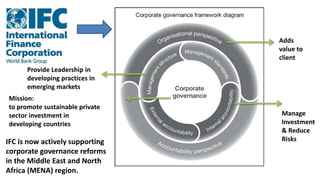

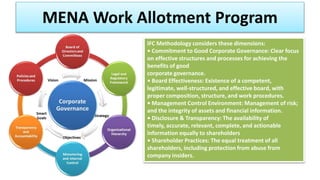

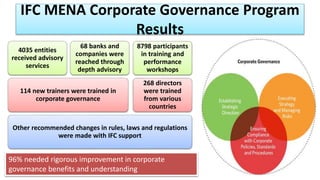

The IFC helps reduce poverty and improve lives in developing countries by supporting private sector growth, mobilizing private capital investment, and providing advisory services to businesses and governments. The IFC promotes sustainable private sector investment and develops best practices in emerging markets. Specifically, the IFC supports corporate governance reforms in the Middle East and North Africa through a program that helps improve access to capital and operational efficiency for small and medium enterprises. The goals of the program are to improve access to affordable financing and performance through better strategic decision making.