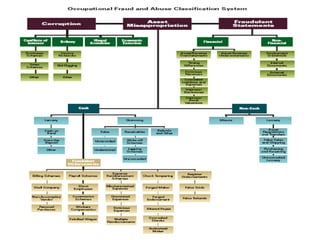

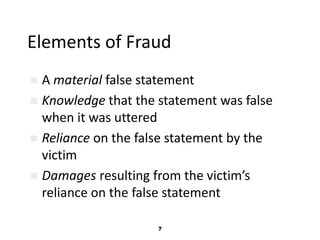

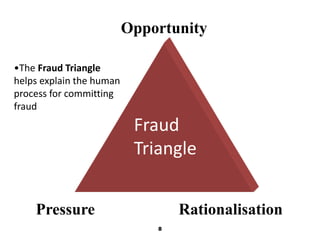

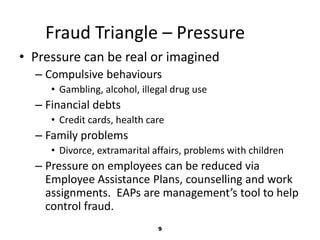

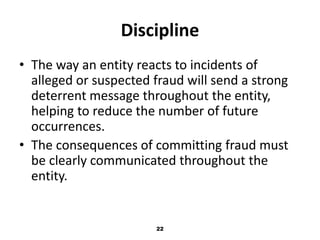

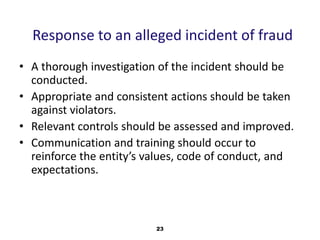

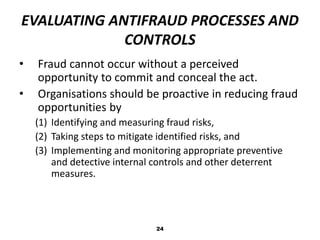

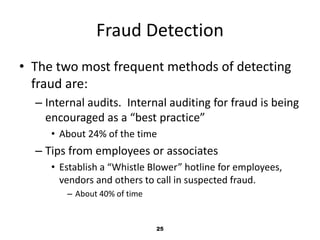

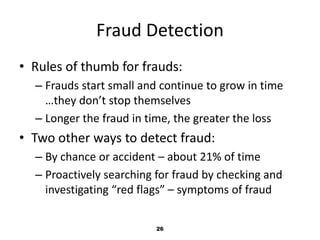

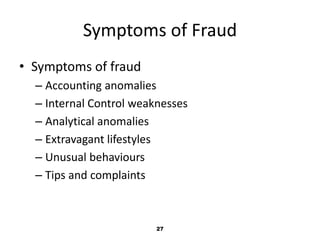

This document discusses corporate fraud, including defining it, the fraud triangle of opportunity, pressure, and rationalization, prevention methods, and detection. It notes that fraud is primarily a human/behavioral problem. The fraud triangle explains how fraud occurs when someone faces pressure and rationalizes their actions when an opportunity arises. Management can influence opportunity through controls and influence pressure through employee assistance programs. Prevention methods include creating an ethical culture, implementing controls, oversight, and discipline for violations. Detection typically occurs through internal audits, tips, or investigating red flags and anomalies.