The document discusses various cost concepts and classifications including:

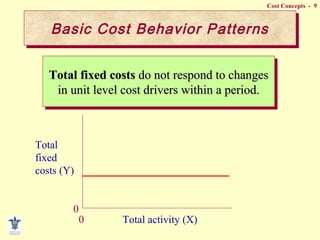

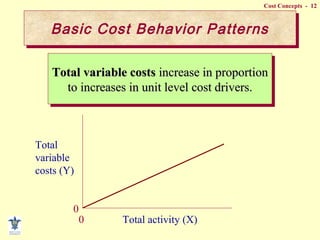

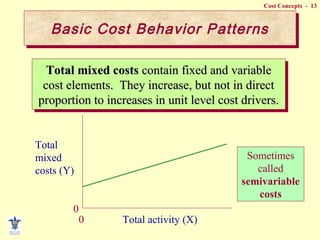

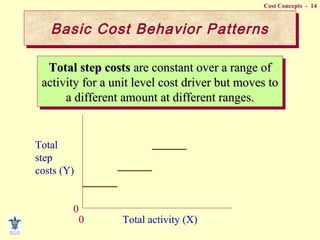

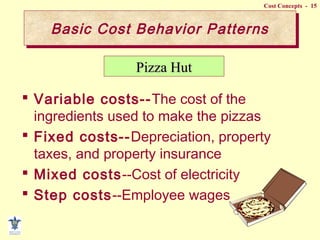

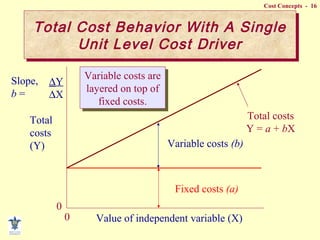

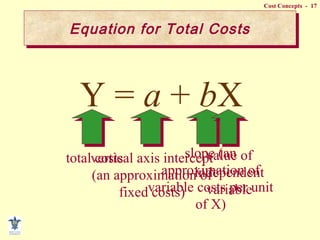

- Fixed vs variable vs mixed costs and how they behave differently with changes in activity.

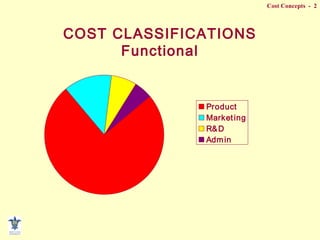

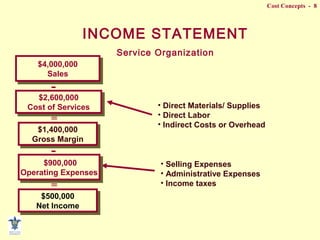

- Functional classifications like product, marketing, R&D costs.

- Behavioral classifications like committed vs discretionary fixed costs.

- Responsibility classifications that assign costs to cost centers like departments A, B, C.

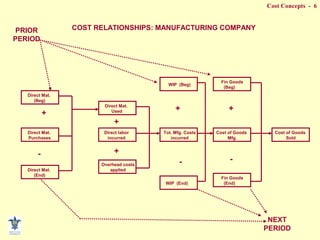

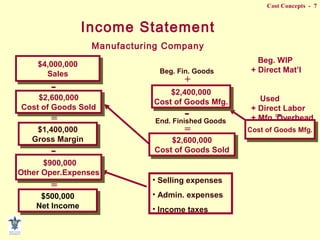

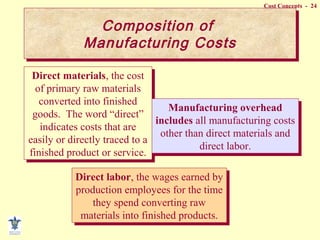

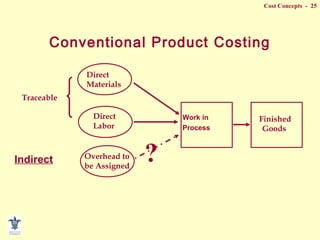

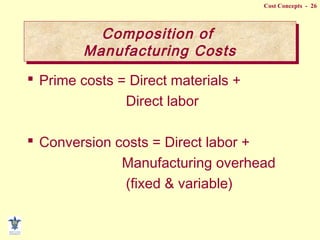

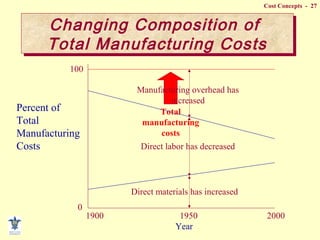

- Composition of manufacturing costs including direct materials, direct labor, and manufacturing overhead.

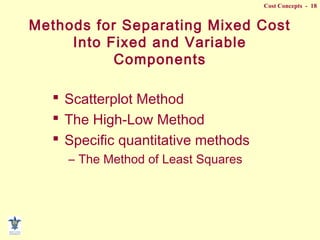

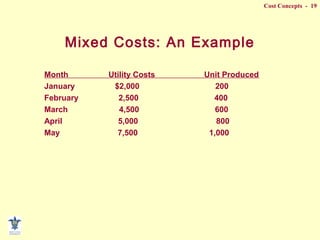

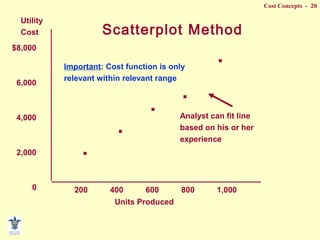

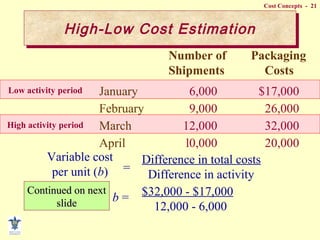

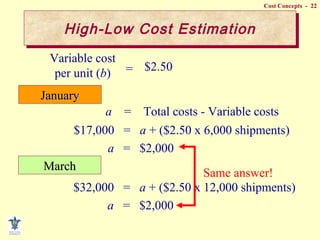

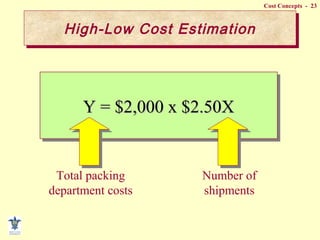

- Methods for separating mixed costs into fixed and variable components like scatterplot, high-low, and least squares.