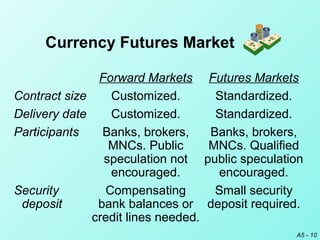

This document discusses currency derivatives markets. It explains how forward contracts, currency futures contracts, and currency options contracts work and how multinational corporations and speculators use them to hedge against or speculate on anticipated exchange rate movements. Forward contracts allow corporations to lock in exchange rates for future currency needs. Currency futures contracts are traded on exchanges and standardized, while options provide the right but not obligation to buy or sell a currency at a set price.