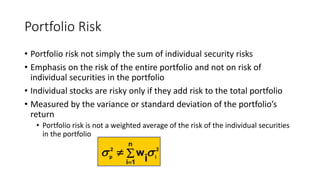

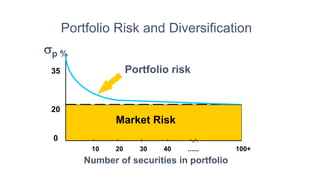

Modern Portfolio Theory proposes that an efficient portfolio maximizes expected return for a given level of risk or minimizes risk for a given level of return. The efficient frontier graphically shows the set of efficient portfolios. The optimal portfolio is the point selected on the efficient frontier based on an investor's preferences. Markowitz Portfolio Theory builds on diversification to reduce risk. It models portfolio risk as a function of the variances and covariances of individual securities rather than just summing individual risks.