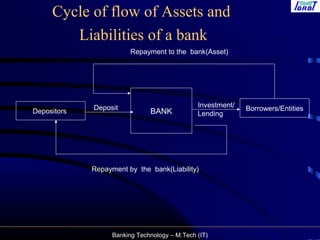

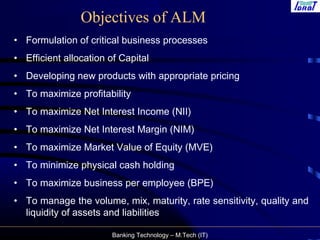

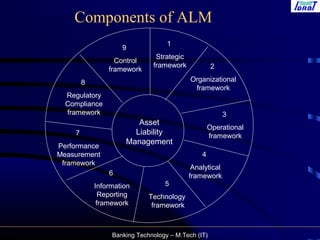

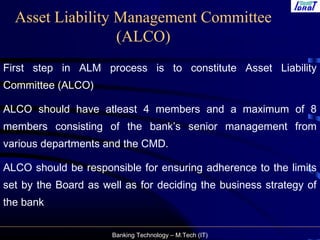

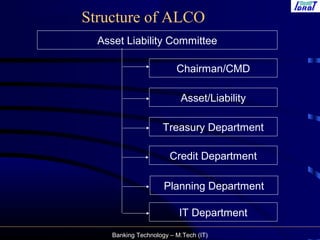

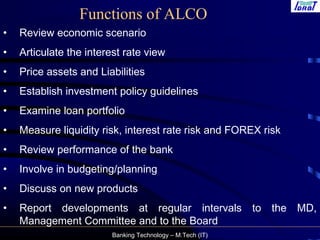

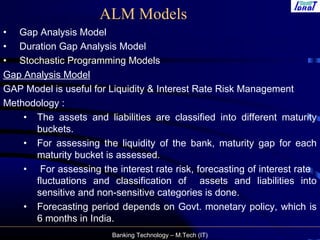

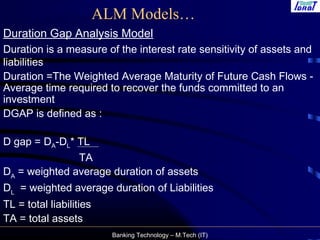

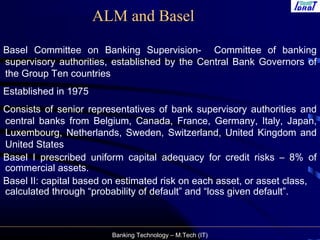

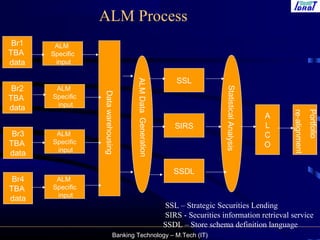

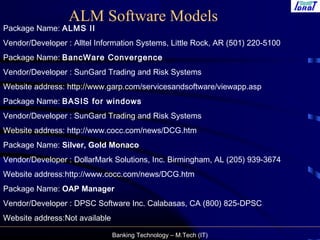

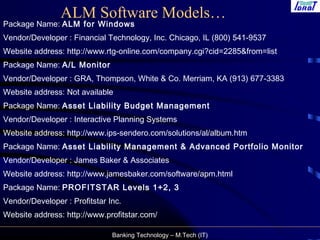

This document discusses asset liability management (ALM) in banks. It begins with definitions of ALM and describes the objectives of ALM as including efficient capital allocation, product pricing, and profitability and risk management. It outlines the components of an ALM framework including strategic, organizational, operational, and other elements. It also describes the ALM process in banks including data collection, analysis, decision making, and monitoring. Key aspects covered include the ALM committee, models used like gap analysis and duration analysis, the role of ALM under Basel standards, and ALM software options.