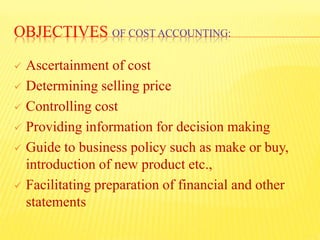

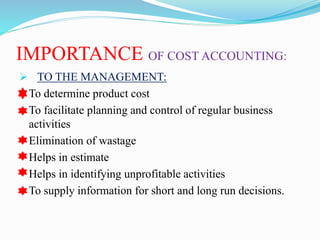

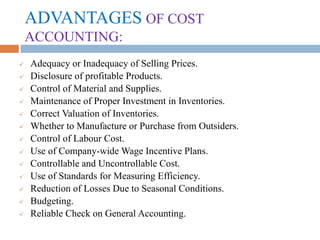

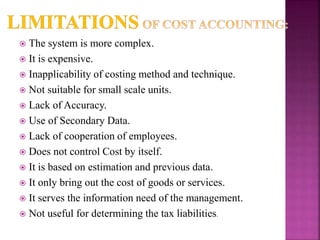

Cost accounting is the process of recording, classifying, analyzing, summarizing, and allocating current and prospective costs related to a product, service, or activity. It provides data to management for planning and control purposes and facilitates the preparation of financial statements. Cost accounting helps management determine product costs, control expenses, eliminate waste, and make decisions regarding pricing, outsourcing, and budgeting. It provides more detailed cost information than financial accounting.