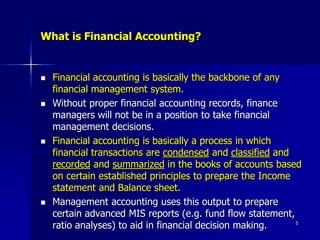

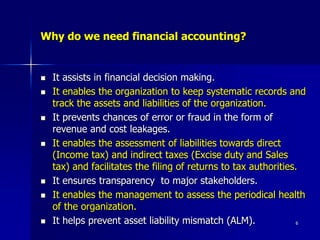

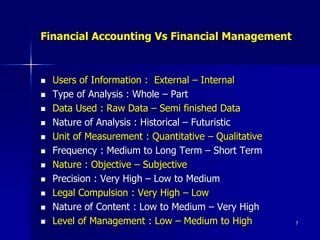

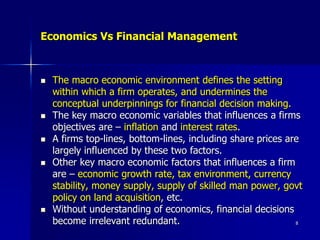

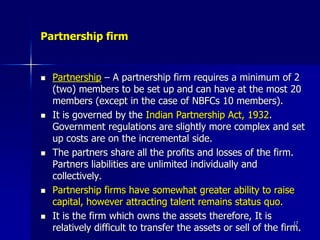

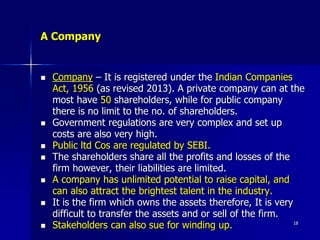

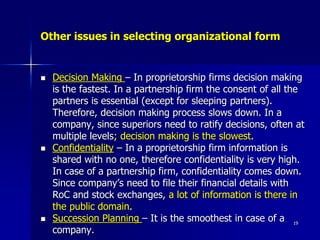

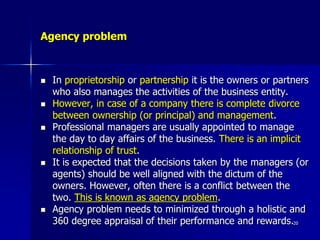

This document provides an introduction to financial management. It defines key financial terms like finance, financial management, and financial accounting. It discusses the objectives of financial management like profit maximization, shareholder wealth maximization, and stakeholder wealth maximization. It also covers important areas of financial decisions like capital budgeting, working capital management, and dividend policy. The document summarizes the evolution of the field and compares financial accounting to financial management. It analyzes different organizational forms and their implications. In less than 3 sentences.