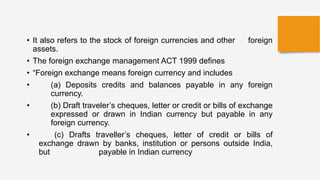

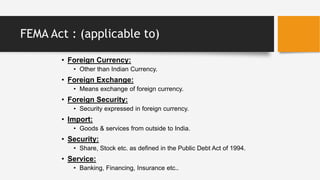

The document provides an in-depth overview of foreign exchange management, detailing its definitions, mechanisms, and the statutory basis under Indian law, particularly the Foreign Exchange Management Act (FEMA) of 1999, which replaced the stricter Foreign Exchange Regulation Act (FERA). It discusses various functions and features of foreign exchange markets, including spot and forward transactions, risks, and the role of banks and regulatory bodies like the Reserve Bank of India. Additionally, it examines the objectives of foreign exchange controls, their historical context, and the evolution of policies related to exchange rate systems in India.