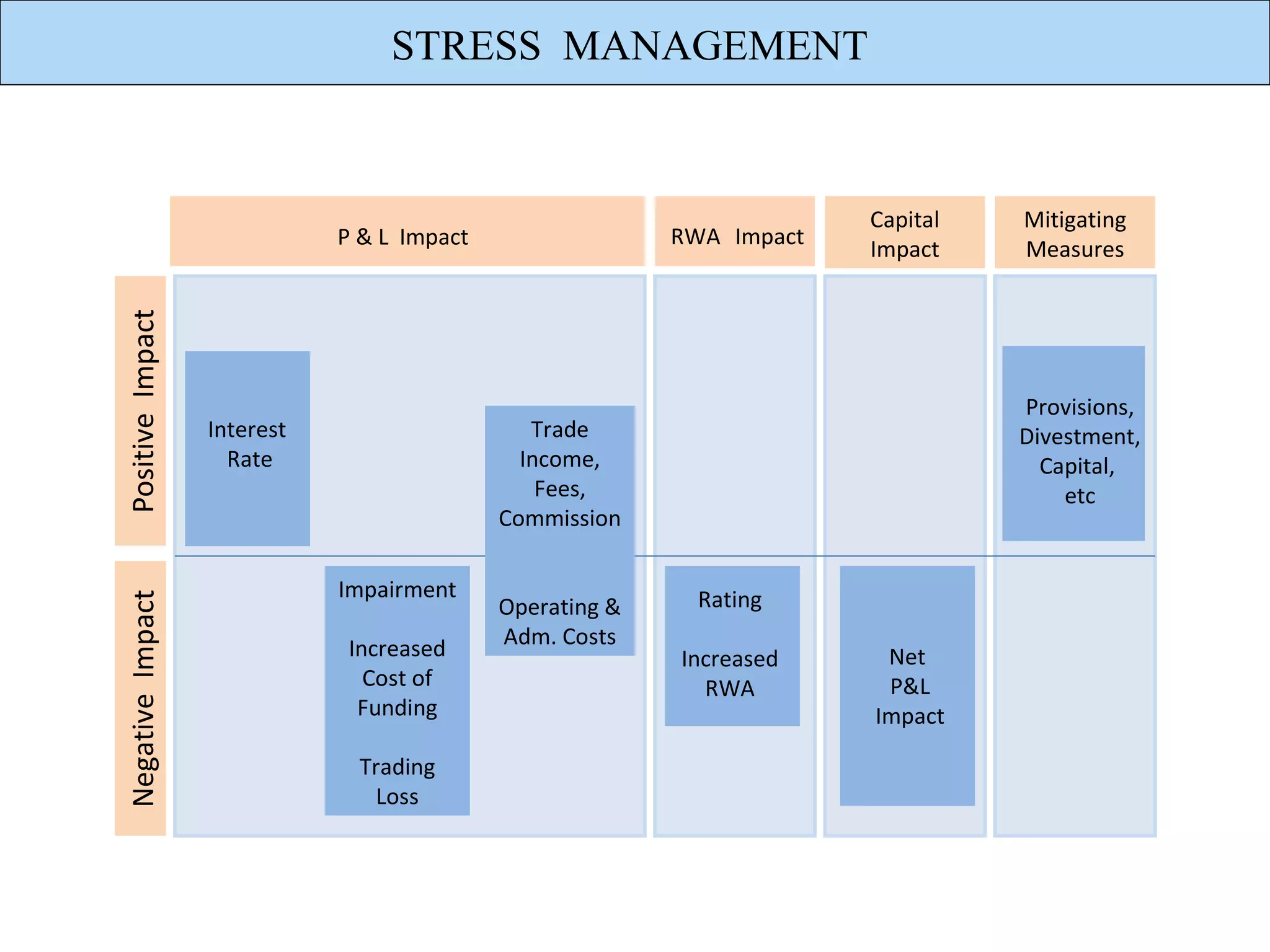

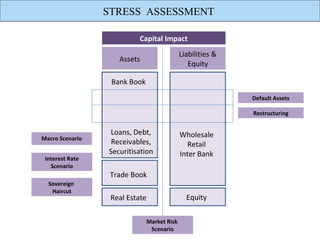

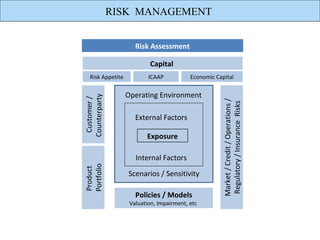

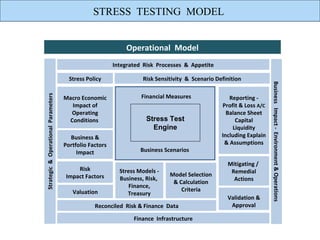

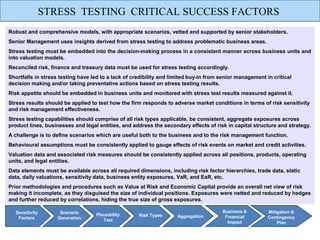

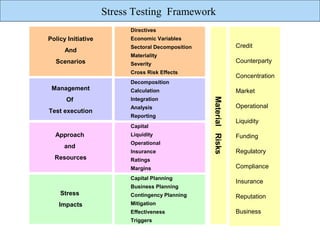

This document discusses stress testing frameworks and critical success factors. It covers topics such as stress testing models, scenarios, risk types, aggregation, business impacts, and mitigation plans. The key aspects are robust stress testing models across all material risk types, senior management buy-in and use of insights to address issues, and embedding stress testing into the decision-making process consistently across the organization. Data reconciliation and clearly defined scenarios are also important factors.