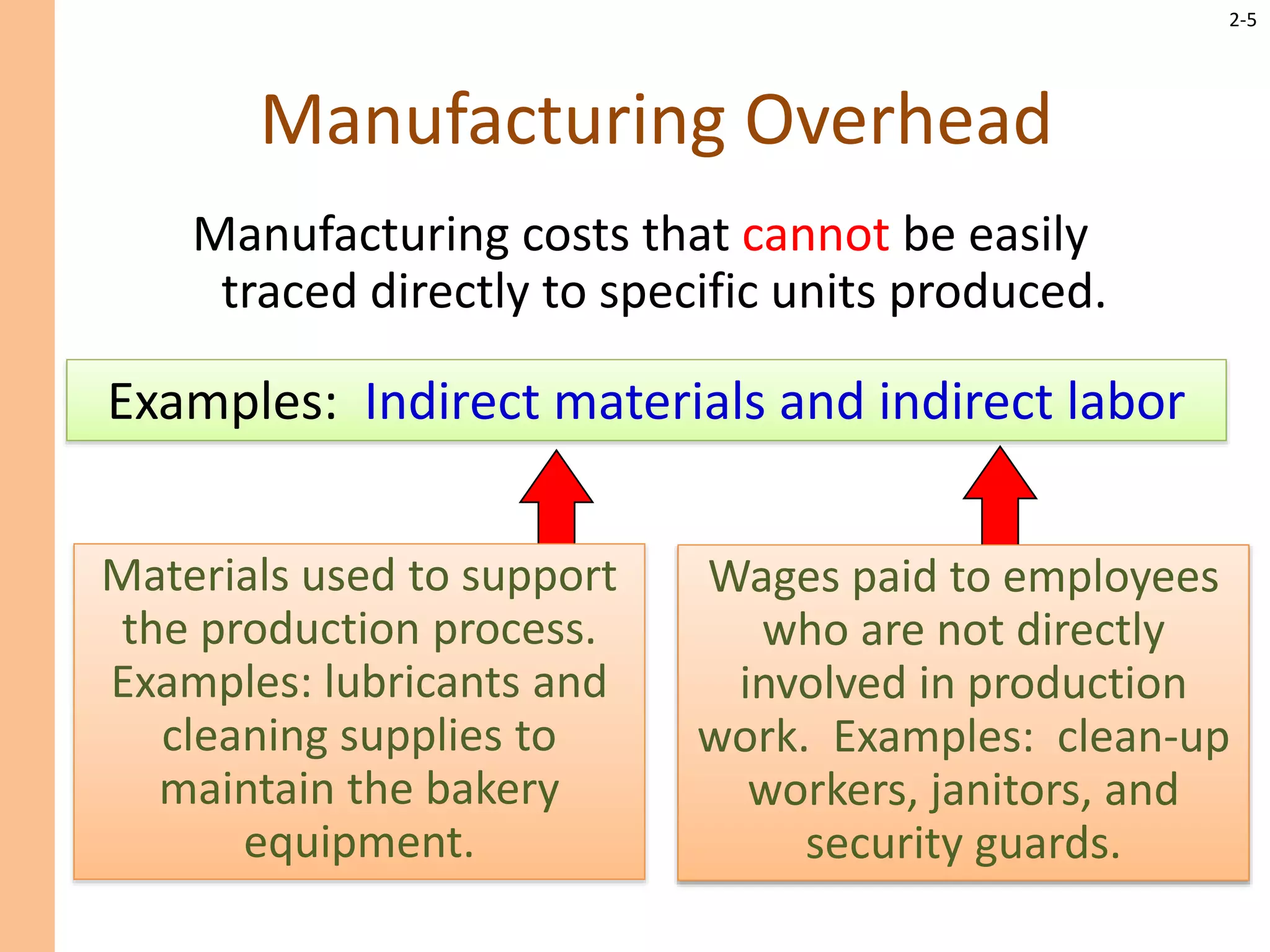

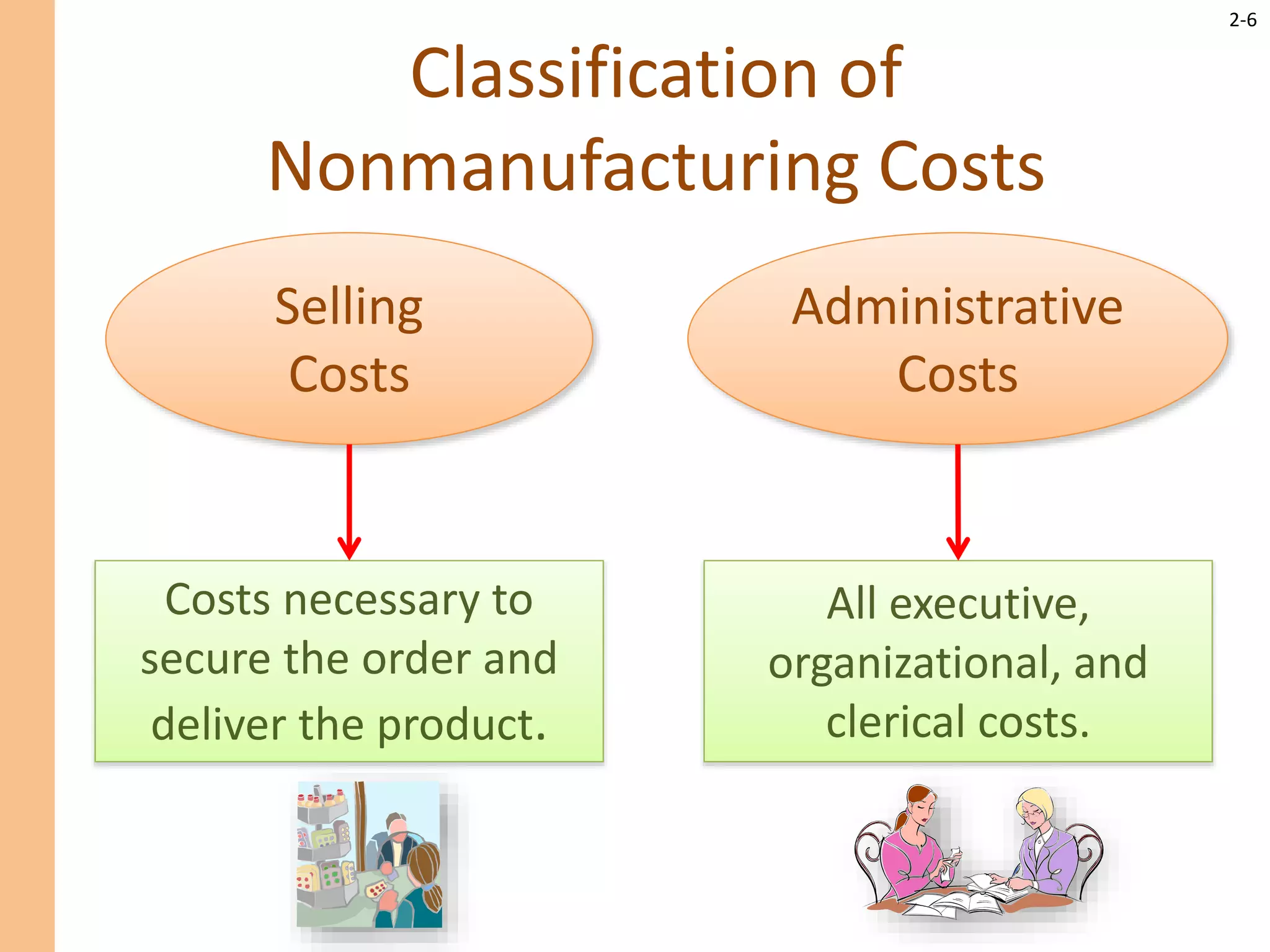

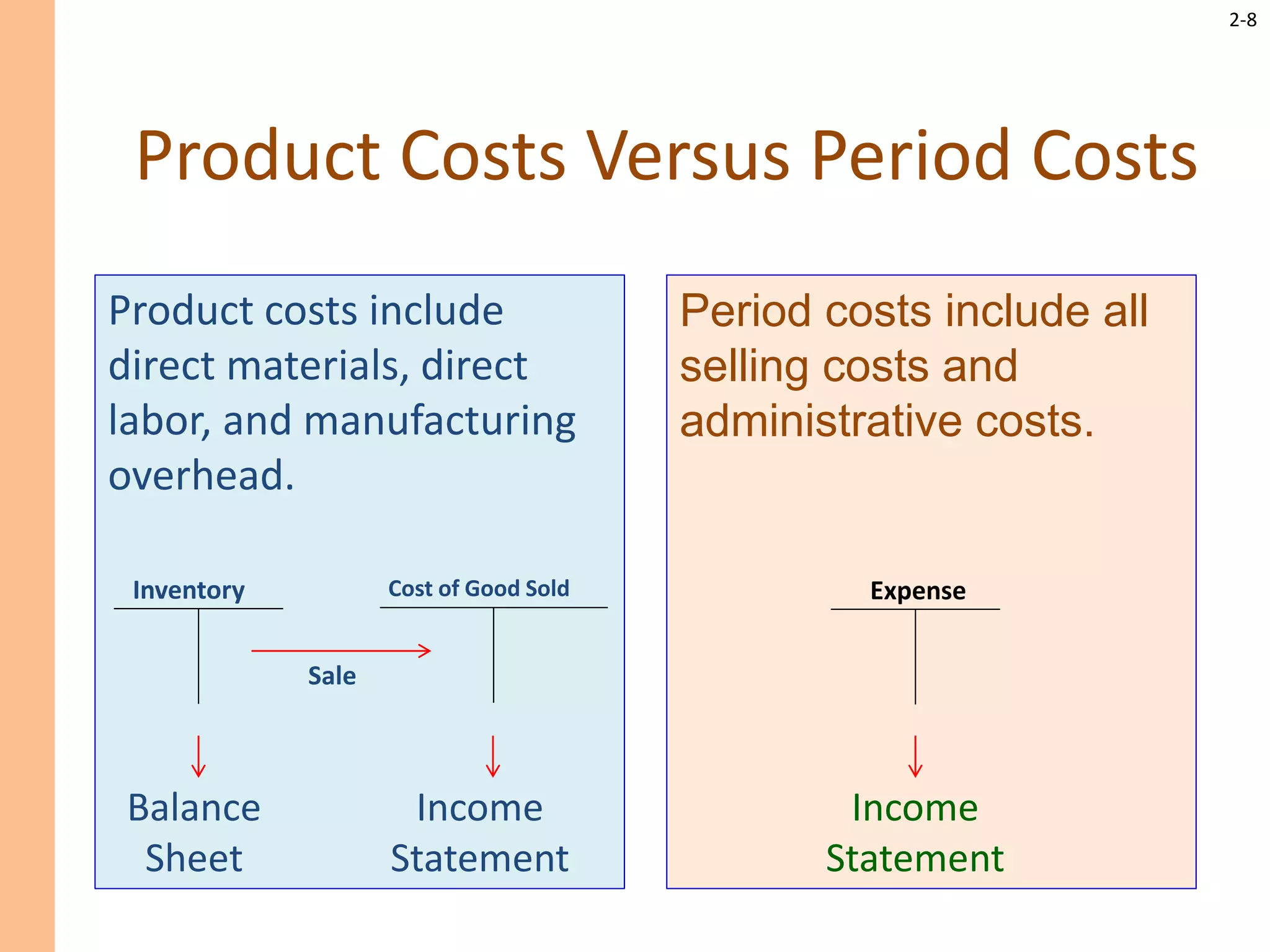

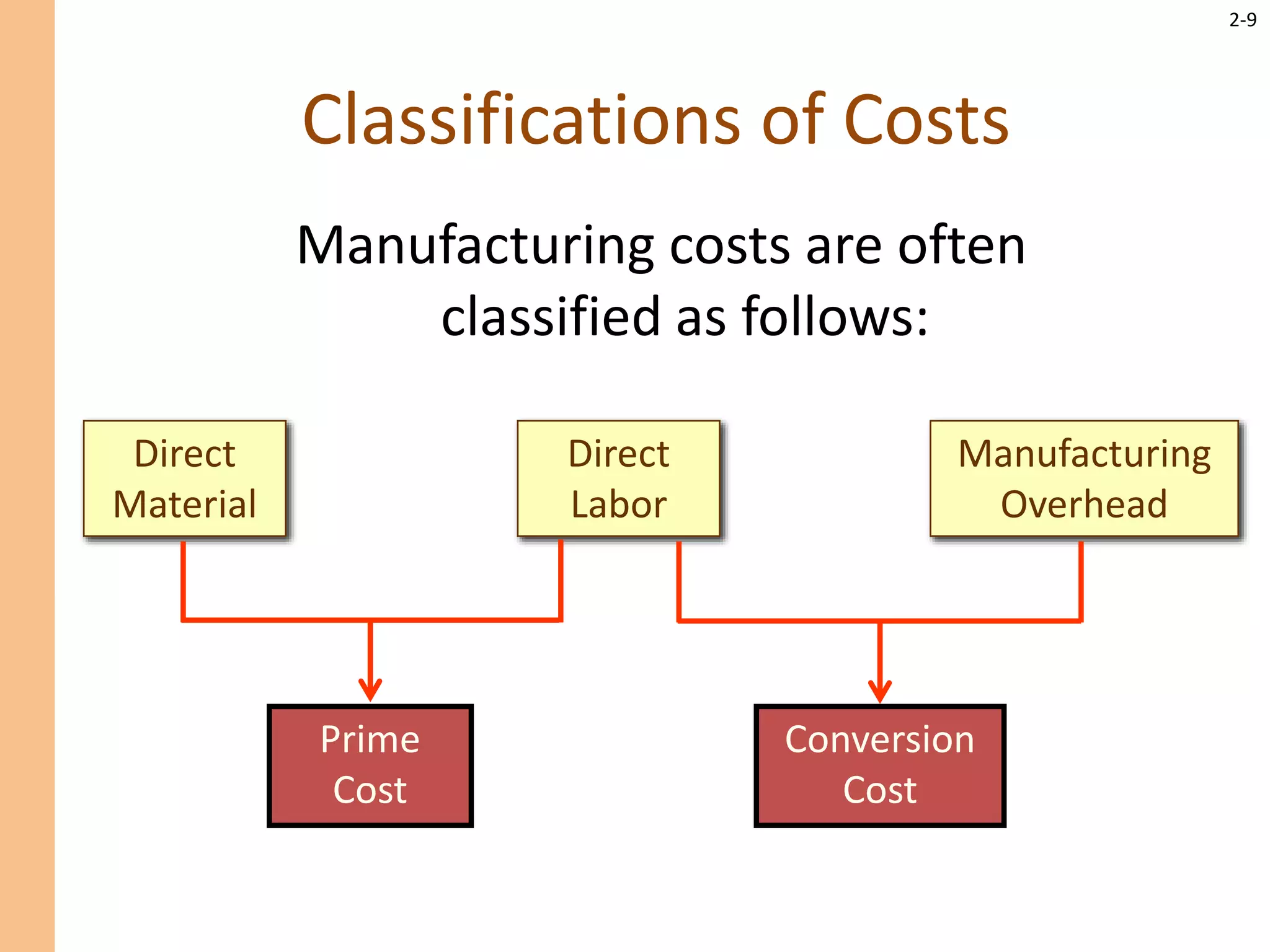

