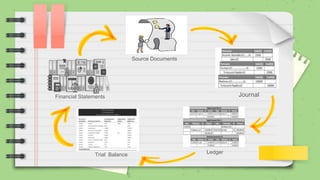

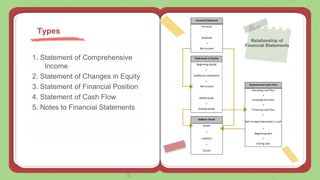

The document provides an overview of financial statements, their purposes, components, and the characteristics that make them useful for various stakeholders. It discusses key types of financial statements, such as the statement of comprehensive income, changes in equity, financial position, and cash flow, while explaining their roles in reflecting an entity's financial performance and position. Additionally, the document outlines the fundamental and enhancing qualitative characteristics of financial information that aid in decision-making.

![Statement of Comprehensive Income

[Company Name]

Income Statement

For the Year Ended

Revenue

Less: Operating Expenses

Earnings before interest and tax

Less: Interest expense

Less: Tax Expense

Net income after tax

[Company Name]

Income Statement

For the Year Ended

Sales

Less: Cost of goods sold

Gross profit

Less: Operating expenses

Earnings before interest and tax

Less: Interest expense

Less: Tax Expense

Net income after tax

Service Business

Merchandising and

Manufacturing

Business](https://image.slidesharecdn.com/ducojhoanamarielledemoteaching-220105170759/85/General-Purpose-Financial-Statements-36-320.jpg)

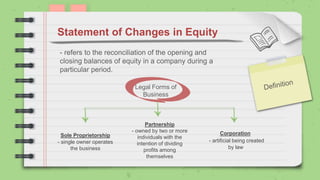

![Statement of Changes in Equity

[Company Name]

Statement of Changes in

Owner's Equity

For the Year Ended

[Name], Capital, beginning

Net income

Less: Withdawals

[Name], Capital, ending

[Company Name]

Statement of Changes in Partners' Equity

For the Year Ended

[Name],

Capital

[Name],

Capital

Capital balances, beginning

Additional investments

Net income

Less: Withdrawals

Capital balances, ending

Sole proprietorship

Partnership](https://image.slidesharecdn.com/ducojhoanamarielledemoteaching-220105170759/85/General-Purpose-Financial-Statements-40-320.jpg)

![Statement of Changes in Equity

[Company Name]

Statement of Changes in Shareholders' Equity

For the Year Ended

Common

stock

Paid-in

capital

Retained

earnings

Treasury

Stock

Total

Beginning balance

Issued shares

Net income

Less: Dividends

Ending balance

Corporation](https://image.slidesharecdn.com/ducojhoanamarielledemoteaching-220105170759/85/General-Purpose-Financial-Statements-41-320.jpg)

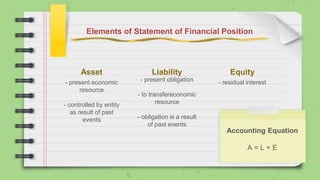

![Statement of Financial Position

Sole Proprietorship

[Name], Capital Partnership

[Name], Capital

[Name], Capital Corporation

Share Capital

Reserves/ Additional Paid-in

Capital

Accumulated profit/ loss

Less: Treasury shares](https://image.slidesharecdn.com/ducojhoanamarielledemoteaching-220105170759/85/General-Purpose-Financial-Statements-45-320.jpg)

![Statement of Financial Position

[Company Name]

Statement of Financial Position

As of the period

Assets

=

Liabilities

+

Equity

[Company Name]

Statement of Financial Position

As of the period

Assets

Liabilities

Equity

Report Form Account Form](https://image.slidesharecdn.com/ducojhoanamarielledemoteaching-220105170759/85/General-Purpose-Financial-Statements-46-320.jpg)

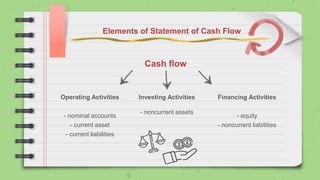

![Statement of Cash Flow

[Company name]

Statement of Casf Flow

Year Ended

Cash flow for operating activties

Cash from customers

Cash from suppliers

Cash for opeerating expenses

Cash for interest

Cash for taxes

Net cash provided for operating activities

Cash flow for investing activties

Cash flow for financing activties

Increase (decrease) in cash and cash equivalents

Cash and cash equivalents, beginning

Cash and cash equivalents, ending

[Company name]

Statement of Casf Flow

Year Ended

Cash flow for operating activties

Net income

Amortization expense

(Increase) decrease adjustments in net income

Increase (decrease) in current asset and liability

Net cash provided for operating activities

Cash flow for investing activties

Cash flow for financing activties

Increase (decrease) in cash and cash equivalents

Cash and cash equivalents, beginning

Cash and cash equivalents, ending](https://image.slidesharecdn.com/ducojhoanamarielledemoteaching-220105170759/85/General-Purpose-Financial-Statements-49-320.jpg)