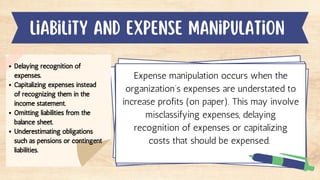

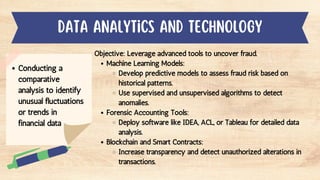

Financial statement fraud involves intentional misrepresentation of an organization's financial statements to enhance perceived performance or conceal misconduct. Common types include revenue recognition fraud, expense manipulation, and improper asset valuation, often driven by pressures to meet performance targets and weak internal controls. Preventing and detecting such fraud requires strong ethical governance, systematic fraud risk assessments, and robust internal control frameworks.