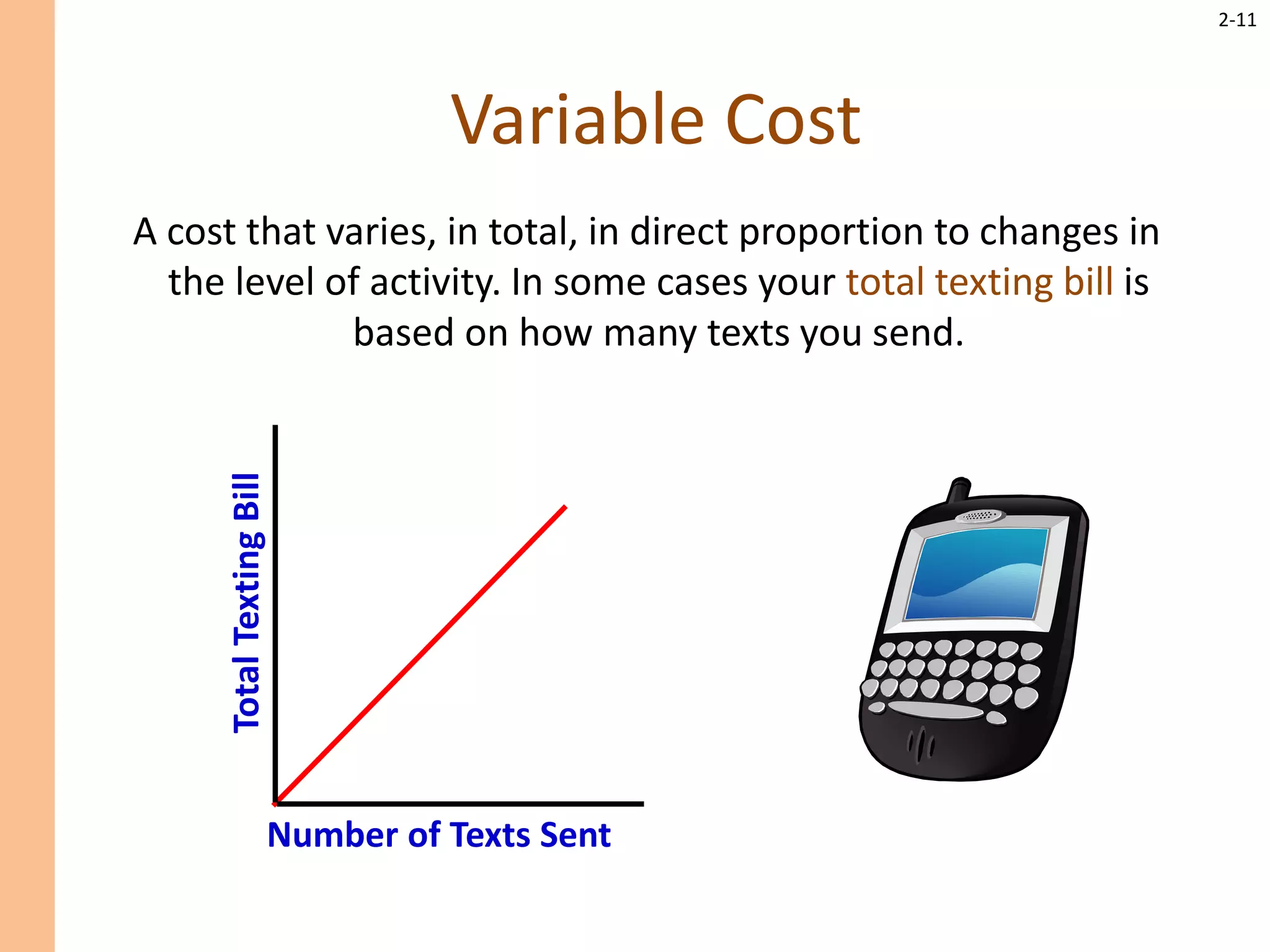

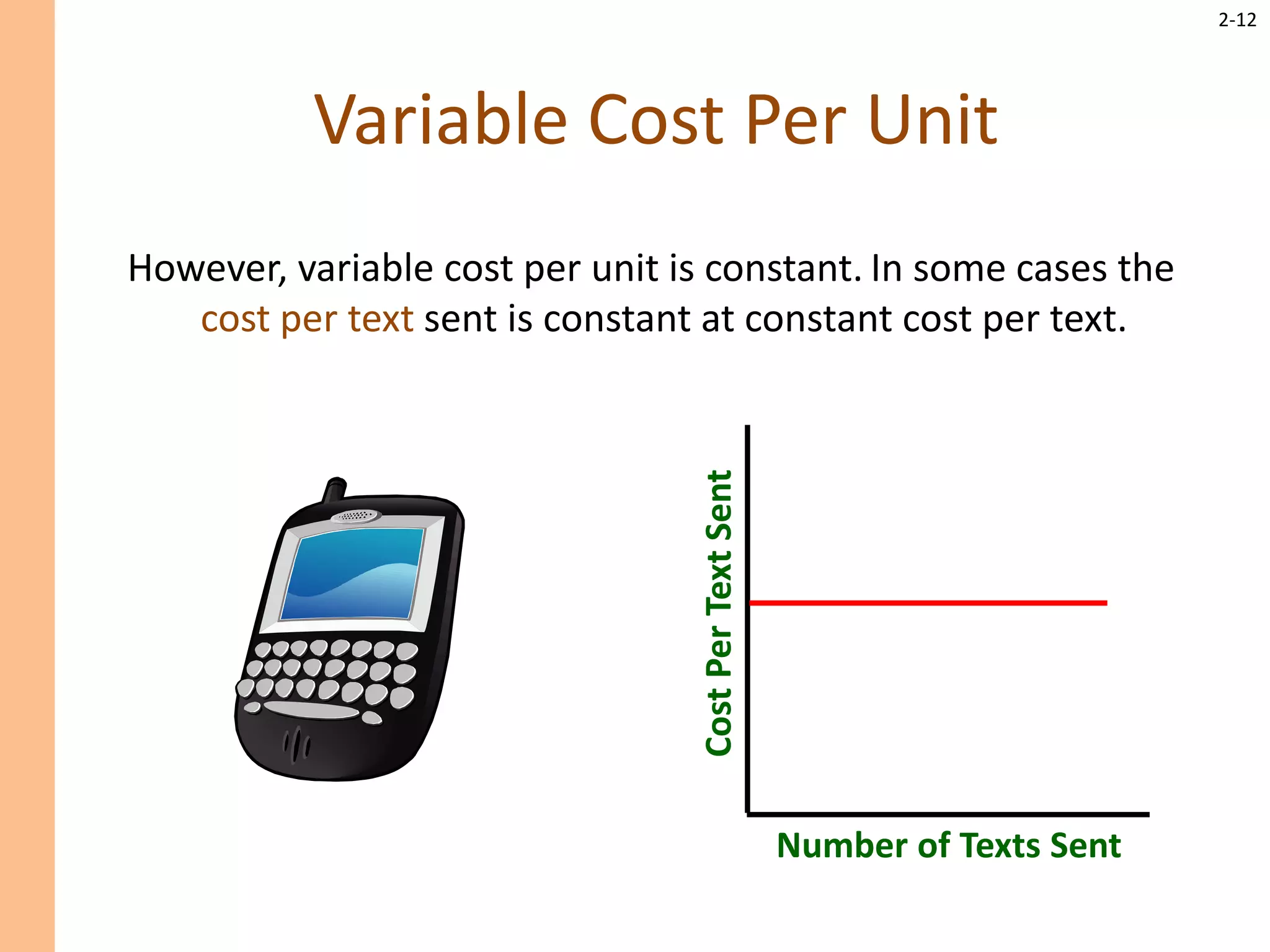

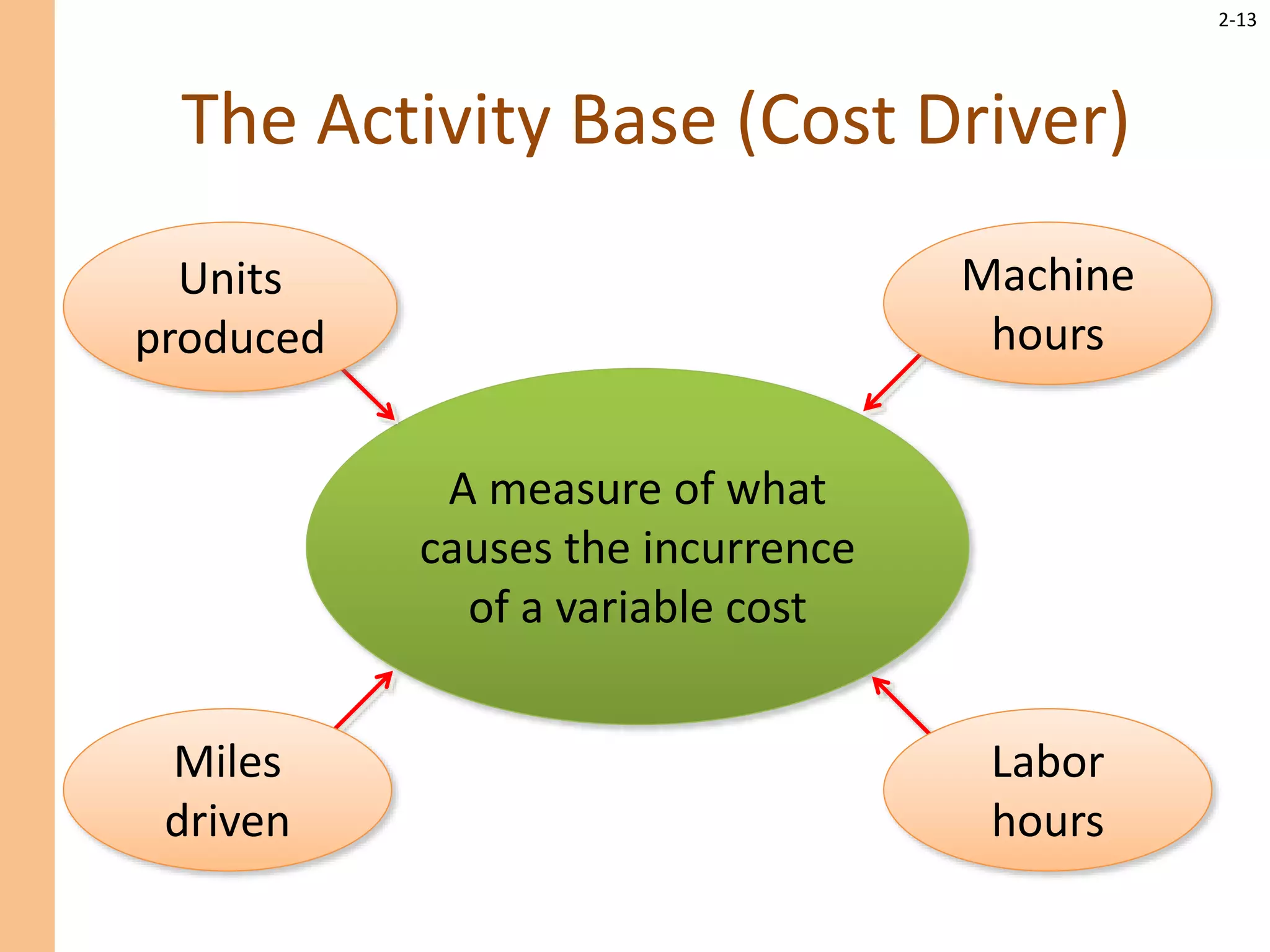

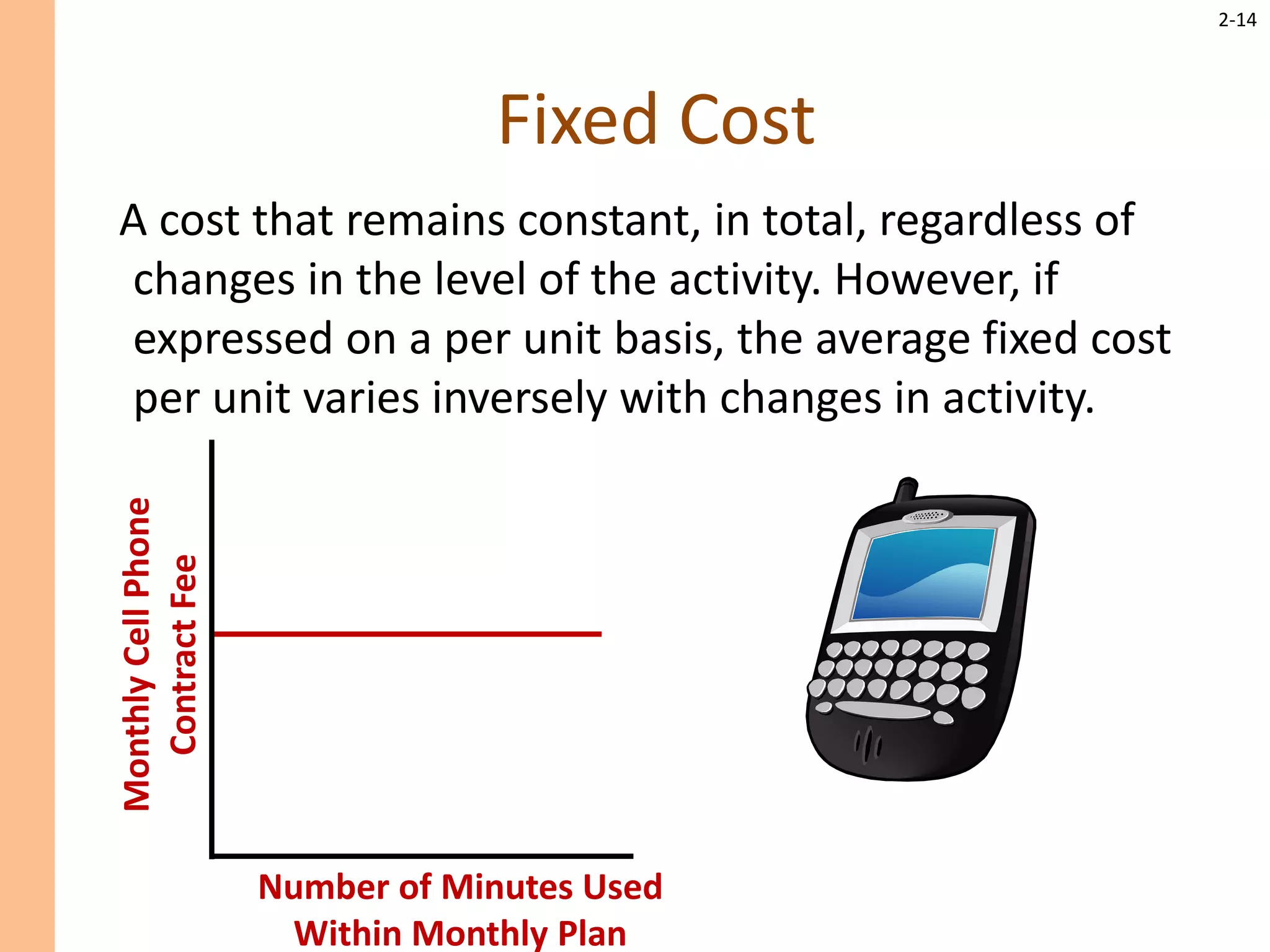

