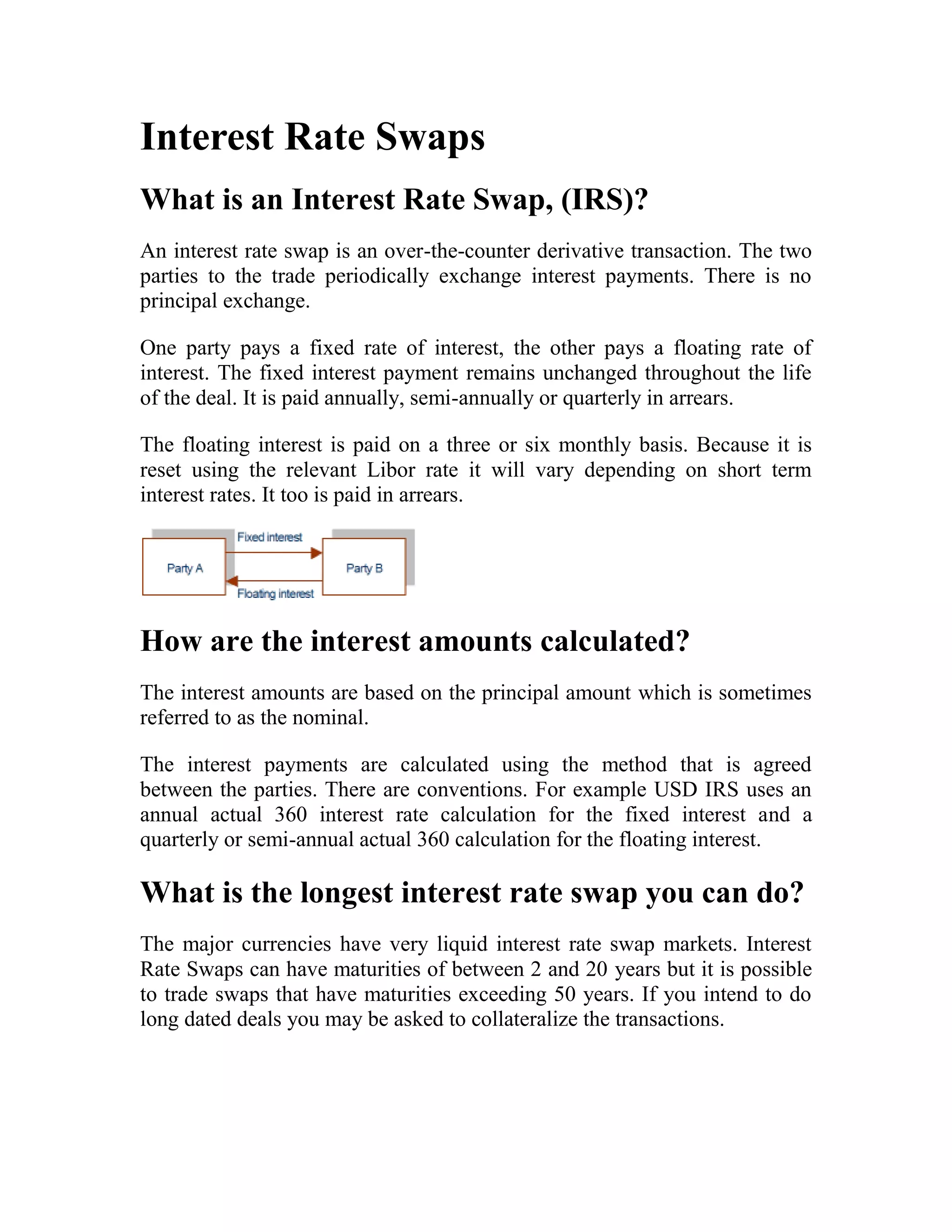

An interest rate swap involves the periodic exchange of interest payments between two parties, with no exchange of the underlying principal amount. One party pays a fixed interest rate while the other pays a floating rate, typically tied to a reference rate such as LIBOR. Interest rate swaps can be used by companies and investors to hedge against interest rate risk and manage the costs associated with fixed versus floating rate financing. While swaps can be profitable if rates move as anticipated, they also carry risks of losses if rates move adversely.