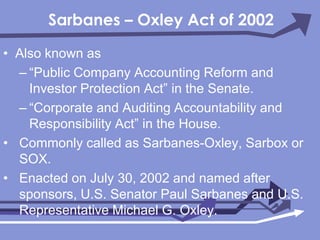

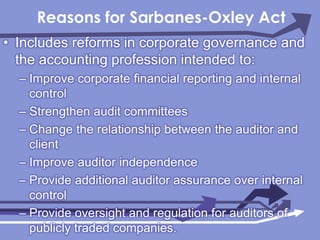

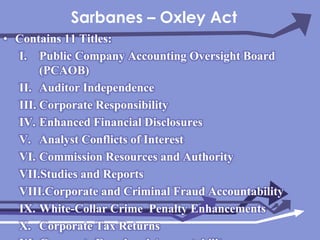

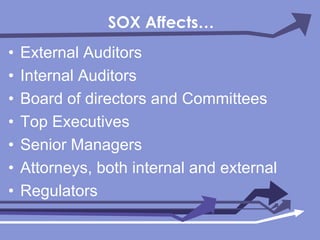

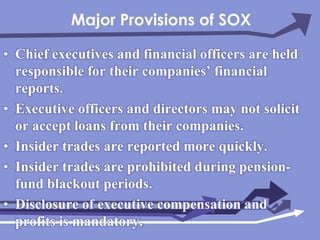

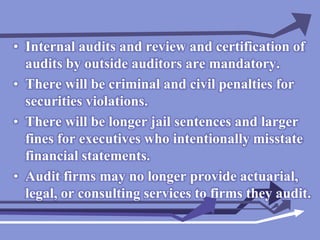

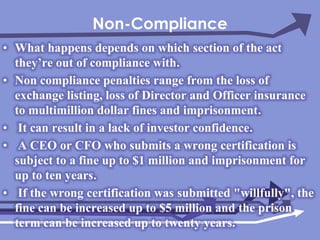

The Sarbanes-Oxley Act of 2002 was enacted in response to several major corporate accounting scandals to increase corporate accountability and protect investors. It created the Public Company Accounting Oversight Board to oversee accounting firms and audit quality. It also mandated executive responsibility for financial reports, independent audits of public companies, real-time disclosure of insider stock trades, limits on non-audit services by auditing firms, and criminal penalties for erasing records or destroying evidence of fraudulent financial reports. The Act aimed to restore investor confidence in the integrity of financial markets through heightened transparency and accountability.