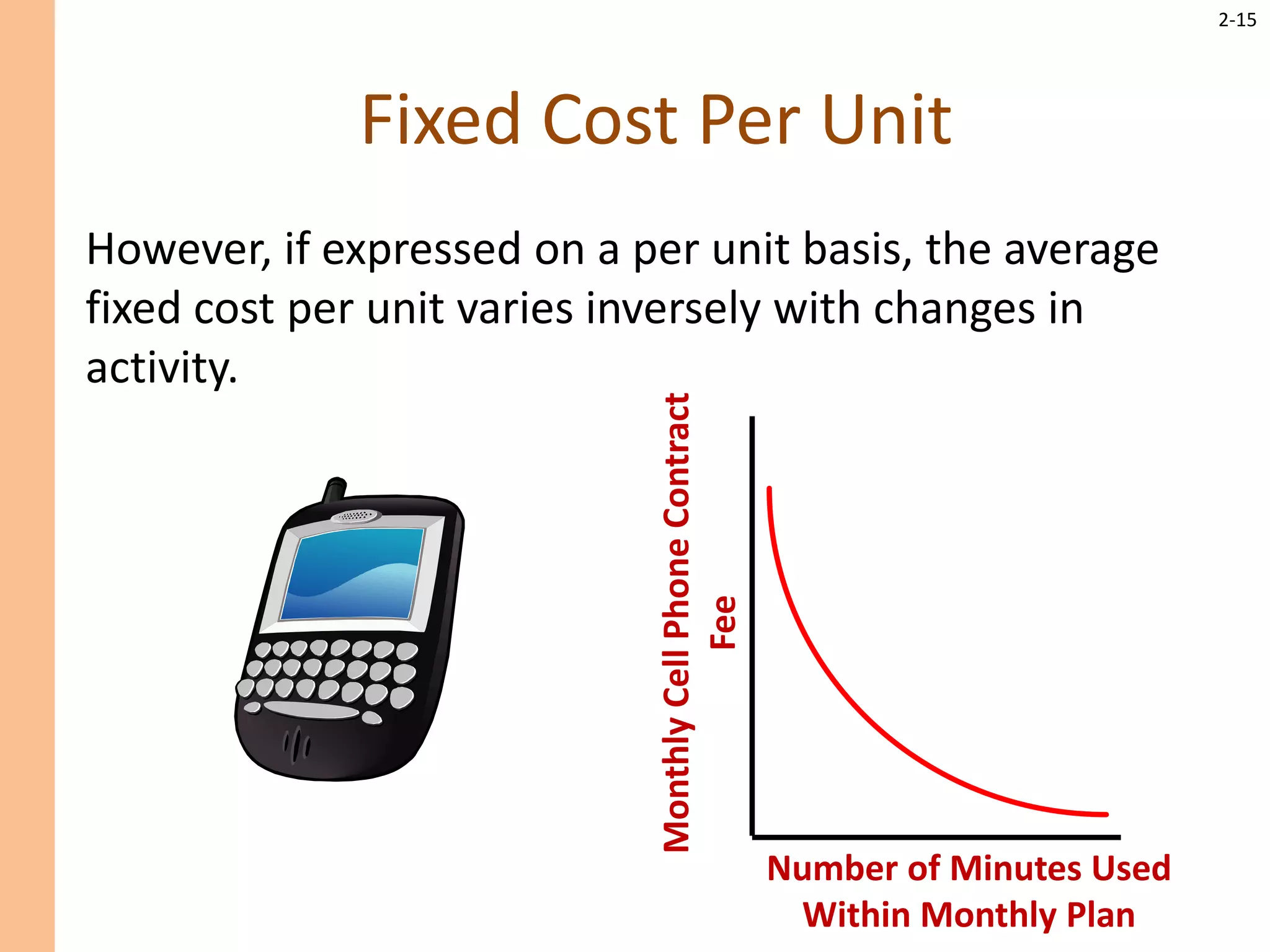

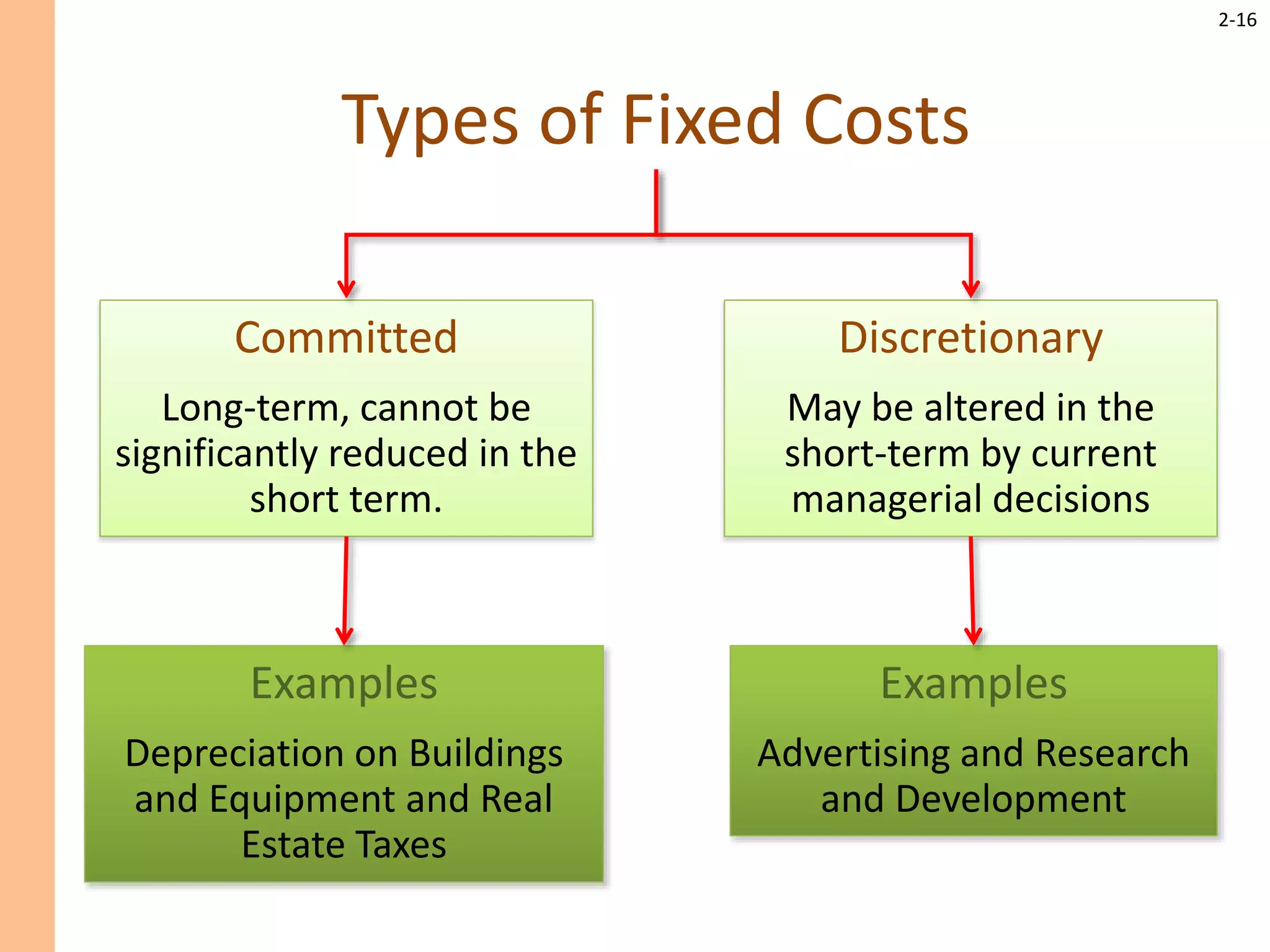

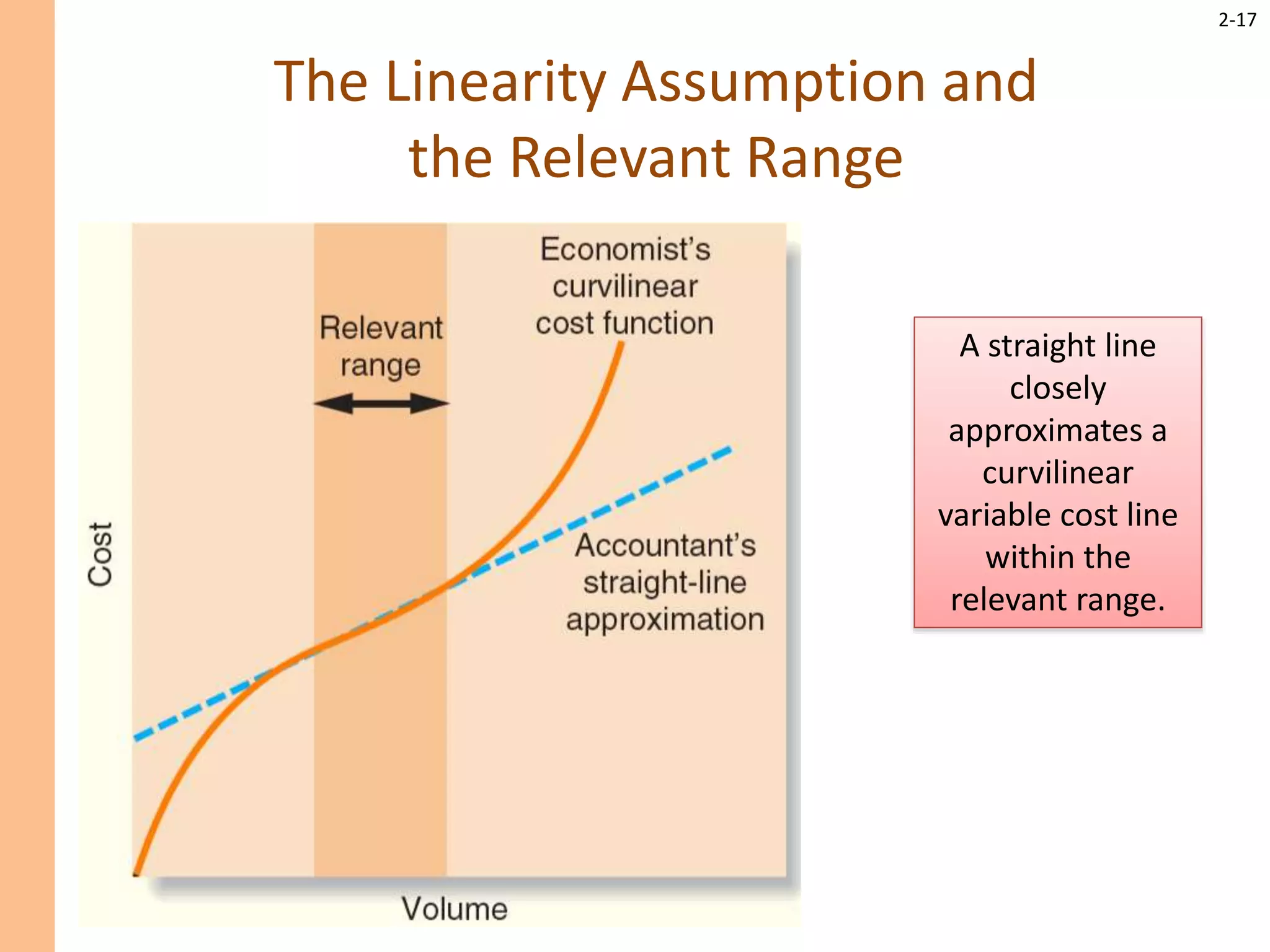

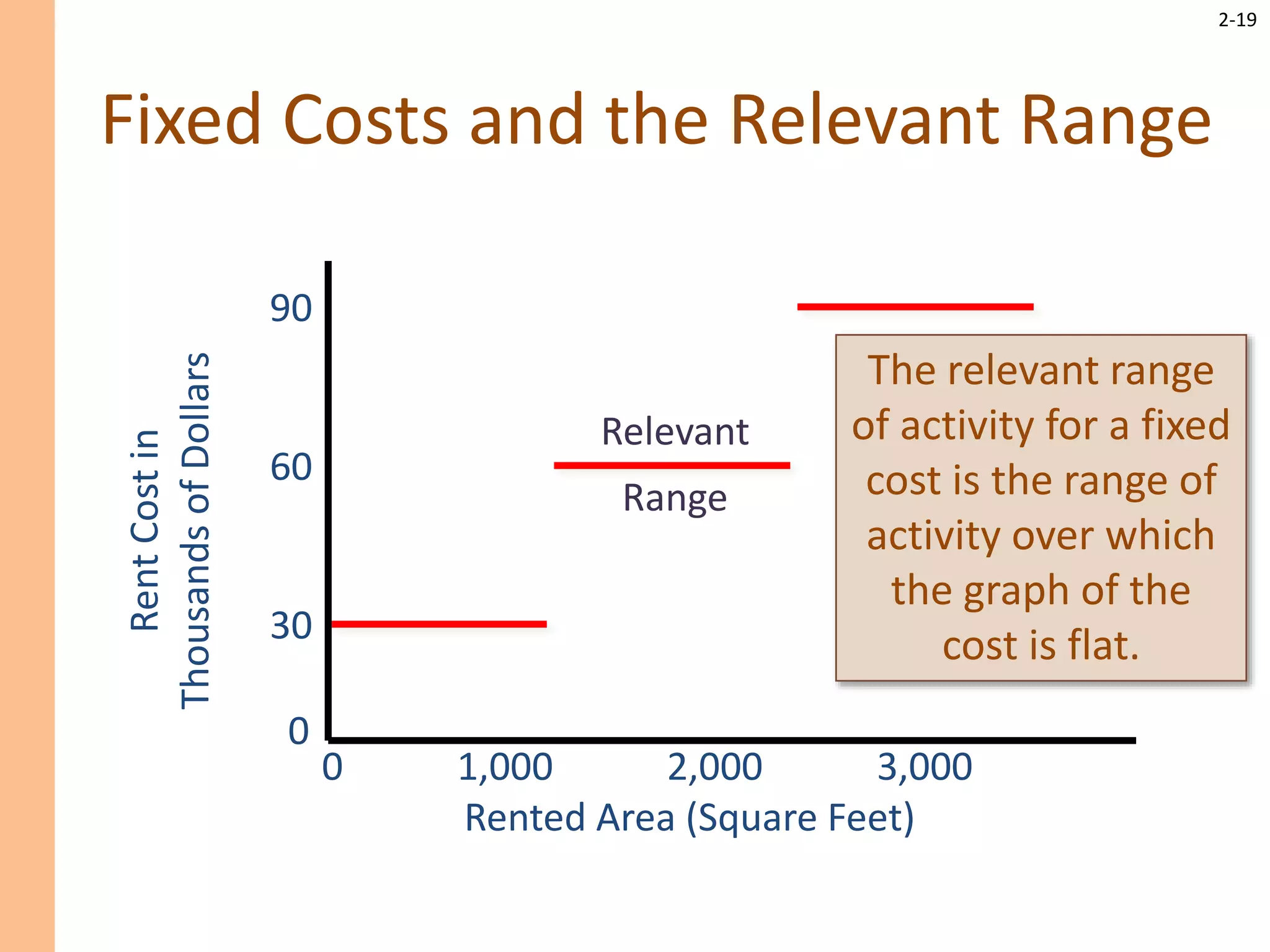

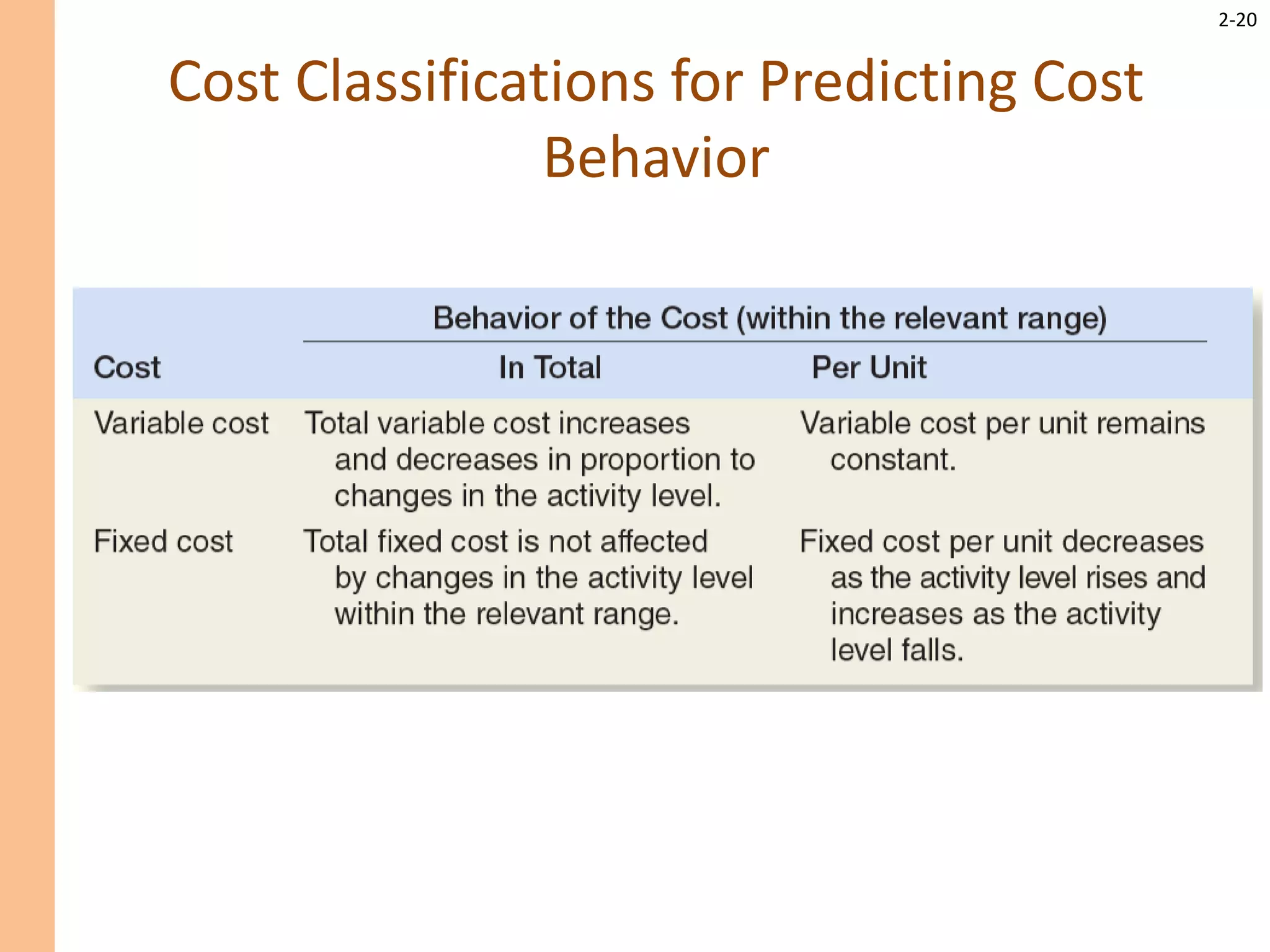

