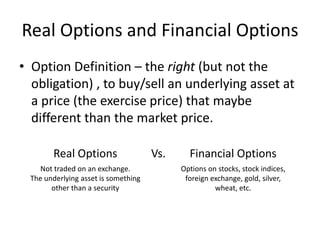

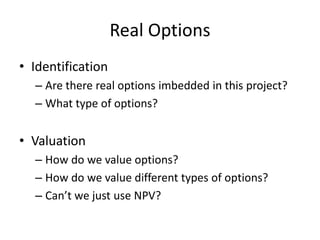

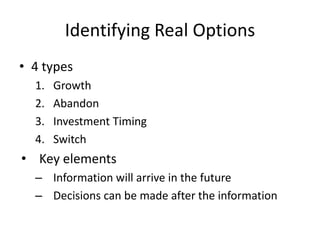

The document discusses different types of real options that can be embedded in investment projects:

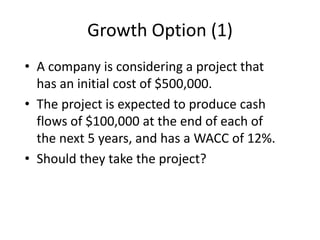

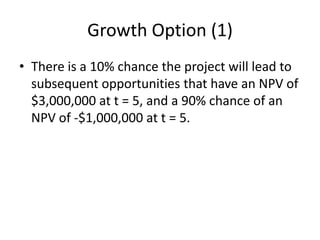

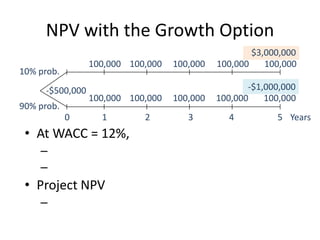

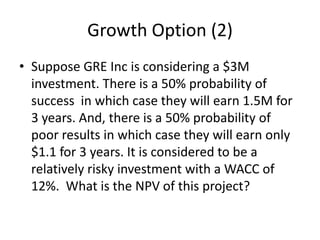

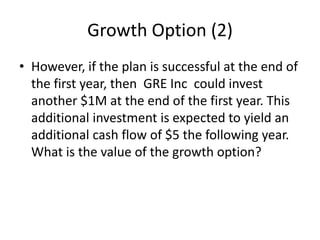

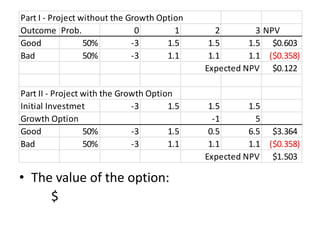

1) Growth options provide flexibility to invest further if initial projects are successful.

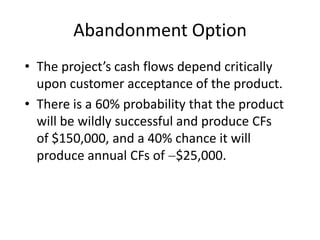

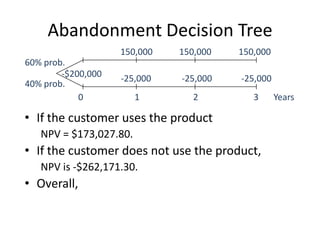

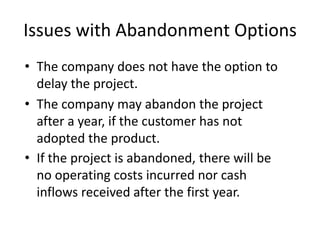

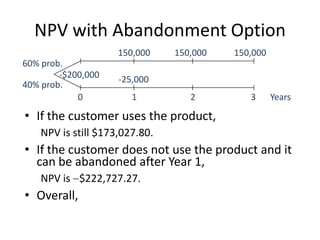

2) Abandonment options allow projects to be terminated if outcomes are poor, limiting downside losses.

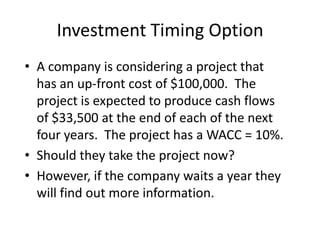

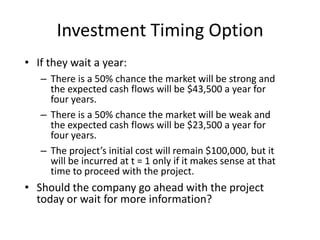

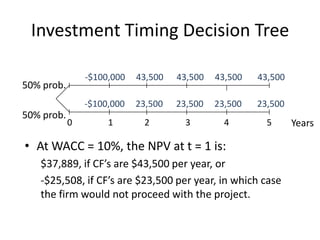

3) Timing options give the flexibility to delay investments until more information is known.

4) Switching options permit changing project scope in response to new opportunities or conditions.

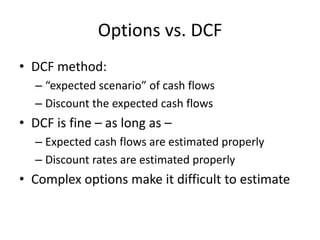

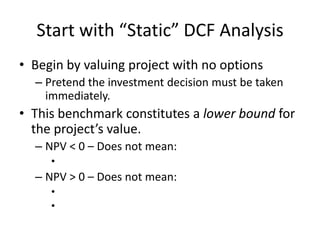

Real options add value over traditional DCF analysis by accounting for management's ability to adapt plans based on future uncertainties and information. Properly identifying and valuing these options leads to more accurate investment evaluations.