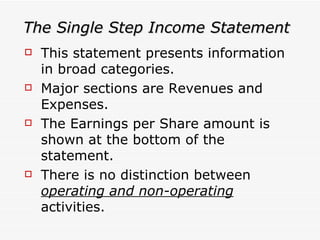

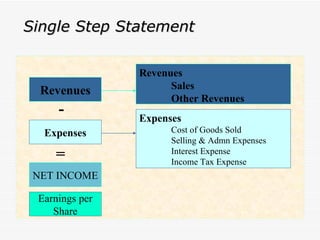

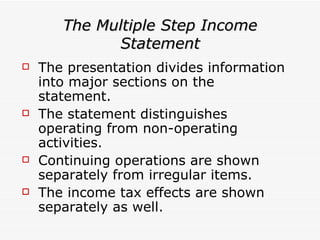

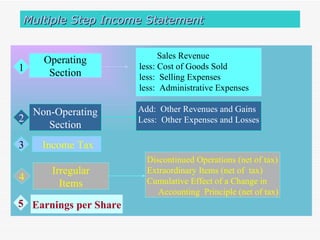

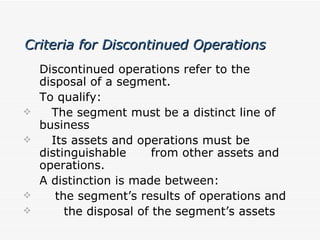

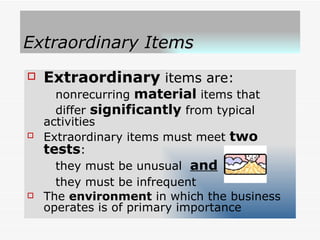

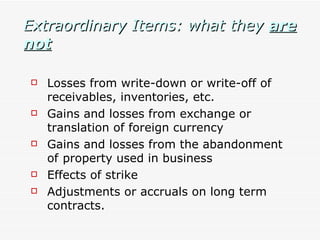

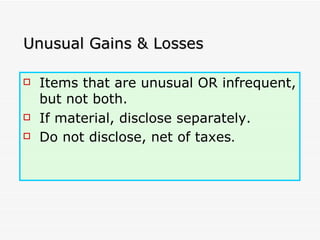

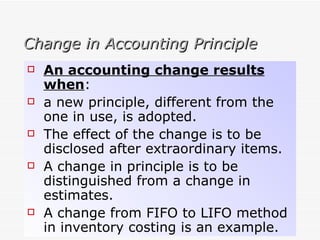

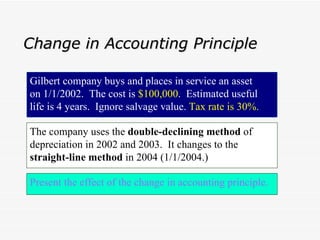

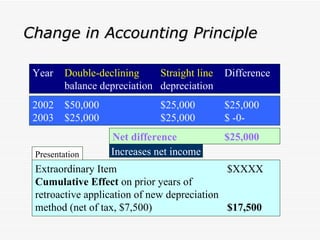

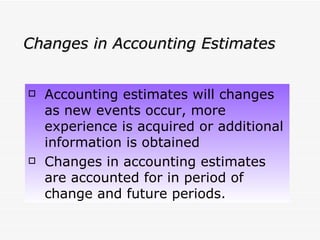

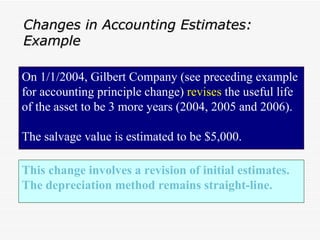

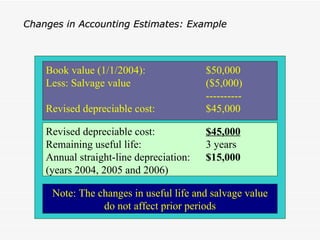

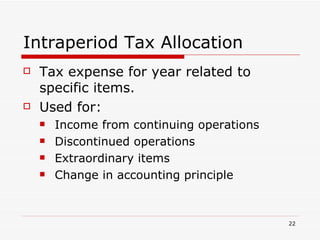

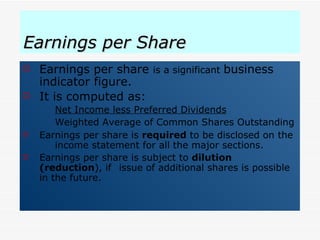

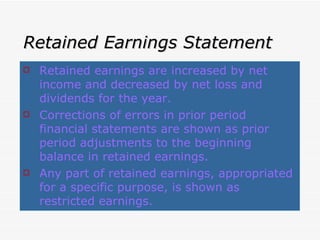

The document discusses different types of income statements, including single-step and multiple-step income statements. A single-step income statement presents revenues and expenses in broad categories, while a multiple-step income statement distinguishes operating activities from non-operating activities. The document also defines irregular items reported on an income statement such as discontinued operations, extraordinary items, and changes in accounting principles.