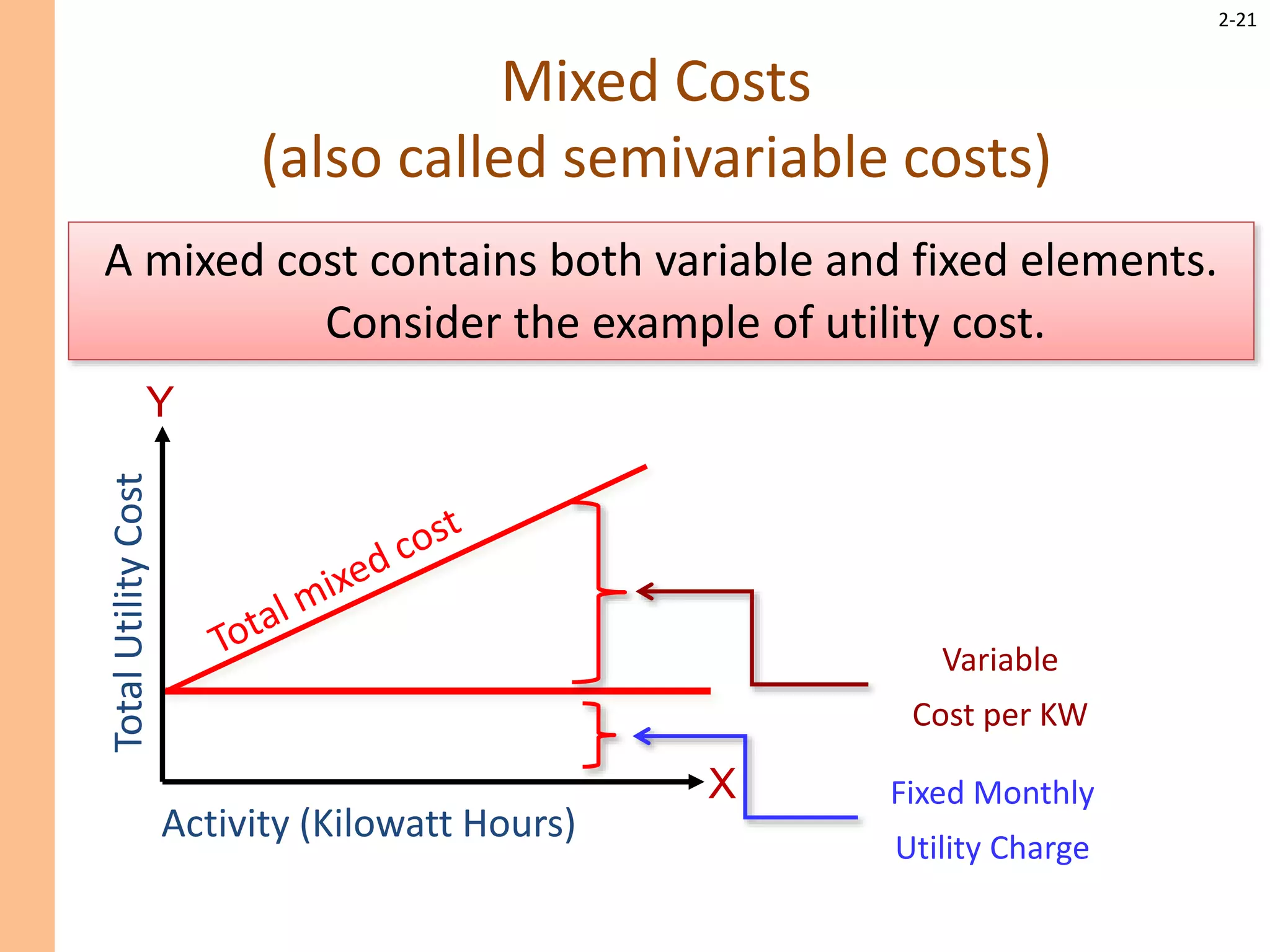

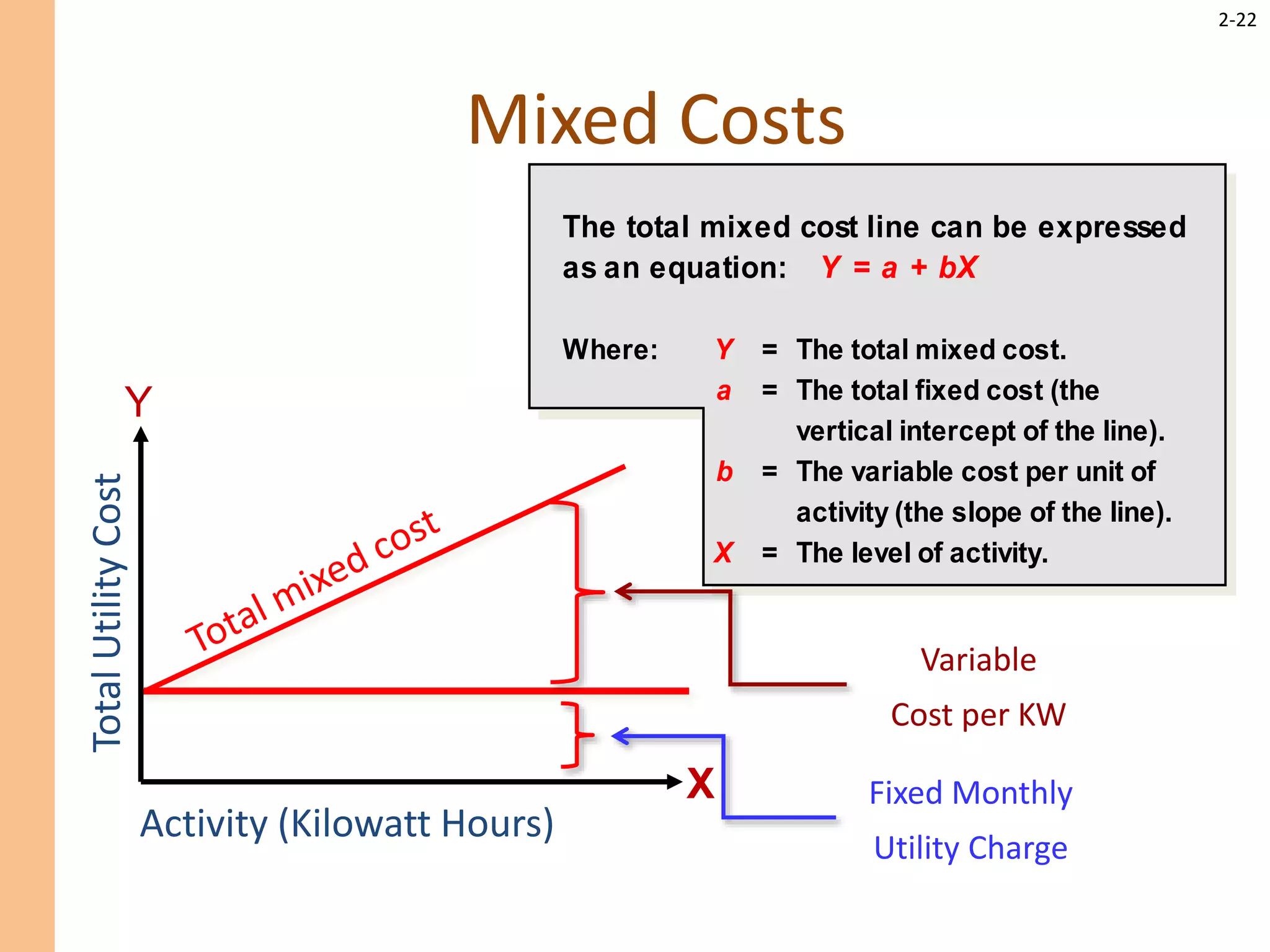

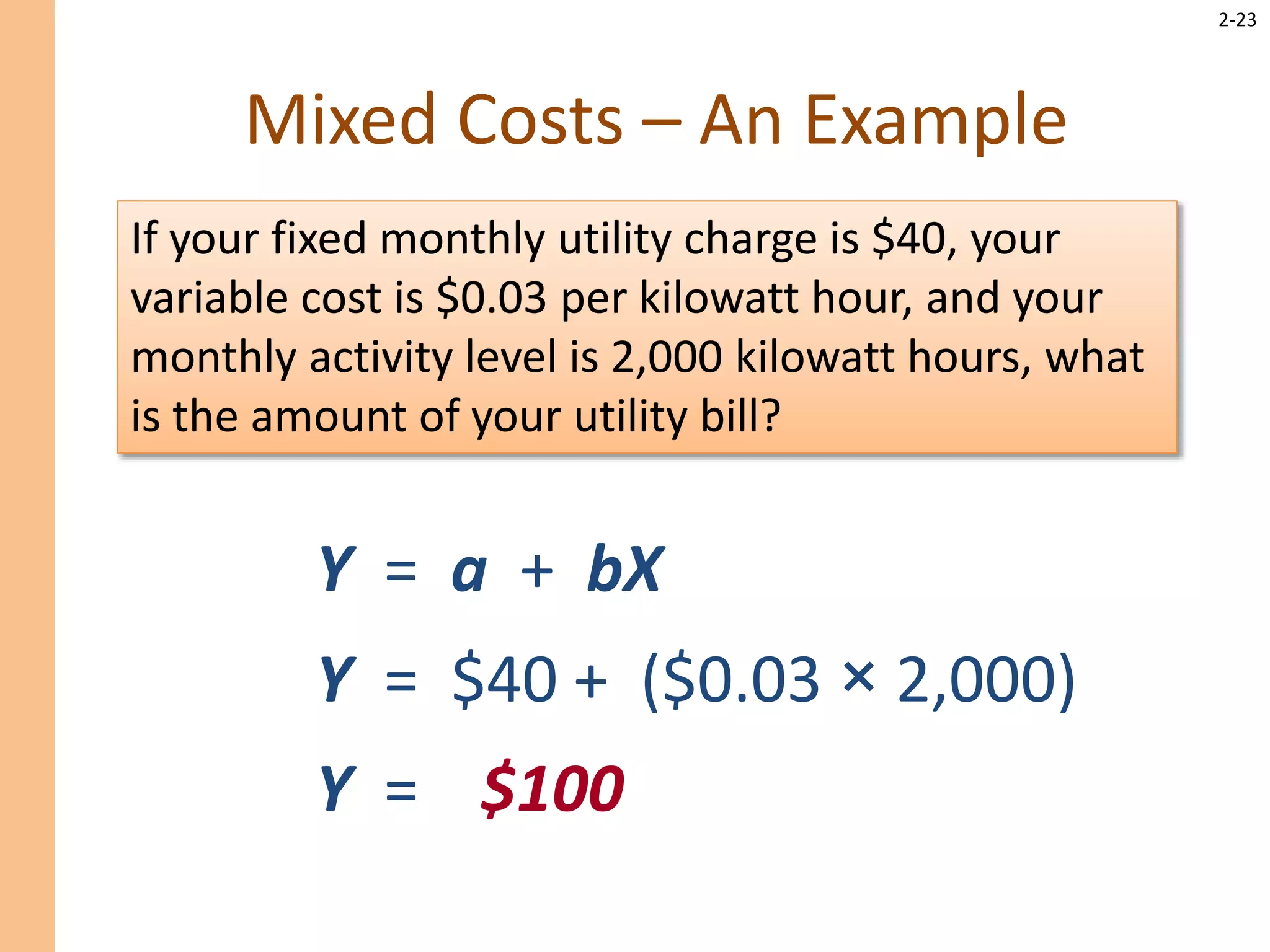

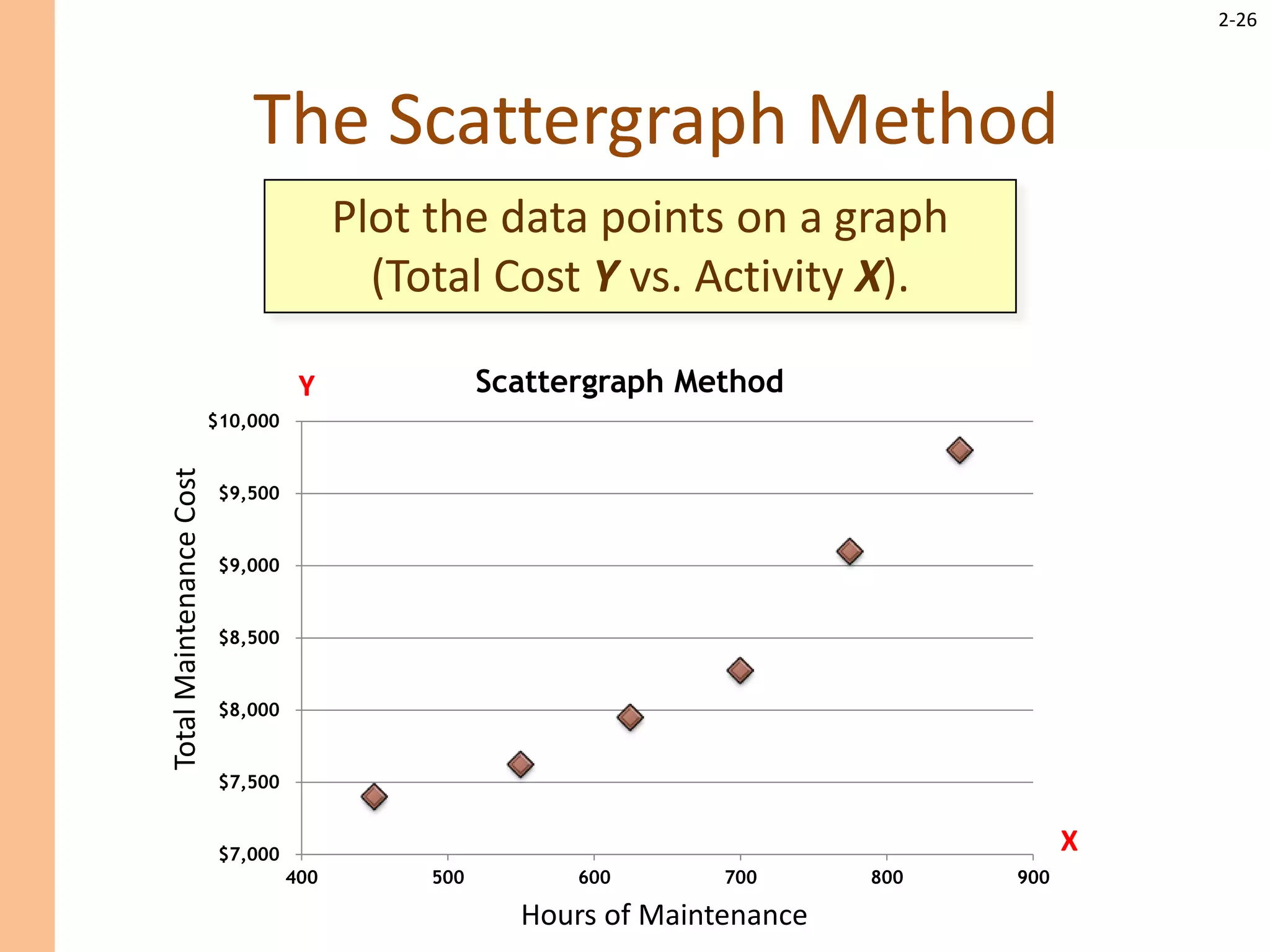

