This document discusses key aspects of lease financing including:

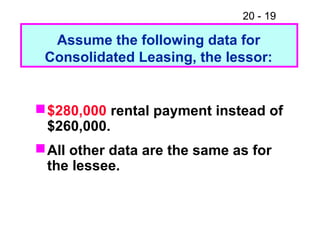

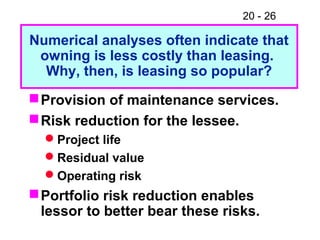

- The two parties to a lease are the lessee who uses the asset and makes payments, and the lessor who owns the asset and receives payments.

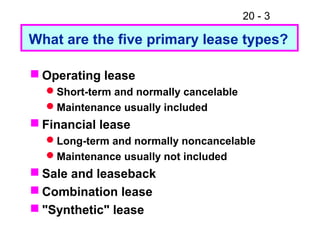

- There are five primary lease types: operating, financial, sale and leaseback, combination, and synthetic.

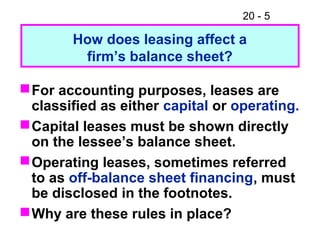

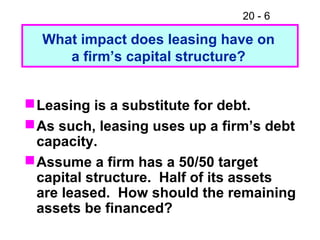

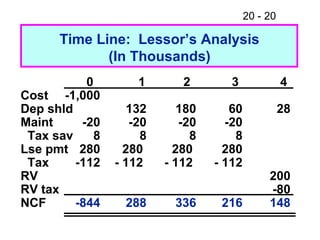

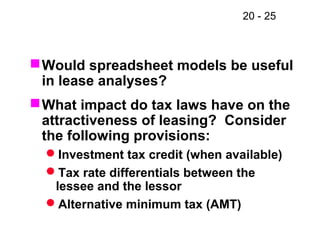

- Leases are classified for tax and accounting purposes, which affects the financial analysis.

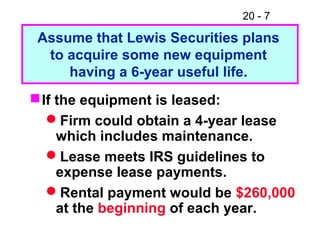

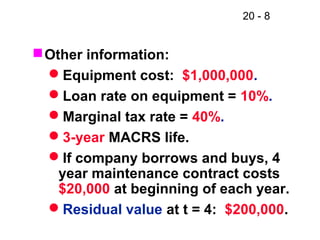

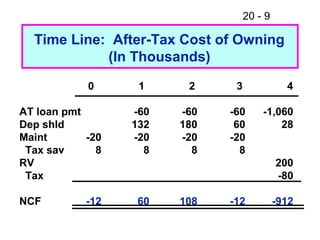

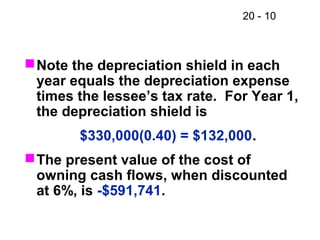

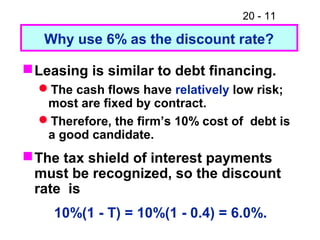

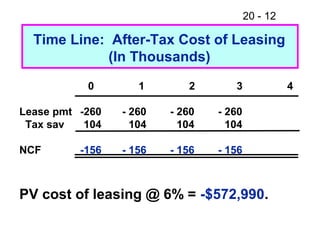

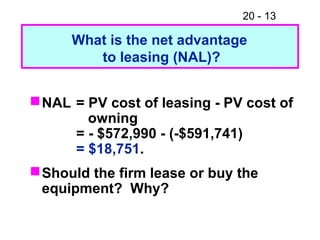

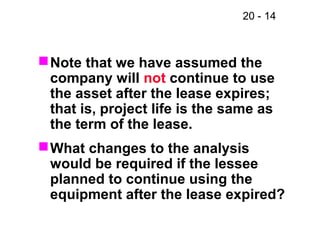

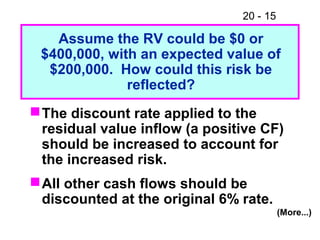

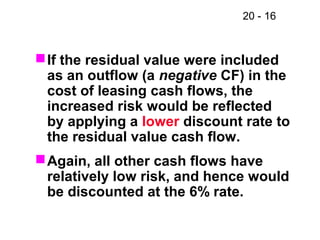

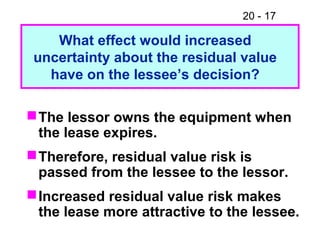

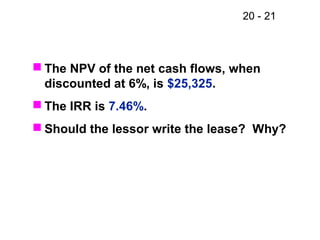

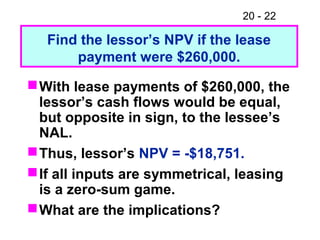

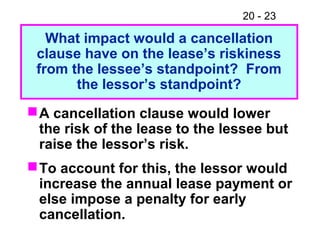

- The analysis compares the net present value of costs for the lessee to lease versus own an asset, considering factors like depreciation, interest, and residual value.