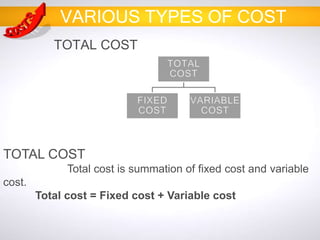

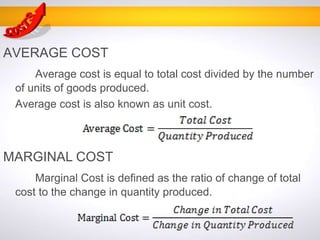

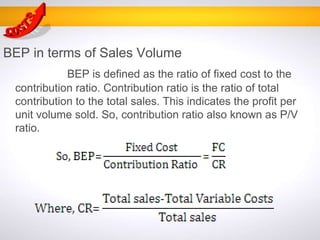

The document outlines various types of costs in business production, including fixed, variable, direct, indirect, average, marginal, recurring, non-recurring, sunk, implicit, cash, short run, and long run costs. It also explains break-even analysis, defining the break-even point (BEP) as the stage where total revenues equal total costs, and provides methods to calculate BEP in terms of production quantity and sales volume. Comprehensive knowledge of these costs is essential for effective cost management and profitability in any business organization.