2% = 8.2%

If decreases

Also decreases

existing income

But New income should

be fixed i.e. 8.2%.

Benefit to Bank: (Concept)

Bank will earn profit of 0.2% from the swap deal as it will receive MIBOR+0.5% (from Ms. Paltu-see example-2)

and Pays MIBOR+0.3% (to Mr. Faltu-see example-1). Difference of 0.2% is profit to bank.

Bank is dealing like dealer, whose activity is to pay floating and receive floating.

What activity will do by bank will depend upon the customer’s requirement.](https://image.slidesharecdn.com/interestrateswap-141120103243-conversion-gate01/85/Interest-rate-swap-3-320.jpg)

![OTC Derivatives

CA Nagendra Page 5.13

Under the swap arrangement, fasteners Ltd can receive fixed and pay MIBOR. The buying rate of swap (9.5%)

would be applicable.

The swap arrangement is shown below

The cost of funds for Fasteners Ltd would be = 12% - 9.5% + MIBOR = MIBOR + 2.5%

In case interest rates fall below 9.5%, which is expected, the firm would end up paying lesser interest than what it is

paying now.

Existing Payment = 12% But New Payment = MIBOR +2.5% = less than 9.5% + 2.5% = less than 12%

Example 4:

[Transformation of Borrowing form floating commitment to fixed commitment using swap]

Let us consider company-A, which has borrowed from the market on floating rate basis at MIBOR + 25 bps. It pays

to its lenders at floating rate.

Further, the company considers that interest rates would rise in future. In view of rising interest rates it would like

to have liability that is fixed in nature rather than variable.

Therefore, it decides to enter into a swap with the bank paying fixed 8.50% (assumed) and receiving MIBOR + 30

bps. What is the result of this swap?

It simply transforms the liability to a fixed payment as shown below.

The net receipts of fixed due to swap = (MIBOR+0.25%) – (MIBOR+.30%) + 8.5%= 8.45%

Types of Interest rate swap:

Interest rate swaps can be categorized on the basis of nature of payment as follows:

Under basis swap payment of

interest on both legs should be

based on Floating rate with

Different reference rate.

Eg. One leg LIBOR

Other leg T-bill

We can interpret basis swap on

the basis of discussion of Fixed Vs

Floating Swap. (We are not going to

do further discussion on it)

Interest rate swap (IRS)

Floating Vs Floating

(Known as Basis Swap & also

known as Non-Generic swap)

Fixed Vs Floating

Under Plain Vanilla or generic swap payment of interest on one

leg would based on fixed interest rate and another leg would

based on floating interest rate.

Plain vanilla and generic swap are similar on the basis of

interest payment. However it differs on the basis of day count

convention (For Discussion on Day Count Convention- Refer subsequent page).

Day count convention of Generic swap is

0

0

. However day

count convention of plain vanilla swap is .

Plain Vanilla swap Generic swap

Fastener Ltd

Bank

(Buyer of swap)

9.5%

MIBOR12.00%

Company-A

Bank

(Seller of swap)

8.5%

MIBOR + .30%

MIBOR + .25%](https://image.slidesharecdn.com/interestrateswap-141120103243-conversion-gate01/85/Interest-rate-swap-4-320.jpg)

![OTC derivatives

CA Nagendra Page 5.14

Swap Market Convention for Fixed Vs Floating Swap:

A fixed Vs Floating Swap should be characterized by:

(i) A notional principal amount upon which total interest payment are based.

(ii) A fixed interest rate

(iii) A Floating interest rate which is periodically re-set (i.e. periodically revise)

(i) Notional Principal

Under interest rate swap, there is no exchange of underlying principal, only interest on notional principal are

exchanged between two parties on “NET BASIS”

(ii) Fixed Interest rate:

Fixed Interest rate refers to the rate that will “not change” over the life of the instrument.

Fixed interest rate is based on “Treasury security (not Treasury bill i.e. T-bill) with a maturity corresponding to the

term of the swap Agreement.

Fixed rate payer is designated as buyer of swap and is said to be “LONG SWAP” (Similar to FRA buyer, where FRA buyer

also pay fixed and receive floating)

Fixed payments are calculated as following:

Fixed payment = Notional principal Fixed rate day count fraction

Day count fraction / Day count Convention:

- Fixed payment can be quoted on days count fraction. It means “Actual no of days” in a

payment period and “ 0 or 5 days” in a year.

- Fixed payment on generic swap typically is based on

0

0

days count fraction. It means 30 days in a

month and 360 days in a year.

Example: Calculation of payment under Fixed Leg: See subsequent page

(iii) Floating Interest rate: [Also known as Variable rate or Adjustable rate]

Floating interest rate refers to the rate that does not have a fixed rate over the life (i.e. rate vary according to the

prevailing rate on market) of instrument.

Example of Floating rate

- LIBOR London Inter Bank Offering rate

- MIBOR Mumbai Inter Bank offering rate

- EURIBOR Euro Inter Bank Offering rate

- PLR Prime Lending Rate

- T-Bill Treasury-Bill Rate

- CP Commercial paper

- Federal Fund etc.

Floating rate payer is designated as Seller of swap and is said to be Short the swap (Similar to FRA seller, Where FRA

seller also pay floating and receive fixed)

Floating Payment are calculated as follows:

Floating payment = Notional principal Floating rate day count fraction

Day count fraction / Day count Convention:

- Floating payment can be quoted on days count fraction. It means “Actual no of days” in a

payment period and “ 0 or 5 days” in a year.

Note: Never use

0

0

days count fraction for floating payment even it is Generic swap.

Different dates used in swap

(i) Trade date(TD): Trade date is the date when swap deal is concluded (or entered).

(ii) Effective date(ED): The effective date is the date from which the first fixed and floating payments starts to

accrue. Normally it is (Trade date + 2 business day). It is also called start date.](https://image.slidesharecdn.com/interestrateswap-141120103243-conversion-gate01/85/Interest-rate-swap-5-320.jpg)