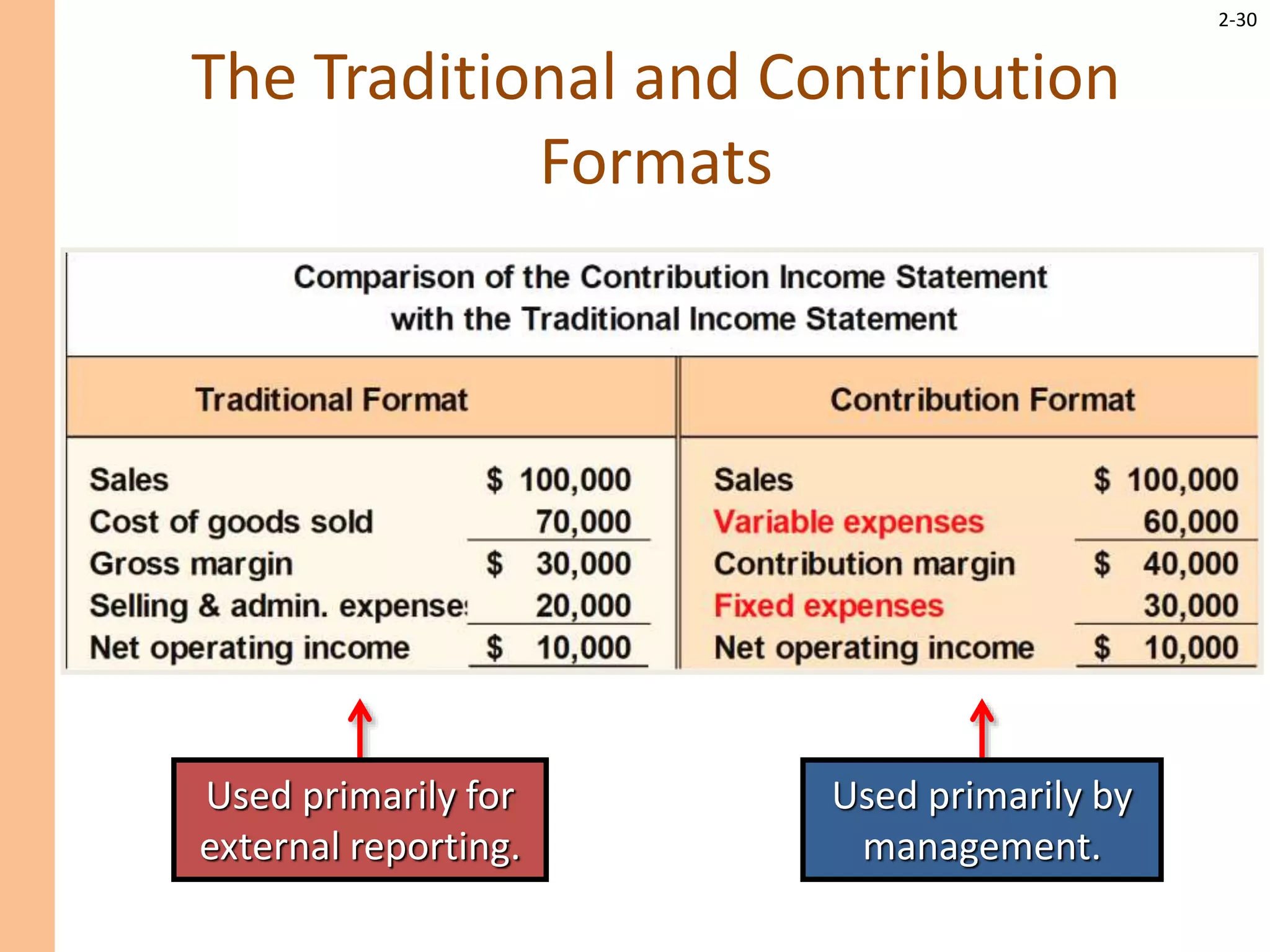

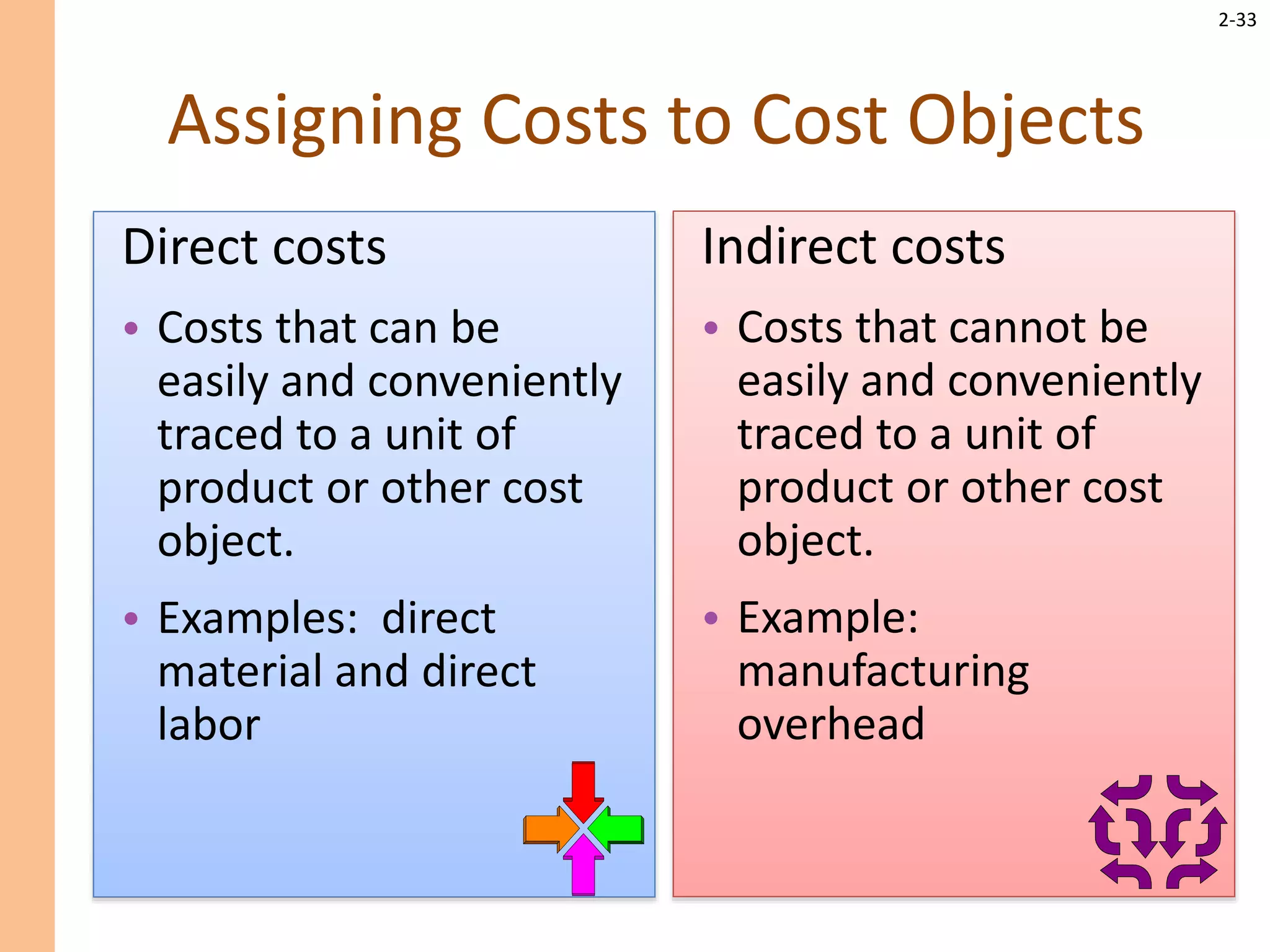

This document provides an overview of different classifications of costs that are important for managerial accounting. It discusses direct materials, direct labor, and manufacturing overhead as the three main classifications of manufacturing costs. It also defines product costs, which become part of inventory, and period costs, which are expensed immediately. Additionally, it examines classifications of costs based on their behavior when activity changes, including variable, fixed, and mixed costs. Differential costs, opportunity costs, and sunk costs are identified as important classifications for decision making.