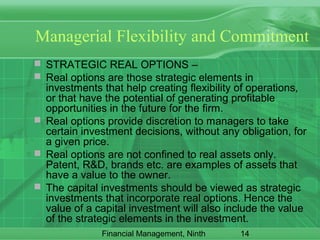

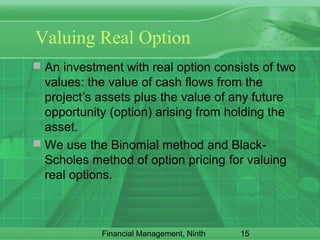

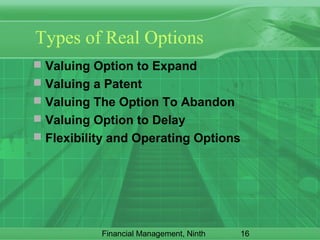

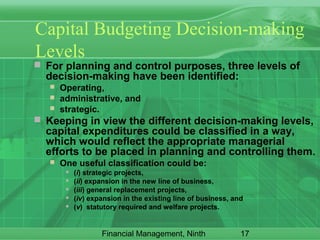

This document discusses the capital budgeting process, including policies, practices, and the linkage to corporate strategy, as well as the valuation of strategic real options. It outlines phases of capital expenditure planning and control, methods for generating investment ideas, and the importance of qualitative factors and managerial judgement in investment decisions. Furthermore, it emphasizes the significance of viewing capital investments as strategic opportunities that include real options and categorizes decision-making levels in capital budgeting.