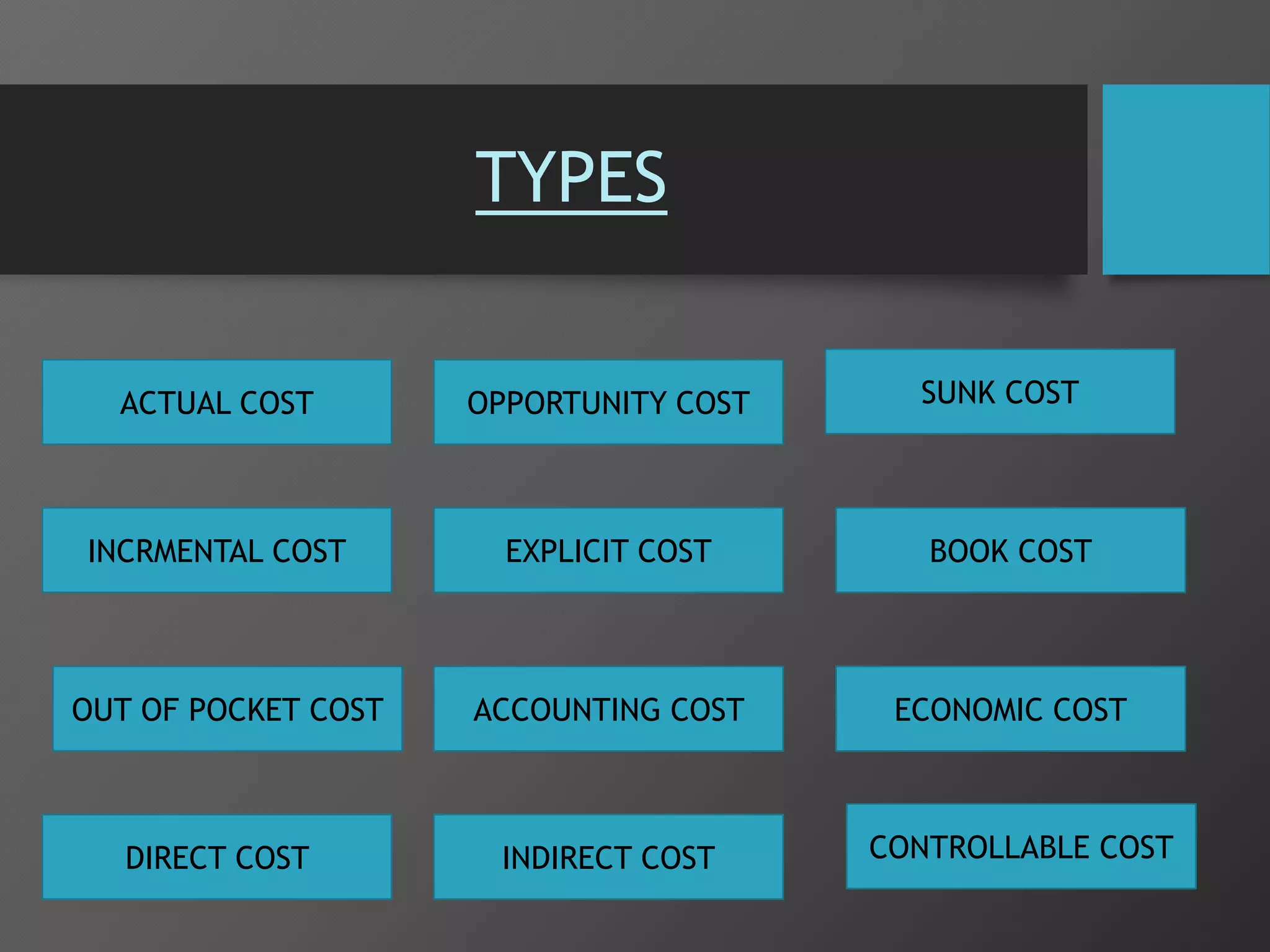

This document provides an overview of different types of costs that are relevant for business. It defines and gives examples of various costs including actual costs, opportunity costs, sunk costs, incremental costs, explicit costs, implicit costs, book costs, out of pocket costs, accounting costs, economic costs, direct costs, indirect costs, controllable costs, non-controllable costs, historical costs, replacement costs, shutdown costs, abandonment costs, urgent costs, business costs, fixed costs, variable costs, total costs, average costs, marginal costs, short run costs, and long run costs. The document is a presentation on costs submitted by a student for their coursework.